Forum Replies Created

-

AuthorPosts

-

Howard Lask

ParticipantAwesome results for the MOC Terry!

Howard Lask

ParticipantThank you Glenn… The issue with my R1K system was less about drawdowns – I had a system that looked pretty good until I started to stress test it. One of the tests was to look at the impact of moving the rotation day from the end of month – when I did that the results were significantly worse. I suppose it’s possible that there is an edge in end of month entry timing and thinking about it I will go away and devise a test to see if that’s the case. My conclusion in the meantime is that I have over-optimised the system

Howard Lask

ParticipantMay 2021

MOC Systems

R1K Long: +12.97%

R2K Long: +4.87%

R1K Short: -0.76%

R2K Short: -2.01%Long Term Systems

Nasdaq Momentum: -1.36%

R2K DTT: +2.05%I have been working for a couple of months now on a R1K rotation system but am struggling to get robust results. I had something that looked ok but found significant deterioration when I moved the rotation day away from the end of month. It may be time to park it and move on to the next idea.

Howard Lask

ParticipantGlad it helped Julian – I found it made a marked improvement to my rotational systems

Howard Lask

ParticipantThanks Glen. Thankfully RT is fast, 20,000 tests in AB is not really viable.

A quick follow up clarification question if that’s ok … are you using the stock dual MA as a component of the ranking criteria or as an entry filter?

Howard Lask

ParticipantJulian, I am using a blended ROC calc combining a short term ROC with 70% weighting and longer term ROC with 30% weighting as the ranking mechanism

Howard Lask

ParticipantCongratulations on the RUI system Glen.

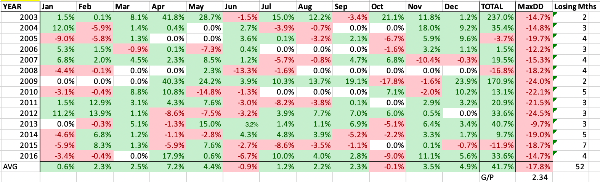

I have spent much of April in RealTest trying to develop an RUI rotation system, based on my NDX rotation system with weighted ROC for ranking, dual stock MA plus index filter and cannot get close to something I am happy with. Best I could come up with had significant losing years and unacceptable drawdowns:

You’ve shown it’s possible so looks like I will need to keep plugging away!

Howard Lask

ParticipantQuiet month for MOC, longer term systems trying to recover from drawdowns

April 2021

MOC Systems

R1K Long: +0.88%

R2K Long: -5.43%

R1K Short: +2.44%

R2K Short: +2.42%Long Term Systems

Nasdaq Momentum: +8.95%

R2K DTT: +7.75%Howard Lask

ParticipantNick Radge wrote:Wow! Epic results Howard.I’m quite sure that error came out of my account…

Ha!! V funny Nick… in fact the gain was on GME and recouped the losses I had made due to WSB in Jan and Feb

Howard Lask

ParticipantJulian Cohen wrote:I would treasure that error….as errors go, to make money on them is a statistical blip

Whenever I make a stupid mistake I try to put additional checks/balances into my process to make sure they don’t happen again however I’m sure that there are still undiscovered errors waiting to happen!

You are right Julian – I will bank this one to fund future losses arising out of stupid mistakes

Howard Lask

ParticipantShort term MOC systems are still taking up the slack for longer term strategies. Full disclosure: I made an error when entering my account size on one occasion which led to overstated gains in one of my MOC strategies. I rectified the error as soon as I saw it however it was too late and the profit had already been made!

March 2021

MOC Systems

R1K Long: +1.95%

R2K Long: +34.48% (+22.41% adjusted for error)

R1K Short: +5.48%

R2K Short: +33.38%Long Term Systems

Nasdaq Momentum: -11.06%

R2K DTT: -5.70%Howard Lask

ParticipantSimilar results here and benefitting from diversification of systems too – overall I’m slightly up (4% YTD), short term systems have compensated for NDX rotation (down 11% YTD)

Howard Lask

ParticipantThanks for raising this Julian – as a UK resident Brit this has got me thinking as I have all my eggs in the IB basket. I’m thinking that the most easily achievable way to achieve diversification will be to identify an alternative broker for those strategies that don’t require an API.

Howard Lask

ParticipantThose are awesomely impressive stats Julian, many thanks for sharing.

Howard Lask

ParticipantHaving a number of diversified systems paid off in Feb, good results from MOC systems offset weaker results from Momo. R2K systems still in beta with limited capital.

February 2021

MOC Systems

R1K Long: +17.71%

R2K Long: +22.23%

R1K Short: -0.76%

R2K Short: +4.61%Long Term Systems

Nasdaq Momentum: -4.17%

R2K DTT: +4.10% -

AuthorPosts