Forum Replies Created

-

AuthorPosts

-

TimothyStrickland

ParticipantTrent, if I don’t include the tech bubble, the worst drawdown my NDX Momo ever got was -35%. It happened once in 20 years. A typical bad drawdown though is somewhere around 20%. I have hit that twice since I started, I can stomach larger drawdowns because most of my money right now are in safer investments like Real Estate and a 401k where my company matches my contributions. The NDX Aggressive can hit -40%, or has once. This account I keep smaller intentionally because it is so aggressive, it has doubled in size just in the last few months. If I didn’t own several properties and a 401k that got matched I probably wouldn’t be so aggressive.

I think Nick gets similar returns as my NDX Aggressive except his drawdowns are only 20% lol. Difference between a Master and his apprentice I guess.

TimothyStrickland

ParticipantTravis, is your NDX Aggressive leveraged? I have a standard and aggressive and the aggressive trades less stocks

TimothyStrickland

ParticipantOctober:

Short term systems

MRV HFT: + 0.0Long term systems

NDX Momo: + 1.6 %

NDX Aggressive: – 8.3%TimothyStrickland

ParticipantSeptember:

Short term systems

MRV HFT: + 6.8%My MRV has just slowly grinded out profits over the year consistently.

Long term systems

NDX Momo: – 3.2 %

NDX Aggressive: – 5.4%TimothyStrickland

ParticipantLol Seth. oddly enough, Nick and I were talking about hedging a couple of days ago through emails. early this month I reblanced my positions because TSLA was more than double the others, I don’t normally do this but I had far more profits than everything else. Since I couldn’t hedge right away I figured this was the 2nd best thing I could do. I also moved some money out of equities and into futures so I can start hedging, unfortunately money doesn’t come available until next week. I knew there had to be a pullback coming, wasn’t expecting it to be this week but hey.

TimothyStrickland

ParticipantNice result on that TLT Len!

TimothyStrickland

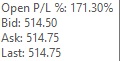

Participant Had to double check my account just to make sure the numbers were right. I am not sure what is driving TSLA so high at this point. The stock has more than doubled, I guess I won’t look a gift horse in the mouth….I am waiting for the inevitable pullback

Had to double check my account just to make sure the numbers were right. I am not sure what is driving TSLA so high at this point. The stock has more than doubled, I guess I won’t look a gift horse in the mouth….I am waiting for the inevitable pullbackTimothyStrickland

ParticipantOur trip fell through.

Update for AugustMRV HFT: +1.4%

NDX Momo: +26.1%

NDX Aggressive: +42.4%

TimothyStrickland

ParticipantI remember that Nick, everyone was saying it was bad timing etc, at least on Twitter. I didn’t feel comfortable getting in either but my system has been right more than I have. Our systems now proved everyone wrong. One thing I have learned trading this way is that no opinion, gut feeling, expert can really beat a properly, thoroughly tested trading system.

TimothyStrickland

ParticipantHaha, thanks Glen. Well, the momentum system has been up and down for 2 years almost being flat and then I get massive gains in just a couple of months. Shows me that I have to trade every single time and not worry about what’s going on in the short term.

On top of that my gut would have told me not to get back in because of the virus, riots, economic data and yet it turns out that it is the best few months for my system. Just goes to show me that trading with your gut is silly.

TimothyStrickland

ParticipantPosting a little early since we still have one more trading day, I won’t be able to post on Monday.

MRV HFT: + 1.9%

Another crazy month for my momentum systems

NDX Momo: +18.7%

NDX Aggressive: +30.8% (Unreal)The account has nearly doubled since it got back in

Mostly due to TSLA, NVDA and AMD

TimothyStrickland

ParticipantI am hoping that MR systems are now getting in sync with the market, they have been out of sync for years but all of a sudden have started to do pretty well. Only time will tell.

TimothyStrickland

ParticipantSolid Seth!

TimothyStrickland

ParticipantNice Julian, seems like several of us had some good results this month.

TimothyStrickland

ParticipantVery nice Nick!

-

AuthorPosts