Forum Replies Created

-

AuthorPosts

-

GlenPeake

ParticipantHey Mike.

Yes, for the shorter term systems i.e. MOC/MR I definitely saw improvement with using the ADX as my index filter. CAR improved and DD was improved as well.

I had also experimented with using other indicators as well i.e. RSI, ROC, ATR etc.

But for my shorter term system(s), using the ADX as my index filter improved results to the point where it warranted inclusion.

For the past 2 days, my ADX Index filter turned off…. so no new trades entered for the past 2 US trading sessions.

I am also using the SPX as my reference INDEX, but I also tried RUI, DJI as well…. so it was a bit of trial an error etc

And like Nick advocates test it, test it, test it……

GlenPeake

ParticipantThanks for the updates Mike….keep ’em coming… Always nice to read through the journals to see the progress and follow along as the systems take shape….

Are you still looking at a rotational system to start with?

Which market(s) US or AUS?

GlenPeake

ParticipantThat’s a nice looking RETURN chart Trent!!!

Very Well Done!!

:cheer:

GlenPeake

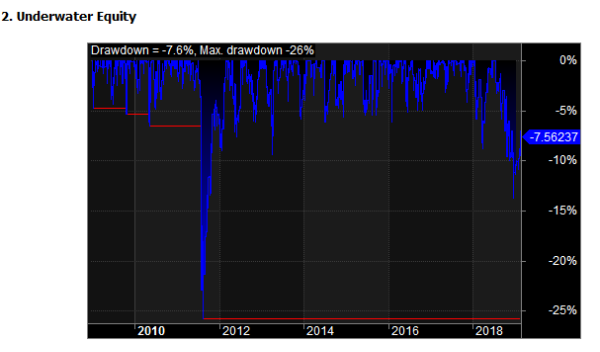

ParticipantFebruary 2019 Stats

US MOC -0.40%

ASX WTT +2.54%Happy that the WTT is now up and running, went live with it at a time when the market started to pick up and the BUY signals started to pop up as well…..

I went live this week with a Mean Reversion system on the R1000, so next month I’ll be reporting on 3 systems! Diversification feels good!!! :cheer:

Nice to see a bit more green in the February stats posts from the other members. Well done!!

GlenPeake

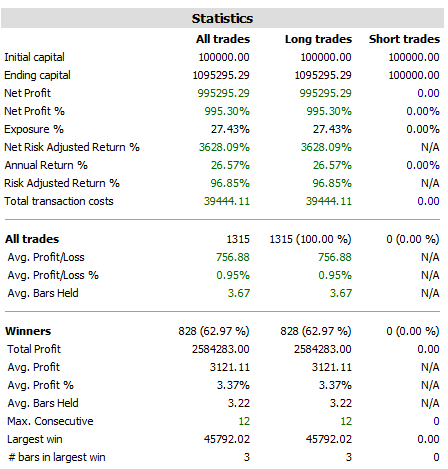

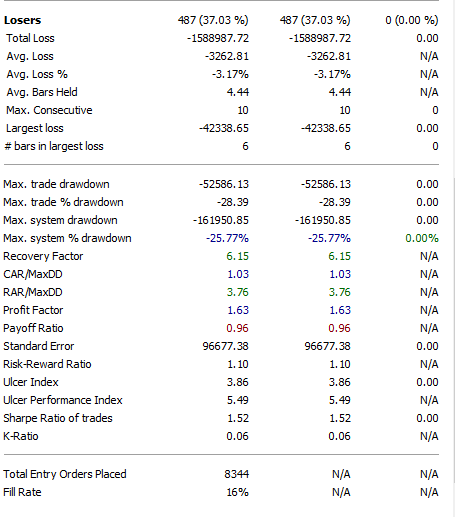

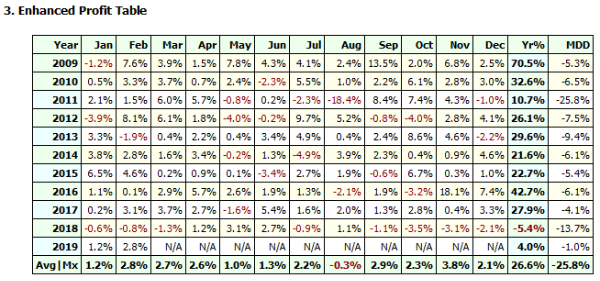

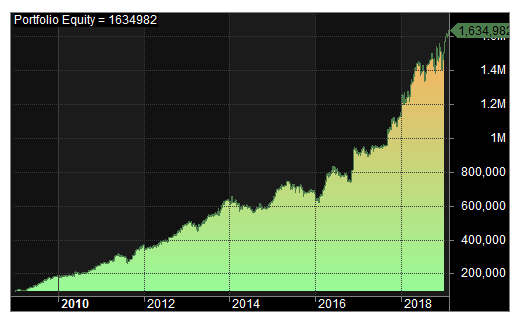

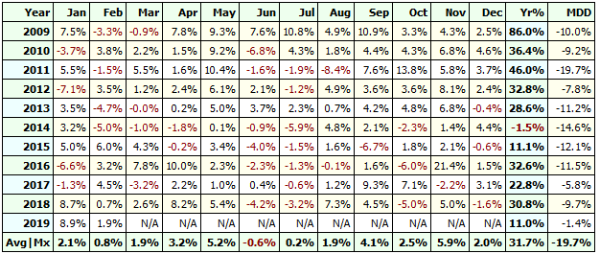

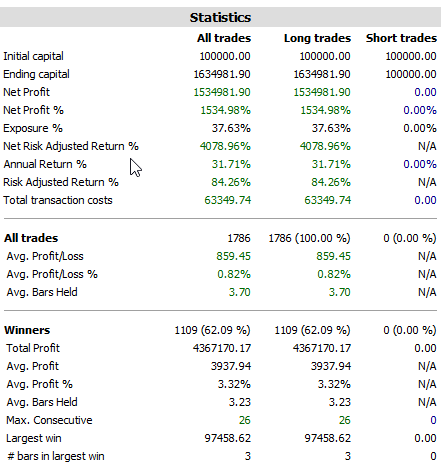

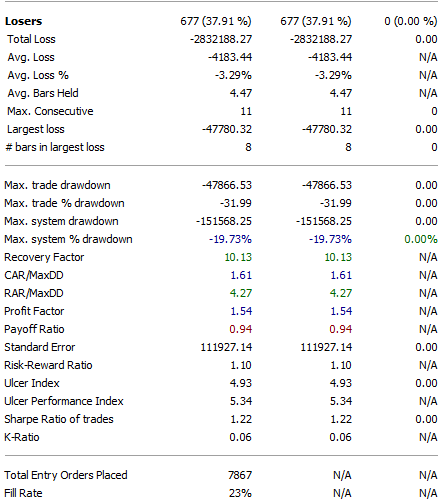

ParticipantAnother update on the MR/Swing system I posted about last week.

I went live with the system yesterday. I ended up using 5 positions @ 20%. So no margin.

I caught my first trade with it overnight!!! 😆

I’ll be using small position sizes for the next month, to triple check everything…. but from my previous backtests/explorations, stress tests and checks everything looked good.

Now that I’m running 2 API’s, I also want to make sure I put the correct trades into the correct API screen… So I’ll be allowing myself a few weeks to adjust to running 2x API’s and getting my ;send order’ routine together etc.

I’ve also being putting together another MR/Swing system (no margin)….. I haven’t spent too much time on it yet, so it still needs some work, but what I tried was to JUST change the entry technique(completely different entry technique) from the above system (MR system #1) and leave everything else the same…. so same MA filters, SellSetup, index filter…. no other changes apart from the entry.

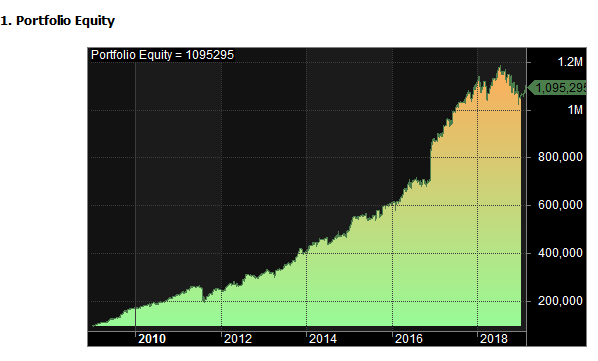

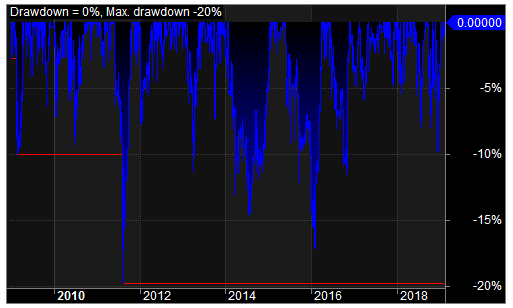

At first glance, what appeals to me about this system is the DD (for the most post) is less then -10%, with only 2 years where DD went beyond -10%. Sure DD is more then MR system #1, but I liked how consistent it ‘generally’ looked.

During the year 2014 this system (MR system #2) had a winning year, while MR system #1, had a losing year…..

Similarly in 2018, MR system #1 was a winning year, while MR system #2 had a losing year…..

So some nice diversification between the 2 systems.

So still some work to do…. but looks appealing.

GlenPeake

ParticipantThanks for the follow up Len…

I guess after running the backtest and seeing 48.58% CAR the eyes would’ve popped out a bit, but scrolling down and seeing DD @ -39.7% churns the stomach a bit….

Yep, play around with the 2 PARAM options to see if there is a sweet spot for you specific system etc

GlenPeake

ParticipantHi Len, No probs…. this was the article that got me thinking about ADX Index Filters etc…..

https://cmtassociation.org/wp-content/uploads/2015/11/0107-geisdorf.pdf

GlenPeake

ParticipantHi Scott, this is against R1000…. yet to check out the other universe’s.

GlenPeake

ParticipantLen Zir wrote:Glen,

Those are great numbers. It looks like you tested trading through Dec 2018-Jan2019. Are you not using an index filter?Hi Len,

Yes, I use an index filter…. however it’s not based on the standard 200MA…it’s based on trend strength…. i.e. ADX. I find it helps keep you out of the market when things are quiet and gets you in when volatility picks up/strength. Increases CAR and reduces DD.

Test it out on your MOC/MR systems and see if it improves things….

///////////////

_SECTION_BEGIN (“ADX Index Indicator Filter”);

//=================================================================================

// Index Filter 4

//=================================================================================

IndexIndTog4 = ParamToggle(“ADX Index Indicator Filter”,”Off|On”,1);

SetForeign( “$SPX” );

IndADXPeriod4 = Param(“Index ADX Indicator Period”,5,1,300,1);

IndADX4 = Param(“Index ADX Indicator Filter”,25,5,80,5);

ForeignADX = ADX(IndADXPeriod4);

IndexIndFilterTrig4 = ForeignADX > IndADX4;

IndexADXInd4On = IIf(IndexIndTog4,IndexIndFilterTrig4,1);

RestorePriceArrays();

_SECTION_END();

///////////////////////////////////////////////////////

IndicatorGroupFilters = IndexADXInd4On;////////////////////////////////////////////////////////////

GlenPeake

ParticipantCheers Nick.

Nice to know I’m in the right ballpark…numbers wise.

Not having access to margin for the shorter term systems is a bummer, but gotta roll with the punches.

GlenPeake

ParticipantUpdate on current status.

ASX Weekend Trend Trader is ticking along nicely…. currently 65% invested….

As I’ve been trading Nick’s turnkey WTT code for for a while, I held existing WTT positions when starting up my ‘tweaked’ version of the WTT code. So I’m still holding a few of the ‘old’ WTT code positions that don’t appear in the ‘open position’ version of my tweaked WTT code…. so a little bit of a transition still talking place in that regard…I was already holding some of the open/existing positions that showed up in my tweaked WTT code, so no action required in that regard, but to keep holding…easy peasy….

MOC….update…. hhmm pretty quiet…. with the restriction around margin by IB now and having to trade without margin…. the backtest stats aren’t setting off fireworks… CAGR 11% DD -6%… using 10 positions @ 10%.

On the back of the MOC status and in a bid to diversify…. I’ve been testing a Mean Reversion swing system (no margin)…. Still a work in progress, but stats look encouraging.

GlenPeake

ParticipantNice work Tim! Thanks for the ongoing updates!!

GlenPeake

ParticipantJust a quick update.

I’ve going live with my ‘tweaked’ version of the Weekend Trend Trader (WTT) on the ASX today.

I have 4 ‘new’ orders/signals pending.

I’m using the Selection Bias Code.

In addition to the 4 ‘new’ orders/signals, I need to place a couple of additional orders for existing positions, so that way my ‘live’ positions held, will align with the backtested positions held etc. i.e. Zero Selection Bias.

GlenPeake

ParticipantJanuary 2019 Stats

US MOC +0,85%

GlenPeake

ParticipantSimilar here Trent…. I’m 8 trades for this month on my US MOC system….. Nothing wrong with being in cash though.

-

AuthorPosts