Forum Replies Created

-

AuthorPosts

-

PB

ParticipantQuiet month – didn’t activate ETF strategy as it turned out – spent the month watching.

Which turned out OK because the strategy was -5.0% for the month.

About to dive in though.

PB

ParticipantI have a question for those using Self Wealth not worthy of a new topic:

Where do you park your money when not invested in the ETF strategy?

When I’m running my Australian strategy I put it in HBRD.

Is there anything equivalent in the US market? I’ve looked and cannot find it.My US ETF strategy generates daily signals and the lag between selling HBRD and transferring the $ to my US account makes my previous work practice inappropriate.

Thanks for any ideas.

PB

ParticipantOK September 2023:

Weekly Trend following: +3.1% – YTD -10.7% Max DD -15.1%

Will activate my version of an ETF Strategy this month, although buy signals are triggered only when a 200 day MA is breached so I expect the initial ramp up to be slow. Also, the system is relatively low volume – 19 trades per year.

PB

ParticipantVolatility is much higher than yours – around 20% depending on the time frame…….

I can wind ROR back and get better Vol I imagine.

Think I’m OK with where it’s at though….. which is of course a bit against the philosophy of “all weather”.

PB

ParticipantConfession / help request:

How to measure volatility…..

PB

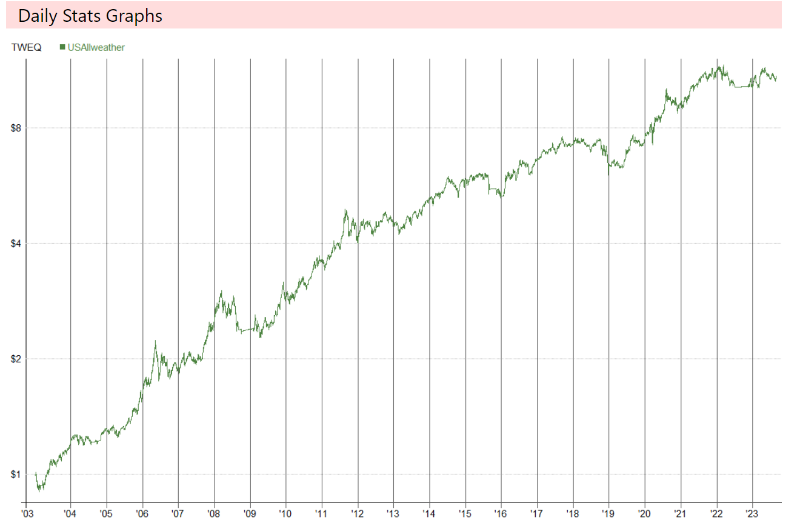

ParticipantI’ve been “playing along at home” as Nick has progressed his ideas regarding flavour variations of the All Weather ETF strategy.

Initially I could only get a ROR in the high single digits / low double digits with a Max DD somewhere just north of 20%.

Knowing that Nick had successfully constructed a system with a ROR of 19% and Max DD of -14.7% helped a lot – made me understand that such a system was *possible*.

This process has also made me very familiar with coding and re-coding Realtest – at least within the boundaries of the system I’m trying to develop – which has been very useful.

Where I’ve landed:

A 6 ETF strategy:

TLT – 20 year Treasury Bond ETF

VIG – Dividend appreciation ETF

VNQ – Real estate ETF

DBC – Commodity tracking ETF

GLD – Gold ETF

QLD – a 2x leveraged Nasdaq-100 ETFI’m using a simple 200 day MA to screen for entry trigger.

I’ve looked at returns over multiple time frames and they are very steady.

10y ROR 20.96% Max DD -22.91% Average exp 60.71%

5y ROR 19.37% Max DD – 21.97% Average exp 53.77%

1y ROR 20.27% Max DD -10.6% Average exp 44.7%There are some lean years in the backtest:

2015 +0.7%

2016 +1.1%And two negative years

2011 -7.3%

2022 -10.3%I feel like it’s now time to run this system I’m happy with the parameters. It’s taken me a month of thinking to get to this point.

Look forward to reporting results.

PB

ParticipantWell I’ve made *some* progress.

I now have a US ETF strategy running 5 separate ETFs:

ROR 20.12%

Max DD 30%Next task: Retain as much of the ROR as possible whilst driving the Max DD down.

PB

ParticipantSo I’ve experimented with different combinations now for several days.

Entry criteria:

Variations of MA and ROCExit criteria

EOM

EOM or falls below entry criteriaVariety of high turnover ETFs as outlined / suggested above.

My best efforts end up with:

ROR low teens

MaxDD around 20%Feel like a more subtle entry criteria / screen is the key.

PB

ParticipantNick,

thinking about how I might come anywhere close to replicating your US ETF strategy.Not quite sure what you are willing to share – can I ask how many ETFs are in your rotation, and how many – max – your system holds at any given time? (It might be a different number).

Cheers

PB

PB

Participant Really enjoying this thread.

Really enjoying this thread.I’ve been looking / coding a GLD / SPY ETF strategy with the SPX as an index.

Using a simple entry gate ROC.

My results are nowhere near as impressive as others published here:

ROR 12.3%

MaxDD 21%….. but I think I’d be willing to trade it.

PB

ParticipantAnyone else having a go at replicating / repeating this?

I’m trying……….

PB

ParticipantJust realised it’s been many months since I posted.

1. Have switched to RealTest and slowly learning the admittedly much easier coding language.

2. Have still not gone back to ASX Swing

3. ASX Momentum:April +1.0%

May -8.2%

June +1.9%Have recently challenged myself to think about how to code for the All Weather portfolio Nick has been talking about on Twitter, but for the moment my best is mid single digit CAGR. So I am yet to crack the code.

PB

ParticipantSensational month Terry, well done!

PB

ParticipantFeb 23

ASX Momentum – -10.0%

ASX swing not traded.My system is now at historic max DD.

Will return to trading ASX Swing in March as well as ASX Momentum.

PB

ParticipantOK, it’s taken me a while to get the point where I am comfortable thinking about January.

I made a rookie mistake with my system and went out of some good positions, into others by getting my amibroker settings wrong.

Ultimately it didn’t end up costing me any dollars – more of an annoyance.

Separately to that, had to buy a car so withdrew cash from my account so I stopped trading the ASX swing strategy.

Finally, in January (& Feb for that matter) I did not do well.

Jan 23

ASX Momentum – -5.5%

ASX swing – not tradedFY 22/23

~-2%Sticking with the plan eh.

-

AuthorPosts