Forum Replies Created

-

AuthorPosts

-

RobGiles

MemberMOC system has had a good few sessions this week (for e.g. it made 1.3% overnight) bringing me back from a 2.5% DD. Maybe I’m looking at it too hard, but it appears the S&P ‘s pull back towards its longer term MA’s is creating better conditions for the MOC system. Just thought I’d share.

RobGiles

MemberOK great…thanks for the insight Julian

RobGiles

MemberSeriously though, have you (or anyone else) seen fills better than NYSE fills on another exchange where the open is lower? Clearly this will affect my BT results. I’m assuming its not material, but I’ll keep an eye on it.

RobGiles

MemberHaha…..yeah or “its you again you annoying little (insert preferred adjective). Why don’t you a) just ‘know’ all this already or b) go away”

RobGiles

MemberNick, would you mind sharing what would be the driver or framework by which you decide to increase your exposure to your MOC system?

RobGiles

MemberI got a fill Friday night on my MOC system that was higher than the backtest fill. Details as follows:

1. Limit order on BBT @ 45.84

2. Market opened lower @ 45.64, which is where I got filled

3. However, NASDAQ opened at 44.62, which is where Norgate data, hence my backtest, reported the fill.The explanation from IB was:

“Your order is configured to work during regular trading hour only. Our smart routing system does not consider a market to be open until the primary exchange posts their opening indication. When Nasdaq reports their executions to the consolidated tape prior to 09:30 est, each report is flagged as “pre market”. At 09:30:00 any Nasdaq trades that occur are reported to the consolidated tape without the pre market indicator. This causes 3rd party quote reporting (Bloomberg, ILX, Reuters, etc) to see the first of these prints as “opening” prints when, in reality, they are not. “

I thought I understood what they were talking about but now I have NFI what the above all means.

RobGiles

MemberJulian Cohen wrote:I reckon Nick might know a bit more about Ceasar’s general modus operandi but I don’t think he’s too leveraged. every time I’ve looked he often uses 10 positions at a low percentage so I doubt he is, although for his own trading he probably would be.So where are we all at with MOC systems and leverage. I reran my backtest on mine at 2:1 instead of 4:1 leverage which reduced my CAGR to 19.5%….kinda think I’m happy with that given only 50% of my account would be wiped out in an ’87 fat tail type event.

RobGiles

MemberNick Radge wrote:Thanks for that link Nick. It was a very timely read for me as I develop my longer term rotational /trend following strategy. The following quote resonated with me:

“Of course, trend-following rules will only work if the massive bear market doesn’t happen in a short time period before the long-term trend rules can signal an exit. Technical rules will not save an investor from a 1987 type “flash” crash, but they can save an investor from a 1929 or a 2008 type crash, which can take a few months to develop. In the end, if one believes in a price dynamic that involves steep and relatively sharp declines, followed by slow grinding uphill climbs, simple technical rules will, by design, improve risk-adjusted performance.”

RobGiles

MemberI was taking the Mickey out of myself, as I seem to have a habit of needing things explained in detail….what do I think of you? I think its bloody great that you’re in this forum!

Thanks for the explanation, it’ll be interesting to see what it tests out like.

How leveraged do you think Ceasar Alvarez’s MR strategies are? I don’t think he mentioned it, maybe he will in part #2.

RobGiles

MemberJulian Cohen wrote:Len Zir wrote:Julien,

What length RSI are you using?

Also I don’t understand how tightening trade entries from RSI 20 to RSI 5 adds trades. I would think you have less trades.

Cheers.I used a Connors RSI at default parameters. If you were to use say RSI 20 you might get 2000 odd trades over 5 years and the selection bias rules out using the idea. However if you drop down to 5 or 8 then you get much fewer trades, maybe 50 over 5 years, but those 50 have a very good Win/Loss ratio. To run them as a entirely separate system is not worth the time and effort to do, and would drive you nuts because you get so few trades, but to tack them onto the end of an existing system takes a few hours in testing and sorting the metrics to your satisfaction and then they are part of a system that you are already running.

I just thought it was a good idea and when I find the odd little thing like that I like to share the love

I listened to the podcast as well Julian, and found it inspiring. Sounds like he trades a lot of different MR systems simultaneously.

Apologies if I seem retarded, but I get the tightening up of the RSI level to a lower number (e.g. from a level of 20 to 5) to improve signal quality, but are you adding this as an additional entry to whatever MR entry criteria you may have in your existing system? If so, how do you handle a day when your original entry criteria max out your investable capital? If I’m completely missing the point here, feel free to write something rude or condescending back.

RobGiles

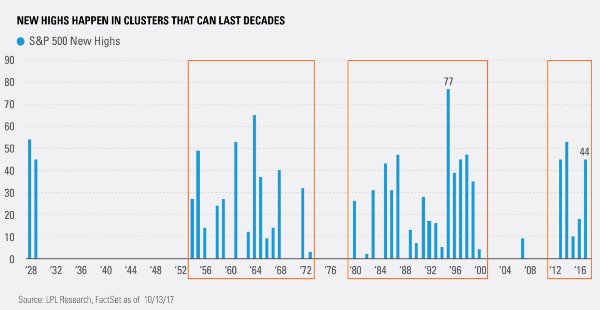

MemberI wonder if option traders, despite the low vol, have been selling out of the money puts and reaping the premium as this trend grinds higher? If so, there will be a lot of selling needed to cover positions if we ever do get a deep correction. In saying that though, take a look at this graph….whilst there are a bunch of market commentators expecting an immanent pullback, the fact is new highs can continue to be made for a long period of time.

RobGiles

Memberthere’s not too many things that make me want to leap off a cliff, but these US tax forms are definitely one of them. Sorry Zac but I can’t recall the exact boxes I ticked.

RobGiles

MemberBrilliant! Thanks Julian. I can see I’m going to run out of capital before I run out of systems!

RobGiles

MemberJulian Cohen wrote:I’m thinking I might apply more acronyms to my systems and as I firmly believe that British toilet humour is the purest kind of humour, the NASDAQ Momo will henceforth be known as Back Up The Truck and I am working on a new Absolute Returns System Etfs to start next week.hear hear

RobGiles

MemberJulian Cohen wrote:Hey guys,Can anyone point me to Nick’s post about Kelly Criterion position sizing. I know I read it ages ago and wanted to go over it again but I’m buggered if I can find it. maybe it was in the mentor course and not the forum but if anyone happens to know it would be appreciated

Module 23/27, Lesson 5/6

-

AuthorPosts