Forum Replies Created

-

AuthorPosts

-

Howard Lask

ParticipantDecember 2021

US Systems

MOC Systems

R1K Long: -0.92%

R2K Long: +4.46%

R1K Short: -2.47%

R2K Short: +1.97%Long Term Systems

Nasdaq Momentum: -9.41%

R2K DTT: +2.11%

WTT: -3.55%Total US Account: -2.67%

AUS Systems

ASX 100 Rotation: +16.16%Full Year 2021

US Systems

MOC Systems

R1K Long: +30.81%

R2K Long: +60.97%

R1K Short: +8.63%

R2K Short: +31.13%Long Term Systems

Nasdaq Momentum: +0.82%

R2K DTT: +22.11%

WTT: -14.21%AUS Systems

ASX 100 Rotation: +24.83%Howard Lask

ParticipantNovember 2021

US Systems

MOC Systems

R1K Long: +1.47%

R2K Long: +4.01%

R1K Short: +5.90%

R2K Short: -0.94%Long Term Systems

Nasdaq Momentum: -12.17%

R2K DTT: -7.41%

WTT: -10.24%Total US Account: -5.66%

ASX 100 Rotation: +7.12%

Taken to the cleaners this month in my US Momo systems – heavy exposure to MRNA caused most of the damage

Howard Lask

ParticipantOctober 2021

US Systems

MOC Systems

R1K Long: +0.70%

R2K Long: +0.60%

R1K Short: -1.73%

R2K Short: +1.86%Long Term Systems

Nasdaq Momentum: +2.73%

R2K DTT: +3.87%

WTT: +3.99%Total US Account: +2.29%

ASX 100 Rotation: +1.91%

Howard Lask

ParticipantThank you Ken. I am in touch with Adrian.

Howard Lask

ParticipantSeptember 2021

MOC Systems

R1K Long: -1.81%

R2K Long: +1.75%

R1K Short: +1.30%

R2K Short: -0.46%Long Term Systems

Nasdaq Momentum: -2.39%

R2K DTT: +0.36%Total US Account: -3.54%

ASX 100 Rotation: -1.56%

I have been working on longer term systems over the past few months and have gone live with an ASX Rotation system in September. I’m also currently overhauling my DTT system and will be moving to a weekly rather than daily timeframe. Performance is comparable and will save me a few minutes a day.

Howard Lask

ParticipantNo worries and thanks Ken

Howard Lask

ParticipantAugust 2021

MOC Systems

R1K Long: +1.44%

R2K Long: -0.78%

R1K Short: -5.22%

R2K Short: +11.67%Long Term Systems

Nasdaq Momentum: +2.98%

R2K DTT: +6.44%Total Account: +3.28%

Howard Lask

ParticipantHi Ken – I was listening to the August group call and intrigued by the Systematic Crypto course that you mentioned – have done some googling but can’t seem to find it. Can you help point me in the right direction?

Howard Lask

ParticipantHi Chris – are you on the TWS stable build? My version number is 981.3c with a build date of June 29 2021 so haven’t seen an update for a couple of months. If you are on beta or latest builds you may want to revert to stable and see whether that resolves things for you.

Howard Lask

ParticipantHi Chris, I haven’t experienced this.

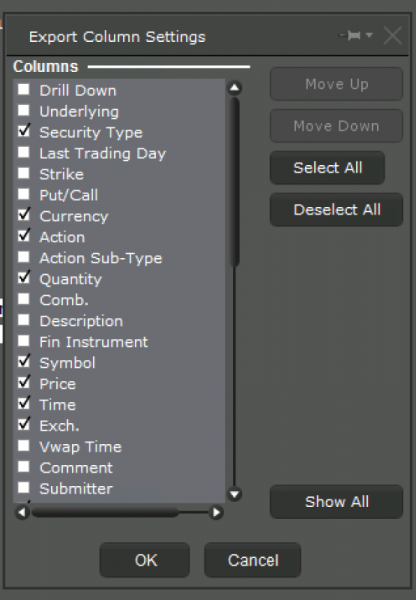

Have you checked the File Export Configuration in TWS? I see both Symbol and Fin Instrument in the Export Column Settings configuration dialog. Do you have the Symbol box checked?

Howard Lask

ParticipantJuly 2021

MOC Systems

R1K Long: +1.97%

R2K Long: -9.52%

R1K Short: -3.52%

R2K Short: -4.39%Long Term Systems

Nasdaq Momentum: +15.88%

R2K DTT: -3.99%Total Account: +2.00%

Howard Lask

ParticipantI have paused research into the R1K system as I’m still not able to get robust results and have turned my attention to MR systems, initially by converting the approach for my MOC systems.

June MOC in the R1K Long system took a hit earlier in the month. The API somehow got disconnected after orders were placed and corresponding MOC orders were not entered. I only realised after the close, manually placed orders to exit at the open and took some losses due to overnight gaps. Another item to add to the daily checklist!

June 2021

MOC Systems

R1K Long: -8.30%

R2K Long: -0.37%

R1K Short: +0.64%

R2K Short: -0.63%Long Term Systems

Nasdaq Momentum: +7.10%

R2K DTT: +3.13%Howard Lask

ParticipantTerry, have I got this right? – if you are using max leverage based on account size and then increasing size by adding an additional profit component then my reading of this is that you run the risk of missing trades when your full leverage has been utilised.

Let’s take your example figures – your initial account is 100, profits are 50 and you are trading 10 positions. Based on 4 x leverage you have 600 available,

if your position sizing is based upon a calculation of 100 + 2 x 50 = 200 and you then apply 4 x leverage then you will be sizing each position at 80, 800 total. You have a shortfall of 200 and only the first 7.5 trades get filled

Howard Lask

ParticipantJulian Cohen wrote:have you tried the same test on your actual system Howard? That might be the next test to doNick Radge wrote:Which begs the question as to why your system test showed deterioration…I had been stress testing the system by changing the rotation day and saw a large deterioration in performance. My hypothesis was that I had over-optimised so performed this test as confirmation.

These results confirmed my hypothesis and should not expect a month end rotation day to perform significantly differently from any other rotation day.

Time well spent as I have learnt something that is valuable for future system development

Howard Lask

ParticipantThanks Scott.

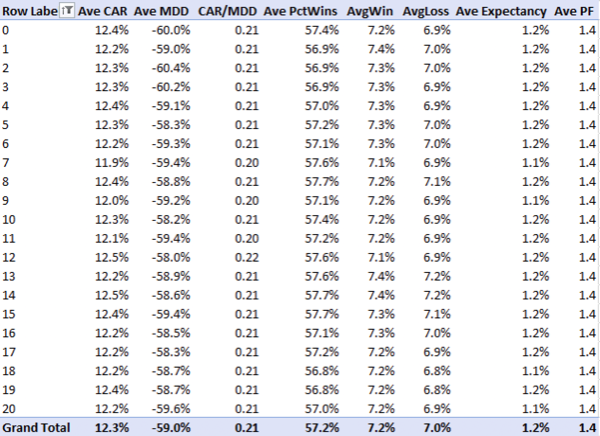

This has been intriguing me so I devised a test. Please throw rocks and challenge me on the approach and conclusions.

I designed a simple rotation system on the RUT. 20 positions selected using randomised ranking, rotated monthly. Test period 1/1/04 to 12/31/20.

I then optimised for rotation day – from 0 to 20 where 0 is the last day of the month, 1 is the first etc (some months may have more than 21 trading days but I don’t think this will make a big difference and more importantly I couldn’t figure out how to test for variable month lengths)

I repeated this 250 times for each rotation day so 21 x 250 = 5250 tests

Results are included in the attached table.

Very consistent results from one day to the next with days 7 and 9 marginally poorer and days 12 and 14 marginally better. I’m no statistician but I doubt these are statistically relevantMy conclusion – open to challenge – is that there does not appear to be an end of month entry edge

-

AuthorPosts