Forum Replies Created

-

AuthorPosts

-

Nick Radge

Keymaster2020 REPORT CARD

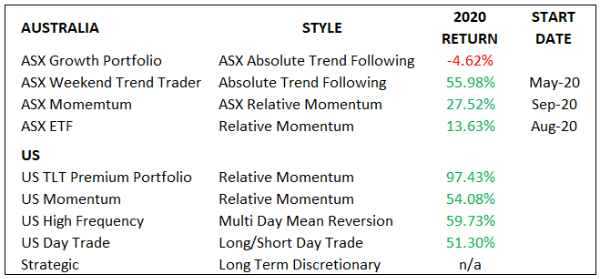

In summary a record year for me with 5 of my 8 systems returning > 50% and my Strategic portfolio making big headway mainly thanks to $TSLA. The goal for 2020 was to continue to diversify through various portfolios, especially with my retirement account in Australia.

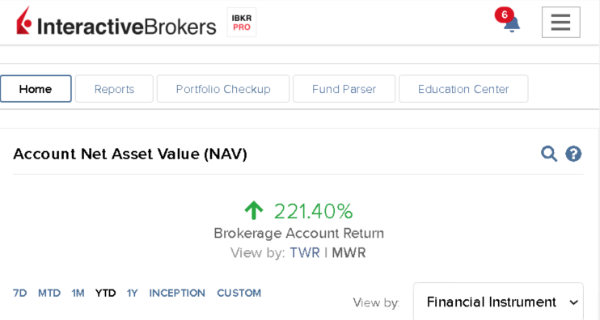

The 221% return shown above is from all the US strategies ex-High Frequency. It sits in a separate IB account & all Aust. portfolios sit in other accounts.

For the last 20-years my almost all ASX exposure was in the Growth Portfolio. With better understanding of signal luck, mainly thanks to @choffstein, that had to change.

Three more strategies were added & as can be seen by the Growth Portfolio, it was just as well.

I also added shorts to the Day Trade strategy in mid-October with almost immediate positive results. As mentioned herein I saw a marked increase in winning days (53% > 61%) and W/L ratio (1.0 > 1.3). Considering the brief window, they’re quite large improvements.

My next project is adding shorts to my HFT strategy. Initial testing is extremely positive but volatility is somewhat higher than I’m willing to cope with (must be getting old). I’ll scale that down by reducing the universe from all US stocks, to just the R-3000.

Another goal is to increase execution fill frequency on the Day Trade strategy which will increase profitability and smooth the equity curve.

Considering the years that was, both in the markets, in life and the BS from the regulator, I’m quite chuffed at how it all panned out.

Here’s to 2021 and #next1000trades.

-Nick

Nick Radge

KeymasterQuote:2016…cant even remember😆

The fog of war…

Nick Radge

KeymasterWell done Mike.

95% of people would walk away after what you went through but you did persevere and it will pay back.

You should also take solace in the fact that many of the investing geniuses had similar drawdowns and losses. Goes to show (a) what a tough year it was, and (b) how much luck was also involed.

Nick Radge

KeymasterDecember 2020

ASX

Growth Portfolio: +1.61%

WTT: +3.00%

ETF: +8.00%

ASX Momo: +15.85%US

HFT: +8.00%

US Momo: +5.39%

MOC: +18.49%

DTVI: +7.97%That’s a record year for me. I’ll write a more comprehensive report card some time in the coming days.

Nick Radge

KeymasterGreat work Glen.

Nick Radge

KeymasterGreat work Tim.

Nick Radge

KeymasterYou can send me your CSV file and I’ll take a look.

Nick Radge

KeymasterWhat was the error message?

Nick Radge

KeymasterYou could exit positions on open then place the new buys using a Good After Time (GAT) order. Set that for a few minutes after open.

Nick Radge

KeymasterI don’t think Trent uses margin, so he might know.

Nick Radge

KeymasterNick Radge

KeymasterSo the R-3000 looks better with an 18% CAGR and maxDD of -14.5%. See how that plays out for the next month.

Nick Radge

KeymasterWell, after looking at todays numbers I’m going back to the drawing board with the multi day short system. Been seriously run over in last few days. If I’m struggling with the volatility, then I doubt any of my clients could deal with it.

My first point of call will be the universe. I’ll move away from the full market and stay with the R-1000.

Nick Radge

KeymasterAnother variant here Taranveer

https://decodingmarkets.com/trend-following-with-etfs-and-large-cap-stocks/

Nick Radge

KeymasterTry VTI, VEU and TLT.

The reason why the very short term ETFs show flat lines are (a) because interest rates are zero, and (b) you need dividends turned ON.

I’ve not had much luck testing an ETF portfolio in the US, but then again I’ve not done that much work with them. I think you need to look at a different mix of ETFs

-

AuthorPosts