Forum Replies Created

-

AuthorPosts

-

GlenPeake

ParticipantOR…. in the Account Management section

Settings > Trading Permissions

GlenPeake

ParticipantIn the Account Management website section:

Access Trading Permissions: In the settings menu, look for the option ‘Trading Permissions’ under ‘Trading’. Click on it. Select ETFs

GlenPeake

Participant@Robert

From memory, for me I think I followed a link after trying to place an order on one of the ETF’s e.g. $IBIT.

i.e.

I tried to place a (manual) BUY order on e.g. $IBIT, then a ‘permission’ dialog box popped up saying “you need trading permissions to trade ETFs, from there, there was a link to modify trading permissions….. this was a ‘systematic’ request and permission was granted immediately.Hope that helps….

GlenPeake

ParticipantNice work Terry! All the best for 2025…..

GlenPeake

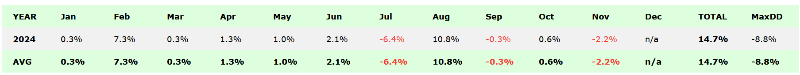

ParticipantDECEMBER 2024

ASX

WTT -6.44%

ASX100 RTN -2.72%

XSO RTN 0%

ASX LSS -2.31%US

MR#1 +2.89%

MR#2 -0.76%

MR#3 -6.51%

MR#4 -2.70%

MR#5 +0.80%NDX100 RTN -5.53%

R1000 RTN -12.33%US LSS -3.87%

Monthly Total Account: -2.87%

Total Account for 2024 +24.48%

2024 Top 3 Best Performing Systems

R1000 RTN +49.11%

ASX100 RTN +37.46%

NDX100 RTN +31.47%GlenPeake

ParticipantHi Kate,

I can’t comment much on the MOC short side systems…. as I haven’t really developed/tested too much there….. and not sure of the % ratio in terms of how much the Shorts contributed to the DD vs the Long side.

…..but on the Long side for MOC’s, generally speaking some of the MOC LONG systems I monitor, 2024 has been fairly mediocre in terms of returns…. however, the backtests will show this happens from time to time over the years….

This link/post here will show the year by year break down…. for the 9 systems I track.

MOCFor NOVEMBER, this combined system was -2.2% return for the month….so nothing dramatic etc, just the ups and downs of trading I’d say……. The break down was:

2x Systems Positive return

2x Systems Flat/breakeven return

5x Systems Negative returnIt always seems to be the way, that the ‘fill(s)’ we miss from time to time, end up going onto be the trades that kick on…..

2024 Monthly MOC (9x systems) breakdown

So…. not sure if any of this helps or not…. but you’re trading a diversified suite of systems so that when a couple of the systems have a red month, then hopefully the other systems offer that diversification/offset etc….. which resulted in a positive month by the looks of it for you. 2024 has been a year where we’ve seen the longer term Momentum based systems out perform etc……how long that continues for, who knows….

GlenPeake

ParticipantNice going Sean…. The systems seem to be ticking along nicely!!!

Well done on flicking the Fund Manager and doing it yourself….speaks volumes about the journey you’ve been on….

GlenPeake

ParticipantNOVEMBER 2024

ASX

WTT +3.82%

ASX100 RTN +19.60%

XSO RTN +3.77%

ASX LSS -1.46%US

MR#1 +8.01%

MR#2 +17.49%

MR#3 +14.79%

MR#4 +5.80%

MR#5 +8.20%NDX100 RTN +3.79%

R1000 RTN +13.94%US LSS -5.51%

Monthly Total Account: +6.09%

GlenPeake

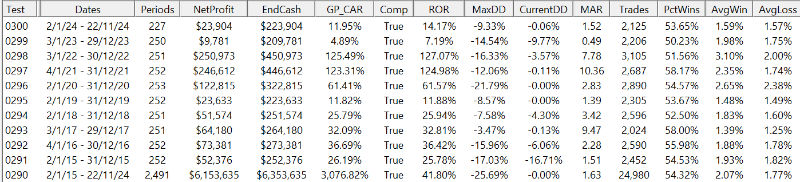

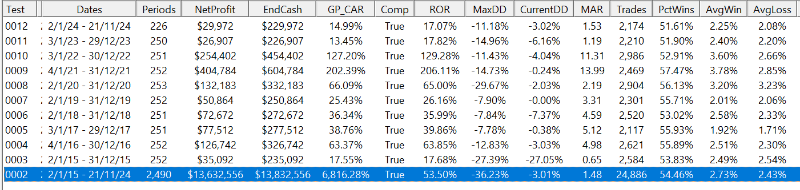

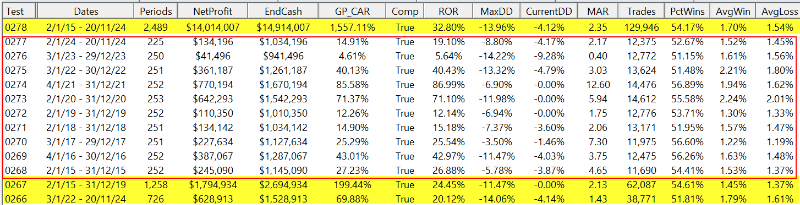

ParticipantAnd just for completeness and a like for like comparison, here’s the same 2x MOC systems from my previous post, this time against the R1000 only. (No turnover filter here etc)

GlenPeake

ParticipantHere’s a sample of 2x MOC systems using Minimum $10million Turnover Filter against All US using the InMEL constituency ($MEL)

I had to cut it back to just 2x MOC systems from 9x Systems due to memory limitations….

Year by Year breakdown…….. (Test# 3-12)

2015-2024 (Test# 2)

GlenPeake

ParticipantHi Nick,

As a comparison (not sure if this helps), here are a suite of 9x MOC systems (using shared equity) each system starts with $100K so total start equity is $900K

All systems are LONG only and trade R1000. Therefore HIGH Correlation between all systems as all are LONG R1000 etc….haven’t tested this suite of MOCs vs entire US Full Market…. but suspect more volatility etc (keeping in mind there are NO Volume/Turnover filters in any of these systems, as they are for R1000 etc…..

2023 was definitely the ‘leanest’ period for the systems….. circa 5% return

Stats attached 2015-2024 period TEST# 278 (top line yellow highlight)

Individual Years between 2015-2024: TEST# 268-277 (middle section within RED BOX)

2015-2019 vs 2022-2024 TEST# 266-267 (bottom 2 lines yellow highlight)I designed the systems a few years ago…. and there has been ZERO re-calibration, haven’t re-touched the parameters since etc…… (Not trading these systems LIVE, just decided to experiment and design some MOC systems etc…..but all are pretty simple and robust imo and the fact that they’ve performed OK over the past 2 years, yeah sure it’s been a ‘lean’ period etc, but in general I think that’s just been the market behaviour during that time and the systems being slightly out of sync etc)

GlenPeake

ParticipantWhile I think of it, if you do ‘skip’ an entry in LIVE trading, e.g. it’s going thru a takeover/buyout and you decide not to take the signal, and want to generate a ‘new’ signal instead i.e. you’d rather use the position slot NOW instead of waiting around for the takeover to complete (which might take weeks)….then have a read thru this thread that I posted on the RT forum…… where you can manage your LIVE positions and ensure it remains sync’d up to your Order Script list…

My Post: https://forum.mhptrading.com/t/delisted-tickers-excludelist-combinations/4449/5

Details for managing ‘takeovers / buyouts’: https://forum.mhptrading.com/t/question-about-excludelist/3050

(Previously I was just excluded the ticker using the ExcludeList: xyz.au option….. the above ‘buyout’ method via an eventlist, seems ‘cleaner’ atm to me).

GlenPeake

ParticipantYeah….My process is to grab the OPEN price for WTT entries. That’s the way it’s tested and the way I’ve gone about it for years etc…. I try not to overthink it too much, as I know if I get ‘fancy’ and ‘outsmart’ the entry etc, it generally results in sub-optimal fills.

But for you Kate, with that stock that pumped 50% on the day…… that sounds a bit of an extreme move, even for me to grab. If the pre-open was i.e. 10%-20%, I’d still try to get the open….. beyond that… as an option then maybe you could consider partial positions…. e.g. grab 1/4 of the position on open, a 1/4 of the position on close and / or smaller chunks during the day, depending on liquidity etc.

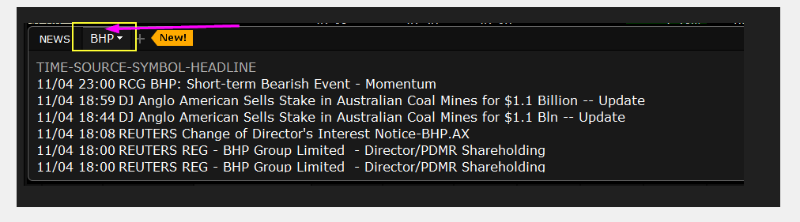

re: NEWS on company….. If Google Search doesn’t produce something meaningful…. IBKR does have a company specific news feed you can cross check.

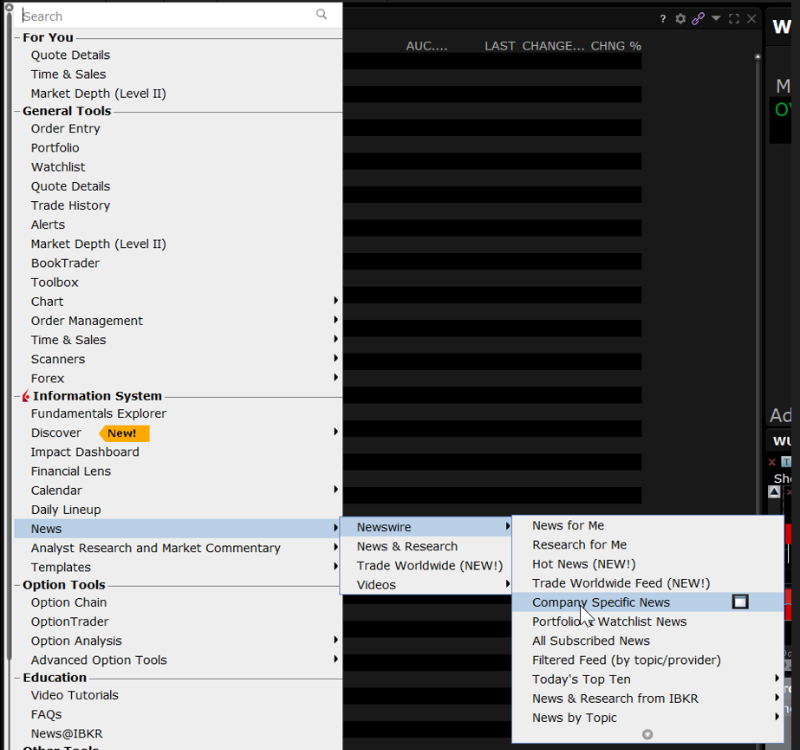

Click NEW WINDOW > NEWS > NEWSWIRE > COMPANY SPECIFIC NEWS and then in the window that appears, type in the TICKER code of the stock and scroll thru the List of news items and select the one you want to read (BHP used in the screen shot below).

GlenPeake

ParticipantOCTOBER 2024

ASX

WTT -1.03%

ASX100 RTN +4.18%

XSO RTN +2.42%

ASX LSS -9.89%US

MR#1 +6.52%

MR#2 +2.68%

MR#3 +1.52%

MR#4 -1.14%

MR#5 +3.00%NDX100 RTN +4.67%

R1000 RTN +3.23%US LSS +0.21%

Monthly Total Account: +0.19%

GlenPeake

ParticipantA Sea of GREEN there Nick! Nice work!

-

AuthorPosts