Forum Replies Created

-

AuthorPosts

-

KateMoloney

ParticipantNice work Oliver

KateMoloney

ParticipantEdit:

April 2022

ASX Momo CASH

Growth Port -0.02%US TLT -3.67%

US Momo -4%WP MOC -7.68%

TB MOC -0.88%Been updating how I track and measure portfolio growth and stuffed up some of my figures.

Tracking our annual & monthly financial growth helps my mindset, especially right now when there has been a few losing months in a row.

Learning how to stress test systems before trading systems has been a godsend. Pushing the buttons has never been easier when you know your system performs reasonably well over the long term.

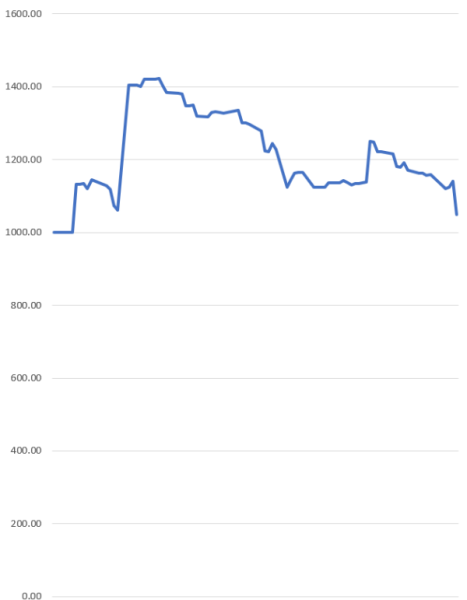

For example, I ran a stress test and assumed that I missed every single trading day that profited over +X%. The equity curve was a little bit chaotic, but the system was still profitable over the long term. It helps me to keep the faith, because the last thing I want to be doing with live systems is to have a knee jerk reaction and tinker.

KateMoloney

ParticipantApril 2022

ASX Momo CASH

Growth Port TBCUS TLT -3.67%

US Momo -13.25%WP MOC -7.68%

TB MOC -0.88%Some wins for the month

– Continued trading without emotion, despite largest intra month drawdown to date. System later bounced back.

– Finished research for first system redevelopment. Did a soft launch this week.

– Started research for second system redevelopment. Much easier than the first time round.

– Set up a tech kit with power bank, spare batteries, mouse, spare cables etc. Great for travel or emergencies (eg no power)

– Reviewed 3 modules of the mentoring program. Learned some new skills.

– Listened to 8 mentoring callsMay goals

– Research redevelopment of second system

– Review at least 2/3 modules from mentor program

– Listen to another 6 (minimum) mentoring calls

– Complete admin jobs (access to accounts, third party authorisation etc)Happy trading everyone

KateMoloney

ParticipantChris,

My experience with STT is that if I add additional funds to the portfolio at a later date, the portfolio return is inaccurate because it shows the return on the starting cash balance only.

Might be my user error…..KateMoloney

ParticipantWhen you did your testing did you stress test to exclude the low of the day?

Craig told me about this, it helps give you more realistic results when backtesting.custom backtesting section (Craigs bit is in red, you just activate the second line and // the first line.

if (LimitPrice < LowPrice) // If Limit Price less than Low

//if (LimitPrice <= LowPrice) // If Limit Price is the low of the day, therefore exclude this signal

sig.Price = -1; // Therefore exclude this signalKateMoloney

ParticipantInteresting read Craig.

Makes having multiple trading strategies even more appealing.

KateMoloney

ParticipantThanks for sharing Ben.

Trading can be so subjective, hey.

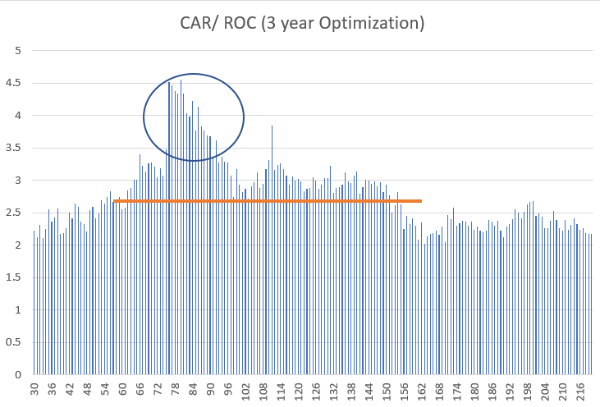

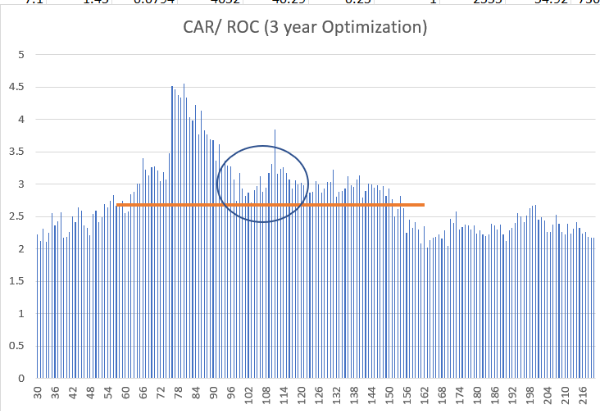

I should have posted up the Max DD & CAGR graphs as well … something else to consider when figuring out what the elusive flat spot is

KateMoloney

ParticipantThanks for sharing for your views Julian.

Just to add context – I also considered the 17 & 5 year optimizations as well as the R2000 version of the exact same param – which I will also be trading. I choose something that would work reasonably well in all those environments. Does that make sense?

I also look at the data as the graphs can be really deceiving. In this instance, the difference between data points is +/- 0.5 – 1% and all params are profitable. So I can either sweat the small stuff or just trade the dam thing

Maybe its the wrong attitude to have, but I know I’ll never get a system (or param) 100% perfect.

KateMoloney

ParticipantAs a much wiser (and senior) trader, please state your case.

Love to hear your process.

KateMoloney

ParticipantConfessions from a recovering over optimizing addict.

In the past, I defined the below area as a flat spot.

Then I learned it was best practice to zoom out, chuck a line down and pick the middle (as below).

I have had a tendency to aim for the best results without understanding the long term ramifications of making those decisions. I’ve had to rewire my thinking to look for what is sustainable long term VS what is the best return I can make now.

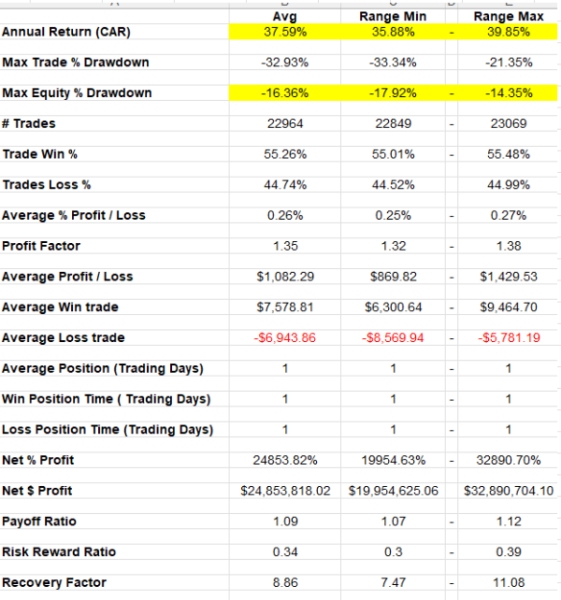

For fun, I ran an experiment using MCS and the above two parameters.

What I noticed is that the second param produced average results in the MCS that were more aligned with the backtest. Also the difference between the high and low return/max DD was a lot smaller (compared to when I tested the first parameter).

This concept probably sounds so simple to the more seasoned traders. But I’m still in newbie phase and before November I didn’t know who or wtf Russell (1000) was.

Step by step, day by day, working on improving skills & knowledge

KateMoloney

ParticipantSprinting!

I had 75 trades and for fun, tested it on 2x STT spreadsheets (each with the months trading results already input)

First STT took 35 minutes – there were other excel sheets open, so I shut them down

Second STT took about 3 minutes.KateMoloney

ParticipantHere is todays head f*ck / lesson from the market.

System one is my first system. I made all the rookie errors, over optimizing too many parameters, changing the rules a lot between the R1000 & R2000 versions. Low trade volume. etc etc. I will be reviewing this system as my next project.

Despite all the errors, system one is profitable.

System two, got a bit better. Applied new learnings. More trade vol. System is nearly back to breakeven.

If I followed what made money, I would stick to the first system and potentially dump or tweak the second system. The problem is that over optimized systems are not sustainable. So measuring success purely from financial results would be naïve.

Another lesson – there is nothing like real world experience. Last year in October Nick suggested I start trading. I was nervous and wasn’t 100% happy with my system. But it was the best feedback he could have given me, it got into the market and with experience comes (eventual) wisdom.

KateMoloney

ParticipantWelcome Marcel.

Hope you enjoy the program. Your in good hands

KateMoloney

ParticipantMicrosoft surface laptop 4. 32GB of ram, 1 TB hard drive.

What laptop did you get?

KateMoloney

ParticipantI keep the longer term strategies on a separate STT to try and eliminate the data on one spread sheet.

I’ve had the longer term strategy STT crash occasionally, but most of the issue is with the MOC strategy.

-

AuthorPosts