Forum Replies Created

-

AuthorPosts

-

KateMoloney

ParticipantEverything in life as a balancing or opposing force.

Hanging onto a fantasy of how life “should be” can lead to depression. Depression, like any emotional state, is simply feedback.

Many traders may be experiencing some form of depression or frustration in the current market. One way to counter act the frustration is to look at how the current environment is serving us as traders.

When we learn to embrace what is, rather than wish it to be another way, we become present and poised and adapt.

Those who adapt are the ones that thrive long term.

KateMoloney

ParticipantMarket is a bit of a test at the moment isn’t it?

Before my forced break, I was working on a multi MOC MR strategy. Some strategies were slapped into the combo just for fun. It was up 2.2% for September. Looking forward to getting back into it and exploring further. Creating multi equity pathways as Nick says …

KateMoloney

ParticipantThat is what I found with the ASX weekly swing … too many missed fills mainly due to lack of vol at the buy price.

Do you think you’ll continue trading it long term?

I spoke to someone recently who trades circa $30k with the swing strategy and so far has no issues with fills.

KateMoloney

ParticipantScott McNab post=14322 userid=5311 wrote:My condolences Kate. I have struggled regarding what to say as we had the same experience and I find it hard to address. If you could permit me one recommendation it would be to take up any offers of counselling or discussion that are available. Twenty plus years ago we were waved out the door and wished the best of luck. I watched my wife struggle with the thought that if only she had done something (or not done something) then the outcome may have been different. This oversimplification is not, of course, the reality of the complex biology involved and I hope today these issues and relevant information are shared and discussed.Regarding the markets, I am sure that everyone here has your best interests at heart but if you feel that getting involved back in the markets is what you need right now then I think (for what little its worth) you should go for it. Your plan to scale gradually back in seems well thought out.

Hi Scott,

Thank you for sharing your family story and advice. Sorry to hear about your experience and that of your wife, it is a very difficult and even though complex biology is involved, some women do blame themselves.

Not much seems to have changed since your time.

We terminated our pregnancy due to several major medical issues with our baby. It was no ones fault and has a 2% chance of happening again.

The Hospital (Catholic) and our GP tried to coerce us into keeping our baby despite clear evidence it wouldn’t live – or at best have a poor quality/short life.

Our termination process was deliberately sabotaged and had I not fought them, we would have missed the termination deadline.We were told by medical experts we’d make great friends at the hospital while our baby was in ICU, my husband should quit his job, set up a go fund me page and build a relationship with a rich Aunt or Uncle. It was then insinuated we were bad parents because we weren’t willing to bring an unwell baby into the world and “do whatever it takes”.

Emotionally it was a lot at the time and thankfully, we’ve had a lot of support from family & friends.

The termination clinic offered counselling, which I tried at two different places, but it was pretty much about telling me I am a victim (which I am not).

Using the Demartini Method has really helped, it is a quality questioning process I’ve used for over 12+ years with various life challenges.

Last night I was part of a session which will be posted on you tube. I had some really big perception shifts and hope it will be a valuable resource for women in the future.It has not been an easy journey, but every day there is progress.

Finding meaning has helped e.g how can I use this experience to help others….

Whilst none of this is trading related, I believe the work I do on this part of my life is helping my trading, especially around mindset and processing life challenges.

KateMoloney

ParticipantThanks heaps everyone.

Yep, markets certainly are a shit show at the moment ….

KateMoloney

ParticipantThanks Julian.

The night I doubled up the orders in basket trader by accident and didn’t pick it up is when I knew I needed to pull back for a bit.

I was on the RT call on Friday and they talked about order clerk for automated trading. Marcel admitted it still makes mistakes and needs oversight.

I’m of two minds whether it is worth exploring long term. Pretty sure even with order clerk in place, I would have stopped trading. Market will always be there …..

KateMoloney

Participant

KateMoloney

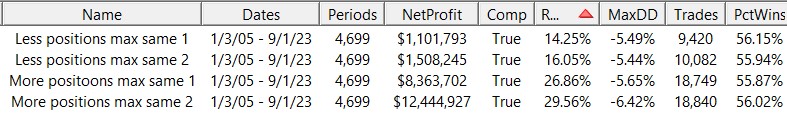

ParticipantSorry about the quality, hopefully this is better

KateMoloney

ParticipantHi Terry,

It is early days for me, but results so far look interesting on the MOCs.

This is a combined strategy with 7 long / short strategies, MOC only. Position sizing and risk per position is very modest.

Now I’m attempting to add more systems to generate higher returns. It requires a different mindset and I’m still wrapping my head around how to stress test the ideas effectively (e.g do I do it in the entire template or stress test individually).

KateMoloney

ParticipantHi Terry,

I’ve been playing around with this thanks to some prodding from Nick.

You’d be surprised how a stand alone B grade system looks when stacked up with a variety of other systems.

You could try de risking the position sizing if the maxDD is a concern for you. Another option to try is play with maxsametrades in real test on your multi systems template.

KateMoloney

ParticipantASX

ASX Momo -5.74%

US

US TLT -4.35%

MOC 1 -1.25%

MOC 2 +0.05%

MOC 3 -3.62%

MOC Long/Short (new) -0.54%MR Long Short (new) + $7 (I’m rich!!) roughly + 0.46% (testing a small account while I wrap my head around the daily routine – had some code / user error glitches)

Combined account: -1.52%

Been a productive month. After swearing I would never ever ever EVER short, I looked into it and it made sense, under certain conditions.

I like the diversification that it adds.This months focus is on;

[list]

[*]Fully launching a combined set of MR strategies

[*]Continuing to test short term multi strategy / lower frequency strategies

[*]Continuing to develop an all weather strategy

[/list]KateMoloney

ParticipantHi Nick

The USA returns you listed, are they domiciled in $AUD or $USD ?

I my testing so far there is quite a big difference between the two.

KateMoloney

ParticipantI’ve tried using the following to include the regime filter, seems to worsen results, don’t think I’ve coded it correctly.

Notes:

All weather example

1) If #NYSEHL is up OR SPY is up

2) If above is true, calcuate ROC for SPY and GLD in last 150 days

3) If the ROC is above 0, buy the strongest, if they are below 0, stay cashImport:

DataSource: Norgate

IncludeList: SPY, GLD {“ETFs”}

IncludeList: #NYSEHL, $SPX

StartDate: 1/1/1995

EndDate: Latest

SaveAs: AllWeather.rtdSettings:

DataFile: AllWeather.rtd

StartDate: 1/1/2005

EndDate: Latest

BarSize: Monthly

Benchmark: Benchmark

Side: Long

Allocation: S.Equity

EntrySetup: Symbol=$$SPX

Parameters:RegimeLen: From 1 to 18 def 12

RocLen: From 1 to 12 def 3Data:

Uptrend: Extern($$SPX, C > MA(C,RegimeLen))

HiLo: Extern($#NYSEHL, C > MA(C, RegimeLen))

Setup: Uptrend or HiLo

MyROC: ROC(C, RocLen)

//MyRank: #rank if(InList(“ETFs”), MyROC, nan) // the “nan” means “don’t rank if not in ETFs list” (you can’t trade $SPX or #NYSEHL)

Myrank: #rank Setup and if(InList(“ETFs”), MyROC, nan)Strategy: AllWeather

Side: Long

EntrySetup: MyRank = 1 // top-ranked ETF

ExitRule: MyRank > 1 // no longer top-ranked ETF

Quantity: 100 //

QtyType: Percent// To work on

// Check that the uptrend and HiLow indicators are switched on – don’t think they are

// Also need code to account for interest earned on cash ???

// And check that the system is in cashKateMoloney

ParticipantWork in progress code

Notes:

All weather example

1) If #NYSEHL is up OR SPY is up

2) If above is true, calcuate ROC for SPY and GLD in last 150 days

3) If the ROC is above 0, buy the strongest, if they are below 0, stay cashImport:

DataSource: Norgate

IncludeList: SPY, GLD {“ETFs”}

IncludeList: #NYSEHL, $SPX

StartDate: 1/1/1995

EndDate: Latest

SaveAs: AllWeather.rtdSettings:

DataFile: AllWeather.rtd

StartDate: 1/1/2005

EndDate: Latest

BarSize: Monthly

Benchmark: Benchmark

Side: Long

Allocation: S.Equity

EntrySetup: Symbol=$$SPX

Parameters:RegimeLen: From 1 to 18 def 12

RocLen: From 1 to 12 def 3 //Data:

Uptrend: Extern($$SPX, C > MA(C,RegimeLen))

HiLo: Extern($#NYSEHL, C > MA(C, RegimeLen))MyROC: ROC(C, RocLen)

MyRank: #rank if(InList(“ETFs”), MyROC, nan) // the “nan” means “don’t rank if not in ETFs list” (you can’t trade $SPX or #NYSEHL)Strategy: AllWeather

Side: Long

EntrySetup: MyRank = 1 // top-ranked ETF

ExitRule: MyRank > 1 // no longer top-ranked ETF

Quantity: 100 //

QtyType: Percent// Below items need work

// 1) Check that the uptrend and HiLow indicators are switched on – don’t think they are

// 2) Also need code to account for interest earned on cash ??? Bonds ETF or just interest on cash in bankKateMoloney

ParticipantMy version gets 11% CAGR with a -38% maxDD, but it hasn’t accounted for interest on cash and I used monthly bars.

I don’t think I’ve coded in the off switch properly either….

Nick or Craig, how to do you code for interest on cash? Do you use a bonds ETF to do this?

-

AuthorPosts