Forum Replies Created

-

AuthorPosts

-

GlenPeake

ParticipantThanks Craig, I’ll keep that open as another option…. It would appear AmiBroker has an option for almost everything.

GlenPeake

ParticipantUPDATE: Running my Mean Reversion systems without margin and the margin issue I occasionally run into.

So just to outline my current situation, I’ll use the following basic example.

Let’s say I have $500 allocated for a MR system. The system will NOT have access to margin via IB and hold a maximum of 5 positions. Each position will be allocated 20% of the account, so $100 per position etc.

Let’s say I don’t have any open positions, I’ll place 5 BUY orders and lets say all 5 orders get fills on a Monday… I hold the positions overnight etc…

Then I get 2 SELL signals for the following trading session, (my system will SELL on the next day’s OPEN), I’ll place my 2 SELL orders which then means I can place 2 new BUY orders.

As I’m placing my orders outside of market hours (typically 20:00 Sydney time), as my 2 SELL orders haven’t yet been filled as the US market won’t open until 23:30 (Sydney time), when I then try to place my 2 new BUY orders, the IB system won’t allow me to place the 2 new BUY orders as all my cash is still fully in use/allocated to the 5 holdings and this would create a margin issue (IB doesn’t factor into the equation that I have 2 SELL orders in the system and the cash from the sale of these 2 positions would then go towards my 2 new BUY orders)… I would need an additional $200 in my account to allow the 2 new BUY orders to be placed outside of market hours etc.

So, this creates a situation where I want to maximise the use of the cash I have allocated to a system and not miss new BUY signals etc.

Current options:

1) Sit up until 23:30 each night and wait until my SELL orders get filled and then place my new BUY orders. (This is not really a great option for the long term…).

2) Automate it…..!!!!

Find a piece of software that allows for a MACRO to be created/recorded and can then be scheduled/automated to run. I.e. create a MACRO that will open the SMARTAPI (if necessary) and then Import/Send my MR orders to market after my SELL orders have be filled/executed i.e. schedule this task to run @ 23:31 Sydney time (09:31 New York time), that way all my SELL orders have already been filled on OPEN and my cash is available again. This could work Ok and I’ll start investigating.3) Put a request in for the SMARTAPI for a an option button along the lines of “SEND ORDERS AT A SPECIFIC TIME”…. i.e. instead of using the existing SEND button in the SMARTAPI, if I could Import my orders, but instead of SENDING my orders immediately, I could instead send at a custom time of my choosing etc. I.e. I could send the orders @ 23:31 (Sydney time) after my SELL orders have been filled etc. Probably the ideal option, but not sure how viable this option is atm, especially if this is a feature that only 1 person (me) would find useful etc.

Nick, your thoughts on option 3?

Let me know if you can think of any other ideas.

Thanks

GlenGlenPeake

ParticipantAPRIL 2019 Stats

US MOC -5.84%

US MR #1 +0.69%

US MR #2 -0.01%

ASX WTT +5.93%Since going live with my ‘tweaked WTT’ code at the start of this year, my ASX WTT portfolio is now up 15.74% (YTD). The overall market is obviously favourable.

However when you consider the volatility of the market(s) during the last quarter of 2018, as a systematic trader, we follow our systems/signals and pull the trigger…… as a discretionary trader, could they continue to pull the trigger into 2019 with the volatility of OCT/NOV/DEC 2018 behind them….? If I was a discretionary trader, I’m not sure I could have continued to pull the trigger into 2019 and therefore would’ve missed the boat over the past 4 months.

The ASX WTT is now 100% invested. Some volatility crept into some of the GOLD stocks I’m holding, but all good, I’ll continue to hold until the system says to sell.

The ‘Rock Star’ performer of the month for the ASX WTT portfolio was Z1P.au which added 44.12% for the month, the stock has gone parabolic over recent days/weeks.

The lag performer of the month (or as I now like to refer to them ‘best candidate for Mean Reversion trades’

) was AMI.au which retreated 19.46% for the month, previously in recent months this was one of my better performing holdings.

) was AMI.au which retreated 19.46% for the month, previously in recent months this was one of my better performing holdings.As discussed on Monday’s monthly mentor call, not having access to margin, I’m finding I run into margin issues when needing to sell MR positions and replace those positions with new BUY orders on the same day….. I’ve got some ideas around this, but will post further details/explanation over the coming days.

.GlenPeake

ParticipantThanks Julian.

It’s encouraging from our perspective to see the numbers they produce….. we stack up OK return wise….

Maybe they need to add some WTT and/or Growth Portfolio to the mix

Maybe they need to add some WTT and/or Growth Portfolio to the mix

Found the link to the screen shot you posted, with better clarity.

http://www.automated-trading-system.com/trend-following-wizards-march-2/GlenPeake

ParticipantRe: VC

Yep…. include me in the VC list…. :whistle:

Next 1000 trades….

GlenPeake

ParticipantGood work Mike!!! All the best with the system!

Lol @ the the warning!!!! :woohoo: I’m guilty of that!!! :silly: e.g. Oct 2018!!!!! Lol……

GlenPeake

ParticipantMarch 2019 Stats

US MOC – 2.48%

US MRV #1 – 4.24%

ASX WTT +4.69%The ASX WTT is now 95% invested, I’m holding approx. 6 gold stocks and a couple of iron ore stocks, plus other randoms etc, but GOLD is definitely the dominant holding in the portfolio atm.

I would say at least 50% of my holdings in my ASX WTT are stocks that the Growth Portfolio has also triggered BUY signals for, the timings for the BUY signals might be slightly different, but considering both are trend following systems, probably no surprises that there is some correlation of signals….which is nice.

Biggest gainer for the ASX WTT portfolio was MGX which added +18.28% for the month.

Biggest loser for the ASX WTT portfolio was IFM which dropped -15.41% for the month. (Entered the position on 15/3)

My MRV #2 system, backtested returns for March of +3.14%, I plan on going live with this system next week.

For April, I want to take another look at my MOC system and try to improve the returns. Trading it with NO MARGIN is….mediocre at best……around 11% CAR over the last 10 years.

Glen

GlenPeake

ParticipantTim Strickland wrote:Some psychology lessons today. Today my system was telling me to get out of MNST. I was a bit irritated as I just took the trade yesterday. The signal got me in and then this morning the system wants me out. I didn’t understand why, but then I learned that the stock had declined below one of my filters. It made sense to get out but my gut wanted me to stay in as I thought it was going to rally. The temptations to stay in a trade when my system says otherwise is getting less and less especially after following the system as prescribed the stock drops another 4%. This is just one of many times this has happened. Most of the time the system is right and I am wrong and that is exactly why I follow it. I haven’t broken any of my system rules in over a year and do not plan to start now. Because I followed the system it went up another 2% today alone.Hey Tim,

Well done on following your system.

The opposite situation can also occur.

Let me give an example.

You get into stock ABC. It rally’s and then you exit for a tidy profit when your sell signal triggers. All good…

The stock then keeps rallying and rallying etc….. as a systematic trader we have clarity of mind knowing that we followed our system successfully.

However, a discretionary trader who (more/less) trades on gut feel, who enters/exits the same trade in our example ABC stock as the systematic trader, will probably be kicking themselves when the stock starts rallying thinking, “I should’ve just held on” etc (we’ve probably all been in that situation), future trades made by the discretionary trader are then affected by “the one that got away”.

That’s what I’ve found/learned (sometimes the hard way in the past), knowing that my systems are making the decisions for me… if a stock continues to rally after our exit signal, than we can always get back on a trade should we get another signal.

There’s a lot of guesswork/second guessing taken out when following our systems…. plenty of peace of mind in that alone regardless of the $ outcome of a trade.

Cheers

GlenGlenPeake

ParticipantHi Mike,

If you haven’t already done so, I have a read of this PDF.

https://cmtassociation.org/wp-content/uploads/2015/11/0107-geisdorf.pdf

Trend Following & Mean Reverting Indicators: How to Use, When to Use, and How to Use Together.

This is what led me down the ADX Index filter path…. so there might be something else in there that triggers a light bulb moment for you….. perhaps not directly for your current Rotational system, but for other systems down the track.

Glen

GlenPeake

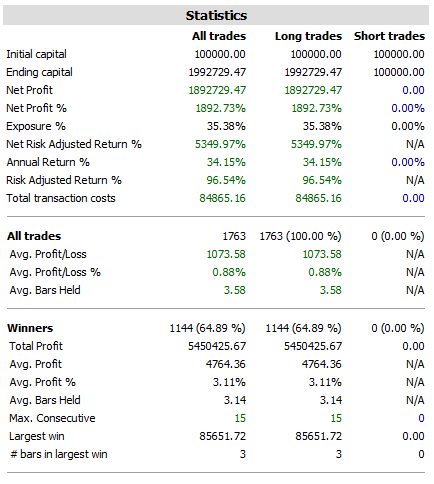

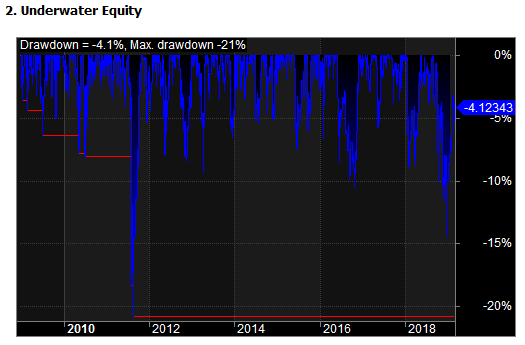

ParticipantMR System #2 Comments:

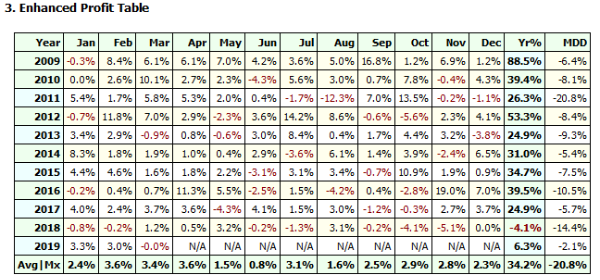

For me MR system #2…. my results I posted CAR 34% and DD 20…. was a bit of an outlier…

Most of the other variations I’ve been testing/focusing in on were around 28%-32% CAR with around 24%-26% DD… which are still good going…

So the system that resulted in 34% CAR and 20% DD, was probably a result of too much optimization of the RANK & STRETCH…

So I’ll look to reel that back in to where most of the other variation backtests results were landing i.e. 28%-32% CAR with around 24%-26% DD, which should offer more flexibility for the future.

Thanks all for the feedback….

Cheers

GlenGlenPeake

ParticipantLen Zir wrote:. I incorporated your adx filter with my MR system and it produced a very significant boost to my back tested results. Will see how it goes with real-time trading.

Thanks again for sharing,Awesome Len!! Thanks for the feedback!!! :cheer:

GlenPeake

ParticipantJulian Cohen wrote:Not sure if anyone has tried it, but I got a nicer result with my systems by adding Glen’s ADX idea to the existing MA(c,200) Index Filter.Sweet.. Julian.

What about when you only use the ADX Index Filter only? I.e. turn off your “IndMA” Index Filter and only run the ADX Index Filter?

For my MOC/MR I run the ADX Index filter only…(no other Index Filter).

In terms of the longer term systems, I haven’t tested it…but, not sure if it would be beneficial.

I wanted to come up with some sort of filter that would get me into the market when volatility picked (either UP or DOWN) and be on sidelines on those days when the market was quiet… Just avoiding those days when the market was quiet, seemed to help the shorter term systems. I.e. it kept me on sidelines for a couple of days last week.

To provide an idea of just how many days you are on sidelines I.e. approx. 347 days out of the past 2562 trading days (calculated back to 1/1/2009) the ADX Index filter would have kept you on the sidelines i.e. no new trades placed on these days…

Also to clarify…. I do not use the ADX Index Filter as a ‘kill switch” to exit any existing open trades…I only use it as an entry mechanism i.e. for a multi day MR system….just let existing open positions close themselves out using whatever Sell Setup conditions configured.

I’d be keen to hear feedback if others have tested it and have seen a benefit or not….Hope it helps.

Cheers

GlenPeake

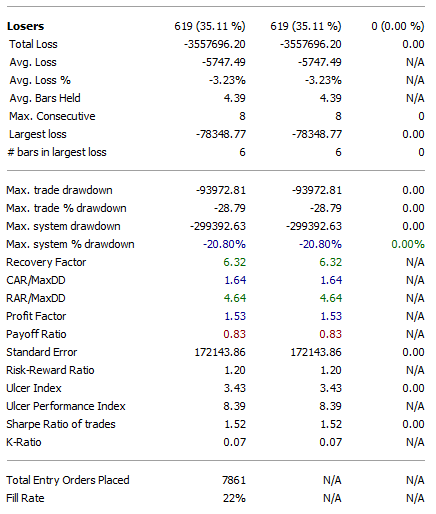

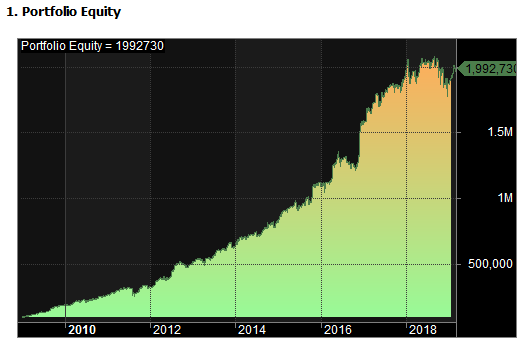

ParticipantUpdate on the progress development for MR System #2….again NO MARGIN being used.

GlenPeake

ParticipantThanks Nick.

Nice numbers.

Besides the very nice additional charts in the backtest report….

The following stood out…

Sector Maximum Holding

A maximum of 3 stocks can be held from any single sector. This reduces sector specific risk, by avoiding a high concentration of the portfolio in any one area.I understand the logic, diversify sector selection and don’t ‘load up’ in one specific sector in case it tanks… but on the surface it seems like it might also be restrictive…. what if 1 sector is ‘hot’ in a given period i.e. what if gold stocks are the flavour of the month(s) or technology stocks or uranium stocks…. you might be restricting yourself if one of these sectors is strong and there could potentially be 5 or 6 stocks (in the same sector) in the top 14 momentum list.

I get how having a max of 3 per sector could ‘smooth’ out the ride a bit… but might also ‘hold back returns’ as well…..an idea to try out in the future.

I guess like everything test it, test it etc….

GlenPeake

ParticipantMichael Rodwell wrote:Have you experimented with ADX and longer terms systems? I’ve been tinkering around with it today without any success so far.Only the short term MOC/MR systems for now.

For the WTT system, it’s just the simple MA Index Filter.

For me, testing the MA Index Filter on the short-term systems, took me out of the market during some high volatility periods e.g. GFC and therefore hurt returns/reduced CAR etc….

I don’t have the backtest on me atm… but you could just see/imagine the amount of time you’d be on the sidelines if you been using a 200MA Index Filter against the SPX on a MOC/MR system….. during this time. You would’ve missed some good returns etc.

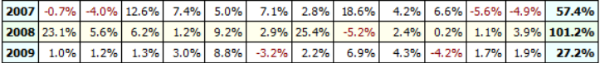

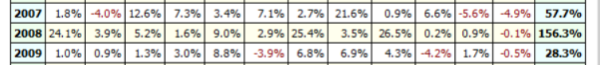

As a highlight for/against using the ADX Filter for my MOC system (with margin) as an example….

This is the return without my ADX Index Filter during the GFC…

…and now with my ADX Index Filter

Stats without ADX Index Filter

https://edu.thechartist.com.au/kunena/progress-journal/413-glen-s-journal.html#6578Same system with ADX Index Filter

https://edu.thechartist.com.au/kunena/progress-journal/413-glen-s-journal.html#6579 -

AuthorPosts