Forum Replies Created

-

AuthorPosts

-

March 5, 2023 at 9:40 am in reply to: What Worked Well in 2021-2022? MOC System Brainstorming #115478

BenOsborn

ParticipantThanks Glen, pretty impressive results over the last couple of years (and earlier).

Where the drawdown is larger in a couple of the earlier years, do you think that it is due to the parameters that make it so good in the recent years or is that fairly standard? (having the opposite effect then?)

I have been playing with MOC systems myself. I have developed 2 more but nothing I am going to trade as they are not too dissimilar to the stats of my current systems.

I have noticed that different ranking methods can change the drawdown profile and when they occur.

BenOsborn

ParticipantFebruary 2023 Performance

US

Combined MOC +1.95% (-55.25% DD, -51.19% since inception (late March 2022))Breakdown:

MOC1 RUI 0.32%

MOC1 RUT 2.12%

MOC2 RUI -0.89%

MOC2 RUT 0.77%

MOCV 0.04%

MOC Short -0.02%NDX Monthly Rotational -6.90% (-13.5% since inception)

BenOsborn

ParticipantI also had that issue come up at one stage, however it was just when running my orders. Was a pain in the arse. I ended up converting to Real Test before I ever got to the bottom of it.

BenOsborn

ParticipantJanuary 2023 Performance

US

Combined MOC +1.13% (-56.11% DD, -52.63% since inception (late March 2022))Breakdown:

MOC1 RUI 1.93%

MOC1 RUT -1.27%

MOC2 RUI 0.7%

MOC2 RUT -1.34%

MOCV 1.32%

MOC Short -0.15%NDX Monthly Rotational -3.23% (-7.08% DD)

BenOsborn

ParticipantDecember 2022 Performance

US

Combined MOC -5.5% (-56.6% DD, -52.66% since inception (late March 2022))Breakdown:

MOC1 RUI -0.84%

MOC1 RUT -2.11%

MOC2 RUI -1.35%

MOC2 RUT -2.75%

MOCV -0.49%

MOC Short 1.94%NDX Monthly Rotational -3.98% (first month)

Happy New Year all!

BenOsborn

ParticipantWow impressive results Terry

BenOsborn

ParticipantThis got me thinking of other things to try. For a MOC system, you might try and vary the low since the limit order for the next day is based off this. I added the following to the data section:

RLow: random(L*0.96, L*1.04,0.01)

Then changed entry limit to:

EntryLimit: RLow – Stretch

I’m no expert in RT but I compared the trade lists of a few iterations and the entry prices were different when the trade was picked up by both iterations.

BenOsborn

ParticipantHi Anthony,

Entryskip is one you could try. “A good use of EntrySkip is, for example, EntrySkip: random() < 0.05. This would randomly skip about 5% of entries, e.g. to simulate not being able to borrow shares to short. By running this same test a number of times we can see the probable range of how this would impact the stats of the strategy."

You could also change SetupScore to random() in your MOCs and and then run a number of times. This could also be done with EntryScore in other systems.

To run the tests a number of times go to optimize and there is a box to select the number of test iterations.

BenOsborn

ParticipantHi Kate,

For the stocks that I want excluded I just create a watchlist and use the Exclude tab in the filter settings to exclude that watchlist.

If it is something that isn’t going to change much, just create a watchlist with one stock in it, close AmiBroker, open the watchlist using notepad or wordpad from your drive, delete the stock and past the ones in there that you want and then save it. Open AmiBroker again.

I find if I do it with AmiBroker open the changes to the watchlist don’t save.

BenOsborn

ParticipantNovember 2022 Performance

US

Combined MOC –5.42% (-54.07% DD, -49.91% since inception (late March 2022))Breakdown:

MOC1 RUI 3.18%

MOC1 RUT -4.32%

MOC2 RUI 1.99%

MOC2 RUT -7.16%

MOCV -0.11%

MOC Short 1.69%BenOsborn

ParticipantMine was fine last night however I did have a problem in the past. TradeStation would randomly crash and / or the VPS would freeze. They advised me that it was a known issue and potentially caused by the screen resizing when logging in from different devices. I continued to randomly have the problem even when only logging in from one device. They ended up rebuilding it and upgrading it to Windows Server 2022 and I haven’t had a problem since (touch wood).

BenOsborn

ParticipantThat was the other thing that I was testing with using different ranking methods, whether it would reduce the instances of holding the same stock twice. Currently I have 2 long systems on RUI, 2 long systems on RUT and then a long system and a short system that looks at all stocks as long as they are listed on a major exchange. At this stage I haven’t restricted them in terms of holding the same stock and will just leave it that way I think (for now anyway).

BenOsborn

ParticipantThey are existing systems; all I have been doing is looking at the results if I was using different ranking methods.

When I was first developing the systems, I noticed that the method of ranking can have a big impact on how MOC systems perform so it was something that I had always meant to look at again down the track.

The systems are all profitable on both R1000, R2000 and other universes of stocks with all of the ranking methods I have tried as well as random.

BenOsborn

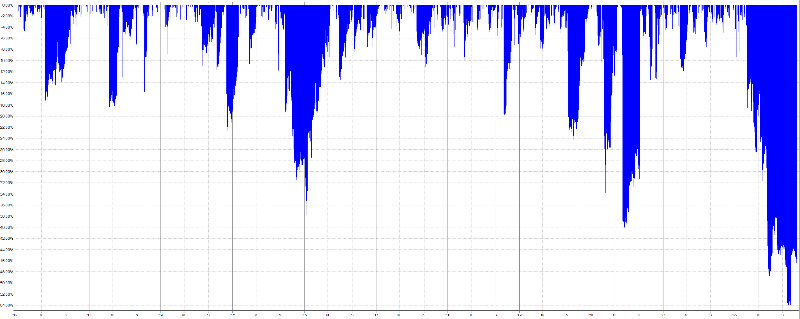

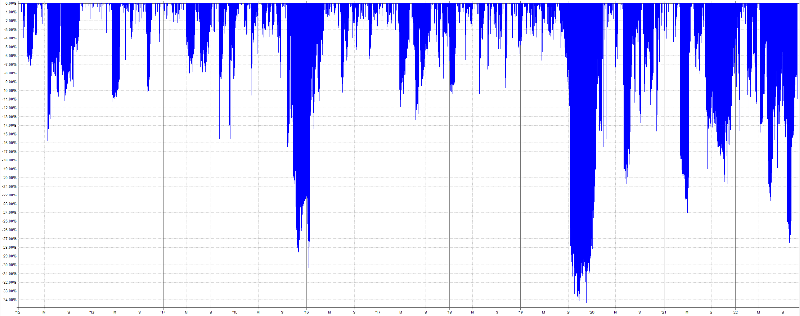

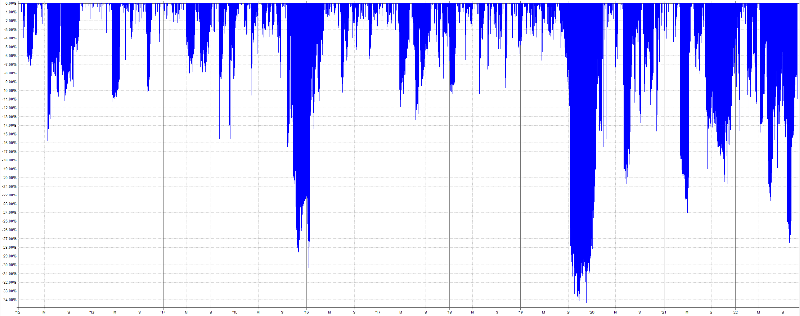

ParticipantI have been playing around with different ranking methods this weekend for my combined MOC systems with some interesting results. Comparing my current ranking method to a new method that I am considering shows two very different drawdown profiles, especially when it comes to this year. Looking at the results for the past 10 years as an example, the new method that I am considering shows a 20% lower max drawdown. The CAGR for the new method is 5% lower.

Breaking the systems apart, I noticed that the new ranking method made more of a difference on Russell 1000 strategies. So I also ran a test that looked at ranking the Russell 1000 strategies with the new method and Russell 2000 and other strategies with the old ranking method. This resulted in a 15% lower max drawdown and an increase in CAGR by about 15%. The combined equity curve also looks a little smother than running every strategy on the new method too.

Do others use different ranking methods or tend to stick to the same method?

Current Ranking Method DD from 2012

Potential New Ranking Method DD from 2012

Combined Ranking Methods DD from 2012

BenOsborn

ParticipantInteresting. Just goes to show you really need to look closely at how any new market that you enter operates. I would have just assumed that most major markets operated in a pretty similar fashion.

-

AuthorPosts