Forum Replies Created

-

AuthorPosts

-

KateMoloney

ParticipantWanted to share some recent lessons. The market is certainly a great teacher.

Upper limits.

I attend a weekly business mindset class online. The class is all about human behaviour, mindset and psychology in relation to business and investing. Lately we’ve been discussing peoples upper limits in terms of their wealth creation, and its been interesting to see my upper limits play out in trading.

For example, the night of the 24th of Feb was a bit winning night that I missed out on. In many ways I don’t think that I was ready to handle another big win so early in my trading business. There was a part of me that felt it was “too easy” to make money like this so soon, and that I was potentially being greedy.

Because I love investing, it doesn’t feel like work to me. I can easily spend 12 hours in a day testing a system and be disappointed because its 10pm and I don’t want to go to bed. Recently there has been a string of losses in the MOC systems (all within the back testing). It has made me question my beliefs around the winning days and whether or not it is greedy. My new answer is, nope, I deserve to make that money. I’ve earned it through the daily work I commit to my trading business and mindset. And also – just because you love what you do, doesn’t mean that you don’t deserve to make a healthy profit from it.

Our mindset group have been working through a linking exercise, where we’ve set our next net wealth goal and are linking benefits to achieving that level of net worth. The exercise literally changes the neuro pathways in your brain. Looking forward to seeing how that plays out in trading.

Lesson two – fear around loss

Even though I had back tested it and was expecting days where the system could lose say 8% or 10% in a night, there was still a part of me fearing it. When it did come the other night, I felt no emotion about it and was able to carry on.

The lesson? Losses are never as bad as you think they will be. On that day, we could still eat and had a roof over our heads. Our daily lives did not change.

The day the system lost 8.1% I intentionally focused on the % and turned the blinkers on to the $ amount. Whilst I deal with the $ in the daily P&Ls, I’ll focus on the $ figures on a monthly basis. One trading session is not enough of a data snapshot to determine how good a system is. Nor is one month.

KateMoloney

ParticipantFrom Speedy

No, I’m not aware of this. The 1014 is the latest release.

Nick send me an email about these MOC orders but he’s talking about a very old version, the 981.3, so I’m not sure there’s a bug with MOC orders, it would have been solved between the 981.3 and the 1014.KateMoloney

ParticipantOk, so I tried the link, it is the same version as what we have now.

KateMoloney

ParticipantThanks Oli

he just gave me this link, but I think its the same as the version I already have (which is where the MOC issues are occurring).

KateMoloney

ParticipantThanks for sharing Nick.

7 MOC orders didn’t submit last night.

Does anyone ever get these issues when downloading the new TWS on speedy trading servers?

Got a support ticket in with them to figure out why it wont download.

KateMoloney

ParticipantA time machine would be nice.

KateMoloney

ParticipantNice !

KateMoloney

ParticipantKateMoloney

ParticipantAlternatively, you could keep testing other ideas?

My first MOC system had a return of 29% CAGR (17 year testing period) with 10% pos size, 25% margin and the max drawdown from memory was about 13%-14% on the R1000.

Look at the day trade system on the chartist website shop. The metrics for the system are posted there too. I bought it to get some new ideas.

KateMoloney

ParticipantDuring the testing phase, Nick got me to do an exercise where you look at the daily profit and loss (non compounded). So in advance of trading, I knew there would be large down days too.

Last night the system dropped -8.1%. No emotion felt. Will be trading tonight.

This is just the cost of doing business.KateMoloney

ParticipantHow do you feel about the 30% drawdown for the 10% pos size system ?

KateMoloney

ParticipantHi Oliver,

I wouldn’t say I have a killer system. The % profit I missed out on only happened in 1x trading session in 18 years of back testing, the profit day I missed was just an outlier day (or dumb luck), that’s all. Outlier losses can also occur. It is not everyone’s cup of tea.

It is wiser to focus on your own personal circumstances and design your system around that.

KateMoloney

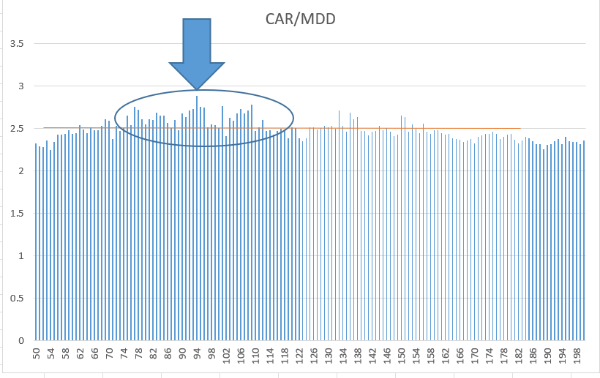

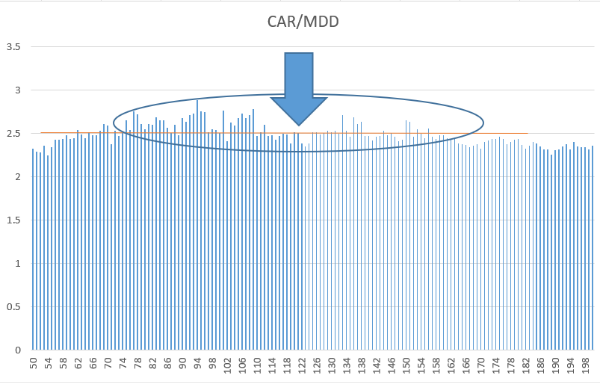

ParticipantJust posting this here, because it is a valuable learning re: choosing a flat spot when optimizing.

It seems I have been narrowing in too much, as opposed to zooming out when choosing a parameter.

KateMoloney

ParticipantAnother thing that has really helped me is to not check the system during trading session.

The news can be such a distraction too, so switching it off helps. We think one piece of news means “a bad trading session” is coming, or the futures market down 2% – 3% means a bad trading session is ahead. In most cases it amounts to nothing.

I used to check my day trade strategy at 5am local time (2 hours before close) but mainly to check the tech as I had issues early on with the API and did not trust/understand TWS. Now there is certainty it works, I just login 20 minutes before market close to see if the MOC orders are placed.

Had I logged in during session on the 24/1, I am sure the system would have been down 15% – 20% at one stage, but it ended trading session with a 32% gain. Don’t know about you Oliver, but I’d rather get my beauty sleep and wake up with a tidy profit than stress all night and second guess the system.

KateMoloney

ParticipantThanks for sharing Oliver. Shame you missed out on gain, and no, it doesn’t make me feel better seeing people like yourself miss out.

Trading is such a head game, isn’t it.

Am putting up a sign in my office “tho shault not over ride the trading system” :whistle:

-

AuthorPosts