Forum Replies Created

-

AuthorPosts

-

TimothyStrickland

MemberNice job on the MOC and MRV Terry considering the environment we are in.

TimothyStrickland

MemberGreat job on the MR system Hendrik, that’s incredible considering a lot of other people’s MRV’s are struggling at the moment.

TimothyStrickland

MemberMRV HFT: -7.8% (-31.88% Drawdown)

NDX Momo: +1.1% (-8.58% Drawdown)

NDX Aggressive : +1.4% (-4.55% Drawdown)

6050 SPX: +0.1% (0.0% Drawdown)After receiving a bonus, I rebalanced my positions a little in the rotational systems. MRNA still makes up a large portion of the system.

Overall the rotational systems have been flat for a while and the MRV system has taken a pummeling.

The 6050 SPX strategy is the new options strategy I designed, it is a hedged decaying delta strategy for those that know options.

TimothyStrickland

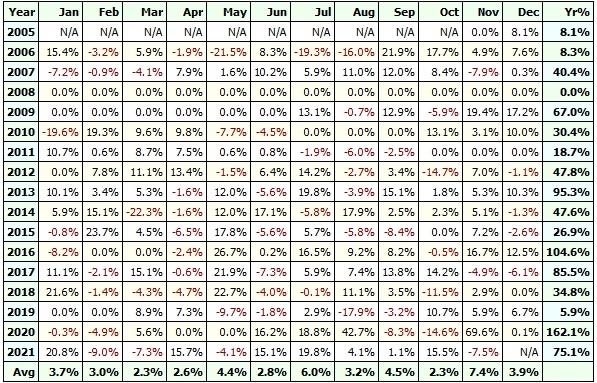

MemberThis is my NDX Aggressive strategy. I built it a similar way, however, this system has up to 35-40% drawdowns!

I have recently retired it, but I think instead I may just run a hedge on it in the event of a crash. I need to test that though.

CAR: 50.66% much higher in recent years

Max DD: -45.33%!!! yikes (which is why I need to hedge it)

Exposure: 76.98%I was willing to accept more risk than most. As a general rule of thumb, if you make the system more aggressive with fewer stocks, leveraged, or focused position sizing, you open yourself up to larger drawdowns and the risk of a black swan event.

TimothyStrickland

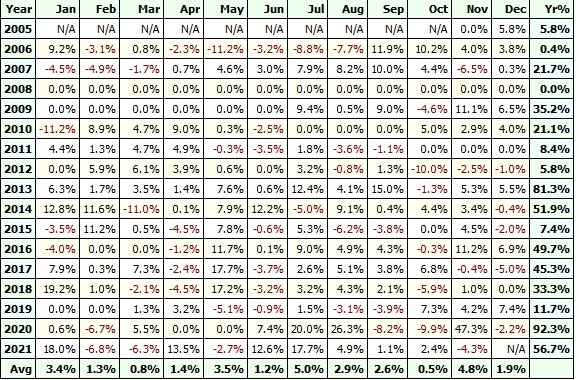

Member@Steve, that seems like a pretty robust strategy. it looks like it is getting similar performance to my NDX Momo system.

Nick, you still recommend putting more weight on recent years for backtesting right? I think I remember you telling me that, I have it written down. Doesn’t seem like it matters much with Steve’s system since it seems consistent over 15+ years.

This is my NDX Momo system. I think I initially tested 2013-2018 ish. I opened it up after that and noticed it didn’t perform as well pre-2010. At this point, I believe Nick mentioned that he puts more weight on recent years (so something to keep in mind).

CAR: 30.4% over the 15 year period, much higher in recent years. Max system drawdown: -32.63%

TimothyStrickland

MemberCraig was instrumental in getting my code working. I had lots of problems at the beginning with random errors. I used to reach out to him quite often, not so much anymore now though because I am not developing systems. Craig’s videos and the coding portion of the course are what changed my life and entire career trajectory. When I started the course I knew nothing about coding. Now I am nearly done with my CS degree (inspired by the course) and got promoted to Lead Software Engineer at my company (nearly doubling my salary) and now getting into the world of Quant Finance. I could probably never thank Craig and Nick enough for what they have taught me.

TimothyStrickland

Member@Steve, grats on getting the MOC up and running well.

I went overkill and rented a remote AWS server to host my trading code. At this point in time, the systems have earned their place and I cannot afford to lose that code.

TimothyStrickland

MemberThis seems to happen occasionally, the market will get out of sync with the shorter-term systems like the MOC and MRV and then align itself for a period of time. It has been a long good run for rotational systems though.

TimothyStrickland

MemberI went through my systems heavily the last couple of weeks. I finished my Options system and it is ready to be traded, I’ll post the monthly results here. It is designed with wealth preservation in mind, not serious growth, so the drawdowns are small which makes the upside limited as well.

I thought about removing my MRV system entirely but then I did a full analysis and it is still outperforming the market by a decent margin, it just happens to be in drawdown right now which skews the returns a bit.

I have removed the NDX aggressive system since the capital in my accounts has grown to a very large number and I don’t want to see 30-40% drawdowns at this point.

I plan on keeping 3 tradeable systems now + my 401k(which I do only for the company contribution). My tradeable systems are:

MRV HFT: Max Expected DD is 30% (more than I’d like)

NDX Momo: Max Expected DD is 25%

SPX Condor Hedge (Options System) Max Expected Drawdown is 10%TimothyStrickland

MemberI have almost finished creating my new options system. So far it has given about a 4% drawdown for 9% CAGR per tranche. If I choose, I can do multiple tranches since options allow for leverage. Since it’s leveraged, it seems that I can double the CAGR but also double the drawdown as one might expect. I do not think that this would be a linear progression though because I suspect as drawdown doubles, the realized CAGR decreases because of how Drawdown works. For instance, having to make back 11% after you lose 10 or having to make back 25 after losing 20, etc.

This system will likely be my largest system because I can limit my risk and therefore reduce anxiety on large drops. It is a hedged system which means it is protected against massive down moves.

Technically the system gets 14% CAGR but I put more weight on recent years when I test systems to try and be more conservative. The biggest gains were from the inception of the system on the backtest.

More testing is needed to make sure I did not overlook things. This system is anti-directional, which means it doesn’t care whether the market goes up or down.

I have been learning about options a lot lately since my certification next year is mostly about options and market derivatives, and if I take a Masters it will be a good chunk about options. My goal is to be able to code my strategies using python.

TimothyStrickland

MemberAwesome Job Glenn! There is no denying that the rotational systems seem to be performing really well. In my opinion, They are the best strategy. The shorter strategies add some nice diversity, but the best performance lies with the rotational system. I think it is easy to see why:

1. Fewer commissions: This helps a lot because your only putting in maybe half a dozen to a dozen trades per year.

2. Holding onto positions longer: Gives the strategy more time to work.

3. The upside bias of the market: The system design itself

4. Long-term capital gains rate here in the US. I made more money than I thought last year as to when I got out of TSLA I had to report long-term capital gains and not short-term. Long-term capital gains are only taxed at 20% instead of the usual income tax.In all my backtesting I have never gotten a shorter system to surpass my rotational systems, I keep trying though!

TimothyStrickland

MemberThe NDX accounts have grown pretty large, considering moving money around into lower drawdown accounts soon. Also, investigating options for hedging, etc. I think Nick already does this.

TimothyStrickland

MemberI am thankful I had the experience, as crazy as that may seem. Because I would probably always have wondered if those things might have worked. I also can let other people know that I myself attempted it and it didn’t work.

To be fair, this occurs in academia as well. I forgot the exact number but I think somewhere around 25-30% of people who spend 4 years of their lives and thousands of dollars work in their chosen field. There are several explanations for this but it does go to show us that the road to success or expertise is not as simple as getting a degree or taking a trading course. It lies mostly with the individual making the decisions for their life.

The average retirement savings of a person in their late 50s is 120k. And most people don’t start thinking about investing until they are in their late 40s, so I think overall I am a bit ahead of the average person, or at least I would like to think so, lol.

TimothyStrickland

MemberThanks again Nick for uploading these!

TimothyStrickland

MemberI enrolled in the Certificate in Quantitative Finance (CQF) rather than pursuing a Master’s Degree in Financial Engineering. I am nearly done with my CS but I will likely finish the CQF before the CS degree. I am doing this to further my knowledge of trading strategies and broaden my horizons on different derivative markets. They don’t teach a lot on stocks but are focused more on options, some futures, and forex. I am also reading lots of quantitative books to learn as much as I can. The community, in general, seems very skeptical if not downright hostile to Technical Analysis. I know Nick makes it work so I don’t question whether it works or not, I just haven’t been able to make it work for me. I spent a lot of money taking courses with only losses to show for it. The instructors I talked to all mentioned it was subjective. I found systematic trading more objective and Nick’s systematic approach has made me enough money to cover all of my losses and then some. Quant trading is right down that alley (which I really like), and will expand my systematic knowledge. I want solid probabilistic methods to determine if I should take a trade or not, not whether a pattern shows up on a chart. Most people in the quant community call it voodoo or astrology lol. I can see where they are coming from because I had the same experience. Depending on what instructor I talked to, they would see a pattern and say the other guy was wrong. I find that the quantitative approach is much more straightforward. I have been increasing my math skills so I can do these advanced strategies and code them up. Calculus I, II, III, Complex Analysis, Linear Algebra, Discrete Math, Differential Equations among many others.

I’ll keep everyone updated on my journey through this process and hopefully be able to share some insight into the community.

-

AuthorPosts