Forum Replies Created

-

AuthorPosts

-

GlenPeake

ParticipantWell Done Sean.

Nice Trade!!!!

Keep us updated on the progress!

GlenPeake

ParticipantAnthony F post=14085 userid=5415 wrote:I’m working on a similar strategy for the R1000.So far I’m at 26/52. That 52% was during the dot com crash and still the year ended with a 39% return. That being said, there’s no way I could stomach a 50%+ DD.

My system is fairly simple and includes: A price and simple liquidity filters, index filter, stock uptrend filter, and uses ROC for the rank/score.

I’m going to keep plugging away. There’s definitely a huge hole I’m forgetting to cover here.

For me Anthony, a monthly rotational strategy on the R1000 was one system I struggled with for a long time trying to find something that produced something acceptable…..

For whatever reason (possibly because of the number of stocks in the universe), it took 100’s / 1000’s of tests to get it up and running OK.

GlenPeake

ParticipantThanks Julian….been tough conditions all around. The results don’t look too bad if I ignore the 2022 period lol….

GlenPeake

ParticipantMAY 2023

ASX

WTT -5.70%

ASX100 RTN 0%

XSO RTN -6.81%US

MR#1 +3.78%

MR#2 +5.57%

MR#3 +2.85%

MR#4 -3.63%

MR#5 +1.80%NDX100 RTN -2.20%

R1000 RTN +5.80%Monthly Total Account: -1.95%

4 out of 5 Mean Reversion systems are profitable Year to Date.

MR#2 is Best with 28.41%

MR#5 is (not so best) with -0.83%ASX Momo/Trend Following continues to chop and change…. sideways. ASX100 goes to 100% invested for June, while XSO goes back to 100% cash.

GlenPeake

ParticipantAPRIL 2023

ASX

WTT +0.78%

ASX100 RTN 0%

XSO RTN 0%US

MR#1 +3.36%

MR#2 +6.76%

MR#3 -0.68%

MR#4 +5.16%

MR#5 -2.46%NDX100 RTN -7.90%

R1000 RTN -5.58%Monthly Total Account: +0.88%

The MR#2 system is the leading performing system for 2023 thus far, returning +21.67% year to date.

The XSO Rotational system will go to 100% invested for MAY while the ASX100 will stay in cash.

GlenPeake

ParticipantHi Ben,

So I saw similar to you…. using the Data inputs you posted, if you add the following to your Script and run a SCAN and note the values for the Standard Deviation (SDValue) column you’ll see that all stocks in the universe are all below 5.

/////////////////////////////////////////////////////

ScanSettings:

DataFile: DataDayTrade1000.rtd // Change to your Data File

EndDate: Latest

NumDays: 1

Scan:

Filter: 1

Ranking1: {#8} Ranking

ClosePrice: {$} Close

VolumeToday: VolumeSort: -Ranking1

// BuyLimitPrice: {$} Limit

SDValue: SdevCalc/////////////////////////////////////////////////////

Additionally you can also use the DEBUG Panel and paste your code “Sdev50/Sdev200” into the Formula field and hit Evaluate (tick Show Evaluation) and see the formula broken down etc.

Symbol: TSLA

BarSize: Daily

Date: 12/4/23

Formula: Sdev50/Sdev200

Evaluation:

Sdev50 = 1.54

Sdev200 = 1.95

(1.54 / 1.95) = 0.790576Result: 0.7906 (0.790576080102531)

Additionally, you can paste the following and get a full break down as to what the formula is doing: StdDev(ATR5, 50)/StdDev(ATR5, 200)

Symbol: TSLA

BarSize: Daily

Date: 12/4/23

Formula: StdDev(ATR5, 50)/StdDev(ATR5, 200)

Evaluation:

ATR5 = 8.63

ATR5[1] = 7.97

ATR5[2] = 8.79

ATR5[3] = 8.74

ATR5[4] = 9.27

ATR5[5] = 9.38

ATR5[6] = 9.62

ATR5[7] = 8.21

ATR5[8] = 7.13

ATR5[9] = 8.05

ATR5[10] = 8.54

ATR5[11] = 8.95

ATR5[12] = 9.32

ATR5[13] = 10.35

ATR5[14] = 10.27

ATR5[15] = 10.41

ATR5[16] = 9.33

ATR5[17] = 9.14

ATR5[18] = 9.20

ATR5[19] = 9.76

ATR5[20] = 10.39

ATR5[21] = 10.66

ATR5[22] = 9.97

ATR5[23] = 10.00

ATR5[24] = 9.33

ATR5[25] = 9.74

ATR5[26] = 10.14

ATR5[27] = 11.11

ATR5[28] = 11.49

ATR5[29] = 10.17

ATR5[30] = 10.54

ATR5[31] = 11.31

ATR5[32] = 11.00

ATR5[33] = 11.43

ATR5[34] = 12.09

ATR5[35] = 12.56

ATR5[36] = 12.57

ATR5[37] = 12.98

ATR5[38] = 12.27

ATR5[39] = 13.20

ATR5[40] = 11.41

ATR5[41] = 11.94

ATR5[42] = 11.32

ATR5[43] = 10.97

ATR5[44] = 11.54

ATR5[45] = 12.44

ATR5[46] = 13.49

ATR5[47] = 13.03

ATR5[48] = 12.46

ATR5[49] = 12.10

StdDev(12.10, 50) = 1.54

ATR5 = 8.63

ATR5[1] = 7.97

ATR5[2] = 8.79

ATR5[3] = 8.74

ATR5[4] = 9.27

ATR5[5] = 9.38

ATR5[6] = 9.62

ATR5[7] = 8.21

ATR5[8] = 7.13

ATR5[9] = 8.05

ATR5[10] = 8.54

ATR5[11] = 8.95

ATR5[12] = 9.32

ATR5[13] = 10.35

ATR5[14] = 10.27

ATR5[15] = 10.41

ATR5[16] = 9.33

ATR5[17] = 9.14

ATR5[18] = 9.20

ATR5[19] = 9.76

ATR5[20] = 10.39

ATR5[21] = 10.66

ATR5[22] = 9.97

ATR5[23] = 10.00

ATR5[24] = 9.33

ATR5[25] = 9.74

ATR5[26] = 10.14

ATR5[27] = 11.11

ATR5[28] = 11.49

ATR5[29] = 10.17

ATR5[30] = 10.54

ATR5[31] = 11.31

ATR5[32] = 11.00

ATR5[33] = 11.43

ATR5[34] = 12.09

ATR5[35] = 12.56

ATR5[36] = 12.57

ATR5[37] = 12.98

ATR5[38] = 12.27

ATR5[39] = 13.20

ATR5[40] = 11.41

ATR5[41] = 11.94

ATR5[42] = 11.32

ATR5[43] = 10.97

ATR5[44] = 11.54

ATR5[45] = 12.44

ATR5[46] = 13.49

ATR5[47] = 13.03

ATR5[48] = 12.46

ATR5[49] = 12.10

ATR5[50] = 12.25

ATR5[51] = 11.99

ATR5[52] = 9.88

ATR5[53] = 8.11

ATR5[54] = 8.05

ATR5[55] = 8.71

ATR5[56] = 7.90

ATR5[57] = 8.29

ATR5[58] = 8.94

ATR5[59] = 8.76

ATR5[60] = 8.62

ATR5[61] = 8.79

ATR5[62] = 9.21

ATR5[63] = 9.73

ATR5[64] = 10.21

ATR5[65] = 10.14

ATR5[66] = 9.53

ATR5[67] = 10.30

ATR5[68] = 11.10

ATR5[69] = 9.24

ATR5[70] = 10.37

ATR5[71] = 10.25

ATR5[72] = 10.80

ATR5[73] = 9.90

ATR5[74] = 10.48

ATR5[75] = 9.27

ATR5[76] = 10.25

ATR5[77] = 9.76

ATR5[78] = 9.84

ATR5[79] = 9.57

ATR5[80] = 10.05

ATR5[81] = 10.98

ATR5[82] = 9.19

ATR5[83] = 8.61

ATR5[84] = 8.47

ATR5[85] = 9.05

ATR5[86] = 9.42

ATR5[87] = 9.69

ATR5[88] = 8.54

ATR5[89] = 9.39

ATR5[90] = 9.96

ATR5[91] = 8.91

ATR5[92] = 9.23

ATR5[93] = 9.16

ATR5[94] = 10.31

ATR5[95] = 9.46

ATR5[96] = 10.65

ATR5[97] = 10.15

ATR5[98] = 10.52

ATR5[99] = 11.65

ATR5[100] = 12.37

ATR5[101] = 12.99

ATR5[102] = 13.83

ATR5[103] = 13.81

ATR5[104] = 13.91

ATR5[105] = 12.69

ATR5[106] = 13.28

ATR5[107] = 13.55

ATR5[108] = 11.75

ATR5[109] = 11.92

ATR5[110] = 11.64

ATR5[111] = 12.03

ATR5[112] = 13.05

ATR5[113] = 13.19

ATR5[114] = 13.75

ATR5[115] = 14.09

ATR5[116] = 14.02

ATR5[117] = 13.56

ATR5[118] = 14.24

ATR5[119] = 12.78

ATR5[120] = 14.69

ATR5[121] = 15.22

ATR5[122] = 14.81

ATR5[123] = 12.99

ATR5[124] = 12.05

ATR5[125] = 13.11

ATR5[126] = 13.70

ATR5[127] = 14.97

ATR5[128] = 14.68

ATR5[129] = 16.04

ATR5[130] = 16.01

ATR5[131] = 16.14

ATR5[132] = 14.12

ATR5[133] = 14.38

ATR5[134] = 12.46

ATR5[135] = 12.72

ATR5[136] = 12.74

ATR5[137] = 12.47

ATR5[138] = 11.65

ATR5[139] = 10.70

ATR5[140] = 10.08

ATR5[141] = 10.66

ATR5[142] = 10.31

ATR5[143] = 10.85

ATR5[144] = 11.47

ATR5[145] = 10.75

ATR5[146] = 9.93

ATR5[147] = 10.96

ATR5[148] = 11.05

ATR5[149] = 11.37

ATR5[150] = 11.33

ATR5[151] = 11.60

ATR5[152] = 11.18

ATR5[153] = 11.11

ATR5[154] = 11.53

ATR5[155] = 10.46

ATR5[156] = 11.22

ATR5[157] = 10.40

ATR5[158] = 10.16

ATR5[159] = 10.90

ATR5[160] = 10.89

ATR5[161] = 11.03

ATR5[162] = 11.19

ATR5[163] = 12.83

ATR5[164] = 13.63

ATR5[165] = 14.09

ATR5[166] = 14.33

ATR5[167] = 14.13

ATR5[168] = 14.57

ATR5[169] = 14.66

ATR5[170] = 15.07

ATR5[171] = 14.58

ATR5[172] = 12.45

ATR5[173] = 13.41

ATR5[174] = 14.52

ATR5[175] = 14.36

ATR5[176] = 13.73

ATR5[177] = 12.36

ATR5[178] = 12.82

ATR5[179] = 11.76

ATR5[180] = 11.66

ATR5[181] = 12.89

ATR5[182] = 13.59

ATR5[183] = 10.55

ATR5[184] = 11.39

ATR5[185] = 11.70

ATR5[186] = 11.89

ATR5[187] = 13.18

ATR5[188] = 14.15

ATR5[189] = 13.43

ATR5[190] = 13.93

ATR5[191] = 12.55

ATR5[192] = 12.24

ATR5[193] = 11.89

ATR5[194] = 13.02

ATR5[195] = 12.03

ATR5[196] = 13.01

ATR5[197] = 13.61

ATR5[198] = 14.42

ATR5[199] = 13.61

StdDev(13.61, 200) = 1.95

(1.54 / 1.95) = 0.790576Result: 0.7906 (0.790576080102531)

GlenPeake

ParticipantMARCH 2023

ASX

WTT -4.49%

ASX100 RTN -0.80%XSO RTN 0% (In cash for March and also April)

US

MR#1 -6.47%

MR#2 -0.08%

MR#3 -3.50%

MR#4 +2.32%

MR#5 -8.67%NDX100 RTN +3.60%

R1000 RTN +10.80%Monthly Total Account: -1.93%

GlenPeake

ParticipantNo issues here…..

As a guess…..check the following:

If you’ve recently updated TWS….(or even if you haven’t)

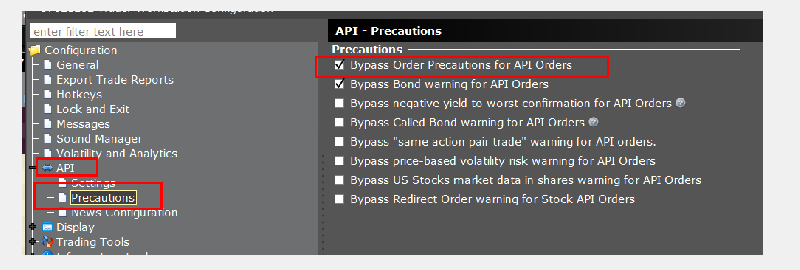

In TWS:

Go to “EDIT” -> “Global Configuaration” -> “API” -> “Precautions” and make sure the option “BYPASS Order Precautions for API Orders” is ticked…..That’s happened to me recently (i.e. I upgraded TWS and this was unticked and was stopping orders being sent)…..

March 5, 2023 at 10:40 am in reply to: What Worked Well in 2021-2022? MOC System Brainstorming #115480GlenPeake

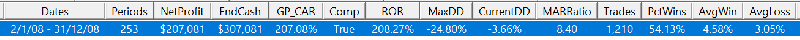

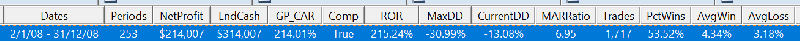

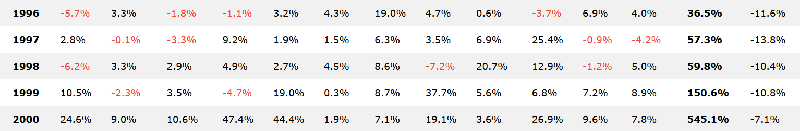

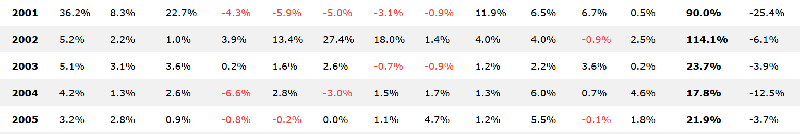

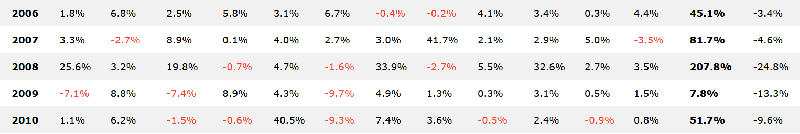

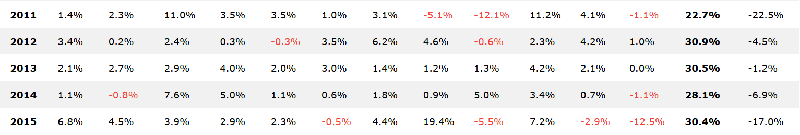

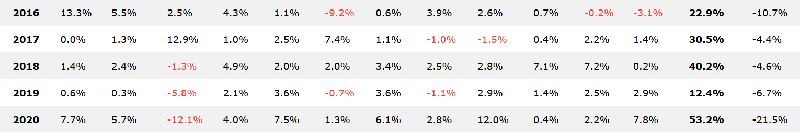

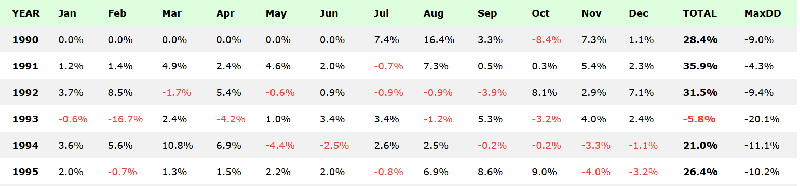

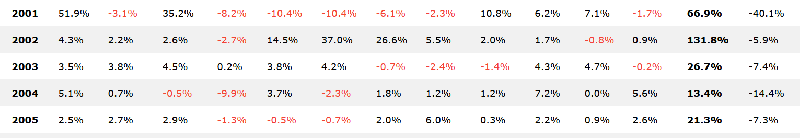

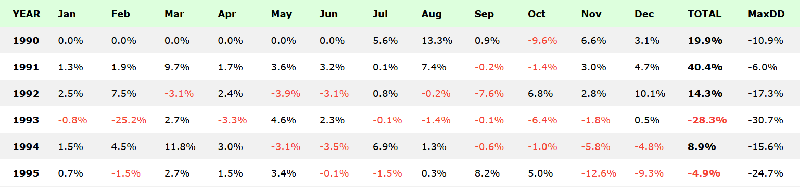

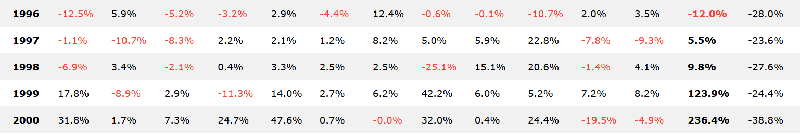

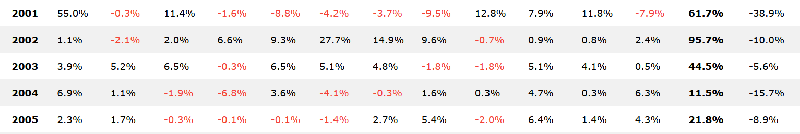

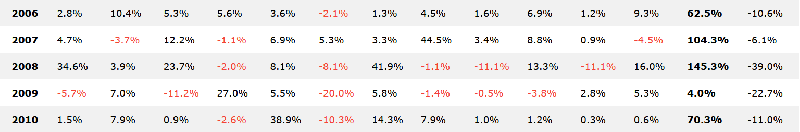

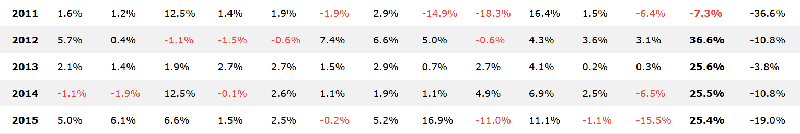

ParticipantBen Osborn post=13880 userid=5409 wrote:Where the drawdown is larger in a couple of the earlier years, do you think that it is due to the parameters that make it so good in the recent years or is that fairly standard? (having the opposite effect then?)Honestly, I think it is market related, as the DD’s occur when the rest market is crapping itself and all trading systems tend to cop a slap across the face during these times, you can’t avoid this…. If we take a quick look at the 2008 stats during the GFC where the Drawdown is the most…. and compare DUAL Stretch Shallow vs DUAL Stretch Deep.

The numbers during this period are slightly higher %Win, AvgWin% and lower AvgLoss% in the DUAL Stretch Deep variation. So small differences there, but definitely a lot less trades in the DEEP stretch variation as well… less fills as a result of a lower BUY Limit price etc, so where not suffering ‘death from a 1000 cuts etc’ burning up cash etc.

Deep Stretch Stats

Shallow Stretch Stats

When I put the system together I focused on the 2021-2022 period as I wanted to try and get a system that actually made a decent return (it was bugging me and I wanted to find something that actually worked for this period

) and then once I had that, went further back in the sample period.

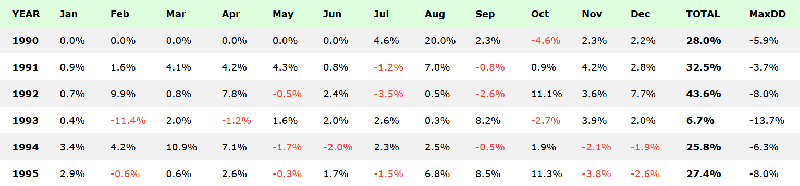

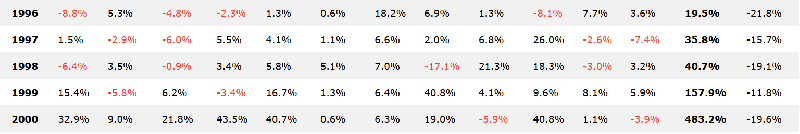

) and then once I had that, went further back in the sample period.I only tested the 1990-2005 period after I got the system to this point….. and I believe Nick mentioned in another post that the mid 1990’s is/was similar to the past couple of years in terms of market conditions. So when I tested that period, the system with the DUAL Stretch option, performs well/acceptable/passable etc…..Additionally, the year 2000 was another year where the returns were pretty amazing e.g. +400% and +500%…. these stats are what the backtest came back with…. (if only I had been trading the system back then

)

)I’m also using the same lookback period for my entry filter and ranking method…. so fairly consistent and simple from that point of view….

March 5, 2023 at 6:06 am in reply to: What Worked Well in 2021-2022? MOC System Brainstorming #115477GlenPeake

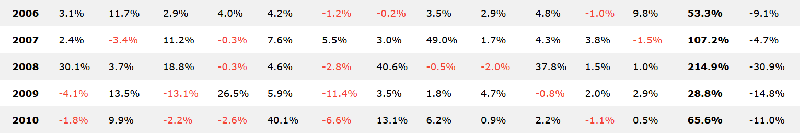

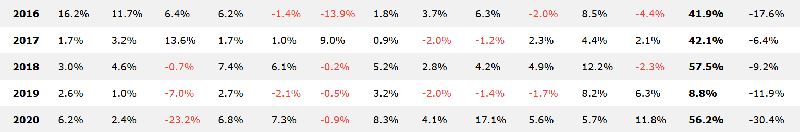

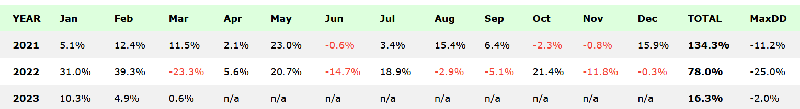

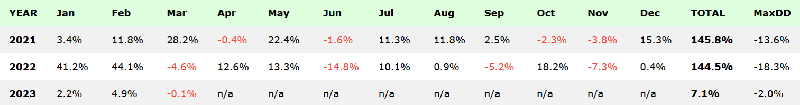

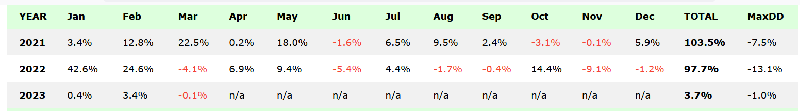

ParticipantMonthly Stats

Dual Stretch Deep

March 5, 2023 at 6:04 am in reply to: What Worked Well in 2021-2022? MOC System Brainstorming #115476

March 5, 2023 at 6:04 am in reply to: What Worked Well in 2021-2022? MOC System Brainstorming #115476GlenPeake

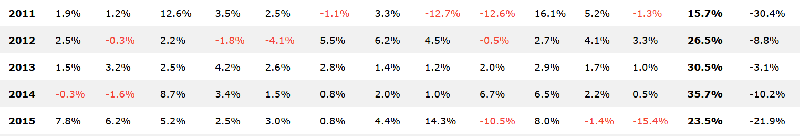

ParticipantMonthly Stats

Dual Stretch Shallow

March 5, 2023 at 6:02 am in reply to: What Worked Well in 2021-2022? MOC System Brainstorming #115475

March 5, 2023 at 6:02 am in reply to: What Worked Well in 2021-2022? MOC System Brainstorming #115475GlenPeake

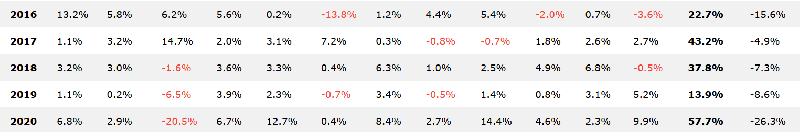

ParticipantMonthly Stats

Single Stretch

March 5, 2023 at 4:54 am in reply to: What Worked Well in 2021-2022? MOC System Brainstorming #115474

March 5, 2023 at 4:54 am in reply to: What Worked Well in 2021-2022? MOC System Brainstorming #115474GlenPeake

ParticipantMonthly Stats

Single Stretch

Dual Stretch Shallow

Dual Stretch Deep

The system entry is based on volatility and uses volatility to determine current market conditions and which stretch to use within the dual stretch option. It has a Min/Max price entry condition and a single Indicator entry condition…. very simple.

GlenPeake

ParticipantFWIW, I use a MSI laptop.

https://www.wireless1.com.au/msi-prestige-14-a10ras-096au-14in-i7-10710u-mx330-16gb-512gb-ssd-laptopI’ve had it for about 14months…. all good.

Whatever you get, providing it’s one of the better known names/brands and reasonably priced, should be fine…..

One thing to make sure of is SSD hard drive….. you mentioned 1TB hard drive in your post, but I’m not sure if this is SSD or HDD….. so whatever you get in the future, ensure it’s SSD….. AB / RealTest will perform MUCH faster on SSD.

Looks like you’re considering a laptop with at least 64gig ram (mentioned in your journal post)….. nice!!!!

GlenPeake

ParticipantKate M post=13851 userid=5397 wrote:OK Glen, stop talking … don’t jinx it!

Zipped…. lol

-

AuthorPosts