Forum Replies Created

-

AuthorPosts

-

GlenPeake

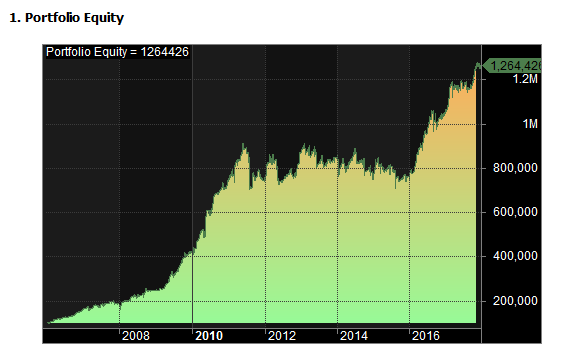

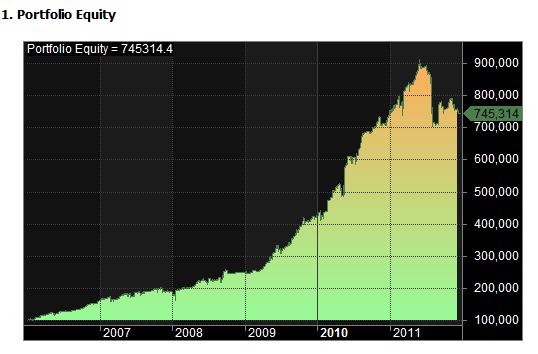

ParticipantCombined IS and OOS 1/1/2006 – 1/1/2018 on S&P500

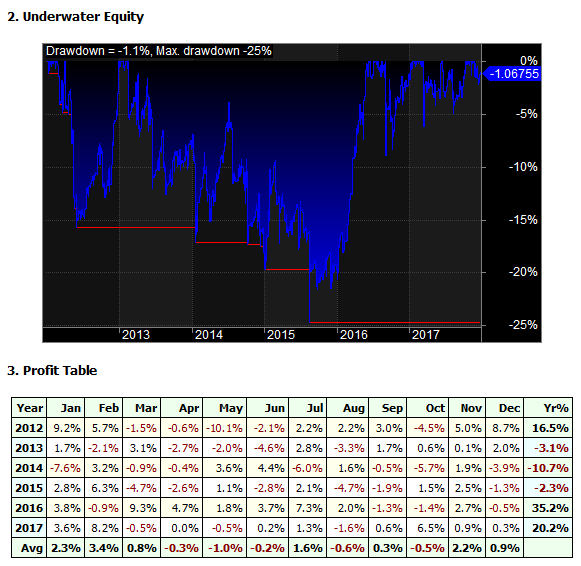

Just curious how other members MR MOC systems perform during the 1/1/2012 – 1/1/2018 period on the S&P500?

Thanks

GlenGlenPeake

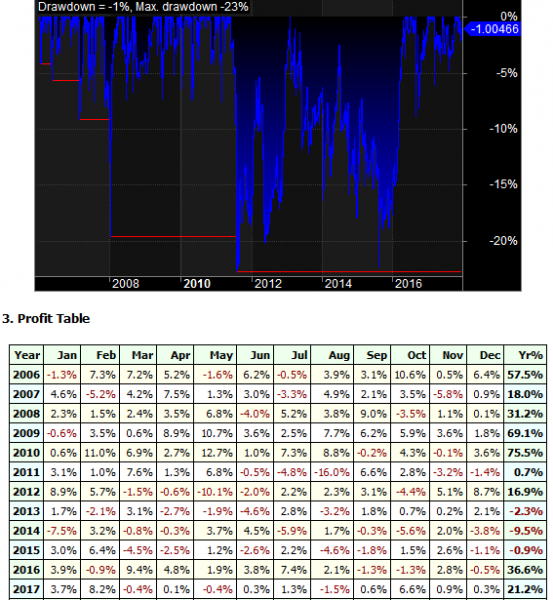

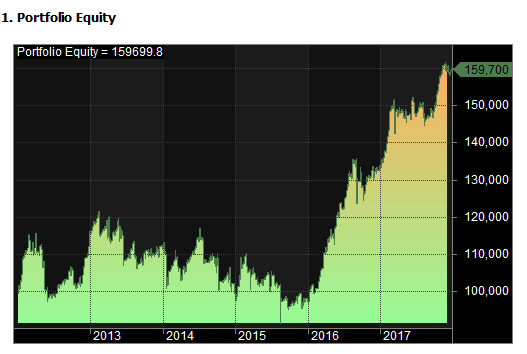

ParticipantMy Out Of Sample period, doesn’t look quite as nice: 1/1/2012 – 1/1/2018 on S&P500

GlenPeake

ParticipantBit of an update on my progress….

I completed the theory part of the course last month and since then have been working on my first system.

I’m heading down the Mean Reversion MOC path atm.

I’ve been looking through the forum for ideas and other websites for ideas. I’ve found the Cesar Alvarez website and then Better System Cesar podcasts beneficial and a good starting point for ideas..

I’ve registered a PTY LTD trading entity via https://www.ecompanies.com.au/

I’ve subscribed to the Norgate Data offer/deal they had going for Beta Testers. Previously I was only subscribed to ASX data, now I have both US and AU data and converted my existing subscription over and am subscribed for the next 400 days.

I still need to sort out my IB Account and get that setup.

In terms of my MR MOC system, my idea is roughly based around a ‘day’s down’ system.

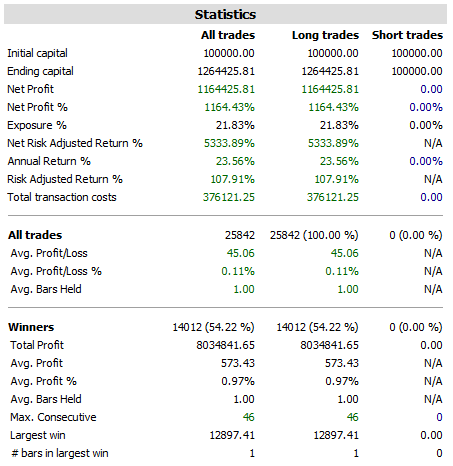

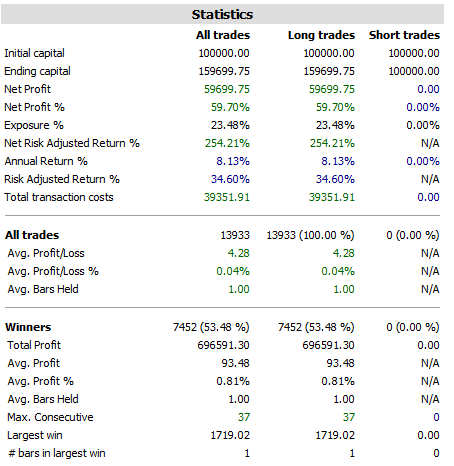

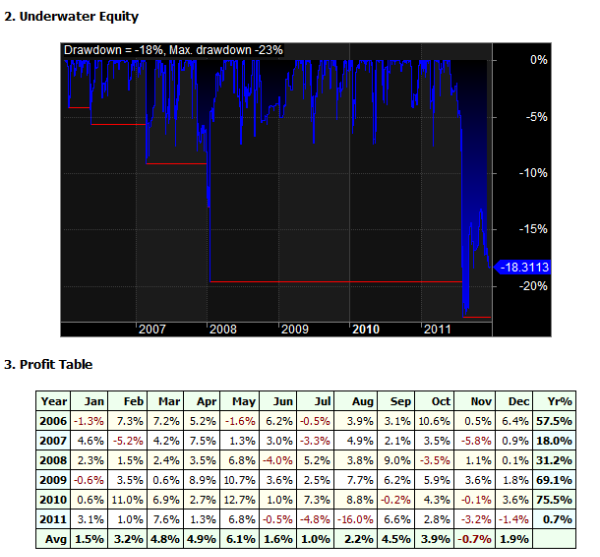

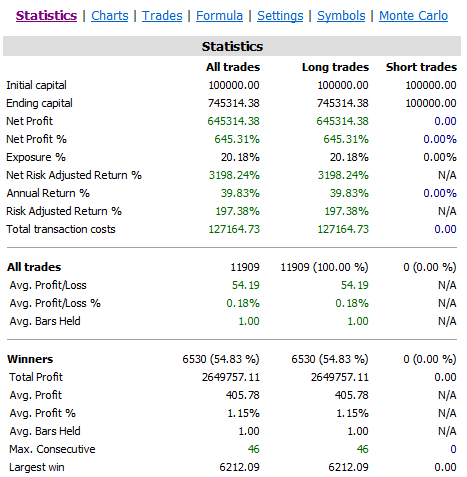

(This is version v0.36)Current work in progress stats for 1/1/2006 – 1/1/2012 (In Sample) on S&P500

GlenPeake

ParticipantHi Justin, welcome to the Mentor Course.

In short, I’ve been trading Trend following systems exclusively on the ASX. As you might already be aware, trend following on the ASX has been tough over the past decade. Simply put, my trend following systems have been ‘out of sync’ for large periods over this time, additionally the systems I’ve been trading have a large percentage of “Selection Bias” with them, therefore my returns have not been that great when comparing against the backtests for the systems. I.e. I’ve generally been picking the trades that end up being the losers etc.

“out of sync” and “Selection Bias” are terminology you’ll become ‘very’ familiar with and understand as you progress through the course.

So I’m looking to diversify both trading systems and markets to smooth out the equity curve i.e. add a short term system(s) like Mean Reversion and trade it on the US Markets in parallel to my Trend following system(s) on the ASX. I’m still looking to trade the Weekend Trend Trader or a variant of it with less Selection Bias.

Cheers

GlenGlenPeake

ParticipantPerfecto….Thanks Julian.

Thanks for the tip on the padding….

Cheers

GlenGlenPeake

ParticipantI’ve also switched over.

I was only subscribed to the ASX data previously, so having recently joined the Mentor course, it was good timing to grab both ASX & US data @ 50% discount. I then converted my existing PremiumData subscription over to Norgate Data which adds additional days (based on pro rata).

GlenPeake

ParticipantHi Scott,

If you want to go down the monitoring of VPS path, then have a look at ServersAlive:

http://www.woodstone.nu/salive/editions.php

http://www.woodstone.nu/salive/features.php#They have an unlimited time free trial period. The ‘free’ version restricts you to the number of devices (10 devices/entries) you can monitor, but that might be enough for what you want to achieve.

It performs email/SMS alerting, can restart services, run batch scripts/executable files after an alert etc.

So it might suit your needs.

Regards

Glen -

AuthorPosts