Forum Replies Created

-

AuthorPosts

-

GlenPeake

ParticipantFEBRUARY 2023

ASX

WTT -4.66%

ASX100 RTN -10.46%

XSO RTN -5.94%US

MR#1 -0.41%

MR#2 +6.36%

MR#3 +1.03%

MR#4 -5.13%

MR#5 +3.17%NDX100 RTN -3.29%

R1000 RTN -6.36%Monthly Total Account: -1.92%

The grind/chop continues……

Mean Reversion trades seem to be picking up in this market, with all MR Systems positive for 2023. With MR#3 leading the way up 15% year to date (JINX Deployed now that I’ve said that).

GlenPeake

ParticipantHi Gavin,

In a nutshell I track the system(s) performance in it’s own performance tab and record the monthly performance/profit from Share Trade Tracker all in US$. I’m interested in the performance of the system itself as traded (excluding currency conversion).

I have another performance tab in the Performance Tables spreadsheet which tracks my IB account NAV, which shows the total of everything in AU$….. cash/open positions/currency hedging etc.

Hope that helps.

GlenPeake

ParticipantHi Kate,

Looks Like we may have hit the same websites, as the calc here on this page is the same as the one you’ve posted.

i.e.

S-RoC = ( Current EMA – Previous EMA ) / ( Previous EMA ) x 100https://www.chart-formations.com/indicators/sroc

My code looks similar to yours and yields the same results when I compared it to yours:

///////////////////////////////////////////

P = ParamField( “Price field” );

Periods1 = Param(“EMA Lookback”, 13, 1, 200, 1 );

Periods2 = Param(“ROC Lookback”, 21, 1, 200, 1 );EMAclose = EMA(Close,periods1);

ROCxma = ROC(EMAclose,periods2);Plot( ROCXMA, _DEFAULT_NAME(), ParamColor( “Color”, colorCycle ), ParamStyle(“Style”) );

/////////////////////////////////////////

Below and attached is a RealTest Script I was experimenting with…. I was trying different combinations of ROC/EMA…. and then comparing the Chart / SROC curve… essentially the ‘flow’ of the curve(s) are similar (pending lookback inputs)….. So for me the flows look similar when comparing the variety of different calculations.

You can remove the // in the RT script to compare various different variations and look at them on the charts etc.

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Import:

DataSource: Norgate

IncludeList: .S&P ASX 300 Current & Past

IncludeList: $XAO.au

IncludeList: $XSO.au

IncludeList: $XAOA.au

StartDate: 1/1/2003

EndDate: Latest

SaveAs: ASX_XSO_Historical.rtd

ScanSettings:

DataFile: ASX_XSO_Historical.rtd

EndDate: Latest

NumDays: 1

BarSize: Daily

Data:

// ROC1: ROC(C,5)

// SMROC1: EMA(ROC1,10)

// SMROC2: (EMA(ROC(C,10),20))

// SMROC3: (EMA(ROC(C,30),60))

// EMA1: EMA(C,15)

// EMAold: EMA(C,15)[5]

// SMROC4: (EMA1-EMAold)/(EMAold)*100

// SMROC5: (EMA(ROC(C,13),21))

SMROC6: (ROC(EMA(C,13),21))

Scan:

Filter: 1

// Filter: Symbol = $PLS.au

Sort: -SROC6

// SROC1: SMROC1

// SROC2: SMROC2

// SROC3: SMROC3

// SROC4: SMROC4

// SROC5: SMROC5

SROC6: SMROC6

ClosePrice: {$}Close

VolumeToday: Volume

Turnover: {$} Close * Volume// ROC_1_Day: ROC(C,1)

// ROC_5_Day: ROC(C,5)

// ROC_10_Day: ROC(C,10)

// ROC_1_Month: ROC(C,20)

// ROC_1_Year: ROC(C,255)

Charts:

// SmRC1: SMROC1{|} // {%|} -This will convert to percentage

// SmRC2: SMROC2{|}

// SmRC3: SMROC3{|}

// SmRC4: SMROC4{|}

// SmRC5: SMROC5{|}

SmRC6: SMROC6{|}

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////GlenPeake

ParticipantThe following thread explains what I needed to do.

Essentially it had to do with removing excess signals.

https://forum.mhptrading.com/t/remove-excess-signals/475/6

Since cutting over to RealTest, I’ve now removed the excess signals code and ‘trust’ what RealTest produces etc….

RE: Your Swing System

In terms of making RT the same (or close to) AB, some indicators are calculated slightly different in AB vs RT so that ‘might’ explain some of the variation(s)…Not sure if others have noticed a difference in the Swing system results RT vs AB…..?

I don’t have Canadian data so I can’t offer any insight/experience on any potential differences… As a stab in the dark, are the constituencies and the use of the “IN…” e.g. InSPTSX correct…

i.e.

$SPTSX InSPTSX S&P TSX Composite

$SPTSX60 InSPTSX60 S&P TSX 60

$SPTSXC InSPTSXC S&P TSX Completion

$SPTSXDA InSPTSXDA S&P TSX Canadian Dividend Aristocrats

$SPTSXMC InSPTSXMC S&P TSX MidCap (Inferred)

$SPTSXSC InSPTSXSC S&P TSX SmallCapGlenPeake

ParticipantKate M post=13821 userid=5397 wrote:Interesting change in results Glen.Silly thought, but I wonder if that is because that index excludes heavy weights like BHP?

I recall Nick talking about it on Twitter and how the index was higher last year because BHP was up and was such a large % of the index.

Yeah, not entirely sure myself….. certainly possible i.e. exclusion of Blue Chips in the XSO

I was thinking about it earlier and one possibility that I was mulling over was maybe when the “growth stocks” i.e. small/mid caps start moving Upwards i.e. XSO constituents, then best to be aligned with the market when they start moving….I also think that my Dual Momentum criteria for the system is capturing/targeting these ‘growth stocks’ that have good MOMO. etc

GlenPeake

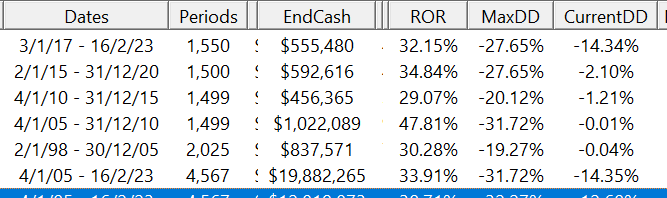

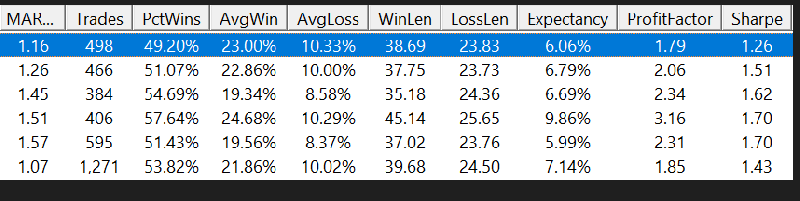

ParticipantBeen testing out a few ideas for another Rotational system (currently testing a Monthly version), this time for the XAO All Ordinaries universe.

Uses 15 positions and a Worst Rank Held of 20.

I was playing around with the Index Filter against the XAO for this system and then as a ‘change up’ tried using the XSO as my index filter instead…. this added 6% to CAR/ROR and MaxDD was basically the same.

A few test samples below:

Results Continued

GlenPeake

ParticipantA few Momentum ideas in this Better Systems Traders interview with Alan Clement.

https://bettersystemtrader.com/172-the-magic-of-momentum-trading-alan-clement/

One idea that got mentioned was a Smoothed Rate of Change (S-ROC) indicator. I hadn’t tested this previously against any of my Momo systems…. So I’ve just been running a few tests to see what happens….. nothing concrete as yet but I’ll keep looking.

GlenPeake

ParticipantJANUARY 2023

ASX

WTT +2.84%

ASX100 RTN +1.31%XSO RTN 0%

US

MR#1 +8.24%

MR#2 +7.21%

MR#3 +14.34%

MR#4 +13.91%

MR#5 +5.99%NDX100 RTN 0%

R1000 RTN 0%Monthly Total Account: +1.59%

Best MR trade for JANUARY came from MR4 with GNS +65%.

GlenPeake

ParticipantDECEMBER 2022

ASX

WTT -8.40% (Since Go Live in JAN 2019: +0.46%)

ASX100 RTN –9.65%XSO RTN -4.63%

US

MR#1 -15.11%

MR#2 -6.32%

MR#3 -3.12%

MR#4 +0.90%

MR#5 -9.28%NDX100 RTN -4.19%

R1000 RTN -11.39%Monthly Total Account: -7.5%

Current Total Account Drawdown: -27.47%

Was great to catch up with Nick and the team in Sydney a few weeks ago. All the best for 2023.

December 14, 2022 at 6:34 am in reply to: Incorporating an Index Volatility Based Trailing Stop with the WTT #115313GlenPeake

ParticipantSounds like you’re on the right track….

The difference with my code is probably the trailing stop modifications depending on the VOLA of the Index (as what I’ve described at the start of this thread).

Take a look at the number of positions as well…. The lesser the # of positions, the ‘quicker’ you’ll deploy your capital when the market turns around i.e. index filter goes from RED to GREEN. However this also comes with the increase of false breakouts/whipsaw/market reversals etc…. and your 100% invested and have to start closing positions etc etc fake outs etc

December 14, 2022 at 2:45 am in reply to: Incorporating an Index Volatility Based Trailing Stop with the WTT #115310GlenPeake

ParticipantApprox 30% CAR and -26% MDD (current Drawdown).

If you haven’t already done so, look at lowering the MIN $ price filter i.e. from the default $1 to .50cents (or even lower towards .10/.20cents)… Also play around with max positions allowed to see what happens.

You can also change the universe around, i.e. ALL ASX Stocks (or ASX All Ords etc)…. you’ll catch some runners/outliers the wider the universe etc, but you’ll also catch some ‘dogs’ as well (lower liquidity stocks etc)….pending you appetite for risk/reward etc

December 13, 2022 at 7:19 am in reply to: Incorporating an Index Volatility Based Trailing Stop with the WTT #115308GlenPeake

ParticipantHi Kate,,

I use:

$1mil minimum Turnover Filter500,000 Volume filter

This is for ASX All Ords

GlenPeake

ParticipantNOVEMBER 2022

ASX

WTT -2.50% (Since Go Live in JAN 2019: +9.67%)

ASX100 RTN 0%XSO RTN 0%

US

MR#1 +2.31%

MR#2 +11.27%

MR#3 +1.17%

MR#4 +1.27%

MR#5 -0.08%NDX100 RTN 0%

R1000 RTN 0%Monthly Total Account: -1.49%

Current Total Account Drawdown: -21.43%

The WTT is back to 100% invested. Both the ASX100 & XSO Monthly Rotational systems are back to 100% invested for this month also.

GlenPeake

ParticipantNick Radge post=13595 userid=549 wrote:Did anyone else’s ChartVPS shut down last night? Seemed like it was toward the end of the session.Mine was fine overnight Nick. No reboots.

GlenPeake

ParticipantOCTOBER 2022

ASX

WTT –1.17% (Since Go Live in JAN 2019: +12.49%)

ASX100 RTN 0%XSO RTN 0%

US

MR#1 +4.86%

MR#2 +14.98%

MR#3 +6.66%

MR#4 -0.38%

MR#5 -1.16%NDX100 RTN 0%

R1000 RTN 0%Monthly Total Account: +1.10%

Current Total Account Drawdown: -22.70%

-

AuthorPosts