Forum Replies Created

-

AuthorPosts

-

Nick Radge

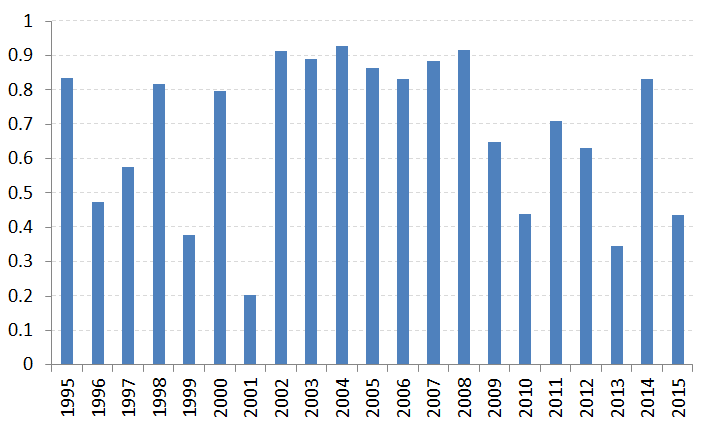

KeymasterHere’s the correlation between the two MR systems.

Nick Radge

KeymasterThanks Trent.

Disproving a theory is quite possibly more important because in many instances our theories are a function of our internal biases. As is always stated with running simulations, the computer has no bias!

It’s also a good thing to always try and punch holes in your theory. The harder you look for something that works the more you tend to miss it’s flaws.

Nick Radge

KeymasterGreat work Said.

How’s the correlation look on the systems – especially the two MR systems?

Nick Radge

KeymasterMONDAY

No US trades.

MC calls

Research on Growth Portfolio pyramiding

MC call

2x ASX entries today (NEC & BAL)

No new entries for tomorrowGrowth Portfolio Pyramiding

I revisited this after concluding several years ago it didn’t add any value. Same conclusion again toady. Very slight increase in total return but only increasing workload and commission drag..

Nick Radge

KeymasterHere is a system that came across my desk a few days ago. The code here is EasyLanguage for TradeStation but the system logic is quite simple:

Code:{Strategy inputs}

Inputs:

P1 (98),

P2 (22),

myFraction (1.75),

SL(600);

{Strategy variables}

Vars: myPOI(0),

myDistance (0),

BO_level (0),

EntryCondLong (false);

{Point Of Initiation}

myPOI = CloseD(1); //Yesterday´s daily CLOSE

{Distance}

myDistance = AvgTrueRange(14) * myFraction;

{Entry breakout level – calculates WHERE to enter}

BO_level = myPOI + myDistance;

{Entry condition – calculates WHEN to enter}

EntryCondLong = DMIPlus(P1)<= DMIMinus(P2); {Entry order - enter WHEN and WHERE criteria met} If (MarketPosition = 0 or time = SessionEndTime(0, 1)) and EntryCondLong then Buy next bar at BO_level stop; {Exits - Exit on STOPLOSS or AT THE END OF THE DAY} setstoploss(SL); SetExitOnClose;Setup:

DMIPlus of 98 days needs to be less than/equal to DMIMinus of 22 days (these appear to be optimised)Trigger:

Buy when prices rise above yesterdays high by the average range of the last 14 days * 1.75 (basic range expansion trigger)Exit:

Hard dollar stop loss of $600 (probably optimised)

or

End of DayInitial Impression

> there appears to be a few optimised variables here

> $600 hard stop probably won’t come into play and could even be ignored (i.e. better to run MAE analysis on a portfolio level)

> The use of the DMI is quite unusual so would be interested to see what benefit that has.

Nick Radge

KeymasterWhat are you trying to do?

Nick Radge

KeymasterNick Radge

KeymasterFRIDAY

No US trades

No ASX Trades

Clear emails

Pick up boat after service (finally!)

Start researching pyramiding on Growth Portfolio

Run ASX mean reversion – 2 signals for MondayNick Radge

KeymasterIf you can try and decrease the size of the image. It’s gone fuzzy here because its trying to squeeze it lower.

I’m sure Craig will answer your question for you.

Nick Radge

KeymasterYep, that’s a great idea. I’m quite sure the guys at Dunn Capital use a signal ranking method based on Swarm Theory. I think they use some 100 signals then rank and position size accordingly.

The alternate is to actually trade both the upward momentum (lookback = 6 to 12 months) AND the short term reversion lookback (1 month). Be interesting to see how they would operate together.

As will be the most likely answer in this section, “Test It”

.

Nick Radge

KeymasterOliver,

Yes hat’s correct. We call that an Index Filter Ribbon.Nick Radge

KeymasterQuote:interesting stuff especially when there is a trading system with 35% exposure time.Yes. Some of my mean reversion systems have very low exposure, i.e. < 15%.

However, many signals are clustered so sometimes (like in the current environment) I’m not seeing much action. However, in other environments I may go 150% invested.One of my goals for 2016 is to work my capital harder at all times – meaning developing other systems that take up the slack when capital is available (like now).

Nick Radge

KeymasterWEDNESDAY

No US orders

No ASX orders – patience!

Call with Business mentor

Call with Mentor Student

Run ASX signals – one new buy signal for tomorrowNick Radge

KeymasterTUESDAY

No US orders

No ASX orders

Clear emails

Con Call with business mentor

Re-optimise mean reversion systems

Australia Day party (designated driver) :angry:Nick Radge

KeymasterQuote:My experience is that the win% tends to drop and the w/l rises to compensate.Voila!

I think you will find that trading a system with a win% less than 40% will be extremely difficult.

Have you tried a longer breakout and wider stop? Might alleviate some of the noise.

-

AuthorPosts