Forum Replies Created

-

AuthorPosts

-

TimothyStrickland

MemberWow! and here I thought running a system with only 5 stocks was aggressive lol.

TimothyStrickland

MemberYes, a red flag Nick picked up. We are analyzing the code now which checks out good. I have a meeting with him on Sunday to diagnose. He thought the results were a little TOO good.

After fixing some of the code my NDX Momo system is now

41.62% CAGR

-20.51% Max DDI threw away the NDX aggressive system for the time being as its way over leveraged, I will use it again but probably spread the leverage over more stocks. It was using 2x leverage 40% per stock. If one stock gets wiped out the system would easily break.

TimothyStrickland

MemberRe-tuned my systems (yearly) to the last 5 years and then re-stressed them, everything looks good.

NDX Aggressive: 70.1% CAGR 36.1% Max DD. (this will be a smaller account)

NDX Momo: 36.1% CAGR 18.9% MaxDD

MR HFT: 22% CAGR 19.1% MaxDD (This performs better on the S&P 500 Composite Index, experimenting with it now. Running all strategies for a full year before going live, using Nick’s systems until then.TimothyStrickland

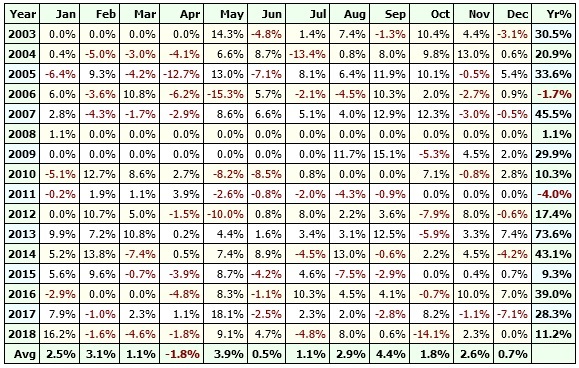

MemberNDX Momo stats (conservative)

TimothyStrickland

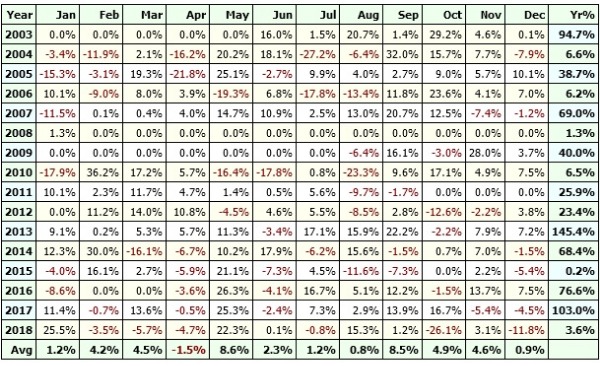

MemberStats for NDX Aggressive strategy:

TimothyStrickland

MemberHmm, I haven’t spent to much time with dividends to know enough about how they work, I may have to take a deeper look now.

TimothyStrickland

Member Slide

SlideTimothyStrickland

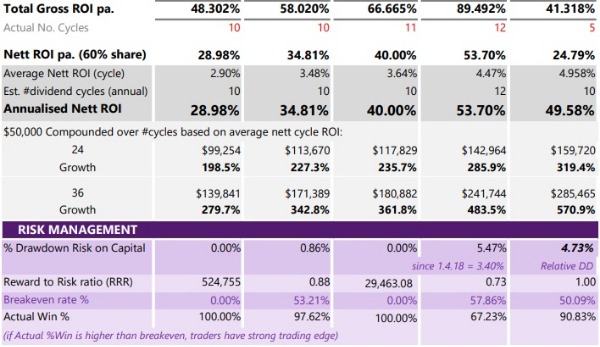

MemberI sent this to Nick already but wanted the groups thoughts as well. To make a long story short, I am in the process of looking for more trading ideas to expand my knowledge and ran across someone who claimed the following:

97% and even 100% Win% lol

0% drawdown or 0.88% drawdown.The person claims that these are the only traders they will accept, ones that have drawdowns less than 3%.

This is a single market system on GLD

TimothyStrickland

MemberYikes, if he would have just spent 9 months on 1 good system. *facepalm*

TimothyStrickland

MemberAwesome Terry! I am sure your 20 years of experience will add a lot of value to us newer traders as well! Only been doing this for 3 years and I love it. Looking forward to seeing your results

TimothyStrickland

MemberYes, I started to sim it but the one I posted was a modified version so I will re-introduce it again. Unfamiliar with acronmyms you used here, RUI?

If I eliminate the tech bubble the system gives mid to high 20s for RAR and high teens for DD.

I did more testing last night and ran it over the Russell, Nasdaq, S&P 1500 Composite and I got similiar results, it performed better on the composite.

TimothyStrickland

MemberAgree with Scott. Focusing on one system type is better as they are all very different and require unique thought processes. I started with a trend system as they have a lot less moving parts (code wise) to deal with. My mean reversion system was much more complicated to code. I had to reach out to Craig 3-4x during my trending system development for instance. For my mean reversion system I think I was sending Craig an email every day for a month (probably an exaggeration but you get my point).

TimothyStrickland

MemberI only built the system over a 5 year period and then opened it to see what it could do over the long term.

CAGR: 35%

MAX DD: 31% (during tech bubble) 21% otherwise.TimothyStrickland

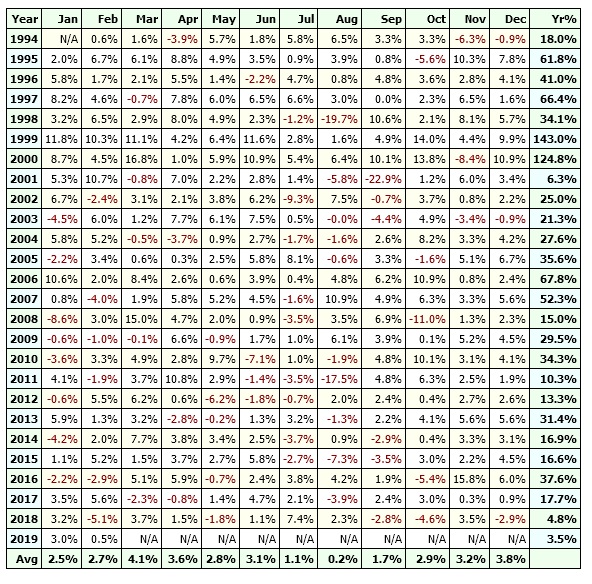

MemberStats

TimothyStrickland

MemberNick, Craig, I honestly can’t thank you guys enough for helping me on my journey to be a profitable trader. I have never before been so confident in my system as I am now.

I am nearly done with my Mean Reversion system. It seems to be extremely robust. I would like to get more profit out of it but I feel as though it would be over optimizing. The worst year was 2018 oddly enough and the system does not have a single losing year. This is because of the amount of trades it makes, about 600-800 per year. It exploits its edge often.

Oddly enough the Out of Sample data most of the time performed better than the In Sample data. I used multiple years at several time periods and could not break the system. I did multiple variance tests on the system and also could not break it that way either. 2018 was the only anomaly but even the losses were not that bad.

-

AuthorPosts