Forum Replies Created

-

AuthorPosts

-

JulianCohen

ParticipantReminder to myself…ask Said what he found was the best method for ranking for trend following

JulianCohen

ParticipantThis is not really a systematic trading system per se, but it is a short read and to me at least, quite interesting.

http://gregharris.info/my-year-long-experience-as-the-fastest-form-4-trader/

I had a friend who was a trader in the 80’s and he noticed that the SPI in Sydney often moved after the late evening news showed the front page of the papers for the next day (well before the days of the Internet). He had a cabbie go to the presses and deliver him the paper just before it was broadcast on tv that evening, which gave him a leg up on the other traders….ah the good old days

JulianCohen

ParticipantYes please Maurice. [email protected].

Cheers

JulianCohen

ParticipantDoes anyone have any recommendations for books on mean reversion systems? I have never studied them or used them so I’d be interested not so much on a particular idea so much, as I’m guessing Perry Kaufman might be a good place to look, but more the overall theory behind them. Something similar to Following The Trend by Andreas Clenow but for MR…if it exists.

JulianCohen

ParticipantOK got it. I see what you have done with the BuyPrice code. Thanks for that!

JulianCohen

ParticipantI decided to take a small break from looping in order to clear my brain.

I spent the day writing some entry code for a system I used to trade a few years ago and that I think could have merits as a mean reversion system, but I won’t know for sure until I have fully worked out how I will use it.

The code what I wrote is below. If anyone can suggest methods to clean it up, or compact it a little I’d be very grateful to see it. This is obviously a work in progress as I haven’t written up the sell signals yet. I know one that I plan to use, but the main exit I haven’t decided on as I need to work out what the mean is that it will be reverting to…

Nick and Craig I hope you don’t think I’m trying to get ahead of myself. I just wanted to see if I could do this myself before pushing on.

Code://===============================BullDB = (C-L)/(H-L)*100;

AlligatorBlue=Ref(Wilders(C,13),-8);

AlligatorRed=Ref(Wilders(C,5),-3);C1 = Outside();

C2 = BullDB > 75;

C3 = AlligatorRed < AlligatorBlue; C4 = H < AlligatorRed; C5 = H < AlligatorBlue; BuySetUp = C1 AND C2 AND C3 AND C4 AND C5; Buy = Ref(BuySetUp,-1); BuyPrice = H + 0.02; Filter = C1 AND C2 AND C3 AND C4 AND C5;JulianCohen

ParticipantActually walking away is what I did yesterday. I realised that my brain was fried and I’d never get any further by going through the code again so I had a glass of wine and vegged in front of the TV. After sending you a help email

Today is another day. Thanks for all the words of wisdom guys.

JulianCohen

ParticipantSaid that is really great advice. Very practical and all techniques that I can see will help. Thank you, and I really appreciate the offer of help.

JulianCohen

ParticipantOK well that’s good to know. There is a light at the end of the tunnel then :dry:

JulianCohen

ParticipantThat’s interesting. I would have thought the vol based position sizing would have eaten the equity much faster…What settings are you using?

JulianCohen

ParticipantAh I see.(said the blind man). Thanks a lot Said. Appreciate it. I have never coded before. I can see how the code solutions can become quite elegant.

JulianCohen

ParticipantThanks Said,

Here’s the code

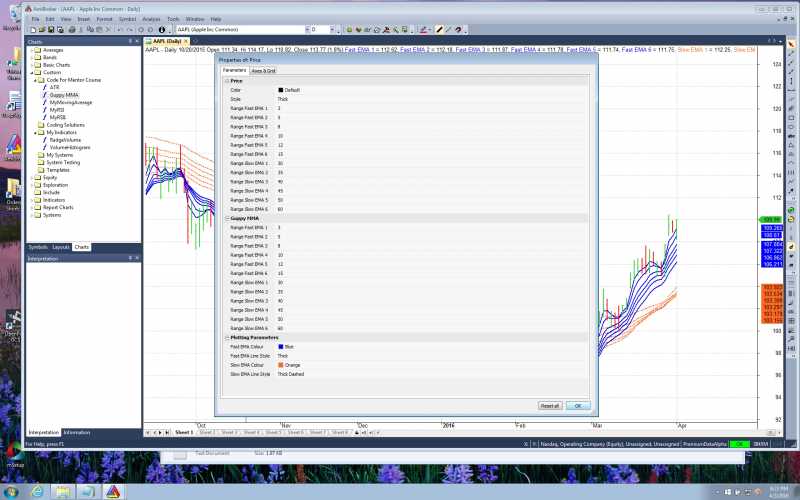

_SECTION_BEGIN(“Guppy MMA”);

//======================================

//Parameters

//======================================F1=EMA(Close,3);

F2=EMA(Close,5);

F3=EMA(Close, ;

;

F4=EMA(Close,10);

F5=EMA(Close,12);

F6=EMA(Close,15);S1=EMA(Close,30);

S2=EMA(Close,35);

S3=EMA(Close,40);

S4=EMA(Close,45);

S5=EMA(Close,50);

S6=EMA(Close,60);Range=Param(“Range Fast EMA 1”,3,1,29,1);

Range=Param(“Range Fast EMA 2”,5,1,29,1);

Range=Param(“Range Fast EMA 3”,8,1,29,1);

Range=Param(“Range Fast EMA 4”,10,1,29,1);

Range=Param(“Range Fast EMA 5”,12,1,29,1);

Range=Param(“Range Fast EMA 6”,15,1,29,1);Range=Param(“Range Slow EMA 1”,30,29,100,1);

Range=Param(“Range Slow EMA 2”,35,29,100,1);

Range=Param(“Range Slow EMA 3”,40,29,100,1);

Range=Param(“Range Slow EMA 4”,45,29,100,1);

Range=Param(“Range Slow EMA 5”,50,29,100,1);

Range=Param(“Range Slow EMA 6”,60,29,100,1);_SECTION_END();

_SECTION_BEGIN(“Plotting Parameters”);

//======================================

//Colours and Style

//======================================Fast1Colour=ParamColor(“Fast EMA Colour”,colorBlue);

Fast1Style=ParamStyle(“Fast EMA Line Style”,styleLine|StyleThick);Slow1Colour=ParamColor(“Slow EMA Colour”,colorOrange);

Slow1Style=ParamStyle(“Slow EMA Line Style”,styleLine|styleThick|styleDashed);//======================================

//Plotting

//======================================

Plot(F1,”Fast EMA 1″,Fast1Colour,Fast1Style);

Plot(F2,”Fast EMA 2″,Fast1Colour,Fast1Style);

Plot(F3,”Fast EMA 3″,Fast1Colour,Fast1Style);

Plot(F4,”Fast EMA 4″,Fast1Colour,Fast1Style);

Plot(F5,”Fast EMA 5″,Fast1Colour,Fast1Style);

Plot(F6,”Fast EMA 6″,Fast1Colour,Fast1Style);Plot(S1,”Slow EMA 1″,Slow1Colour,Slow1Style);

Plot(S2,”Slow EMA 2″,Slow1Colour,Slow1Style);

Plot(S3,”Slow EMA 3″,Slow1Colour,Slow1Style);

Plot(S4,”Slow EMA 4″,Slow1Colour,Slow1Style);

Plot(S5,”Slow EMA 5″,Slow1Colour,Slow1Style);

Plot(S6,”Slow EMA 6″,Slow1Colour,Slow1Style);_SECTION_END();

JulianCohen

ParticipantHi guys,

Any idea why my Guppy MMA properties are showing on the chart parameters under price as well as under their own section please?

JulianCohen

ParticipantMy name is Julian Cohen. I retired seven years ago after a long career in the money markets as a broker. I never turned my hand to trading until I retired, although I had read a lot about it for many years, and aways leaned towards trend following or momentum trading, and certainly systematic as opposed to discretionary.

I have been trading my own account for four years now, and haven’t blown up my account, which is something to be happy about. I have learned a lot about myself during this time, and I know that to remove the emotion from my trading, I have to remove all the discretion. This I have done for the last year with a futures account that I run on Trading Blox. I had a programmer write my system for me and thoroughly tested his work. This cost a lot, but I have more than made up for it results. I run a long term weekly trend following system based on Donchian breakouts, with a counter trend mechanism running alongside. It is simple and it works.

I realised that I had other ideas I wanted to test, but with no programming knowledge I was always going to be paying someone to do it for me. Then I heard Nick on a podcast, read Unholy Grails, trawled the website and saw the mentor course actually taught programming. Not only that but they could teach complete beginners too. So here I am.

In my spare time I am an underwater photographer and I travel quite extensively. A weekly trading system is great for that.

-

AuthorPosts