Forum Replies Created

-

AuthorPosts

-

GlenPeake

ParticipantJulian Cohen wrote:Nick Radge wrote:I have done 98 trades in three years myself. Frequency changes depending on market conditions.Glen, do you use Wealthsafe?

I’m with eSuperfund. https://www.esuperfund.com.au

September 18, 2018 at 2:01 am in reply to: Plugin Status error for Norgate Plugin in AmiBroker #109180GlenPeake

ParticipantHi Drew,

Here’s a link with further details about the plugin which might answer some of your queries.

https://norgatedata.com/amibroker-usage.php#maintenanceBut yes, it’s normal i.e. we right-click on MAINT etc should only take a few seconds to process.

Glen

GlenPeake

ParticipantHi Nick,

Depending on his availability/travel schedule etc. Cesar Alvarez is a name that springs to mind as a candidate/presenter… Considering that there are a number of us on the course trading MR and are familiar with some of his work, it would seem like a nice fit.

But regardless , some MR content would be a nice inclusion @ Noosapalooza 2019.

Thanks

GlenGlenPeake

ParticipantHi Julian,

I haven’t seen any permitted MAX trade numbers published with my SMSF… (Trading WTT, so my volumes are low…etc)

I’m not sure what you had in mind in terms of the trade volumes/strategy for your SMSF? If you had MOC/MR in mind for your SMSF you might run into some other limitations around the borrowing rules allowed etc.

https://www.wealthsafe.com.au/services/superannuation-smsf-faq/

But, as you mentioned definitely one for the Accountant to comment on.

Glen

GlenPeake

ParticipantI’m currently in stress testing phase for my MOC system and wanted to highlight a finding.

As part of my testing, I’ve also been scanning the market everyday and then confirming trades with a daily backtest to see which trades were triggered (paper trade testing), trying to simulate what it would be like to ‘live’ day to day with the system etc and also confirm signals matched the backtest report.

I’m testing 40 positions @ 10%.

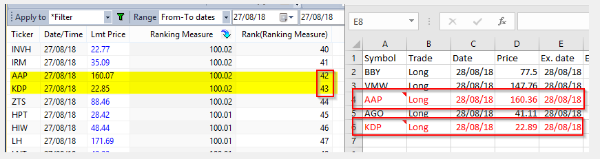

What I was seeing is that some trades that were in the backtest report, were ranked outside the TOP 40 stocks in the explorer.

Explorer is on the left for the 27/8.

Backtest report is on the right for the trades that were triggered on the 28/8.Notice that AAP & KDP were ranked 42 & 43 in the explorer, however they were being flagged in the backtest report. As we only ever place the TOP 40 ranked signals, both AAP & KDP would not have traded in real time and should not appear in the backtest report.

(Notice how there are numerous 100.02 in the ranking measure).

I was also seeing stocks/signals ranked in the TOP 40 which (would’ve) triggered in the market, however these trades were not showing up in the backtest report.

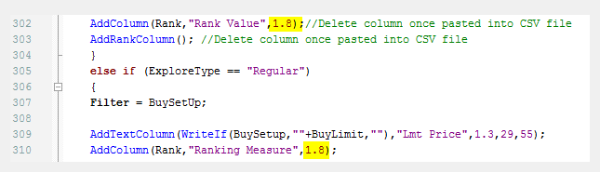

After contacting Nick/Craig, I’ve increased the number of digits for the Rank column in the custom backtesting code.

Changed from 1.2 to 1.8

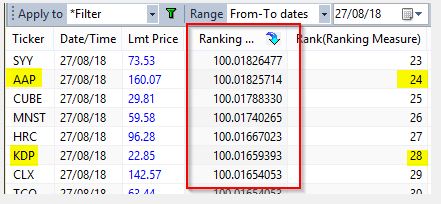

The 2 stocks that were previously ranked outside the TOP 40, are now sitting in the TOP 40 ranked stocks

Additionally, the ‘missing’ trades from the backtest report for some of the signals previously ranked in the TOP 40, were in fact for stocks that should have been ranked outside the TOP 40 and should not be flagged in the backtest report, as we only place the TOP 40 ranked signals etc.

So the rounding up of the 2 digit version was changing the order of the ranking measure for the Explorer output.

After updating the ranking digits to 1.8, trades are now consistent between the Explorer TOP 40 and the Backtest report.

Cheers

GlenGlenPeake

ParticipantNice Julian!!! :woohoo:

Hopefully the ‘next 1000 trades’ contains many more mean reversion trades like this one!!

GlenPeake

ParticipantHi Tim,

Thanks for your comments….

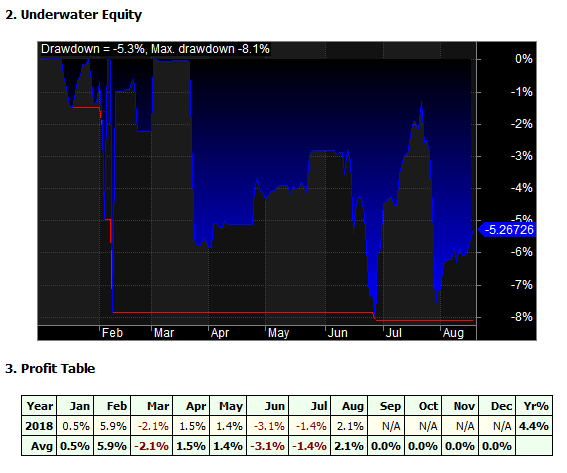

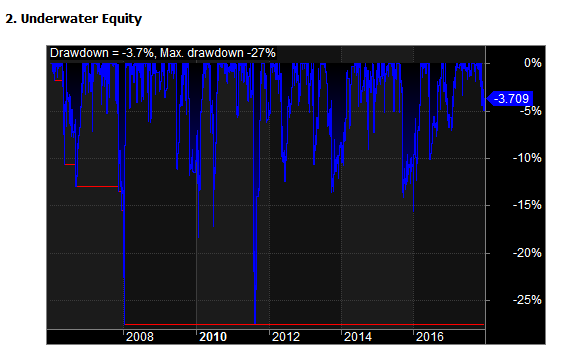

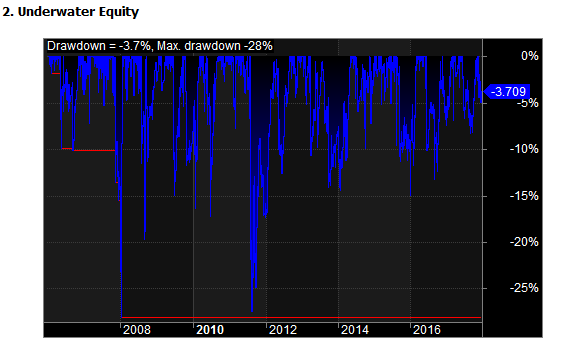

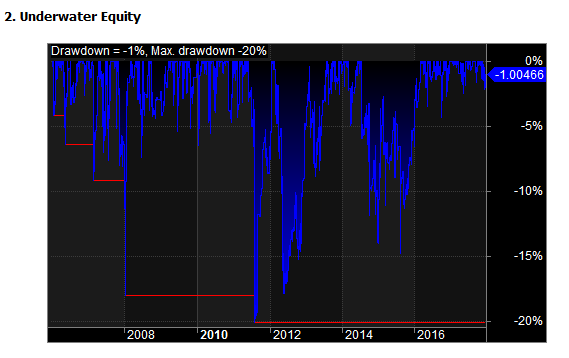

RE: Drawdown.

As they say, your worst drawdown is always in front of you….. :woohoo: So atm, just testing various combinations to find a balance I’m comfortable with.The good thing is, the length of the drawdown is not overly prolonged and the Recovery Factor for this version of the system is 11.46 (anything above 10 is very good).

Cheers

GlenGlenPeake

ParticipantHi Len,

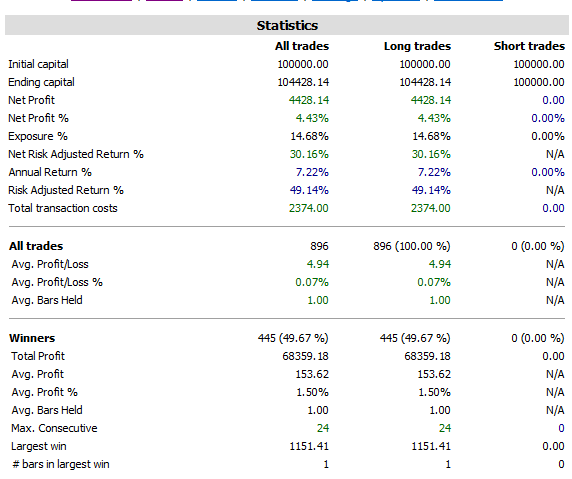

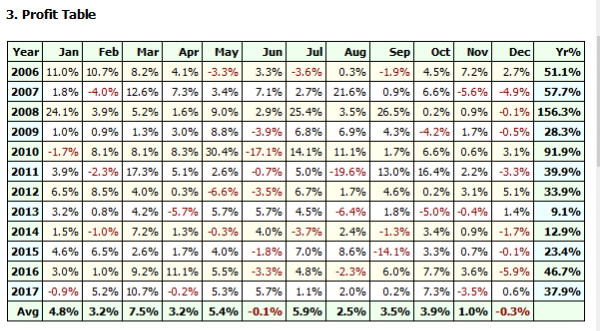

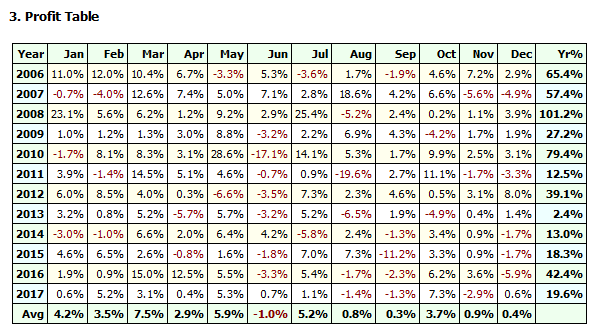

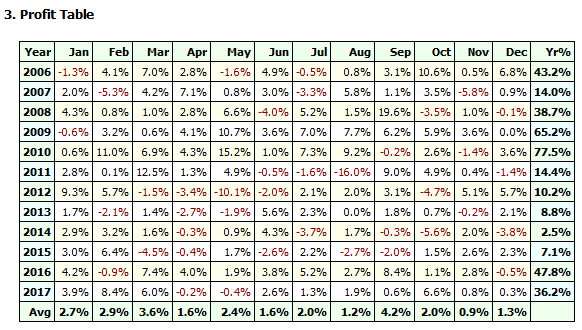

Here is 2018 thus far……

GlenPeake

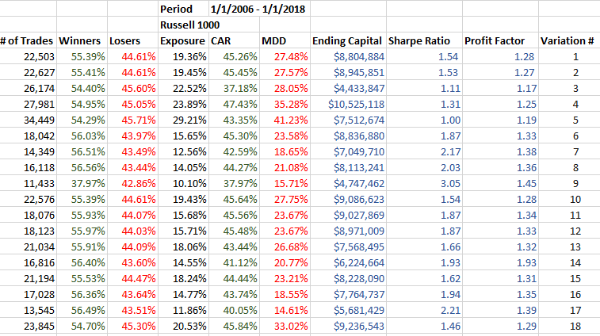

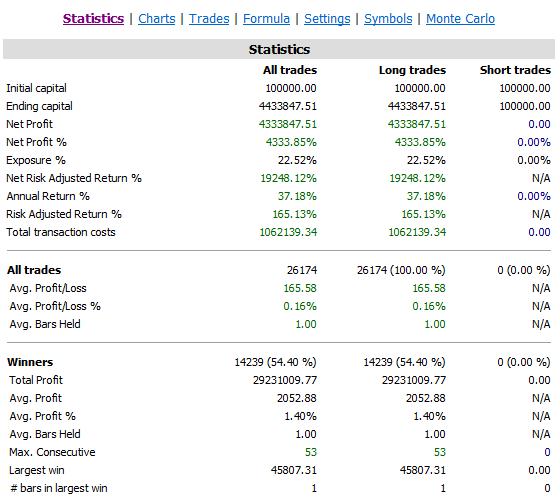

ParticipantCurrently testing different variations of this system, adjusting parameters to see “what works pretty good most of the time”

Cheers

GlenGlenPeake

ParticipantWhen I apply the index filter that I had applied in my original/first system…..

So although my original/first system didn’t pass the ‘sniff’ test, I managed to find an option that has made a positive impact on this system.

GlenPeake

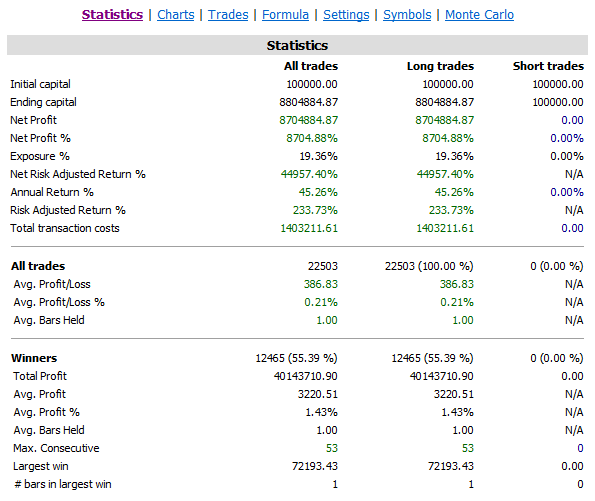

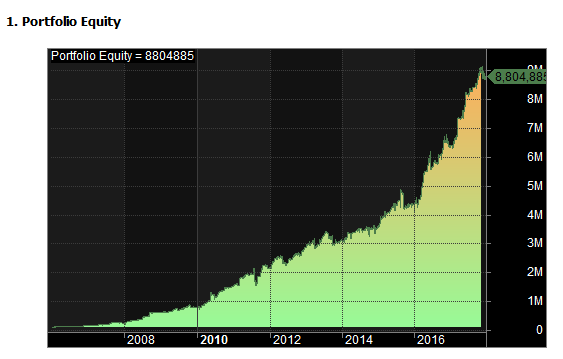

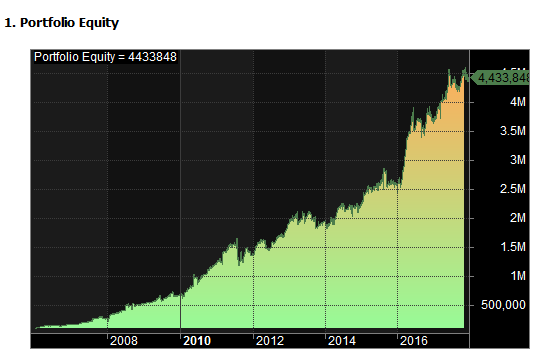

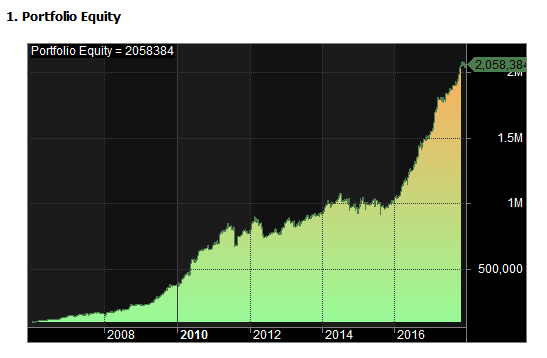

ParticipantSo with a new approach along with Nick’s assistance and guidance during the week…….This is what things are looking like atm….

GlenPeake

ParticipantI’ve been working away on my MOC system and had been experimenting testing various ideas/options.

I managed to improve the performance of my system with the use of an index filter. Increase CAR, decrease MDD decrease exposure etc.

So although there’s improvements, the system doesn’t really fit the “perform pretty good most of the time” profile.

So, it was time to changed things up……

GlenPeake

ParticipantTrend Following & Mean Reverting Indicators: How to Use, When to Use, and How to Use Together

https://cmtassociation.org/wp-content/uploads/2015/11/0107-geisdorf.pdf

GlenPeake

ParticipantHi Julian,

There was a discussion around the Pad & Align function here:

https://edu.thechartist.com.au/kunena/amibroker-coding-and-afl/323-rotational-systems.html#5025

To quote Craig’s comments:

“AB have recommended using P&A for rotational systems due to the way the ranking is processed in regard to the first symbol in the watchlist being tested. It will give erroneous results if that symbol does not have full data history for the test period. This was a recent development after noticing a small number of trades being held past rotation dates when testing certain watchlists.

You can use any symbol for P&A so long as it has full data history, but I’d suggest it needs to make sense for your system and universe being tested.

Do not use P&A for other systems. It can skew some indicators. “

So it seems like a function specific for Rotational Systems.

I haven’t used the function myself… So perhaps others can expand on the thread above if necessary.

Cheers

GlenGlenPeake

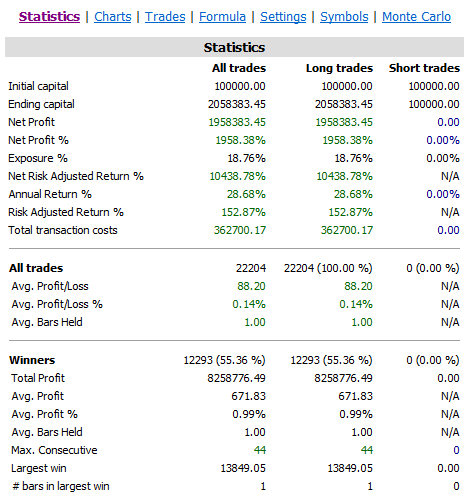

ParticipantThanks for that Julian…. Some very nice numbers you have there..!!!

Yep…In terms of the market over that period, that was something that I had noticed….. The market just kept making Higher High Lower Lows etc….from 2012 to mid 2015…. etc…so possibly a lack of volatility is hurting the system…I might see how applying the VIX as a filter works out.

BTW… this system is only initiating/closing the position on the same day. I haven’t yet gone down the multi day hold MR ‘rabbit hole’ yet…. to see what difference that makes.

Cheers

Glen -

AuthorPosts