Forum Replies Created

-

AuthorPosts

-

KateMoloney

ParticipantI run the same rules for each universe.

The only thing I might change is the stretch e.g slightly higher stretch for the R2000 vs R1000.

Did the same exercise as you a while back and like you found that a new ranking improved the drawdown on one of the systems. Decided not to go ahead with it as further testing disproved the theory.

You’ve got to figure out what risk/reward you are willing to accept … and as long as its a robust system …

KateMoloney

ParticipantTerry, an error message came up but I accidentally clicked OK. Something to do with the exchange I think.

Easily solved with limit orders.

KateMoloney

ParticipantReviewing first week of Canadian orders.

4 trades executed, only one suffered slippage of 1 cent.

Placed MOC orders on all positions on Friday afternoon local time. IB cancelled some of them (not all). Solution moving forward will be to use limit orders either placed on Friday afternoon or Saturday morning.

KateMoloney

ParticipantHi Terry

See my first post.

KateMoloney

ParticipantI had 2 orders fill last night.

The rest were cancelled by IB.

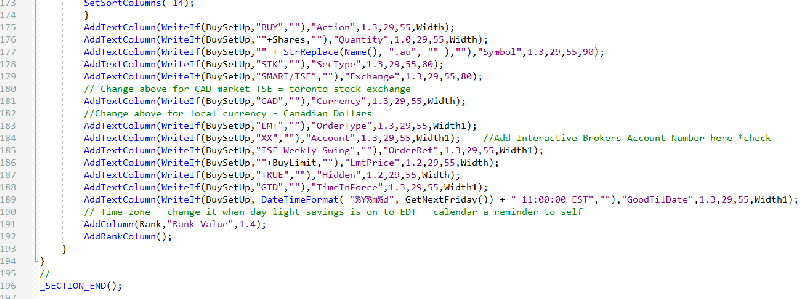

Error message was boardlot orders can’t be hidden orders. Going to adjust a few things in the code and try again next week.

KateMoloney

ParticipantLoaded some small orders on TSX today as a test. Still ironing out a few things.

Made following changes to the code.

Re: timezone, not sure if this will need to be changed for day light savings from ET to EDT.

KateMoloney

ParticipantIf only it was a short sale …

KateMoloney

ParticipantSomething to be aware of (for Australia IB accounts trading in Canada).

FX Offering

IBKR Australia can only support currencies in AUD, USD, HKD, EUR and GBP and you can convert between these currencies. If you have cash balances in currencies other than IBA supported currencies (AUD, USD, HKD, EUR or GBP) these will to be converted into your nominated base currency.

IBAU clients, when permissioned, can trade in any market available across the IBKR network, even those outside the 5 supported currencies above. However, upon your instruction for any market outside the 5 supported currencies, IBKR Australia will automatically execute Forex conversions to ensure non-supported cash balances be cleared.

For example, if an IBKR Australia client using a Cash account wishes to buy JPY denominated securities, as long

as the client has sufficient available funds, the trade is permitted. To settle the trade, IBKR Australia will convert the existing cash balances into JPY. Similarly at a later date, if the same client wishes to sell their JPY denominated securities, IBKR Australia would automatically convert the JPY proceeds to the base currency by day end, once again leaving no residual JPY cash balances.If an IBKR Australia client using a margin account has any positive or negative cash balances outside of the 5 supported currencies, it will be automatically converted to base currency by day end.

KateMoloney

ParticipantTerry, I’m going to start with a small account and see.

Best way to understand it is with skin in the game.KateMoloney

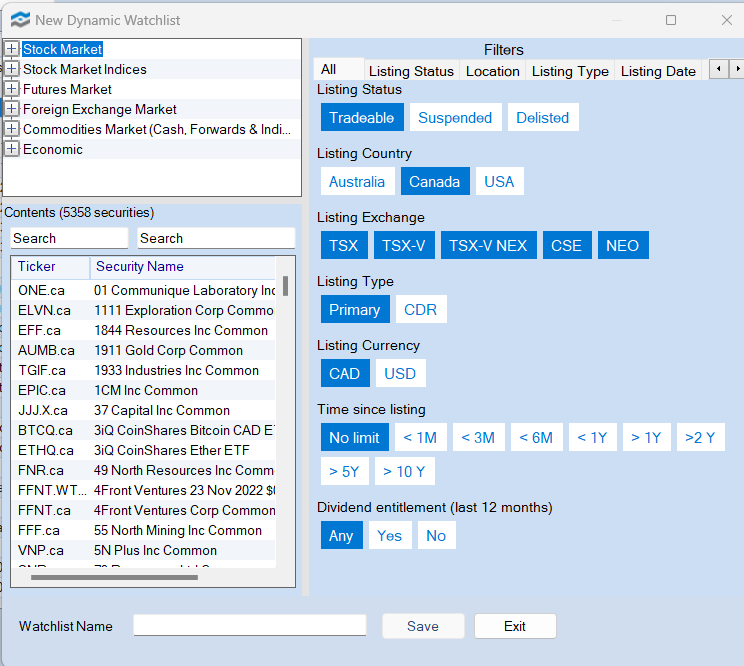

ParticipantSetting up Canadian watchlist (for some reason it deleted when my computer did a software upgrade …). Now setting up the watchlist is different to when I initially set it up.

These are the settings I’m using for “All present Canada stocks”

I decided not to include USD stocks as there were only 190 on the TSX and I didn’t want to mess with different currencies.

Re: listing exchange – I ticked all of them, but need to research it further to understand it.

KateMoloney

ParticipantNick/Craig, why was the weekly system designed to cancel orders at 11am local time on Friday?

Is it because price movements in one day didn’t add much value to the system? and adds commission drag?

KateMoloney

ParticipantFor sure Ben. That’s why I am starting with a small account.

There is also another currency to hedge.

And also the weekly buy/sell process to think about. At this stage I’ll probably use manual MOC orders – input on a Friday afternoon local time.

Only thing I haven’t yet thought of is how to deal with any stocks bought during Friday day (before 11am Friday Canada time).

KateMoloney

ParticipantASX

ASX Momo 0%

Growth Defensive 0%

ASX weekly Swing +0.8%US

US Momo 0%

US TLT 0%

MOC #1 0% under construction

MOC #2 +0.14% launched small account 7 days ago with dynamic stretchGoal for November is to complete research for MOC #1 and trade it by month end.

Then will work on a Canadian weekly swing system.KateMoloney

ParticipantUpdate:

Launched my own version of the ASX swing strategy a few weeks ago on a small allocation. Really like the strategy and find it very easy to manage.

Currently reviewing day trade strategies, with the aim of re entering in a week or so. Researching different methods to dynamically change the stretch e.g a higher stretch in a volatile/down trending market, lower stretch in an up trending/stable market. The R2000 strategies were the ones that suffered the most in terms of drawdown this year.

While the computer is busy testing, I’ve been looking at the swing strategy on the Canadian market. The original code tests at 60% CAGR with a -37% max DD. With some changes to the filters/settings I’ve been able to get it to 49% CAGR with a -14% max DD. This is without any extensive research, which I’ll hook into once I’ve finalised the day trade strategies. I like the idea of adding Canada for some diversification. The downside will be another currency hedge to manage if I go down this route.

Other than that, been reviewing the mentoring program and setting myself small coding challenges. Thanks to Craig for checking my work. Still got a bit to go to get better, but practice makes makes perfect.

KateMoloney

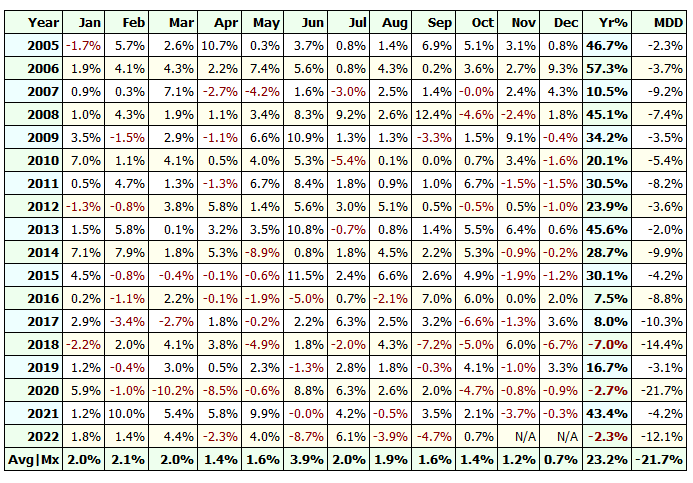

ParticipantRob M post=13464 userid=5369 wrote:Anyone testing this on the US markets to see if that is a possibility? I know Nick said it wasn’t a good fit, but curious if someone finds a creative twist that works reasonably on a US market or just a good diversifier for only US traders.My system runs 23% CAGR with -21% DD on R3000. That is without any meaningful research or tweaks because I don’t intend to add anymore US systems.

Here are the returns;

Canada is meant to be better.

-

AuthorPosts