Forum Replies Created

-

AuthorPosts

-

GlenPeake

ParticipantNick Radge post=14690 userid=549 wrote:Total account was about -2.52% for the month.

Amazing how we trade similar yet different systems with different % of funds allocated to them, yet for the Total account % for the month was almost the same…..

My total account was -2.54% for the month……..how does that happen? lol

GlenPeake

ParticipantAPRIL 2024

ASX

WTT +0.40%

ASX100 RTN -4.60%

XSO RTN -6.82%

ASX LSS +0.38%US

MR#1 -5.07%

MR#2 -1.97%

MR#3 +2.56%

MR#4 -8.63%

MR#5 -0.98%NDX100 RTN -5.47%

R1000 RTN -11.45%US LSS -5.60%

Monthly Total Account: -2.54%

GlenPeake

ParticipantNice month Sean… Well done!

As for the takeover on MRM.au, in the past Nick has suggested waiting a few weeks to see if a higher bid comes along if/when holding a position that is going through the takeover process….not sure if the ‘type’ of takeover i.e. Binding or Non-Binding has an effect here or not when deciding to ‘bank’ the position etc…… But if a higher bid is in the wings, then it generally comes out sooner rather then later etc…

FWIW:

I’m still holding AZS.au which is under a Scheme of Arrangement for $3.70, with a fallback to a takeover of $3.65…. They’ve had 1 increase in the bid from $3.50 to $3.70, since the initial $3.50 was made……My reason for holding… if the Scheme/Takeover is delayed by a few weeks, it will likely mean I’ll be holding for 12 months and therefore benefit from the 12 month tax discount…. i.e. early MAY. etc….

So my reason for holding versus the down side risk of a failed bid is validated imo, as the risk of a failed bid is pretty unlikely at this stage…. and the remote/off chance that another bidder steps up at the 11th hour….(unlikely, but who knows).

GlenPeake

ParticipantMARCH 2024

ASX

WTT +4.07%

ASX100 RTN +2.30%

XSO RTN +2.61%

ASX LSS -6.14%US

MR#1 -1.17%

MR#2 -0.40%

MR#3 -2.06%

MR#4 +4.77%

MR#5 -0.57%NDX100 RTN +2.14%

R1000 RTN +5.17%US LSS -0.77%

Monthly Total Account: +1.09%

GlenPeake

ParticipantNo problems Julian!

GlenPeake

ParticipantPerfect…. Thanks Nick.

GlenPeake

ParticipantThanks Nick. Impressive!

Demonstrates/Highlights the value of a simple robust idea working across a number of universes etc….

Just a quick general question regarding ETFs, as I haven’t traded them in the past…. Are there any additional fees involved when buying/selling ETFs (apart from the standard brokerage fees etc)…. ? Are there fees for some ETFs, but no fees for other ETFs?

GlenPeake

ParticipantEpic month… Well done Nick.

GlenPeake

ParticipantFEBRUARY 2024

ASX

WTT +0.34%

ASX100 RTN +9.80%

XSO RTN +1.41%

ASX LSS +3.98%US

MR#1 +10.55%

MR#2 +4.77%

MR#3 +5.13%

MR#4 +2.21%

MR#5 +3.01%NDX100 RTN +18.67%

R1000 RTN +20.04%US LSS +2.01%

Monthly Total Account: +5.06%

A green Month across the board…. rare for that to happen.

February 15, 2024 at 2:13 am in reply to: Capturing Gaps UP on OPEN While Managing Risk (STOP Orders) #115981GlenPeake

ParticipantThanks Nick.

Wasn’t aware of the “Adjustable Stop”… will take a look into it.GlenPeake

ParticipantJANUARY 2024

ASX

WTT -3.61%

ASX100 RTN +0.60%

XSO RTN +1.40%

ASX LSS +2.60%US

MR#1 -11.35%

MR#2 -8.43%

MR#3 -10.68%

MR#4 -5.77%

MR#5 -0.99%NDX100 RTN +14.37%

R1000 RTN +1.58%US LSS -1.52%

Monthly Total Account: -0.61%

GlenPeake

ParticipantThanks for the Congratz Terry, much appreciated….It’s been a tough 2 years for all us systematic traders.

In terms of MR systems and ‘secret sauce’….. I think the only secret sauce is the ability to ‘stomach’ some pretty long & extended drawdown periods and some ‘less then ideal’ Max Drawdown during some extended ‘out of sync’ periods with the market….. combined with the ability to stick with the system.

Nick was recently quoted in an article, where he mentioned:

“It takes a very special psychological fortitude to cope with a career where losing money is an integral part of success.”I like this quote….. and have concluded that, maybe I have some of that ‘special psychological fortitude’, combined with a bit of resilience…. or I’m just ‘concussed’ from the ‘face slaps’ the market dishes out from time to time.

Here are some other stats in terms of MAX drawdown for each MR system:

MaxDD experienced in Live Trading for each MR system. (Most systems exceeded the historical backtested MaxDD)…..additionally, the DD has occurred in the last 12-24months (where most systematic MR traders have also struggled….which in turn has validated that my systems aren’t necessarily broken if everyone is struggling etc)

MR#1 -41%

MR#2 -36%

MR#3 -45%

MR#4 -57%

MR#5 -67%So, some pretty big numbers there, which is not ideal….and a bumpy ride…etc….. and high amount of volatility….. But, it seems to work out OK in the long run…when the systems sync up with the market.

NOTE: MR#4 & MR#5…. they trade in the “ALL” stocks universe (small caps etc…which is an area of the market which has struggled considerably these past 2 years, which goes part of the way of explaining the deep drawdown) and I’ve only allocated a very small % of capital allocated to these 2 systems….so I can keep pulling the trigger as the DD only represents a very small % of total account etc….

If you want further details…. then just DM me on the RealTest forum @ “LeTourTrader” or via Twitter etc…

GlenPeake

ParticipantDECEMBER 2023

ASX

WTT -4.54%

ASX100 RTN 0%

XSO RTN +0.81%

ASX LSS -0.71%US

MR#1 +10.52%

MR#2 +14.00%

MR#3 +15.41%

MR#4 +14.54%

MR#5 +4.02%NDX100 RTN +4.76%

R1000 RTN +5.46%US LSS +4.90% (***New System***)

Monthly Total Account: +0.84%

/////////////////////////////////////////////////////

2023 Yearly System Performance

ASX

WTT +52.18%

ASX100 RTN -25.38%

XSO RTN -13.73%

ASX LSS +35.23% (***New System*** Launched APRIL 2023)US

MR#1 +19.86%

MR#2 +50.04%

MR#3 +41.70%

MR#4 +2.61%

MR#5 -30.72%NDX100 RTN -3.18%

R1000 RTN -15.33%US LSS +4.90% (***New System*** Launched DECEMBER 2023)

2023 Total Account Yearly return: +25.06%

/////////////////////////////////////////////////////

Launched my LeTour Swing System on the US markets this month. In a nutshell, the same approach as the ASX Swing System.

The story of the portfolio for the year was $AZS.au, without it, my yearly return is likely in the red.

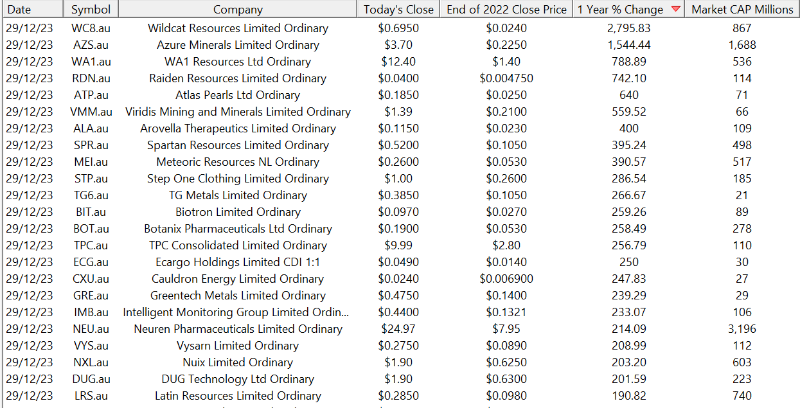

Best returning stocks to be holding in the ASX for 2023 was:

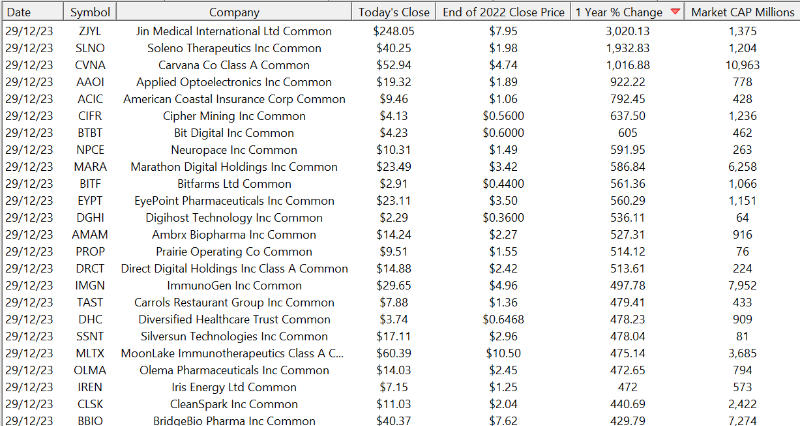

Best returning stocks to be holding in the US for 2023 was:

GlenPeake

ParticipantHey Julian,

Average holding time is 2-3 days….. my exit is the same across all MR systems i.e. C > C[1]…

-

AuthorPosts