Forum Replies Created

-

AuthorPosts

-

GLENNPREECE

MemberFeb 2022

ASX

ASX100 ROT -7.66% – Moving to Cash in March

ASX WTT +8.26%

ASX B&H -3.74%US Market

MOC – R1K +3.47%

MOC – R2K +3.80%

NDX100 Rot +1.53% – Moving to Cash in March

MR3000 (in cash)

TS(ASX/US) rotational (Discontinued)Total Portfolio CAGR -2.66%

A pretty so so month for most of my systems. All rotational systems have gone to cash and only one stock left in the WTT, which ironically has been doing very well. Have been working with Nick on a MOC system, and kicked off trading it on the R1K and R2K this month using the API (thanks Nick / Craig for your help once again). Next for me will be to revisit my MR system, and see if I can develop one that trades through all markets. As the rotational systems are in cash, I will also take the time to revisit these and see if they need any tweaking.

Happy trading all.

Cheers

Glenn

GLENNPREECE

MemberJanuary 2022

ASX

ASX100 ROT -9.39%

ASX WTT -19.57%

ASX B&H -11.39%US Market

NDX100 Rot -14.45%

MR3000 -30.64%

TS(ASX/US) rotational -10.43%Total Portfolio YTD CAGR -13.64%

A sea of red this month, but I take it with a grain of salt having come off some very big high last year. The MR system took the biggest hit, but it also had the smallest allocation of capital and had gained nearly 70% in 3 months. The biggest overall drawdown is really in the NDX which when combined with Dec as taken a bit of a fall. Thankfully that system was partially sitting in cash, which tempered part of the losses.

Anyway, onwards an upward as they say.

Happy trading.

Cheers

Glenn

Glenn

GLENNPREECE

MemberDecember 2021

ASX

ASX100 ROT + 12.50%

ASX WTT -7.99%

ASX B&H +1.45%US Market

NDX100 Rot -17.15%

MR3000 +22.17%

TS(ASX/US) rotational + 10.51%2021 Annual Results

ASX100 Rotational +29.18%

ASX WTT + 13.11%

ASX B&H + 21.36%

NDX100 Rotational +30.42%

MR3000 + 55.64% YTD (started 1st May 2021)

TS(AXS/US) Rotational +3.08% YTD (started 1st August 2021)Total Portfolio CAGR +25.64%

Almost a full year of trading most systems, and have to say that I’ll take the results, particularly in a year where I relocated countries. For 2022 I would like to introduce one more MR system, testing for which is well underway.

Happy new year all. Hope you have a extremely prosperous 2022.

Happy trading.

Cheers

Glenn

GLENNPREECE

MemberNovember 2021

ASX

ASX100 Rot +5.42% (Inception CAGR +35.55%)

ASX WTT -5.57% (Inception CAGR +18.22%)

ASX B&H +5.74%US Market

NDX100 Rot +3.20%

MR3000 +0.37%

TS(ASX/US) Rotational +17.28%Total Portfolio Performance = +3.68%

Bumpy ride this month. Was on both MRNA and DMP(.ax) each shedding +20% in a matter of days… Diversity through other systems saved the day though, and both stocks recovered more or less, so overall results for the month were good.

Happy trading all!

Glenn

Happy trading all…..

GLENNPREECE

MemberThanks Tim.

I am a big fan of the rotational systems, if only for their simplicity. I’d love to explore them on more markets if it was possible to get accurate historical data.

I do however think that these systems look good in the current market conditions, which have had such a strong run up over the past 18 months or so. They recognise however that they also tend to sit in cash for lengthy periods so there are periods I wont be getting any returns, so it balances out. I do still like the shorter term systems, which perform well & whilst don’t shoot the lights out, just keep ticking along with nice steady returns. For that reason, I tend to have the rotational systems in my Super and the others will eventually be used for producing a supplementary income…..”eventually”

Cheers

Glenn

GLENNPREECE

MemberOctober 2021

ASX

ASX100 Rot +3.26%

ASX WTT +2.37%

ASX B&H +1.69%US Market

NDX100 Rot +0.41% (Annual = 102.5%)

MR3000 +6.20%

TS(ASX/US) Rotational +0.06%Total Portfolio Performance = +1.69%

Well its been 12 months since I implemented my first rotational system on the NDX and have no complaints over its performance being up 102.5%, so a big shout out to Nick and Craig for all their helping me implement it. All other systems are also ticking along nicely as well. I haven’t had much time of late to focus on looking at any new systems as the move back to Sydney has been a wee bit distracting… This will be a new year focus. Would like to get one more MR system in play…and also another rotational or long term system for my Super… Also still need to get myself structured properly here in Australia as no more tax free capital gains….

Happy trading all!

Glenn

Happy trading all…..

GLENNPREECE

MemberDitto Julian….think we might have been holding the same stocks….. similar results across portfolios….and agree…moving on to October.

GLENNPREECE

MemberYeh a bit of a lumpy month Tim, but those are expected from time to time in this game, right???

Actually wasn’t that bad, as it comes down to the amount of capital allocated to each system…

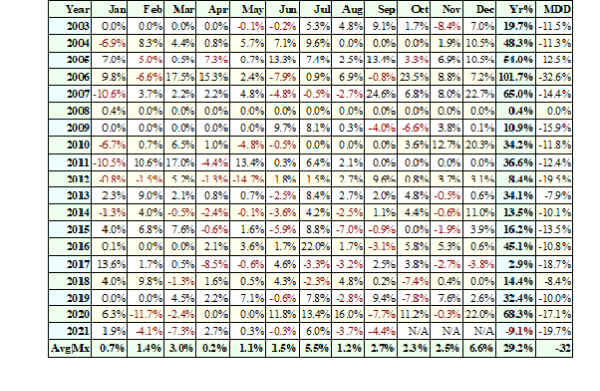

Actually wasn’t that bad, as it comes down to the amount of capital allocated to each system…Have attached the backtest results from 2003,,Its run pretty well except for 2006 with 32% DD, but I balanced that against the substantial gains that year of +101%…generally the DD is around 20% which is well within my tolerance. The recovery rate is also very strong…

Run over shorter timeframes the results improve of course….but I like looking at the longer picture for some perspective on what I might be facing…..

GLENNPREECE

MemberSeptember 2021

ASX

ASX100 Rot -11.57%

ASX WTT –-2.38%

ASX B&H -5.25%US Market

NDX100 Rot -1.01%

MR3000 -0.29%TS(ASX/US) Rotational -12%

Total Portfolio Performance = -4.93%

Sea of red this month with the ASX dragging down the overall results.

More importantly we have made it back to Sydney (not without its dramas), so may be posting a few questions soon, as will need to sort myself out on how best to deal with Australian tax again…yay…

Happy trading all!

Glenn

Happy trading all…..

GLENNPREECE

MemberHey Michael,

I run an aggressive ASX rotational system with only 3 position, but with a smaller portfolio to help de-risk. Overall it has low drawdowns but still susceptible to bigger drops. I was carrying the miners, LYC & MIN, who both took a hit last month. It was also carrying REH, will also fell out of favour.

The overall system is still up 40% YTD (excl Dvds) so I’m not going to complain.

Cheers

Glenn

GLENNPREECE

MemberAugust 2021

ASX

ASX100 Rot -10.18%

WTT +3.345%

B&H +8.01%

US Market

NDX100 Rot +5.05%

MR3000 +16.06%TS Rotational -2.43%

Total Portfolio Performance = +1.88%

Happy trading!

Happy trading all…..

GLENNPREECE

MemberHi Terry,

That sounds great. I get back to Sydney in late September, so if its something later in the year (when things have opened up again) count me in.

Cheers

Glenn

GLENNPREECE

MemberVery interesting exchange guys and something I too have been considering, as I’m sure have many others. To make matters worse, this was the very first trade I placed after completing the course in October 2020… Thanks Nick / Craig….but talk about setting high expectations.

For me MRNA now up over 500% and represents 58% of my NDX portfolio.

For me MRNA now up over 500% and represents 58% of my NDX portfolio.I’m generally inclined to just follow the signals, but I’m also very practical and believe in risk management (I work in insurance, so my apologies). MRNA now has achieved the 2nd largest gain out of NDX system (NVDA was the largest @ 540% but it occurred over 500 days – MRNA has done it in just 250days). I’m therefore going to be doing a little rebalancing… It may continue to go higher, who knows. For me it just seems prudent to ensure I have a good spread of risk.

Happy trading!

GLENNPREECE

MemberJuly 2021

ASX

ASX100 Rot +14.5%

WTT +7.75%

B&H +2.29%US Market

NDX100 Rot +20.21%

RUI Rot +11.02%

MR3000 +13.39%All and all a pretty solid month. A lot of gains in the NDX system, from one stock, which no doubt we are all holding, e.g. MRNA. I am most likely going to ditch my RUI – Monthly Rotational. I’ve never really been comfortable with the system, and whilst some of the numbers look okay on the surface, believe there is too much variability in the likely returns. Instead I have been testing a cross market / index rotational system, taking the best of the US and ASX markets. So far looks pretty promising.

7 more weeks until we land back in Sydney. If someone could sort of the mess down there before we arrive that would be great

Happy trading all…..

GLENNPREECE

MemberJune 2021

ASX

ASX100 Rot +2.38%

WTT -11.07%US Market

NDX100 Rot +14.16%

RUI Rot +10.05%

MR3000 +2.16%Positive month overall up 5.9% across my entire portfolio. WTT has taken a hit over the past couple of months but its kinda to be expected… Next work for me is more portfolio analysis and risks assessments. I want to test overall expected impacts of the systems and how different portfolio weightings might minimise risk.

Happy trading all.

-

AuthorPosts