Forum Replies Created

-

AuthorPosts

-

KateMoloney

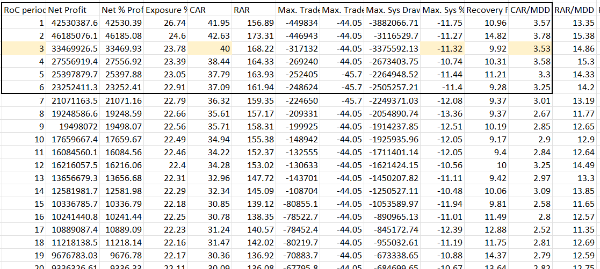

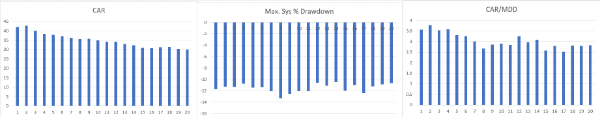

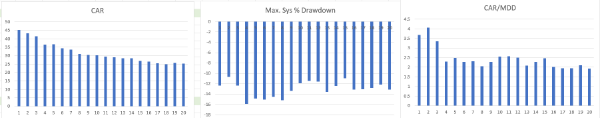

ParticipantI then played around with the ROC rank and managed to get the following results…

The results deteriorate as the param gets higher, but not as much as the first ROC example.

My question to Nick is, do you still consider the above example to be a robust system? Given that ranking rule is ranking on a smaller sample of stocks compared to the normal rules/conditions we put in our trading system.

My thoughts are it is a robust system. The 3 year optimization showed similar results and given it is a short term system, it makes sense that the shorter term ranking parameters will produce better returns.

KateMoloney

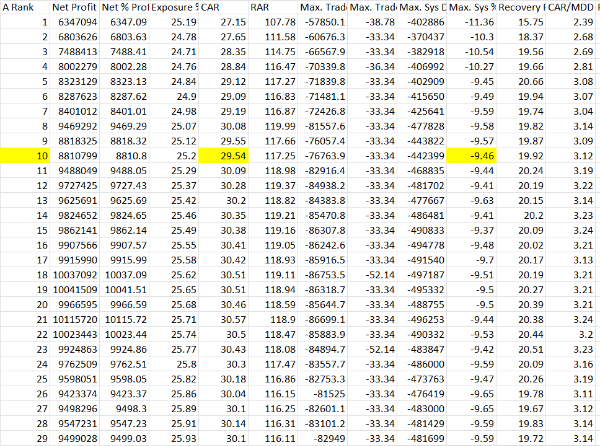

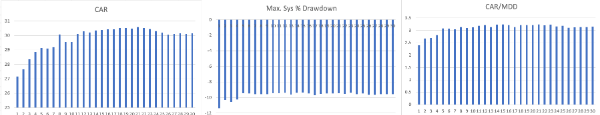

ParticipantWhereas with this ranking system, which is based on volatility, the parameters are pretty stable across the board.

KateMoloney

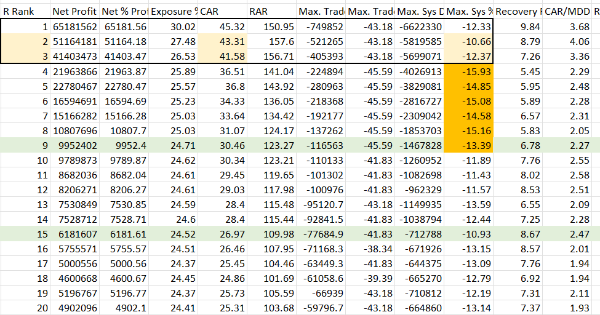

Participant17 Year optimization

KateMoloney

ParticipantThought I would had this for the benefit of the group.

A better explanation of what the 1 does (in the code above)

The exploration now sorts by Rank first, then alphabetical second.

So the latter will only occur when there are tied Ranks, which is what the backtester will do via PositionScore.

Rerun on those days you had anomalies to confirm.It has no bearing on the CBT code, just matching PositionScore.

KateMoloney

ParticipantI have a second machine set up with AB. Saved me twice now.

KateMoloney

ParticipantHave you been watching ARK ….?????

I watched a video of a guy promoting her in 2021 as “the best performing fund manager” of 2020. Put a bunch of his net worth into her fund. He doesn’t talk about ARK these days ….

KateMoloney

ParticipantJulian, Warren Buffett is such a great reminder to have a longer term focus (eg years/decades)

We can get so wrapped up in the day to day results. I still have a roof over my head, clean water, food and a husband that supports the trading business through the ups and downs.Trading wise, I’m back to where I was about 7-10 days ago. Had a nice run recent then *bam* *slap*

… but nothing a bit of chocolate can’t fix. It is the universal cure for everything.

It is the universal cure for everything.KateMoloney

ParticipantEndured largest one day loss in day trading so far. Down 13% & 15%. All within expected range from the stress testing, granted these are outlier down days.

Over the weekend I reviewed my YTD figures and was reasonably happy with the progress – only to get slapped by Mr market today and have nearly half my YTD profits wiped out.

The key for today is to continue my normal trading routines, including research. Today is not a day for a knee jerk emotional reactions or system tweaking.

On a funny note, went out for breakfast this morning and my husband said “Are we going to be like Warren Buffett and order the cheaper breakfast option because the stock market is down?” 😆

KateMoloney

ParticipantGood luck with everything Marcel. Hope things improve for you soon.

KateMoloney

ParticipantThanks Julian.

No blood pressure worries here.

Just get to the bottom of it and next then 10,000 million trades

KateMoloney

ParticipantQueried IB again and they insist the following …

Thank you for replying back to us.

As mentioned in the previous response, we would like to inform you that the time you mentioned (10:17 pm Brisbane time) coincides with the server reset time for your region due to which you may have experienced a disconnection. This is by design and the reset happens for server maintenance. For further information about server reset timings, please refer to the following link : https://www.interactivebrokers.com/en/software/systemStatus.php

Regards,

Abhay I

IBKR Client Services – Technical Assistance CenterTWS worked fine last night.

KateMoloney

ParticipantIB got back to me. Said it was the autolog off time (it was not).

Then insisted it was the following issue …

Initial Description: TWS logged out

Response from IBCS at 05-May-2022Adding to the previous response we would like to inform you that the time you mentioned coincides with the server reset time for your region. This reset happens for server maintenance. For further information please refer to the following link : https://www.interactivebrokers.com/en/software/systemStatus.php

Regards,

Abhay I

IBKR Client Services – Technical Assistance CenterWill see what happens tonight. Hopefully it was a one off.

KateMoloney

ParticipantYes, windows update is turned off.

The API was still open when I logged in.Waiting to hear from IB ….

KateMoloney

ParticipantOver the weekend I created a strategy that performed better on one index VS another, and I wanted to know why that was so.

After speaking with Nick, he had me run a non compounded back test, specifically looking at average profit & loss per trade.

The average profit and loss per trade was pretty much the same on all the indexes, however, trade frequency was higher on one index VS another, which meant compounding was what produced higher returns on the backtests.

It is one thing to see a system that performs well on a back test, but to understand WHY it makes more money is even more useful. Now my next steps in the system design process are clear.

This is another area I am starting to learn about … utilizing compounded & non compounded back tests to assess the health of a system.

KateMoloney

ParticipantIs your balance out by a little or by a lot?

Have you added or withdrawn funds and not recorded it on your STT?

Have you checked your IB statements for other incidentals not on STT, eg interest, currency conversion, other fees

-

AuthorPosts