Forum Replies Created

-

AuthorPosts

-

TimothyStrickland

ParticipantOh, I didn’t know you went there last year. very cool about your dad, he worked for Boeing as a pilot? I don’t mention I work for them lately because of the whole 737 Max incident which I do not work on, but people I talk to seem to think that everyone works on the same thing haha, I guess it is just human nature.

I work at a facility in Northern VA, so if you ever visit New York, DC, Hampton Roads or Richmond let me know and we can meet up! Maybe we can do a crossfit workout together, although with all those videos you been posting on facebook I am not sure I can keep up haha.

TimothyStrickland

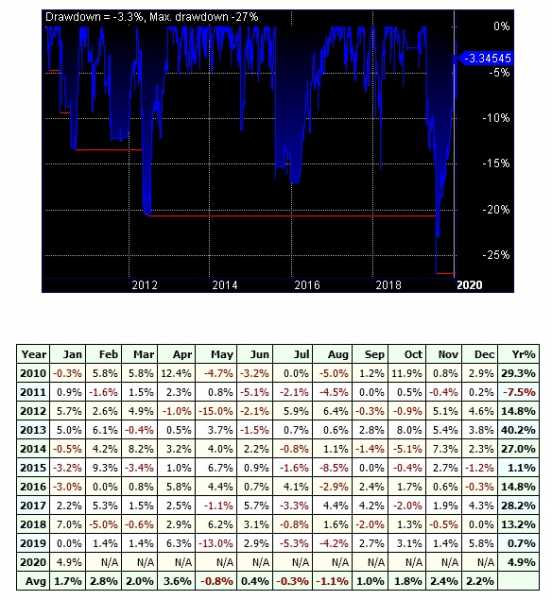

ParticipantFor instance, this is my system backtested on the Nasdaq. The system was built for the S&P but the performance is very similar overall. Big drawdown in May, even on the Russell it shows a big drawdown in May 2019 and a recovery after.

TimothyStrickland

ParticipantI am a little late to the conversation but my MRV had a big drop in performance as soon as I took it live. However, this was not unusual compared to other’s MRV performance. 2019 was a losing year but mostly because of May where I lost 15.1% which I could explain, the rest of the year wasn’t that bad. If I removed May out of the equation it would have been a positive year. I had read other’s MRV wasn’t doing well like Caesar, and a few people mentioned too many people were trading it so the edge was gone, I wasn’t buying it. How do you know how many people are trading MRV’s or not trading them? So I wrote this off as just a guess and kept plugging on, plus:

I spent months testing this system with Nick. I ran the system 100s of times on almost every index, not only that but I threw out at least a dozen systems before I even got to my system because they failed to perform on other indexes, only the one I was testing in which in my mind is a (huge red flag). This one performed well on all indexes I tested it on even the Nasdaq which I was a little surprised because the system generates its profits through a high volume of trades, there are a lot fewer triggers in the Nasdaq because the amount of stocks is less. It had much lower returns but it still had a positive equity curve on the Nasdaq on the time.

I have had Nick check my system numerous times last year because it had surpassed its max drawdown that was tested. However, both of us could not find anything inherently wrong with the system so I stuck it out, even though it was at 30% Drawdown.

Fast forward to now, the system has recovered over half of its drawdown and is performing well, from what I can tell my system just was out of sync with the market in a good portion of 2019 but started a fast recovery close to the end. Looking at the backtest this is actually not that unusual and has happened multiple times in the past.

What Scott said is one of my requirements. I will not use a system that does not perform well on other indexes, Nick told me this before I started building it. If the system does not perform well on other indexes and you can’t explain why its a red flag. I also made sure I didn’t optimize but one parameter. The other parameters were standard and the one I decided to optimize, I tried to pick a flat spot near the middle of the optimization point. Because of all the testing, I put my system through it helped me hang on to it longer, even when it was in a very bad drawdown and now it is in a nice recovery.

I am a Test Engineer at Boeing and my job is to break, invalidate, software or systems that are in my charge. I would much rather break something in testing than after it is delivered to the customer, I took the same philosophy here. My goal is not to make the system work but to break it if at all possible and if I can’t, that is a very good sign. Another thing I did to all my systems was to run random tests on each index meaning I added a random change on the parameters in the system by a certain percentage and then re-tested everything on all indexes and got very similar results, this might be overkill but I was trying to break the system and I was unable too. Hope that was helpful

TimothyStrickland

ParticipantWelcome Seth!

I have a similar story, I have probably dropped more money in trading and business courses than a college education, actually, I know I have. I have tried all kinds of tricks but in the end, Nick’s “simpler is better” method worked for me. I do a little bit of research here and there but for the most part I just stick to what Nick teaches. I abandoned most strategies I have tried in the past.

TimothyStrickland

ParticipantMR HFT: +1.7% (Drawdown continues to get less and less)

Momentum Systems:

NDX Aggressive: + 1.4% (all time highs)

ROR: +0.6% (All-time highs)Moving Average Systems:

SPX Momo: +0.2%(All-time highs)

Opening Range: +7.5% (This system does well in times of panic) aka. Coronavirus scare

Overall: I think my momentum system was up over 10% at some point in the month but gave most of that back the last few days…I have come to expect that. Opening range performs poorly in times of quiet steady gains of the market (last 4 months or so) but then rocketships when people panic.

TimothyStrickland

ParticipantIt has been a rough 2 years trading. I feel like as soon as I turned my systems on they went into drawdown. Last year, in particular, was just menacing but I learned a lot emotionally. Early on in the year, I was not disconnected to the money and I am sure Nick was amused at some of the emails I sent him haha! Many times I questioned the market, Nick’s expertise, my own expertise, and even if I am cut out to be a trader. Eventually, I disconnected from the money like Nick teaches and survived a series of brutal drawdowns in all my systems. At one point the peak was over 20% in all of them and all of this while the market was recovering! I had heard for years the emotional side of trading was the hardest but didn’t really know what that meant, now I do! It took me about 6-7 months to learn how to trade systematically but then about 1.5 years after that to learn how to confront the emotional side of trading.

Honestly, I look back now and I am thankful this happened right way because I am a better trader for it. I have weathered a bad storm and I am still standing with the rest of you. As of today my MRV has recovered half of its drawdown and is moving back into only 15%, at one point it was nearly 30%. My momentum systems continue to hit record highs alongside my moving average systems.

I couldn’t be more pleased with the instruction I received here, very thankful.

TimothyStrickland

Participanthaha, nice! I missed out on the other 2, I would think that most are holding AMD right now because of the amazing momentum that it has been doing.

TimothyStrickland

Participant AMD continues to be good to me

AMD continues to be good to meTimothyStrickland

ParticipantOk thanks Nick!

TimothyStrickland

Participantto be fair, most of the gains in those winners have been in the last couple of months, they have just taken off leaving the underperformers in the dust.

TimothyStrickland

ParticipantI made a calculation error in my results. I went back to look at what my broker statement and here is the amended returns for December. I had to rely on backtesting which does not account how much I have allocated to any position % wise which is why I like to do broker statements.

MR HFT: +3.59%

NDX Aggressive: +12.2% (This is due to the most amount of % being allocated to my winners that have just been crushing it, a good thing in this case).

ROR: +11.8% (similar situation)SPX Momo:+6.1%

This brings up a concern I have. I have been in 2 stocks for a while and because of that it now far outweighs my other 3 stocks that I am In.

Nick, how do you handle re-balancing in this case? For instance, the amount of money allocated to my top stock is now about over 50% when compared to the stock that isn’t performing well…

TimothyStrickland

ParticipantPosting early again due to being out of town

Mean Reversion systems:

MR HFT: +1.3% (22% Drawdown now)

Momentum Systems:

NDX Aggressive: + 9.6% (All-time highs) +15.7% YTD

ROR: +11.8% (All-time highs) +15.2% YTDMoving Average Systems:

SPX Momo: +6.4% (All-time highs) +18.5% YTD

Opening Range: +2.5%

TimothyStrickland

ParticipantAgreed Nick, its because it’s so highly leveraged in futures, I am thinking about reducing the risk, not much money it to begin with so its not a big deal but certainly something to consider as it grows.

TimothyStrickland

ParticipantPosting my results now since I’ll be out of town and likely to post in a timely manner, the only trading day left is Friday (half a day).

Mean Reversion systems

MR HFT: + 6.6% A nice recovery this month, some of the drawdown alleviated.

Momentum (Rotational systems)

NDX Aggressive: +5.2% +7.1% YTD

ROR: +6.1% +5.2% YTD

Moving Average systems

SPX Momo: +4.2% +5.1% YTD

Discretionary Systems

Opening Range: -9.1%

An excellent month for all my systems. Opening range has had a good 3-4 month run things can’t always go up or down.

TimothyStrickland

ParticipantI feel like my rotational system would be struggling if not for some really good picks. More good earnings announcements, a string of good luck I guess ( I am long overdue for some good luck lol).

-

AuthorPosts