Forum Replies Created

-

AuthorPosts

-

KateMoloney

ParticipantBen Osborn post=13262 userid=5409 wrote:July 2022 PerformanceUS

Combined MOC 14.13% (-34.78% since late March 2022)A little reward after the punishment

KateMoloney

ParticipantBack in the game Slade

KateMoloney

ParticipantThank you for sharing Said.

KateMoloney

ParticipantNice work Terry

KateMoloney

ParticipantAnother thing that really stuck with me (courtesy of Nick) was looking at indicators on a stand alone basis and only adding additional indicators if they *add value* to the over all system.

What I took from it is simple is best.

KateMoloney

ParticipantSeth Lingafeldt post=13255 userid=5356 wrote:Kate M post=13249 userid=5397 wrote:Curious to know how people come up with ideas for their MOC systems? What process do you go through to come up with a trading idea?I have this saved so I’ll post it here. A long time ago Said Bitar wrote something about “I’m not too creative, so I start with ranking”. That is some of the best advice I’ve gotten.

When I start system creation, I do the following:

- make my thesis (big idea)

- make my ranking (how to express my big idea)

- make my stretch (how sensitive is my big idea)

- make my filter (how much support does my idea need)

- add indicators to my filter if needed (any edge cases to be handled, such as don’t short biotech and don’t short something that was $2 one week ago)

If #1 is not done, there is no need to proceed to #2… and so on.

Great share – thank you Said & Seth.

One thing that has always stuck with me is looking for either;

a) reversion from the mean (using RSI, MA etc to determine)

or

b) expansion in volatility (from Nick)

KateMoloney

ParticipantTrent Rothall post=13253 userid=3988 wrote:Have you read Atomic Habits Kate?It’s similar to the Demartini books. You might like it if you haven’t read it yet.

Haven’t read it yet, will put it on the list, thanks Trent.

Re read the weekend trend trader today. The author seems to think he knows what hes doing ….

KateMoloney

ParticipantJulian Cohen post=13251 userid=5314 wrote:A good place to look is here:https://school.stockcharts.com/doku.php?id=technical_indicators

I have gone through this list, coded them up and tested them on my own universes and with my own ranking ideas. Combine them, change the parameters. Try whatever you can to examine them for edge.

There’s a lot there and over the last few years I have come back to here, or pages similar and retested ideas I had already tested and discarded, but with a bit more experience I have found things that work which I didn’t find before.

So it’s a long process of constant research and development, often going over things a number of times at different points in your journey.

Another thing to think of when trying these ideas, is maybe running a moving average over the indicator eg MA(RSI(2),5) instead of just RSI….

Also try the setup but one or two days previous…eg Ref(3LowerLows,-1) Often a pattern works but the move is better the second day after the setup, when the stock has turned and is now going up with some momentum….that might give you a better edge.

Thank you for sharing your wisdom Julian.

KateMoloney

ParticipantThe last few weeks have been head down bum up in research.

For some strange reason my AB settings changed without my input. It happened on both computers running AB, which cost me additional time to rerun some tests. Can only assume it happened because of a windows update when AB was open…..very annoying but the word doc I have with the default settings saved the day.

Was running day trade @ 80% capacity as I wasn’t happy with one of the systems. Have tried to come up with ideas and haven’t found anything satisfactory (yet). In the meantime, I am running at 100% capacity by doubling the capital in one of the lower leverage systems. That way, if it takes 6 months to come up with an idea it won’t matter so much.

I have also been challenging myself to think beyond what I currently know.

As an example, and this will sound completely rookie to some of you, I did not know you could take the stretch beyond 1

…… so now I test all systems at the 0.2 – 1.4 stretch range.

…… so now I test all systems at the 0.2 – 1.4 stretch range. Glens idea about the dynamic stretch also made me see new ways of thinking….

My goal is to create a R1000 & R2000 using indicators that are completely different to what I have in my other systems. At this stage I have a huge grave yard and a bunch of ideas I don’t like, which is why I am now looking at how I am thinking …..

In the MOC thread by Julian, I noticed Glen and Slades backtested results were an improvement on what I am currently getting in my own backtests. Trying to find the balance between pushing myself to create better results, whilst also not getting into a state of FOMO or comparison, because each traders journey is their own. Plus you never know the ins and outs of someone elses strategy unless you have all the data.

Its been a fun process and there is much more work to come yet! Another goal is to improve my coding.

Again, this will sound completely rookie to some of you … but for me, putting Slades code into my own systems and coding it up correctly was quite a challenge. Would have taken Craig two seconds to get it done , but after 15 minutes of thinking and some research into what some of the code meant, I was able to get it done and test it successfully. For me, a huge achievement, due to having no background in coding as of last year.

, but after 15 minutes of thinking and some research into what some of the code meant, I was able to get it done and test it successfully. For me, a huge achievement, due to having no background in coding as of last year.Happy trading everyone !

KateMoloney

ParticipantThanks Glen for the idea with the stretch filter.

Noticed that daily drawdowns increased from a maximum of 18% to 27%, mainly during 2020. Something to be considered ……

KateMoloney

ParticipantSlade Chisholm post=13238 userid=5407 wrote:Thanks for posting this Glen, I am working on my second MOC system so your timing is great.I tried it out and have a solid improvement. I followed your lead and reduced the stretch where the Index PDI was above Index MDI which gives the below:

Sample AB Code below for info:

// Generate PDI/MDI for $SPX.

SetForeign( “$SPX” );

IndexPDI = PDI(5);

IndexMDI = MDI(5);

RestorePriceArrays();// Calc Stretch based on Index PDI/MDI.

StretchMulti = IIf(IndexPDI > IndexMDI, PDIUpMulti, MDIUpMulti);

EntryStretch = ATR(ATRRange) * StretchMulti;I also messed around with the PDI/MDI at the stock level but found it a bit inconsistent.

Plenty for me to play with here.

Cheers

Thanks for sharing Slade.

What timeframe did you test on?

KateMoloney

ParticipantIt is one the things I like most about the Chartist website … the posting of performance results (including the negative months).

KateMoloney

ParticipantI think the wise move is to leave it as is, just thought I would ask the q ….

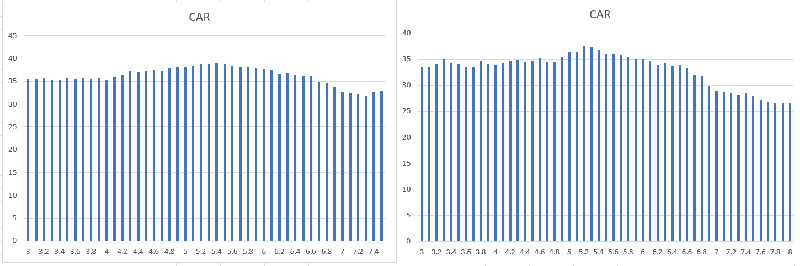

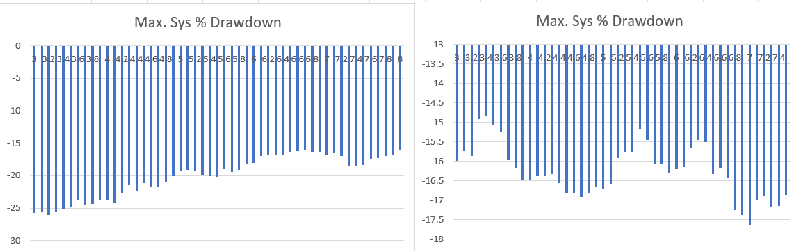

There might be an element of data mining by waiting 6 months, but considering what June did to the data …….In all params it is the DD that skews the results. Some DD graphs are all over the shop. But when I look at the original param graphs on the current optimization tests, they are still

in a flat spot.CAGR example

Jan 19 – Jan 22 left, July 19 – July 22 on right)

DD example

(July 19 – July 22 left, Jan 19 – Jan 22 right)

KateMoloney

ParticipantHi Julian

It is the drawdowns where there is the biggest difference – mainly from the end of June data where the big drawdowns where.

CAGR across the various params is pretty stable.

KateMoloney

ParticipantLen Zir post=13216 userid=5316 wrote:Kate,

Did Parker mention any rules for how you ramp up your account as it turns profitable after a drawdown?Nothing came up in research, but you could try something simple in reverse?

As I said earlier, my plan is to continue trading MOC as is and learn from it. The more I understand my numbers the more I feel comfortable with this current DD.

-

AuthorPosts