Forum Replies Created

-

AuthorPosts

-

December 13, 2022 at 7:01 am in reply to: Incorporating an Index Volatility Based Trailing Stop with the WTT #113119

KateMoloney

ParticipantWhat vol / liquidity filters do you use on the WTT system?

I note the default is $500,000 minimum turn over per week. Bit worried its a bit low. Have played around with higher $ amounts but it negatively impacts the CAGR & DD quite a bit….

KateMoloney

ParticipantHow did your system perform in the 90’s?

In 2008 the interest rates dropped, this year they are rising and in higher increments.

I added a dynamic stretch to my MOC systems – it increases the stretch when the market is trending down.

KateMoloney

ParticipantSometimes it can hard to properly convey a point in writing.

One thing Nick taught us is to watch the track records of great traders, especially during a drawdown period. I consider Nick a great trader, so I track his results.

According to my calculations (and I could be wrong) the HFT system was down -43.07% this year on a compounded basis (Jan – October, excluding last months return).

Nick had the psychological fortitude to continue trading that system despite the volatility and drawdown. The drawdown came after he added the R2000 component, which would have put many traders off the system.

The healthy return made last month ? Nick bloody earned it. Especially when you consider the journey he went through.

Through Nick and Craig we have the opportunity to stand on the shoulders of giants. So for me, rather than praise a good result/month, I like to understand the journey so I can fully appreciate what it took for the trader to create result.

KateMoloney

ParticipantThat was a really good group call. Worth relistening to.

KateMoloney

ParticipantLen Zir post=13634 userid=5316 wrote:Kate,

Keeping the big picture in mind the HFT on Nick’s site which I trade is only down 5.9% for the year and in Nick’s case less than that. These are outstanding results in a year when mean reversion systems have taken a major hit. The system is volatile but I am fine with the drawdown and looking forward to the next 1000 trades.Hi Len,

Nick posted some monthly drawdowns for that system of -25.30% & -11.94% & -19.50%

Not knocking the system or Nick, its just a ride many traders couldn’t handle to get to the 25% profit month.

KateMoloney

ParticipantFor sure Tim.

Whilst everyone is happy to take a profit, most would struggle psychologically with some of the monthly drawdowns from this year.

KateMoloney

ParticipantAustralia

ASX Momo Cash

Growth Defensive TBA

ASX Swing +1.98%USA

Trade Long Term +2.56%

US Momentum Cash

MOC #1 +0.15%

MOC #2 +0.31%KateMoloney

ParticipantThose of you praising Nicks HFT result … go back and look at Jan, April and June 2022.

Not knocking you Nick ….we humans praise the profits and sometimes forget the journey it took to get there.

KateMoloney

Participant

KateMoloney

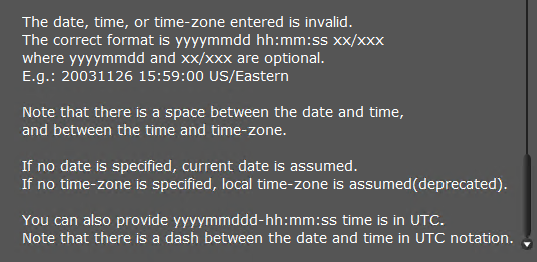

ParticipantBasket trader has changed in IB.

I previously used 20221125 11:00:00 EST

(canada)

and 20221125 11:00:00 AEST

(Australia)This works

20221125 11:00:00 Australia/NSW

20221125 11:00:00 US/EasternThey are very specific about spaces and capitals.

I also had to click yes to a pop up window for every single share, discussing margin requirements if the position is taken.

KateMoloney

ParticipantHas anyone had issues with basket trader today?

Mine worked perfectly for the last 5 weeks, now it says the time/date is incorrect….. I’ve tried amending it… nothing has fixed it.

I did notice basket trader opens as a tab, not a pop up like it used to. I tried STABLE version and latest version … no luck.

KateMoloney

ParticipantHope you get better soon Mark.

KateMoloney

ParticipantUpdate;

Canada system is up and running on a small account. Plan is to re-evaluate it in 3 months and recheck every 3 months to see if its tracking the backtest.

If it passes its 6 month probation period I’ll likely allocate a small % (eg 5%).ASX Swing strategy, just increased account allocation by 50%.

Been reviewing and working on portfolio allocations and improving my spreadsheets to track this.

Have also refined my record keeping processes for systems development. It has been so helpful reviewing old spreadsheets and code, trying a new twist on old ideas, or revisiting them with fresh eyes. Some of the spreadsheets I have are 100’s of mb full of notes, data and screen shots. I also kept extensive notes from mentoring and review them often. Sometimes something Nick/Craig say doesn’t land until I re-read those notes months later.Also been working a lot on my money mindset. I meet up with a mate once a week where we apply the Demartini Method questions to business/investing. This morning I worked on clearing my attachment to consistent profits. Had some big realisations and insights. I can see this year, whilst challenging at times, instead of giving up, I’ve put in extra work, invested into additional mentoring and improved my processes. I started keeping a notebook with me and write down random ideas that come to me throughout the day.

My time to profit will come and when it does, I know I will feel that I’ve earnt that money …..

KateMoloney

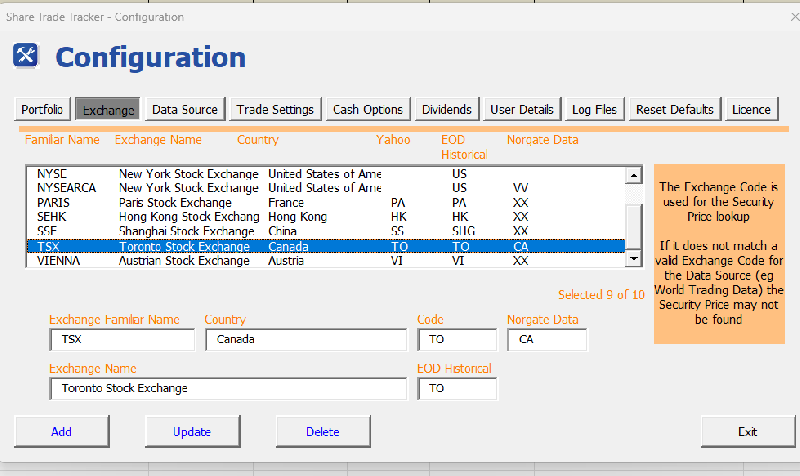

ParticipantSTT – had to make this adjustment to get updated price info on Canada stocks

KateMoloney

ParticipantMine was fine

-

AuthorPosts