Forum Replies Created

-

AuthorPosts

-

TimothyStrickland

ParticipantNice Julian, a good error to make I guess. I had to start doing that out of necessity because I had thought my system wasn’t working for a while, now I check it weekly to make sure the trades that I took match everything.

TimothyStrickland

Participantnice Said!

TimothyStrickland

ParticipantMy wife and I take 80% of our income and dump part of it into a 401k where it is matched by our company up to a certain % at which point we dump the rest into my SPX Momo 10 month MA system (The system outperforms the S&P 500 by about 2% with less than half of the drawdown unless something like October happens again lol).

We then take the other 10% and put it into our businesses (real estate and amazon) to grow it.

9% is then split into the more aggressive MRV and NDX Momentum.

The last 1% is put into super-aggressive systems like ROR and Opening Range. The ROR system is essentially a momentum system like my NDX momentum with slightly different parameters running at 2x leverage. The opening range is discretionary so I have to take a position based on current account size, risk size, etc. I keep the opening range account size very low unlike ROR where I let compound. if I make a lot of profits, I pull those out and put it into some other system that way the drawdowns aren’t that bad when they do occur but still keeping the account at a decent enough size to make a good profit during the good times.

TimothyStrickland

ParticipantThanks, Trent, it is a very small account still though. Most of the profits come from the really big moves like the FOMC announcement, I have been fortunate to catch the right side of the move almost every time, which won’t likely last. It is also a home run kind of system, taking little losses but then catching a home run, it has had a good several months but it tends to be on and off, it will do well for a while and then not do well, for instance I ran this 2 years ago and ended up running a 35% drawdown so yea. I just wish I knew when it was going to go into a dry spell. The system tends to have huge swings because it is futures systems, in some of the backtests the drawdowns are as bad as 60%, I will never put a lot of money into this system, the ones that Nick taught me will host more of my money.

TimothyStrickland

ParticipantMean Reversion systems

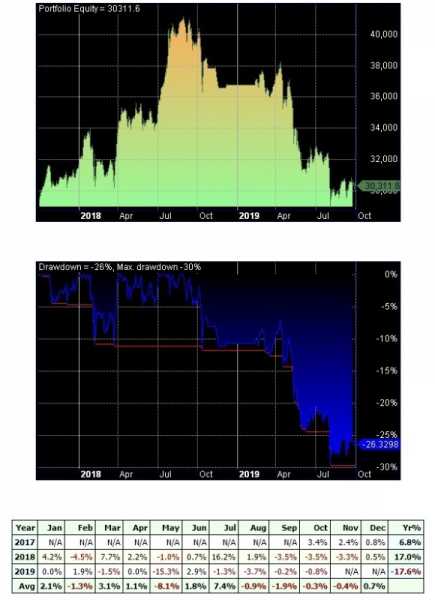

MR HFT: -4.2% The Great Mean Reversion drawdown continues. 29% Drawdown now.

Momentum (Rotational systems)

NDX Aggressive: +8.2% (LRCX made a lot of the gains here as it gapped up.) was up over 10% until today’s small pullback

ROR: +10.8% (Has a larger share of LRCX)Moving Average systems

SPX Momo: +2%

Discretionary Systems

Opening Range: +18.4%

All systems are on fire this month save the MRV which continues to struggle as usual.

TimothyStrickland

ParticipantNice Mike! Hope the real estate works out. Something to consider is how much you can cut expenses. Cutting expenses is one of the easiest things to do and easy to track. Making more income is less uncertain because it depends on investments working out, job letting you work overtime etc. It is harder to control, it is somewhat easier to control how much we spend. My wife and I will be able to retire just from the money we have invested from our jobs which is a good thing. The hope is that the real estate we have been buying and our trading systems will do well so we can be very generous with our giving its just those things I feel are a bit less uncertain right now. I know everything is uncertain but I have not been trading these systems long enough to say that they will beat the markets consistently yet, but I do believe they will.I do not need to completely trust that they will because I didn’t dump all my capital in it, that way its easier to disconnect myself from the money and let them do what I tested them to do. I think once I get some years on the system I will be more confident to moving more money into them and less into the other things I feel are reliable investments

TimothyStrickland

ParticipantThanks Nick! Yes, I know you have been traveling a ton and the system is still active for the time being will wait till you get settled back in.

Good point on the time. My wife and I plan on working with our church as well as spending more time in our side businesses which have not been getting the attention it needs due to work. I am fully engrossed in a Computer Science degree so I can learn the ins and outs of coding and algorithms and full time engineering position. Luckily I get paid to go to school due to serving in the military, one of the biggest benefits.

TimothyStrickland

ParticipantIts goal writing time for the next year and early retirement seems to be getting closer and closer for my wife and I.

The wife and I are now saving over 70% of our income with the end of next year goal being 75%.

We are looking to retire in 7 years although we will probably hang around for 10 years out of an abundance of caution.

If we wait till 10 years we will have well over the amount needed to survive comfortable indefinitely. This will make me 49 years old at the point of retirement. I am only including conservative conventional investments also, things like 401k, Roth IRA, Mutual Funds etc. Even if we lost all of the money in our trading accounts and all of our properties in real estate went belly up we can still retire in 7 years because only a small portion of our savings goes into higher risk investments about 25%. If our trading takes off which I expect it too and our properties do well then we will just be buying be donating more to charities and maybe a few extra luxury items, an exciting time.On a trading note, the momentum system seems to be recovering while the MRV system continues to struggle. Nick looked at the system again after the mentor call but neither of us could really pin point anything solid. We tried seeing if changing the entry point might make a difference but I didn’t see anything earth shattering. I tried temp building several MRV systems with different parameters but none of them performed well over the last 2 years. Clearly the market has not been conducive for MRV profitability lately.

TimothyStrickland

ParticipantSeems to happen to often now a days, churn out small profits over a month and lose it all in a single day and then some = P. Not a lot of people can deal with this type of punishment, us traders are a special breed.

TimothyStrickland

ParticipantOh ok, that makes sense. Sounds like something I should investigate too

TimothyStrickland

ParticipantMy system follows the same strategy but the S&P has not penetrated through the 200 day MA. My system does not trade stocks that have closed below their 200 day MA either.

TimothyStrickland

ParticipantCurrent system

TimothyStrickland

ParticipantLen,

As Nick has pointed out MR systems are struggling. Mine is in 25% drawdown. This is the first month since May I have captured any profit at all.

I have been trading too long to know though that if I were to stop using MR and try something that is currently working, Murphy’s law will come into effect and that strategy will stop working and MR will start working again.

In fact the only system that has made me any money is my current discretionary trading system which is up over 50% and just started trading it 4 months ago. All of my systems including my 401k are in drawdown otherwise.

My long term plan is to now just make more strategies.

TimothyStrickland

ParticipantMR HFT: +1.3% ( Yes, you read that right, a positive month for my MR system, the first one in several months.) Long way to go before climbing out of its drawdown though.

NDX Aggressive: -4%

ROR: -3.2%

SPX Momo: +1.7%

Opening Range: +2.2%TimothyStrickland

Participantoddly enough I didn’t get much in August. It was a light month. You can only remove luck so much in trading. My fill rate is generally high over the year, my goal was to try and shoot for a certain trade amount at the end of the year.

-

AuthorPosts