Forum Replies Created

-

AuthorPosts

-

GlenPeake

ParticipantZach Swann wrote:Learn Something knew everyday. ThanksDitto here as well Zach.

This was something that had crossed my mind as well!!!

Cheers

November 6, 2018 at 12:46 am in reply to: Migration to IB Australia Pty Ltd: Margin Restrictions for Retail Accounts #109385GlenPeake

ParticipantNick Radge wrote:I’ll make some suggestions on another thread on how to handle any MOC or leveraged systems if you do not meet the Wholesale or Professional Investor requirements.Look forward to reading your thoughts on the MOC/Leverage alternatives/suggestions Nick.

When I remove the leverage from my MOC and adjust position sizing then backtest etc, the returns are mediocre compared to the levered backtested results. I’ve started to convert/test my system into a multi day MR (non-leveraged) to assess the results there etc.

I’d still like to trade some form of short term system to diversify strategies etc.

It’s a shame that ASIC/IB don’t have another option to qualify for use of leverage via a REG-T, that is, if you’ve completed the Trading System Mentor Course and have the Amibroker Backtests to prove your system is simple/robust/has a positive edge. :cheer:

You said it yourself on last weeks monthly call Nick, we’ve got a number of students using different varieties of systems that use leverage and none of use blew up our accounts (not even close to blowing up) in extremely volatile market conditions….. where all still in the game and can continue to pull the trigger the next day!!!! Which is something we can all be quite proud of and a testament to the quality of the Mentor Course material and the Mentors themselves!!!!!!

GlenPeake

ParticipantOctober 2018

Went live on 9/10/18, so only a partial month of trading i.e. the rough part of the month :cheer:

US MOC -12.5%

GlenPeake

ParticipantCheers Nick. Well said!!! Wise words as always!!

A feel sorry for your Crossfit weights/kettle bells etc

I’m actually in a really positive frame of mind atm, even with all the volatility etc. I have a new trading system which went live this week (timing is everything :cheer: ), but with the knowledge I’ve acquired via yourself/Craig and the Mentor Course, I know I have a trading system that is diversified and stress tested to the best of my abilities and have confidence in, so when times like this come around, I can pull the trigger each and every time.

Following the process and placing my orders again tonight without any hesitation (looking forward to it). :cheer:

Results since going live this week with my MOC.

Day 1: no fills

Day 2: down -6.6%

Day 3: down -0.3% (I expected a bigger decline when I woke up this morning and saw the DOW close negative again, but what do I know :cheer: …I should probably remind myself not to have any expectations )

)Cheers

GlenGlenPeake

ParticipantYep… noted Rob.

I’m looking forward to placing tonight’s orders. (I’m only trading smaller $ sizes atm, while I test the system live and develop my routine for placing orders, so if I stuff up it’s not a big mistake etc).

With the testing I’ve being performing, day’s like this are typically followed up with volatility in the positive direction anyway….(at some point).

I’m really impressed with the whole automatic API process….it’s awesome!!! I feel really professional!!!

GlenPeake

ParticipantI don’t have the exact % figure in front of me atm Rob, but down -6% would be about right for my MOC today….

GlenPeake

ParticipantJulian Cohen wrote:It’s a bugger when things go to plan innitHahahahaha….. :cheer:

GlenPeake

ParticipantMy MOC system had its first fills with the API today!!!

:woohoo: :woohoo: :woohoo:Worked as expected!!

The DOW down -3.15%…. sorry guys it must have been me….. 😆 ..:lol: 😆

Glen

GlenPeake

ParticipantHi Said,

If you’re scratching your head wondering what happened and why the market is down approx 3%…..?? One explanation might be, I went live with my MOC and got my first fills in this Volatility today!!!! 😆

Next 1000 trades :cheer:

GlenPeake

ParticipantYep, correct. Thanks for the heads up Rob.

GlenPeake

ParticipantNick Radge wrote:Great news.

Let us know how it all went…40 Orders placed…. with Zero fills. :cheer:

Rinse and repeat for tonight.

Glen

GlenPeake

ParticipantQuick update.

My MOC system is going live tonight. :woohoo: :woohoo: :woohoo:

My VPS is setup with Speedy Trading Servers.

Nick took me though the API today and also tweaked a few settings in TWS.

My orders have been Imported into the API and Sent to TWS.

Cheers

GlenGlenPeake

Participant2 New articles recently posted by Cesar on Ranking & Rotational strategies

https://alvarezquanttrading.com/blog/stockcharts-technical-rank-sctr-indicator-analysis/

GlenPeake

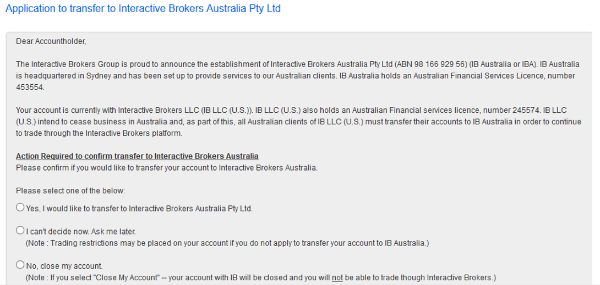

ParticipantA few updates on the IB front.

When I logged in during the week I was presented with the following message.

(The image might be a little hard to read, but it basically reads that IB US will cease business in AUS, so I need to transfer my account from IB US to IB Australia)

Having just opened my account, I found this odd.

Not sure if others have recently encountered this? However, I contacted IB and confirmed the message.

So it’s either transfer or close account…. tough choice

So my account that’s only recently been setup will transition to IB AUS. Apparently, no negatives/restrictions associated with the transition (i.e. I confirmed leverage was still OK etc).

However, they did mention that I’ll be receiving a new ACCOUNT ID. So, I believe Nick’s API is associated/configured with your unique ACCOUNT ID etc??? So, just thought I’d mention it here in case others might be affected etc.

In addition to this, I hit a hurdle when activating my IB Key via my mobile phone.

This is in relation to the 2 factor authentication. I loaded the IB Mobile app on my phone, I was then suppose to click on “REGISTER 2-FACTOR”. I was never presented with this option, only a Live/Paper Trade Login

https://ibkr.info/article/2277

Anyway, to cut a long story short, the explanation to why I couldn’t see the “REGISTER 2-FACTOR” icon is that my Mobile is (apparently) a dinosaur and doesn’t meet the minimum Android spec……. Minimum Android version is v5, I guess my 6 year old Samsung Galaxy S3 Android version 4.4.4, just isn’t up to scratch these days

Solution is, IB are posting me the hard device/token and in the meantime I’ll use the online Security Card.

Glen

GlenPeake

ParticipantNick Radge wrote:Glen, any additions to MR that would interest you?Apart from the Rotational/Trend Following, which I’m sure you’ve already got covered….

Perhaps a ‘Special Report’ presentation? I was utterly impressed when you published your first Special Report a decade ago… So perhaps something along those lines…. (I think you may have touched on this with the ‘Secular Bull Market’ comments @ the last Noosapalooza).

So a similar ‘long term pattern progression, here’s where things stand atm’ view, would be well received.

-

AuthorPosts