Forum Replies Created

-

AuthorPosts

-

GlenPeake

ParticipantDecember 2018 Stats

US MOC: +7.76%

***NOTE:

Margin was removed by IB halfway through the month (account migrated to IB AUS) and it took a few working days to sort out a couple of post migration items, as a result I missed a couple of trading days. Surprisingly the trading days I missed would’ve been negative down days for the system.First half of the month traded with MARGIN (upto 14/12), second half of the month traded with NO MARGIN.

(Backtested Returns for the entire month for both MARGIN/NO MARGIN system: For comparison)

Complete month NO MARGIN +6.29%

Complete month with MARGIN -2.67%GlenPeake

ParticipantMerry Christmas to everyone!!

Some encouraging stats to keep in mind after such a downturn:

December 16, 2018 at 10:29 pm in reply to: Migration to IB Australia Pty Ltd: Margin Restrictions for Retail Accounts #109334GlenPeake

ParticipantUpdate:

FYI

Spoke to IB last week, they indicated that the migration of accounts was schedule for this past weekend.

Logged into IB this morning to check the status….. Confirmed, my account has now been migrated over and my access to margin has now been removed……… 👿

I also needed to fill out/submit some online forms (to do with tax etc).

I also have a new account number.

Bugger!!!

December 12, 2018 at 9:47 pm in reply to: Migration to IB Australia Pty Ltd: Margin Restrictions for Retail Accounts #109333GlenPeake

ParticipantThanks for the update Nick.

I haven’t had any further ‘reminder’ alerts from IB about the migration…. no follow ups. So we’ll see if they follow through with their plans on the 14/12.

GlenPeake

ParticipantBUMP!!!

So true…. Don’t miss a single day….!!!

Had my best session since going live with my MOC in October (2 months ago).

Up 7.16% last night :woohoo:

I assume most had a pretty good session last night….

GlenPeake

ParticipantWell Done Dustin on creating the 5 systems!!! Nice stuff!!!

If it’s one thing the Mentor Course does is open you eyes to the different possibilities, building those robust trading systems and trading the way professionals trade.

In regards to the MOC systems and the 30-40%+ returns, as the CBT code has only been available/live the last few months, I guess will have to wait and see what the market does. However as you say…. compounding 15-20% year on year would sound pretty sweet to most I think.

GlenPeake

ParticipantNovember 2018 Stats

US MOC: -2.4%

GlenPeake

ParticipantHi Len,

Have a read here: https://edu.thechartist.com.au/kunena/amibroker-coding-and-afl/323-rotational-systems.html#5025

To quote Craig’s comments:

“AB have recommended using P&A for rotational systems due to the way the ranking is processed in regard to the first symbol in the watchlist being tested. It will give erroneous results if that symbol does not have full data history for the test period. This was a recent development after noticing a small number of trades being held past rotation dates when testing certain watchlists.

You can use any symbol for P&A so long as it has full data history, but I’d suggest it needs to make sense for your system and universe being tested.

Do not use P&A for other systems. It can skew some indicators. “

So it seems like a function specific for Rotational Systems.

I haven’t used the function myself… So perhaps others can expand on the thread above if necessary.

Cheers

GlenGlenPeake

ParticipantCurrent Update:

MOC/IB/Margin Restrictions: A case of wait and see whether IB follow through with their changes to margin….etc… until then I will continue to trade my MOC as usual.

WTT Testing: Working through testing my WTT. I originally purchased the turnkey code from Nick a couple of years ago (2015 from memory), so I’ve been tweaking some of the settings, adding a ‘stale exit’, sell after X bars if the stock is less than entry etc (in a bid to weed out some of the false breakouts).

Also adding in an additional Index vs Stock filter comparison.

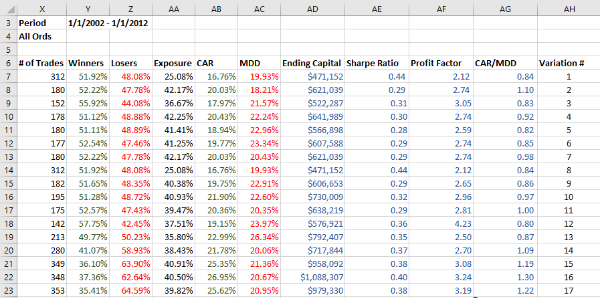

Current variations test results:

I also want to add a Relative Momentum system(s) to the mix. Yet to start any design/build.

Cheers

GlenNovember 6, 2018 at 10:47 pm in reply to: Migration to IB Australia Pty Ltd: Margin Restrictions for Retail Accounts #109392GlenPeake

ParticipantNick Radge wrote:I have arranged a call with the head of IBKR Aust today to discuss, specifically,(1) is this just an IBKR decision,

(2) an ASIC directive to IBKR or

(3) an ASIC directive to all retail broker providing margin?Will revert afterward.

Thank you Nick.

GlenPeake

ParticipantZach Swann wrote:Learn Something knew everyday. ThanksDitto here as well Zach.

This was something that had crossed my mind as well!!!

Cheers

November 6, 2018 at 12:46 am in reply to: Migration to IB Australia Pty Ltd: Margin Restrictions for Retail Accounts #109385GlenPeake

ParticipantNick Radge wrote:I’ll make some suggestions on another thread on how to handle any MOC or leveraged systems if you do not meet the Wholesale or Professional Investor requirements.Look forward to reading your thoughts on the MOC/Leverage alternatives/suggestions Nick.

When I remove the leverage from my MOC and adjust position sizing then backtest etc, the returns are mediocre compared to the levered backtested results. I’ve started to convert/test my system into a multi day MR (non-leveraged) to assess the results there etc.

I’d still like to trade some form of short term system to diversify strategies etc.

It’s a shame that ASIC/IB don’t have another option to qualify for use of leverage via a REG-T, that is, if you’ve completed the Trading System Mentor Course and have the Amibroker Backtests to prove your system is simple/robust/has a positive edge. :cheer:

You said it yourself on last weeks monthly call Nick, we’ve got a number of students using different varieties of systems that use leverage and none of use blew up our accounts (not even close to blowing up) in extremely volatile market conditions….. where all still in the game and can continue to pull the trigger the next day!!!! Which is something we can all be quite proud of and a testament to the quality of the Mentor Course material and the Mentors themselves!!!!!!

GlenPeake

ParticipantOctober 2018

Went live on 9/10/18, so only a partial month of trading i.e. the rough part of the month :cheer:

US MOC -12.5%

GlenPeake

ParticipantCheers Nick. Well said!!! Wise words as always!!

A feel sorry for your Crossfit weights/kettle bells etc

I’m actually in a really positive frame of mind atm, even with all the volatility etc. I have a new trading system which went live this week (timing is everything :cheer: ), but with the knowledge I’ve acquired via yourself/Craig and the Mentor Course, I know I have a trading system that is diversified and stress tested to the best of my abilities and have confidence in, so when times like this come around, I can pull the trigger each and every time.

Following the process and placing my orders again tonight without any hesitation (looking forward to it). :cheer:

Results since going live this week with my MOC.

Day 1: no fills

Day 2: down -6.6%

Day 3: down -0.3% (I expected a bigger decline when I woke up this morning and saw the DOW close negative again, but what do I know :cheer: …I should probably remind myself not to have any expectations )

)Cheers

GlenGlenPeake

ParticipantYep… noted Rob.

I’m looking forward to placing tonight’s orders. (I’m only trading smaller $ sizes atm, while I test the system live and develop my routine for placing orders, so if I stuff up it’s not a big mistake etc).

With the testing I’ve being performing, day’s like this are typically followed up with volatility in the positive direction anyway….(at some point).

I’m really impressed with the whole automatic API process….it’s awesome!!! I feel really professional!!!

-

AuthorPosts