Forum Replies Created

-

AuthorPosts

-

BenOsborn

ParticipantIt has been a while since my last update as work has been in the way yet again.

I have been working on a few things over the past two months when I have had a chance.

I have developed a monthly rotational system for the NASDAQ as well as a weekly version that was to trade on the RUI (as the weekly seemed to trade on the RUI slightly better than the NASDAQ). The weekly system does not perform as well as the monthly momentum system, which doesn’t perform as well (in general) as the combined MOC systems.

Therein lies a dilemma that I have been struggling with for the past 4 weeks (many more actually). I understand overall the benefits of having a diversified collection of systems. It makes sense to me; I have combined my combined MOC systems with the rotational systems, messed with different capital allocations and can see the benefits in the greatly reduced drawdowns in terms of the whole portfolio.

However, this does come at the sacrifice of the larger potential returns of the combined MOC systems. At the moment, the majority of my funds are in the combined MOC system. My plan has been to grow my capital as fast as possible in a way that is not taking stupid risks or having unrealistic expectations (I’m not expecting to turn $5k into $1m overnight or anything). To do that, I am comfortable with the larger drawdown that goes with my MOC systems for now. I would then diversify out into other systems as the capital grows.

So when the weekly system turned on at the end of last week I made the decision not to split the small allocation I had for the weekly and monthly rotation systems and keep it just for the monthly (understanding the reasoning around signal luck).

But this is all part of the dilemma I have been struggling with in my mind. Is my thought pattern and plan logical, does it make sense or am I just being greedy and it is clouding my judgement? Is there more risk in my plan than I understand?

Apart from this I have been working on a Short MOC system. It is uncorrelated to the long systems and although it does have some flat periods, it reduces my drawdown and increases the overall gains (in backtest world anyway!). The API is currently being finalized (to add in shorting) so I can start testing the system.

There are some uncertainties with this system. I have been testing and refining on a wide universe which includes all shares that are listed on a major exchange and meets volume and turnover conditions. However, in reality I am not going to be able to short all of these stocks. TradeStation has a list of shares that you can easily borrow, the problem is that this changes daily. There are usually about 2500 / 2600 stocks on there though with 100 or so being added and removed daily. For the past few weeks I have then been testing on this universe each day. Although lower than the full universe, the results have remained fairly consistent. The real power is when it is combined with the other systems as it is uncorrelated. I am still unsure how it will fair in real trading but will live test it and see how it goes.

I have also been playing around with RealTest for the past couple of weeks. Really enjoying the features. The amount of time it has saved me in spreadsheet cleanup and manipulation for the MOC systems is amazing (maybe I went about it in excel the long way).

It also alerted me to a problem that I had in one of the MOC systems excluding a watchlist in my orders for amibroker. For the longest time I couldn’t figure out why RealTest and Amibroker didn’t match!

It has also saved me a lot of time in generating orders for the API as I have been able to automate more of it.

I am glad I learnt Amibroker first though and undertook all of the other calculations and spreadsheet manipulations manually as it has given me a better understanding. Will probably continue to use both.

Sorry for the long post!

BenOsborn

ParticipantCase in point is THFF. My limit order was $45.15. There was some lone trade just below but as you can see price never really traded anywhere near there. Most aren’t this obvious. I think I need to add in some volume or turnover filters because I had 3 of these last session that don’t look like they have a lot of volume.

BenOsborn

ParticipantHi Chris,

Just double check that you are selecting GTC and not GTC+. Pretty sure GTC+ puts you in the pre and post market.

I was lucky enough to catch $ECPG in both my systems. Using the API I was filled at $65.43 and $65.77.

Both orders would have been submitted when it opened below the limit price but obviously they were back in the queue.

I think IB is different to TradeStation in that it doesn’t reserve your capital if you enter a limit order. As TradeStation does, you can’t have the API enter your limit orders straight away (unless you have less orders than available margin). What I got Harrison to do for the TradeStation API is that it watches the price for each potential order and only submits the limit order when price is at the limit price or x distance from it. That way your capital is only reserved at that point in time and you can have more potential orders. I may be wrong but I don’t think those with IB have the capital reservation issue.

I have mine set to enter the limit order when it hits the limit order price. I occasionally don’t get filled but not so much that it is an issue and would change it. Most of the times when I don’t get filled it is because there is some lone order for 100 shares or something 10 cents below where all of the other orders. Price never really properly traded there in my view and I wouldn’t have got filled no matter what.

I use chart VPS. Although I have an issue occasionally when accessing from ipad and PC. TradeStation doesn’t like the scaling between different screen sizes and will crash. Has happened to me 4 times since late March. I just make sure that I don’t open it from another device during market hours just in case. If it does you just need to reload the template and it is all there. Don’t have an issue with speed or memory.

BenOsborn

ParticipantYeah I’ve got a smile on my face today after the last few months

BenOsborn

ParticipantJuly 2022 Performance

US

Combined MOC 14.13% (-34.78% since late March 2022)July 20, 2022 at 5:57 am in reply to: From gym owner to finance quant and everything in between #114957BenOsborn

ParticipantReally appreciate the post Seth. I have really enjoyed the mentorship and want to dive further into coding and system design myself.

BenOsborn

ParticipantHi Len, my MOC systems also came back strong this week. I actually probably feel more nervous now than when it was constantly taking a beating as I don’t want to give back the gains! Can’t wait for the trading week to begin either way.

BenOsborn

ParticipantDoesn’t look like the second file is showing so here it is.

BenOsborn

ParticipantI have been playing with a short MOC system to try and diversify and have run into similar issues.

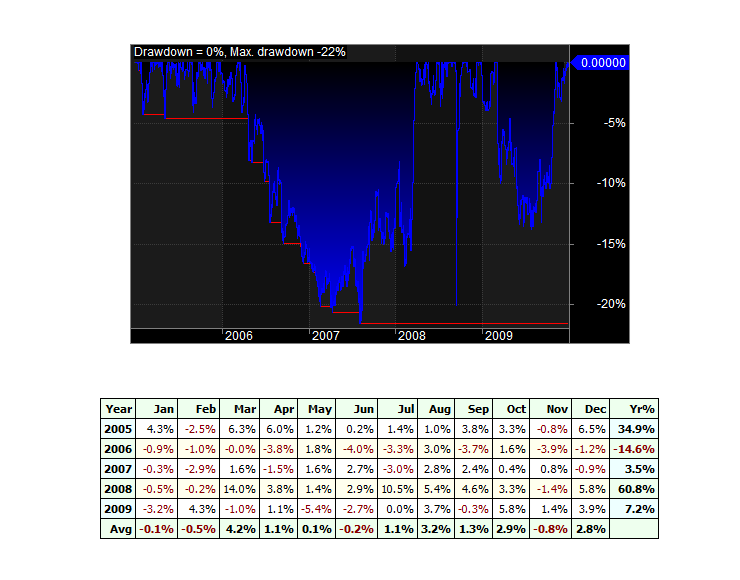

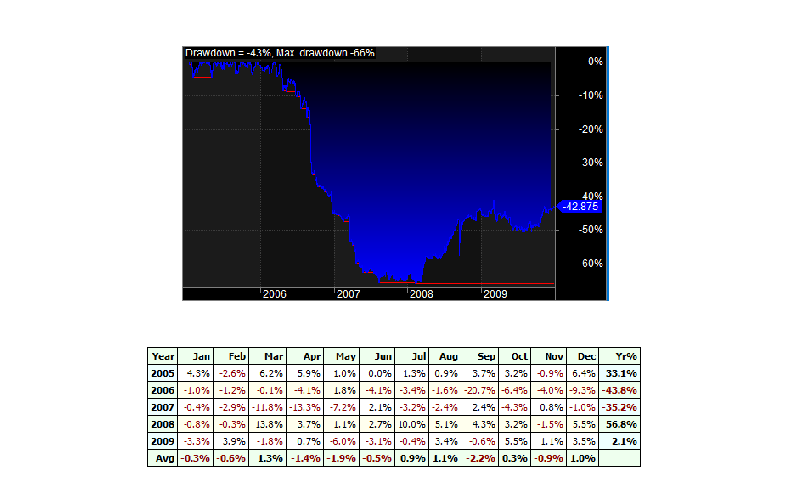

I have attached two files to try and highlight the difference. The first backtest uses a commission of $0.005 per share. The second uses a flat commission of $3 per trade. This is the only difference.

The first has a CAGR of -4.44% and a Max DD of -65.77%. You can see from the screenshot it is underwater for a the last couple of years The second has a CAGR of 16.19% and a Max DD of -21.55%.

I have only limited it to a few years as once the account grows a $3 flat commission isn’t going to be realistic.

Most of the damage is done by one stock which has an adjusted price of 2 cents (so the system is buying a shitload of shares resulting in a huge commission) and is traded around 20 times.

BenOsborn

ParticipantHi all,

When going back to the early 90’s my MOC systems were getting creamed (underwater for years). After going back to the drawing board and testing a few other ideas for MOC systems I started to look into the results further. I noticed that there were a few anomalies that appeared to be the main cause of the crappy results.

I had trades where there was a gain in price but the result was a significant loss. For example, I had one where the price ended up flat for the day yet I had a 350% loss. Another where there was a 10% gain in price but the result was a 30% loss. Looking closer, the reason for the loss was the commission.

There were two reasons for this. 1. The prices of some stocks were very low (e.g. $0.005) so I was buying a shitload of shares and 2. I have my commission set higher as I’m using TradeStation and not IB ($0.01 vs $0.005), so this just compounds the issue.Looking further into the results I noticed a lot of shares were below the $10 minimum in my settings, especially back in the 90’s. This meant that I was buying a lot of shares of some stocks, leading to very high commission charges.

After speaking with Craig, he advised that the test is being run on adjusted data but referencing unadjusted close if using a price filter on that setting. Therefore, any backtest metrics are calculated on the adjusted data.The following is an example of a more recent stock that I was able to find the unadjusted price for. The effect of this is not as pronounced as in the early 90’s where some shares were trading for just cents.

For example, my system has a $10 price minimum. It bought CTRA on 29/4/2005. On my chart and in the backtest it shows the price as $3.40. This was because it is the adjusted data.

However, it was included as the unadjusted price was about $30 in April 2005, which is higher than my $10 price minimum. So if I had of run my exploration after the market close on 28/4/2005 the real price then would have been around $30 and not $3.4.

This means that in my backtest I am buying 10 times the number of shares than I otherwise would have at the time. I have now excluded the share that was causing a couple of 350% losses and changed my commission to 0.005 and it is giving me a better representation.

Just a heads up for those like me that hadn’t really thought about this. Also shows some of the effects a higher commission can have.

BenOsborn

ParticipantJune 2022 Performance

US

Combined MOC -22.30% (-42.86% since late March 2022)ASX

Growth Portfolio -2.56 (-6.31% since Oct 2021)Tax return looking good this year, although I will probably win myself an audit.

BenOsborn

ParticipantI have just started to try and see whether some type of Index filter would be useful. However, instead of turning it off, the stretch is increased.

I have only just looked at some random periods, just trying to get some time to do it properly. Might just be a dead end.

BenOsborn

ParticipantPub didn’t help … now I’m down another 6.4% plus I have a hangover.

Getting quite uncomfortable now as it moves towards a 50% drawdown.

BenOsborn

ParticipantCombined MOC daily results for June so far:

-0.01%

0.53%

-0.29%

0.34%

-0.13%

-0.78%

-3.63%

-5.94%

-0.41%

0.18%

-6.86%Not looking pretty! I must admit that last night has hurt the most (even though I have had bigger one night drawdowns) as it took me over 40% drawdown for the combined MOC system. Selection bias has come into play a couple of times this month; however, results don’t exceed what the backtests shows overall (something which I am keeping an eye on).

Hopefully we end the week with a bounce (either way I will be at the pub tonight)!

BenOsborn

ParticipantI haven’t been updating progress much lately as I have been swamped at work.

After speaking with Nick, I found out that my selection bias on the combined MOC systems was a bit high at 11.25%. I have since played around with the stretch, number of positions, position size, universes, etc to reduce the selection bias. The challenge is balancing reducing drawdown and uncertainty to acceptable levels whilst still maximising profit potential, levels that will be different for all of us.

I had slowly been eeking out small gains over that last few weeks but the last couple of sessions put a little dent in that. Overall, in terms of my re-jigged parameters, I am still sitting below the max drawdown in backtesting (although it is not too far away). The system has been in drawdown for 72 days now; this length of drawdown has occurred 10 times in the past 20 odd years so nothing new. The max period that the system has been in drawdown in backtesting over the last 20 years is 185 days so I might still have a way to go before I see new equity highs.

I have also been trying to develop a rotational system for the Nasdaq. I have tried various ways and indicators for measuring momentum. At this stage I am getting CAGR in the mid 20’s and drawdown in the high 30’s. I have been able to get drawdown into mid 20’s but CAGR then drops down to high teens.

I don’t mind taking on a bit of risk and drawdown in order to try an achieve higher gains, I just want to make sure that the system is robust and there is not something that I am missing. My thoughts are to try and maximise capital growth early on with a view to tuning things back a little in the future when my accounts are at a larger size.

Although I would love to be making new equity highs instead of lows, I am still pretty happy with how things are going and it is just a matter of time before the equity highs come.

-

AuthorPosts