Forum Replies Created

-

AuthorPosts

-

Nick Radge

KeymasterAugust 2022

ASX

Growth Portfolio: 0%

WTT: -2.71%

ASX Momo: 0%

ASX Swing +0.72% (new strategy)US

HFT: -2.25%

US Momo: 0%

MOC: -9.46%

DTVI: -3.88%Nick Radge

KeymasterNick Radge

KeymasterChris,

It sounds like your orders are being executed in the pre-market. I would suggest you investigate how to change that so they’re executed during regular market hoursNick

Nick Radge

KeymasterLen,

I’ve just rearranged all my accounts and portfolios as we’re launching a managed product in the coming months. I’ll need to assess percentage allocations when I get some timeNick Radge

KeymasterJuly 2022

ASX

Growth Portfolio: 0%

WTT: 0%

ASX Momo: 0%US

HFT: +6.67%

US Momo: 0%

MOC: +5.88%

DTVI: 0%July 20, 2022 at 7:41 am in reply to: From gym owner to finance quant and everything in between #114958Nick Radge

Keymasterawww…some bro-love – it’s a great story and I’m glad we’ve been involved. Looking forward to the new chapters ahead.

I’d say Trish and I will be State-side sooner rather than later. We were thinking October, but not so sure. I have a very good friend in Charlotte, so we’re due to see him and will certainly make time for that dinner

Nick Radge

KeymasterNick Radge

KeymasterNice. Thanks Julian.

Nick Radge

KeymasterSorry – typo. Should be 1.0 which has now been edited.

Nick Radge

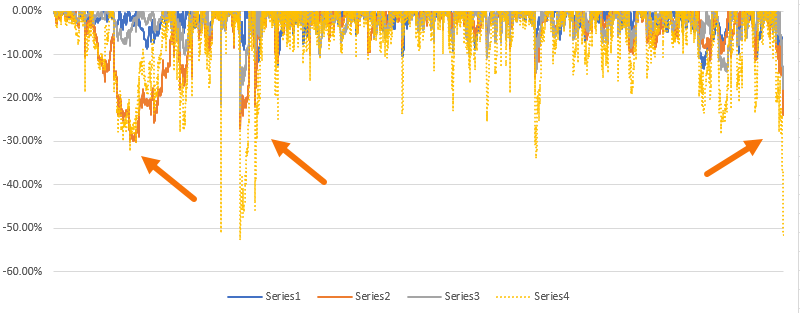

KeymasterUpdate to my prior post. I adjusted my stretch for Setup #2 from 0.75 to 1.0. The MAR ratio lifted from 1.51 to 2.45. The combination of all 3 setups together saw a slight reduction in maxDD but pushed the MAR from 2.76 to 2.91. You can see the difference with this underwater chart.

Nick Radge

KeymasterThanks for dropping in Tim – great to have you onboard.

Nick Radge

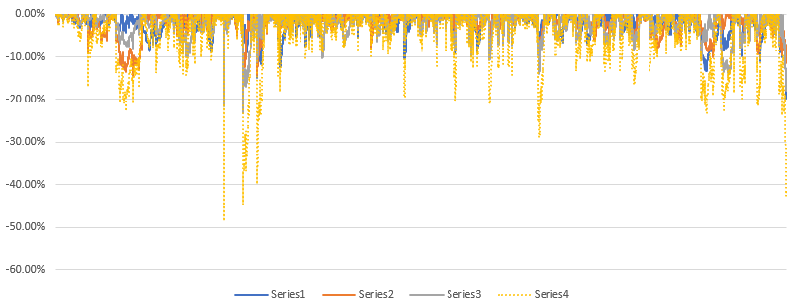

KeymasterMy MOC is made up of 3 setups. Yesterday I stripped each out separately and looked at the drawdowns of each and also combined. The chart below is a little hard to decipher, but Series 1, 2 and 3 are the individual setups and Series 4 is the combined. What is obvious is that setup #2 tends to have larger drawdowns and slower recovery rates. It has the highest CAGR of the 3, but also the worst drawdown and the lowest MAR.

I might spend today optimising the position sizing.

Another interesting fact that may appeal to others, is the combination of all setups have a higher MAR than each individually.

Setup #1 = 1.60

Setup #2 = 1.51

Setup #3 = 1.65

Combined = 2.76

Nick Radge

KeymasterLen Zir post=13176 userid=5316 wrote:Nick , so bottom line, you will just continue to trade your MOC without major changes?

Thanks

LenThat’s correct.

Nick Radge

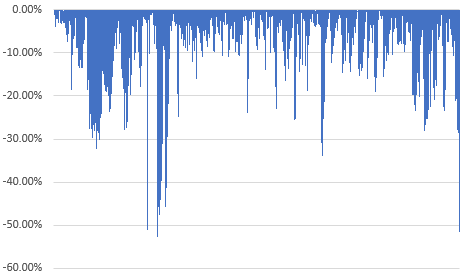

KeymasterJust ran the backtest back to 1990 for the MOC system. Current maxDD been seen several times, mainly in the Asian Currency Crisis of the late 90’s

27 Oct 1997 – single day was -51% (fuck me) but recovered immediately on the following day

31 Aug 1998 – 3 days to -52% but recovered 13 Jan 1999, about 4.5 months

19 Apr 1999 – single day was -45.8% but recovered 5 Aug 1999, about 3.5 months

Nick Radge

KeymasterI suggest everyone retest their strategies back to 1997, specifically 27th October 1997 – the start of the Asian currency crisis. While the bounce was just as spectacular, you should see a similar depth of drawdown to what is being seen today

-

AuthorPosts