Forum Replies Created

-

AuthorPosts

-

KateMoloney

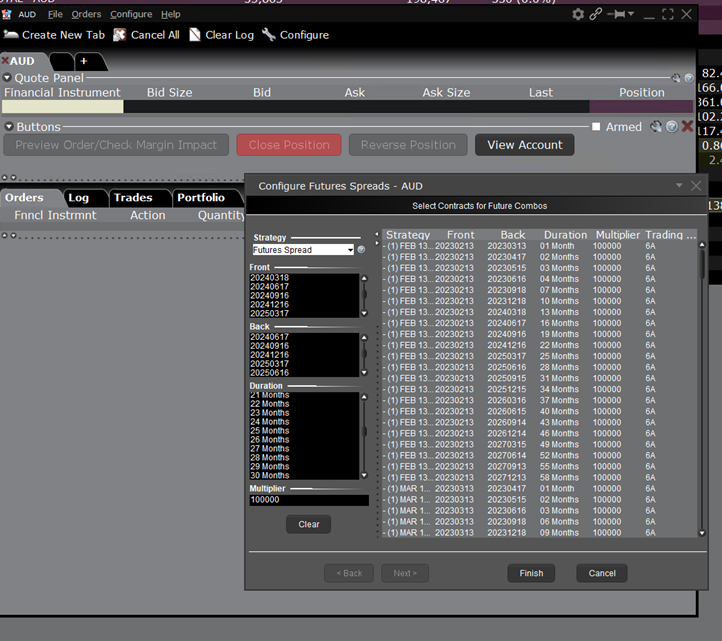

ParticipantWhat are the steps to rollover a futures contract?

Mine don’t need rolling until April, but trying to get my head around it and type up an SOP of some sort.

IB gave the following info;

https://www.interactivebrokers.com/lib/cstools/faq/#/content/36996766Use the SpreadTrader tool to roll a future in TWS:

- Right click on a Future position

- Select SpreadTrader

- When the Spread Trader window opens, select Futures Spreads

- Towards the bottom half of the page, look in the left column and find the month you want to roll to.

To roll a long future position:

- Click on the displayed Ask for the contract you wish to buy, and the Spread Trader will set up an order to buy that contract and sell (to close) your long open future position

- Select your desired order parameters and Transmit once finished.

Where I get stuck is point 2 (in red).

Here are what my windows look like;

Then I click on the contract I want (in theory) and the following window shows up, there is no transmit button.

Have asked IB for help, but curious if some smart cookie on here has it figured out

KateMoloney

ParticipantDoes real test show your overall portfolio return (multiple systems) … including systems across different time frames eg weekly, monthly, daily

KateMoloney

Participant

KateMoloney

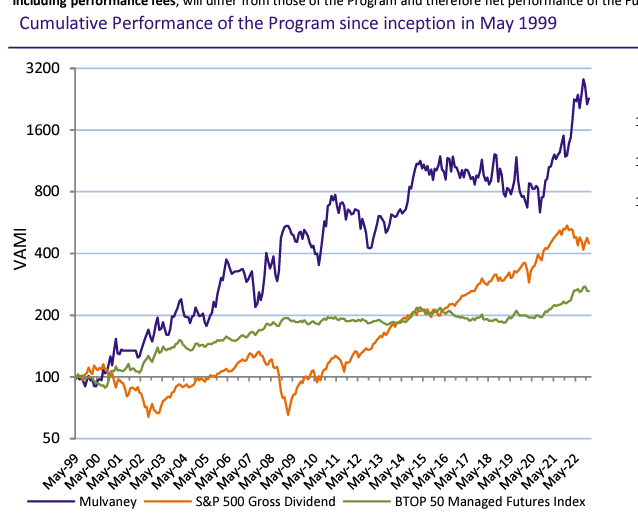

ParticipantTrend following Fund performance

Mulvaney Global Markets FundNote 2015 – 2020 the funds performance was negative then …. 2022 88.58%

chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://mulvaney.profundcom.net/dms/download/56151561217037400982043897979_12%20Mulvaney%20Monthly%20Fact%20Sheet%20LLC%20-%20December%202022.pdf

KateMoloney

ParticipantSome sad stories there Tim

KateMoloney

Participant2022 Summary

Overall account -15.57% (in AUD)

June was the worst month at -6.87%

Dec was the second worst month at -4.07%

Best month was Jan & March at 9.38% and 6.91%2022 was my first full year trading my own strategies. What a year to start!

When I started the mentoring program, I studied how other traders handled 2020 … so maybe I’m the one that manifested 2022

Feeling pretty grateful to have only lost -15.57%. The power of having multiple strategies was not lost on me.

Low light of the year was missing out on a high profit day in Feb, my results would have looked different had I traded that day. On the other hand, we were about to get flooded and with a death of a close friend, I followed my trading plan and did not trade. There will be plenty more opportunities to make money in the market.

Highlight was being able to continue mentoring with Nick and Craig. Around September/October I got to a point where I felt I could code/run AB and design strategies independently. No expert by any means, but having the confidence to operate independently means if Nick/Craig get run over by a truck, my trading business can continue.

Also really enjoyed connecting with other traders offline. Looking forward to more of that in 2023.

KateMoloney

ParticipantRob M post=13727 userid=5369 wrote:Stellar results in a very challenging year Terry.Appreciate you sharing the family situation as we are going through my parents’ estate distribution at the moment, as they were both hit by the metaphorical truck within the last year and a half. I’m learning a lot about what not to do and what to do to make things as easy as possible for my kids. I feel like I could write a book when we are done. The experience is making me value much more having those uncomfortable conversations about their wishes, pre-planning arrangements, assigning beneficiaries, setting up property in a trust, etc. … and now I am finding all the small pieces that were not addressed. All of this has motivated me to put together a similar instruction booklet. I may label the book in big bold letters. “Read this first if I get hit by a truck.!”

Sorry to hear about your loss Rob.

An instruction booklet is a great idea. I have one stored in our safe and with solicitors. It is updated every year in January.

KateMoloney

ParticipantTerry Dunne post=13720 userid=719 wrote:Thanks for your thoughts Kate, I really appreciate it…it seems like you have an interesting family.

Don’t we all

KateMoloney

ParticipantHi Terry,

Nice result for 2022.

Re: your children. I know its not trading related, but my Dad is a deca millionaire from business/real estate and is dealing with a similar issue with his children.

My brother and his wife are quite entitled, which Dad struggles a lot with. His wife of 6 months asked for $700,000 as a gift because “Dad has the money” whilst my brother asked Dad to gift him his $250,000 sports car because “I am your son”. I am not saying your children are that entitled, but the experience in my family has taught me a lot about succession planning and responsible handling of the family business.

Dads approach, for what its worth, is he is willing to do business with his children provided it is fair exchange. For example, buy an investment property together 50 – 50, profits split 50 – 50 and when the child wants to buy Dads share out, this is done at market value. This (in Dads view) builds business acumen in his children. If we don’t want to do business in a fair exchange manner, then Dad won’t do business with us.

If you give something to someone for nothing, they may not appreciate it as much as you do. In extreme cases, it can destroy peoples lives (google lottery winners ….).

If your children were really keen, you could send them off on their own journey of learning to trade, creating their own systems and trading with their own money. If they are still in the game 12 – 24 months down the track then you could offer to teach them. That way you know they are genuine about trading rather than chasing the perception of quick and easy money.

Trading is not for everyone.

KateMoloney

ParticipantRe: Canada Swing I’m trying to figure out what IB data to use for tax returns in Australia.

Put several enquires into IB 3 – 4 weeks ago and have had no response. My accountant has looked at it, but I’m not sure I agree with his answer. (accountant hasn’t been as present in his accounting business last 6 – 8 months, looking at changing in the new year)

IB show trade data for CAD trades. These figures match my STT figures.

Then IB convert the CAD figure into AUD, I have asked IB how this figure is calculated.Also, IB show the forex data, from AUD to CAD and back again. I would have thought you’d use this data for tax returns, as it encompasses the forex conversion and (maybe) the P & L on the CAD trades. Again waiting on IB to confirm.

Anyone have any ideas?

KateMoloney

ParticipantASX

Growth Portfolio 0% (didn’t trade due to holidays)

ASX Momo -6.45%

Weekly Swing +1.19% (+4.01% since October Inception)US

US TLT -4.94%

US Momo 0% (didn’t trade due to holidays, probably just as well)

US Day trade #1 –4.45%

US Day trade #2 -4.91%Canada Swing -1.21% (up 1.37% since Nov inception)

Its been an ……. interesting year. Lots of learning and growth.

Happy new year everyone.

KateMoloney

ParticipantReviewing portfolio performance since inception and improving my spreadsheets.

Also using the holiday period to review systems and update my trading plan.Overall portfolio is down -7.22% on initial capital since 2021 inception (factoring in currency conversion – converted AUD to USD when it was at 0.75)

Or -10.54% on initial capital since 2021 (when looking at it from $ perspective i.e without forex conversions)

Obviously, my figures don’t take into account profits earned and lost, some portfolio drawdowns are slightly higher when this is accounted for.

This weekends exercise was purely about looking at initial investment and risk going into 2023.Mentally, I am getting sick of the current market environment. Looking at the big picture has helped my mindset somewhat.

December 14, 2022 at 6:04 am in reply to: Incorporating an Index Volatility Based Trailing Stop with the WTT #115312KateMoloney

ParticipantBtw Glen … nice results

December 14, 2022 at 6:04 am in reply to: Incorporating an Index Volatility Based Trailing Stop with the WTT #115311KateMoloney

ParticipantThanks Glen,

The results I posted prior were using 20 cent or 50 cent price minimums. But that was on the $500,000 T/O settings and on “All ASX” stocks.

Increasing liquidity to 1M diminished results quite a bit, so next step is to play around with the rules and other settings.

December 13, 2022 at 9:11 am in reply to: Incorporating an Index Volatility Based Trailing Stop with the WTT #115309KateMoloney

ParticipantThanks Glen

Would you care to share your up to date CAR and max DD metrics?

I’m currently sitting at 22% – 25% CARG with a max DD of 22% – 26% (depending on the filter settings).

-

AuthorPosts