Forum Replies Created

-

AuthorPosts

-

PB

ParticipantMonth end – April 2022

OK, firs month trading my weekly ASX 100 momentum strategy.

Finished the month -11.6%.Good news is that I’m starting small whilst learning the ropes, so -11.6% is -$1594.

I’m also enjoying reading through everyone else’s journals and working my way through the group calls.

Particularly enjoying when all of you work through an issue together.Cheers everyone,

PB

PB

ParticipantThat’s a really good post, Ben – thanks for sharing. I suspect a few of us are in the same boat – although I’m just at the start of my own journey.

PB

ParticipantEnd of week 3 summary:

Month to date -10.0%

Another shorter trading week – this time Easter Monday – leading into ANZAC Day – same for everybody trading the Australian market.

3 week periods with a -10% return are actually a <1% occurrence in my backtesting, but also perhaps representative of what happens at the start of running a system when perhaps I didn't get the best timing for the selected stocks as would occur when a system is up and running.

All in all, everything is OK.

PB

ParticipantEnd of week 2 summary:

Month to date -6.0%

A shorter trading week – had some ups and downs and finished about even for the week. The top 5 remain the top 5 – so no trades on Tuesday.

Still trying to figure our how to make a R1000 weekly system without much luck in finding the right combination.

PB

ParticipantThanks Nick, yes that is the way I have ultimately gone.

End of week 1 summary

Week ending 8/4/22 – -5.4%

1. Bought into 5 positions Monday am at the open, been interesting to watch them wax and wane through the week according to my custom (but not that funky) ranking system.

2. End of the week I am -5.4% which is within expectations

3. No changes this coming Monday – my lowest rank held share is at #7, my system sells when the share exits the top 10.

4. Working on another system that will allow me to trade an unrelated market – I’m sure this is familiar to all of you.

Cheers everyone, have a great week.

PB

PB

ParticipantSolid debut post, Slade, and a great way to make the rest of us newbies feel like rampant under achievers! Seriously, though, well done and good luck.

PBPB

ParticipantThanks Kate,

not sure who else reads this, but I have been thinking about how to scale into my system.Have started v small – 5x $2.5k positions. Will add more as I go and gain some confidence that the system works.

I have a question as to how others have done this – add to all current positions at a particular cash balance would be one option vs buying single bigger positions as new trades are triggered.

Bear in mind I’m running a 5 position ASX 100 momentum system, so individual stocks will / may remain in the system for several weeks or even months. Of course can be shorter.

Not sure if Ive explained that correctly.

PB

PB

ParticipantPleased to report that I am now the proud owner of an ASX100 based weekly momentum system, plan to slowly scale into positions over the next few months.

PB

ParticipantOK, have spent much of the last week thinking about a weekly momentum based ASX 100 system – which I’m sure many of you have done before. Thanks to Nick and Craig for the assistance so far.

Some thoughts as a reminder to my future self:

1. You can’t beat putting the hours in with AB – it’s not intuitive if you aren’t using it a lot. Also quite unstable from time to time. The “MAINT” icon bottom right means something. Yesterday I just couldn’t get the system to look at the right data – reinstalled AB; also re did the data from NDU and all in all it worked.

2. Building a momentum system is really about the balance of trying to get a system that does a sufficient number of trades; gets you out early when things go bad – but not too early; and lets your winners run. Or at least that’s what it seems to me.

3. I wonder how difficult it is to convert the back test results into real life. And when I say that, I assume it’s difficult not the other way round.

4. Even in my best years on back test, there are many negative months.

5. If I include time out of the market due to market filter, the longest run of non positive results is 9 months. That must feel like a long time.

6. In a series of 300 months: 1 had a return of -11% (0.3% of months); 23 had returns between -5% and -10% (7.6% of months); 75 had returns between -0.01 and -5% (25%); 45 months out of the market (15%); 105 months with a return between +0.01 and 5% (35%); 36 months with a return between 5% and 10% (12%); 15 months with a return >10% (5%).

7. I wonder what rookie errors I’m making.Anyway, that’s today’s update for future me.

PB

ParticipantThanks Nick,

that was the missing piece.PB

PB

ParticipantSo Ben,

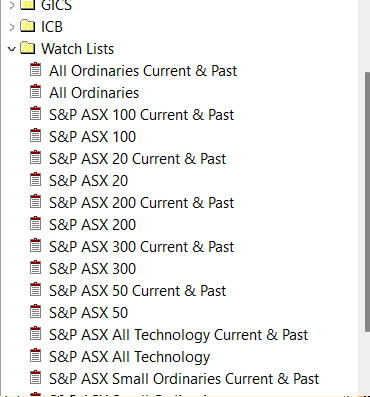

you’re exactly onto my problem:On Norgate I’ve got the same list as you.

On AB I’ve only got the Aussie watch lists.

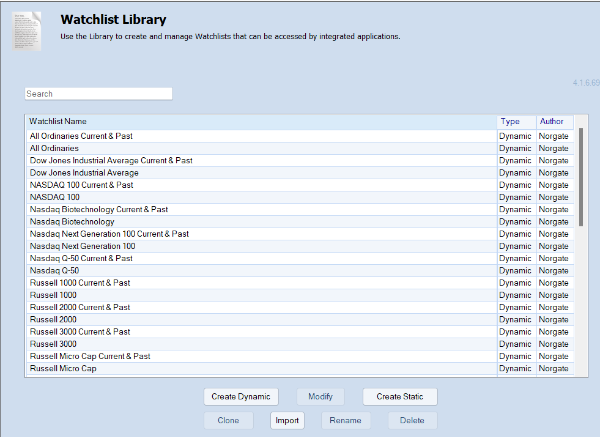

See attachments.

PB

ParticipantThanks,

yeah – I’ve got the list on Norgate updater but not AB right now – maybe I’ll “turn it off and on again” – the old IT fix.Thanks for the reply Ben,

PB

PB

Participant… ran out of room. So – watchlists come from the Norgate data updater, I can see a whole list of them there – but there are options like: Create Dynamic; Create Static; Clone; Import etc that I’m struggling with a bit.

Then what to name it and where to put it – presume with the other Norgate Data.

Or

Am I totally off track.

Cheers everyone.

PB

PB

ParticipantJust to add that I had a great conversation with Nick last week, and following some emails with Craig have the barest of bare bones monthly momentum trading systems. This is the fun bit.

PB

ParticipantSorry been busy with C19 in WA.

Trading update:

Nov 2021 +17.4%

De 2021 -7.2%

Jan 2022 -11.1%

Feb 2022 -5.7% -

AuthorPosts