Forum Replies Created

-

AuthorPosts

-

KateMoloney

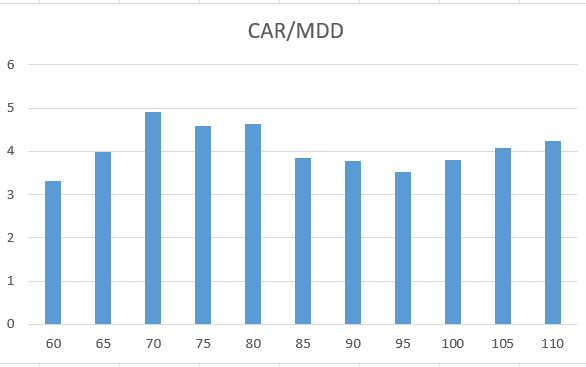

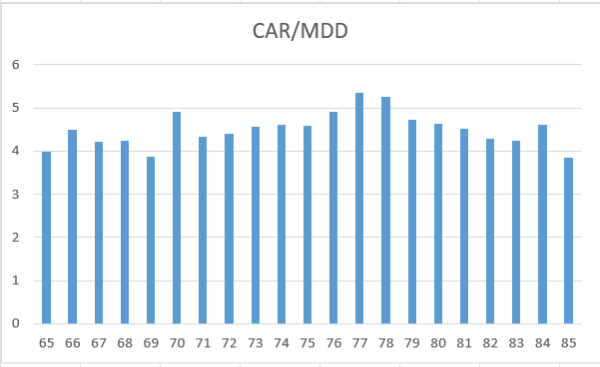

ParticipantAttached are the 2 year & 4 year optimizations.

The original 2005 – 2021 testing indicated best to have an 80 ROC.

The shorter term tests, particularly the 2 year one indicates a slight shift to 76 – 79 ROC is best.

4 year Optimization

2 year optimization

One positive – the system is robust across all parametsrs in the chart.

KateMoloney

ParticipantThat’d be great Mike. I’m away first week of Feb, but around for the rest of Feb & March.

KateMoloney

ParticipantYour shout tonight !

KateMoloney

ParticipantLast night I learned a very valuable lesson.

Lets just preface this by saying I’m on some strong medication from an emergency surgery that is messing with my mind/sleep. So I’m not my usual self.

A certain someone (won’t mention any names hey Nick

LOL) tweets “Looks like its going to be a nasty trading session”

LOL) tweets “Looks like its going to be a nasty trading session”My mind goes into over drive. Shit … do I cancel my trades … do I scale back the leverage ?

After 5 minutes of deliberations I decided to stick to my system and avoid the chatter on twitter.

So I went to bed, had some crazy dreams about losing a bunch of money (I told you my meds are really good), woke up at 3am, checked the trades and the total account was only down 0.7%.

LESSON LEARNED … don’t listen to gurus on twitter.

KateMoloney

ParticipantHi Michael.

Are you still in Rosalie?

I live in South Brisbane/West End … near the William Jolly Bridge …

KateMoloney

ParticipantYou can set onedrive to save files, even ones under program files. Quite handy.

KateMoloney

ParticipantInteresting times at the moment hey?

One benefit – good time to get stuck into the course.

KateMoloney

ParticipantWelcome to the program Slade!

I see you are from the hermit kingdom

KateMoloney

ParticipantTaking away all winning days over 5% over the 15 year back test period is a good exercise to go through …

Day Trade System #1

61 days with winning days over 5%

Day Trade System #2

83 days with winning days over 5%

CAGR reduced in both instances by nearly half, but CARG metrics were still desirable – I would still trade it (and that was leaving the big losing days in the metrics).

A good reminder that whilst the big winning days are nice, it is the little wins the bulk up the trading capital in day trade/MR systems. The big winning days are few and far between and they should be considered a bonus.

KateMoloney

ParticipantI went through my systems and deleted the big winning days from the backtest to see if the system was still profitable, which it was.

Big winning days are nice, but I didn’t want to rely on them. Just because a trade comes up in a backtest does not mean you get it in real life. One of my fears was that not all my orders would be filled on the big winning days. So I’ve done some pretty detailed analysis on my big winning days to see if the trades would get filled, but removing them from the back test gave me the confidence to trust in the system and that the little wins are more important than the big days like this.

Completed todays back test and all but one trade were missed. Out of 93 trades to miss one is pretty good, but I’ve had plenty of missed orders on other days, due to being low of the day, not enough vol, user error etc.

KateMoloney

ParticipantIt certainly is helpful early on to lose. I am not cocky about this.

KateMoloney

ParticipantEdit: up 13.5% over night on the two systems I designed.

(insert crying tears of gratitude emoji here)

Just capturing this moment here because markets are always in flux and I want a reminder that these days are possible. I’ve experienced more ass whooping than profits, so its a nice reminder that the other side is there too.

Last night I was playing with spreadsheets on long term compounding returns and couldn’t imagine what that would look like.

Got a painful ear infection (post surgery issue). But the pain isn’t noticeable when I work on the trading business. Freaking loving it.

KateMoloney

ParticipantBeen reading progress journals since the beginning (for the second time)

Trying to learn from other peoples mistakes and successes.

Inspiring to see how peoples trading has evolved over time.

On an interesting note … day trade system up 11% over night. Mum invested some money into the system on Sunday, and since this happened last time she invested, I have ascertained that she is a lucky charm. Will have to backtest this theory by asking her to invest weekly (or daily).

And Glenn … before you think of responding, please don’t, anytime you speak the market seems to punish

KateMoloney

ParticipantStarted trading second day trade system with a small account. Full capital will be allocated by mid month.

First trading session the loss was 8.8% (nice new year present).

The process of creating the second system has been so much easier (and more inspiring) than first time round. My confidence has improved a lot, I had fun and was creative with different rules and even had the confidence to try some code myself (which is huge for me because I still consider myself illiterate with coding).

Very grateful for Nick & Craigs support. The mentoring program has been excellent – I really appreciate the focus on getting people to take action and trade (rather than learning theory and not using that knowledge to trade).

There is still a lot for me learn and lots of knowledge gaps to fill etc, but I’ve learned enough to confidently trade and am filling the gaps as I go. When you have skin in the game, you learn a lot more – and the learning sticks.

Nicks certainty has been very helpful, especially at times when I’ve doubted myself or doubted that this will work, sometimes it just seems “too simple”.

Looking forward to seeing the long term results and the growth (professionally and personally).

KateMoloney

ParticipantThis is from the Australian IB website ………………………..

How We Handle Client Assets

Client money is segregated in special bank accounts (Client Money Accounts held in Trust with Authorised Deposit-taking Institutions (“ADI”)) which are designated for the exclusive benefit of Australian clients of IBKR. This segregation is a requirement of Australian Financial Services License (“AFSL”) holders and, Interactive Brokers Australia (“IBKR Australia”), as an AFSL holder, fully complies with these principles.

By properly segregating the client’s assets, if no money or stock is borrowed and no futures positions are held by the client, then the client’s assets are available to be returned to the client in the event of a default by or bankruptcy of the broker.

Client money is NOT invested by IBKR Australia, and is at all times held in these Client Money Accounts held in Trust. In addition, IBKR Australia does NOT hold any excess amount of its own money in these Client Money Accounts held in Trust.

-

AuthorPosts