Forum Replies Created

-

AuthorPosts

-

KateMoloney

ParticipantNice work Glen

KateMoloney

ParticipantAustralia

ASX Momo 0%

ASX Swing -2.8%USA

TLT +5.70%MOC 1 +1.50%

MOC 2 -1.54%

MOC 3 +0.13% newly launchedTSX

Swing -1.96%

Daily -4.8% newly launchedAdded a new MOC system and also a daily TSX system on a small account. Most of the DD for TSX daily was attributed to HC not selling MOC, and then gapping below sell order the next day by over 25%. Turns out certain exchanges don’t support MOC orders. Commissions are high as well. Will review in 6 months.

Goals for the next month are to finalize two more systems.

KateMoloney

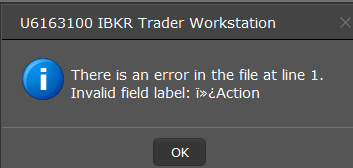

ParticipantHas anyone else had issues uploading weekly swing orders to TWS?

Error is

Odd thing is, I go onto the VPS and can upload the exact same file to TWS through there.

TWS versions both on and off the VPS are the exact same 10.19.1m

Tried uninstalling and reinstalling TWS. No luck.KateMoloney

ParticipantASX Momo – TBA/cash

TLT – TBATSX swing -1.2%

ASX swing -0.86%MOC 1 +0.26%

MOC 2 -0.73%Launched 2x new MOC systems – still trading the old ones, just splitting the capital across more systems for diversification purposes.

Overall, been a productive month of systems development.At an event this weekend, listening to someone worth $50M talk about investing. Very interesting weekend and its been so easy running the systems with RT vs AB whilst away from the office.

KateMoloney

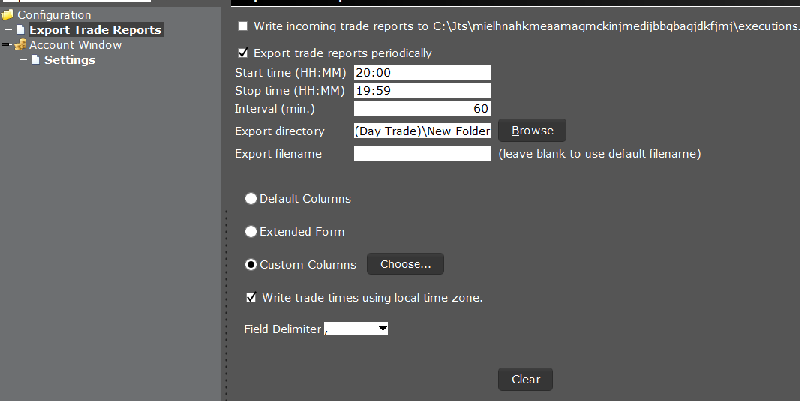

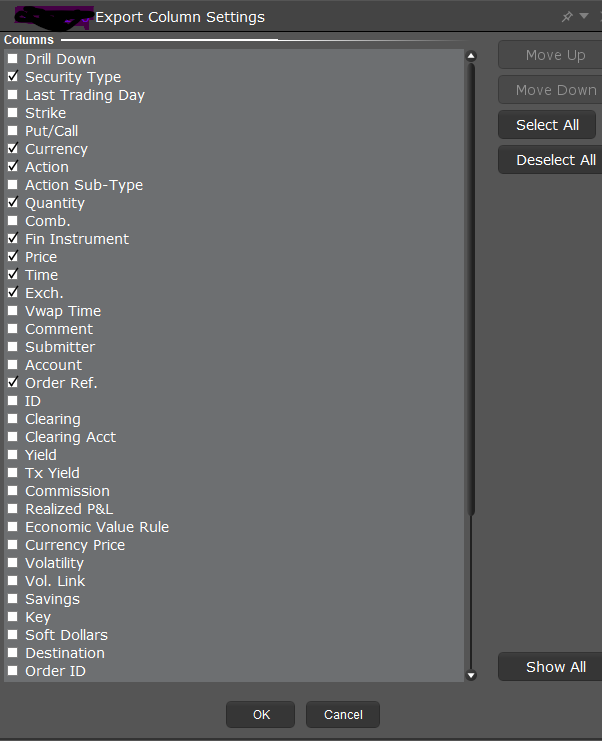

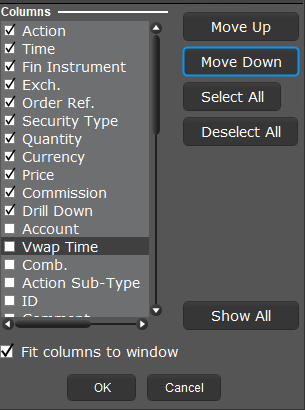

ParticipantNick Radge post=14000 userid=549 wrote:In TWS Export Trade Reports, change the custom Columns to the following, then use the IBKR transfer in STT.

I use Last 2 days, then change the Start Time to 20:00. That gives me just the trades from o/night. to->

to-> Just making a note for others as this took me a bit to figure out

Open trade history window, select last 2 days

Top right corner, click more options to change the start time to 20:00 for trade export

KateMoloney

ParticipantHi Nick,

Just checking this is correct. IB chat said the export section didn’t exist.

-> Configuration is where I found export settings.

Are my settings correct? And then once a day go into STT and upload from IB directly?

I added order reference because of different MOC strategies. Not sure if it will work, have to wait and see…

KateMoloney

ParticipantNick Radge post=13997 userid=549 wrote:Yeah, I canceled the VPS several months ago too. I’m not running OC but BasketTrader does what I needFor the MOC strategies, is there a way to extract the data that matches the STT format?

I pulled data from trade history in IB, and was able to change the order to resemble STT by clicking settings, layout.

Just need to manually change buy/sell and instrument to share.

KateMoloney

ParticipantAt least your head size has shrunk so you can walk through doors again.

Happy trading for April !

KateMoloney

ParticipantJulian Cohen post=13972 userid=5314 wrote:I don’t use the scan section very much..Would you like to give us an idea about how you are using it to spot errors?

(1) Take the ATR of last 5 days.

(2) Take the standard deviation of (1) for 50 days, and divide that by the standard deviation of the last 200 days

(3) If less than 5, then buy limit tomorrow at todays low minus (1) x 0.5

(4) Exit a close

(5) Apply to all stocks in US in an uptrend, above $20 and with t/o > $300kI may have misunderstood the rules, but I coded up the SD of 50 days, not the SD of the ATR.

The scan function ran the calculations and it was noted from the scan that no calculation (3) ran above 5, so rule 3 was essentially invalid on my version, but it did work at .5These exercises have been great from the perspective of critical thinking and using RT to pull apart a strategy.

Apart from that, I’m very reluctant trusting random trading gurus & the strategies they post on the internet

KateMoloney

ParticipantJust to clarify, I put input one of the rules incorrectly. My version is till a WIP.

Glen showed me how to do a scan to pick up my error. Only 4 weeks into my RT learning journey…..

Where are you stuck?

KateMoloney

ParticipantCancel my last comment Scott. Still trying to figure out if we interpreted the rules correctly.

The equity curve looks nothing like Nicks.

KateMoloney

ParticipantSecond attempt more on the money.

Thanks to Glen for the help.

This weekends job is to learn the scan function on RT so I can pick up the errors myself.

KateMoloney

ParticipantNick, isn’t this what you teach us not to do ?

KateMoloney

ParticipantThank you for sharing.

My first attempt produced a 38% ROR with a -57% maxDD.

The maxDD was in 2008. Last year produced a 120% return.

KateMoloney

ParticipantHi Trent

I did read that 90% of cash will be dispersed to shareholders if they can’t find another project and relist.

Have emailed the company for more details since IB and Computer share were of no help.

-

AuthorPosts