Forum Replies Created

-

AuthorPosts

-

KateMoloney

ParticipantNice work Anthony

KateMoloney

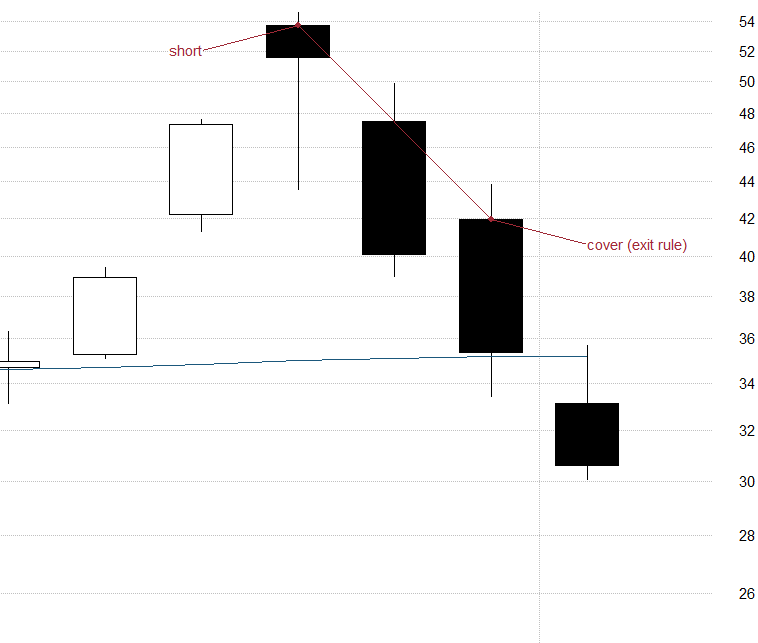

ParticipantDJT share

Short Trade

circa 22% profitI really love Donald Trump because of this trade LOL

Most of the drawdown in the MR system is gone thanks to that trade.

Shows the power of sticking to a system. You never know how or when the tide will turn.

KateMoloney

ParticipantThank you everyone for your messages.

My Mum passed away recently. I flew to Switzerland to say goodbye, now we are in the process of finalizing her affairs.

Because of the brain tumor she left a financial mess behind. It has really taught me the importance of proper estate planning and setting up power of attorney to manage your affairs if you are incapacitated. Something to think about for our trading accounts … giving our family instructions on how to access and close off trades.Personally, I’ve just started to turn the corner (mentally speaking). I have a wonderful family in Switzerland, whom I barely knew, and was able to connect with through Mums passing. Understanding Swiss finance and law has made me really appreciate the opportunities we have in Australia. My counsin built her first house. $1.8M AUD to build a average quality 170sqm home.

I’ve continued trading every day, albeit neglecting some of regular practices … now catching up. The cool thing was putting in the trades and not having ANY emotion about it. This has been the most detached I’ve ever been to trading.

Australia

WTT +1.22%

US

MOC #1 -0.14%

MR #1 +1.62%

MR#2 +6.79%US TLT +2.57%

US AW +0.8%KateMoloney

ParticipantNice work!

KateMoloney

ParticipantWisdom right here Nick! Words to live by.

KateMoloney

Participantnice work Glen!

KateMoloney

ParticipantThis last month has been insane, so will update the missing stats when I come up for air.

Between having a miscarriage and the health complications with it, to Mums health declining rapidly (shes now in pallitative care), and a new build, I’ve had a lot on my plate.

I’m lucky to have a good psychologist and doctor helping me through it all, and we have a very supportive family who flew inter state to be with us.I’ve still been showing up every day to do my trades, because I still shower and brush my teeth even when life gets a bit rough … so I’ll still show up for the 15/20 minutes to do my trades. Literally just pressing buttons and letting the trades fall where they will. Theres a few system reviews and system developments on hold, but the market will always be there and can wait till things settle down.

The good thing about systematic trading is as long as you collect the daily data, you can catch up on EOM financials at a later date.

WTT + 5.33% (really happy with this system, mainly because of the minimal time commitment and diversification from US)

MOC Long Short + 4.40%

US TLT

US All WeatherMR Long Short #1 – the shorts cost these systems money in September, although they are producing some nice 6% & 7% profit trades in the last 2-3 days

MR Long Short #2KateMoloney

ParticipantNice work Nick!

KateMoloney

ParticipantThanks Sean, Julian and Rick for your replies.

The account was -0.72% below last month, so whilst it could have been in profit, the result isn’t too bad considering ….

I believe its important to understand why we do what we do, then we can improve as traders.

Family crisis seems to be the tipping point for me when there is market volatility. Will be mulling over ways I can handle this differently in the future and adjust the trading plan. Handled some volatility in July like a pro, and kept trading the systems, with no emotion.

The main difference betwen July & August volatilty was the family crisis, and I learned I’m pregnant which can really impact my thinking (baby brain is a thing). At least now I know so I can question my thinking. Having to triple check orders atm because my brain is somewhere off on Mars LOL.

KateMoloney

ParticipantAugust

MOC Long / Short + 1.02%

MOC #2 – put on hold due to deteroiating result especially on RUT, missing profitable trades skewing results (eg low of the day)MR #1 -5.1%

MR #2 – 8.26%US TLT -3.74%

US AW +1.5%WTT +3.34%

KateMoloney

ParticipantStill working on the results .. posting this for future reference.

This last month has been a ride with many lessons learned.

When the volatility struck, I had a major family issue arise on the same day. My normal emotional coping ability was diminished, so I made the decision to exit the market until the personal volatility died down.

This ended up costing me missed profits on the MOC and exiting at the low in the MR and long term systems.

A part of me was pissed about it, but it is part of my plan to scale back trading when there is personal & market volatility at the same time. I didn’t see sense in beating myself up for too long, rather getting back on the horse asap and learning from it.

Reading the forum, reading Nicks words helped … something along the lines of …. “I’ve been in this drawdown before, I’ve had worse than this drawdown before and I will keep trading and build back up again”

After getting back into the market, things started to move ….

1) The strategies started to claw back to DD, especially the MRs

2) I added a WTT system (diversification!)

3) Added US all weather (adding AU all weather once brokerage account is open)

4) Opening a SMSF for all weather strategies

5) We are building a home, build cost was finalized, which helped give me clarity as to capital allocation for trading and systems

6) Finally, Dad invested some $ into trading… he is well aware of my mistakes / learnings … and still wanted to put some money into trading. This means alot.Ended the month up from the account low ….

Set some very solid boundaries with the family members that were a part of the emotional volatility. Brain tumors can be a very complicated illness and change peoples personalities. It takes a lot of emotional intelligence to navigate it. Taking all the lessons from it to apply to trading, learning to be stable within myself, trust my systems regardless of what is happening around me, and to think long term.

Onwards and upwards!

KateMoloney

ParticipantNick, Once I interviewed a financial planner who encouraged me to lodge a complaint if she lost me money because “my insurance will cover your losses”

I did not engage her with that attitude. Where is client responsibility? And why do the other people have to pay for advisors with complaints?!

KateMoloney

ParticipantI’ve noticed IB have made their ASX trades much more competitive.

https://www.interactivebrokers.com.au/en/pricing/commissions-stocks-asia-pacific.php?re=apac

As I understand it, it is 0.088% per trade or a minimum of $5.50 per trade.

Only downside is they are not CHESS sponsored trades.

KateMoloney

ParticipantThanks Nick.

The amount of regulation is insane. Trying so much to stop people losing money they also stop them making money.KateMoloney

ParticipantGreat stats. Especially handy for those fearful of a repeat of the 2008 market.

I’m currently looking @ using Stake in a SMSF environment to trade those portfolios.

$3 per trade and $990 per year to manage the fund.

Having a convo with them tomorrow to find out all the downsides.

Been using Hostplus in the past for monthly trading, but its way too restrictive.

-

AuthorPosts