Forum Replies Created

-

AuthorPosts

-

BenOsborn

ParticipantThanks Glen, impressive work with the dashboard.

I have been doing similar research into breakouts over the past couple of months. I haven’t been able to code anything satisfactory that is fully automated (not through lack of trying) but have recently started paper trading on the basis of running daily scans to identify the top momentum stocks and a then a quick manual flick through to see if any are breaking out of a pattern on volume.

BenOsborn

Participantwow they are some low Max DDs

BenOsborn

ParticipantI also hadn’t planned on trading a short system initially but implemented one last August. It has returned 7.78% over the past 12 months with a drawdown of 3.39%. Nothing to write home about in % terms overall but when combined with the other MOC systems backtesting shows it has a decent impact over time. Plus I would be 7.78% further in the hole without it! haha

BenOsborn

ParticipantAugust 2023 Performance

US

Combined MOC 3.26% (-61.57% DD, -58.09% since inception (late March 2022))Breakdown:

MOC1 RUI -0.27%

MOC2 RUI -0.88%

MOC Deviate 0.09%

MOCCOD 4.73%

MOC Short -0.36%NDX Monthly Rotational -2.28% (-2.28% DD, 4.48% since inception Dec 2022)

BenOsborn

ParticipantJuly 2023 Performance

US

Combined MOC -1.72% (-62.78% DD, -59.41% since inception (late March 2022))Breakdown:

MOC1 RUI -0.12%

MOC2 RUI -1.09%

MOC Deviate -0.63%

MOCCOD -0.53%

MOC Short 0.73%NDX Monthly Rotational 0.27% (6.92% since inception Dec 2022)

Started counting my MOC chickens before they hatched this month. Was up nicely until 20 July when everything turned around! You win some, you lose some. Bring on August.

BenOsborn

ParticipantHi Kate,

This is something that I have been monitoring but don’t have an answer to myself.

Over the last three months I have the following that fall into this type of category:

– Spike down at open (would never realistically get a fill as maybe 100 shares traded at some level below my limit order) – 3 missed trades, -1.47%

– No fill due to low volume – 4 missed trades, -1.16%

– Slippage – 32 trades, -0.42%.

BenOsborn

ParticipantJune 2023 Performance

US

Combined MOC 2.49% (-62.13% DD, -58.7% since inception (late March 2022))Breakdown:

MOC1 RUI 0.60%

MOC2 RUI 0.08%

MOC Deviate 0.75%

MOCCOD 0.87%

MOC Short 0.27%NDX Monthly Rotational 3.90% (6.63% since inception Dec 2022)

BenOsborn

ParticipantMay 2023 Performance

US

Combined MOC -0.76% (-63.06% DD, -59.7% since inception (late March 2022))Breakdown:

MOC1 RUI -0.63%

MOC2 RUI -1.21%

MOC Deviate 0.73%

MOCCOD 0.97%

MOCMR -0.11%

MOC Short 0.62%NDX Monthly Rotational 11.53% (2.61% since inception)

BenOsborn

ParticipantApril 2023 Performance

US

Combined MOC -4.92% (-62.77% DD, -59.4% since inception (late March 2022))Funnily enough I was actually very slightly positive for the month until this last week.

The work to reduce selection bias continued into the first week or two of the month. Some systems have been swapped out for others to get the best mix of systems working together with the least selection bias. Nothing wrong with the systems alone, the final mix of systems just perform better when combined (in theory anyway!).

Breakdown:

MOC1 RUI -1.67%

MOC2 RUI -0.71%

MOC Deviate 0.12%

MOCCOD -0.38%

MOCMR -0.89%

MOC Short -0.56%NDX Monthly Rotational -3.88% (-8% since inception)

I have noticed that I had made an error in my monthly calculations which overstated the drawdown.

Previous results should be:

Dec 2022 -6%

Jan 2022 +3.22%

Feb 2022 -1.12%

March 2022 -0.2%BenOsborn

ParticipantSorry, every time I try and delete it just reposts it.

BenOsborn

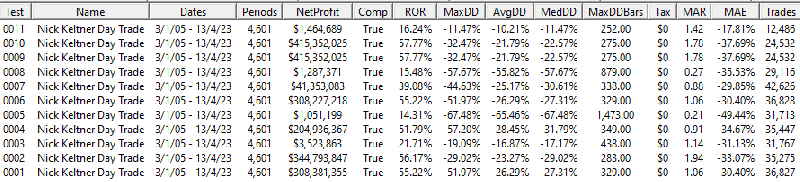

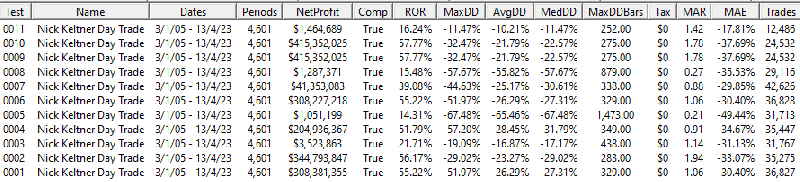

ParticipantProbably stating the obvious, but I always find it interesting looking at the impact different ranking formulas have. The 10 below (ran one twice) show the vast differences they can have on a system:

BenOsborn

ParticipantBenOsborn

ParticipantThanks Glen, that’s pretty handy. I hadn’t played with Scan before.

BenOsborn

ParticipantNoting that my results don’t match Nick’s (except for the benchmark

), this is how I coded it:

), this is how I coded it:Data:

Liquid: C > 20 and Avg(C*V, 50) >= 300000

ATR5: ATR(5)

Sdev50: StdDev(ATR5, 50)

Sdev200: StdDev(ATR5, 200)

SdevCalc: Sdev50/Sdev200

Uptrend: C > MA(C,200)

Longset: Uptrend and Liquid and SdevCalc < 5

Ranking: 100 – ROC(c,3)

LimPrice: L – 0.5 * ATR5CAGR 56% DD 52%. Max DD was only in mid 20s until 2022 when it got creamed.

I don’t use scan but changed the rules to SdevCalc > 5 and got no trades, so this rule isn’t having an effect for me either.

BenOsborn

ParticipantMarch 2023 Performance

US

Combined MOC -12.5% (-61% DD, -57% since inception (late March 2022))Breakdown:

MOC1 RUI -2.95%

MOC1 RUT -2.63%

MOC2 RUI -2.23%

MOC2 RUT -2.31%

MOCV -4.54%

MOC Deviate -0.02%

MOC Short 1.28%NDX Monthly Rotational -7.57% (-20.04% since inception)

Thanks to Nick who took a look over my MOC systems. Although I had reduced selection bias compared to how my system was running earlier last year, it was still likely having more of an impact than I estimated. I have since undertaken a significant amount of further testing, swapped some systems out with others and reduced orders, resulting in a system with selection bias on 0.42% of days. RealTest makes a huge difference running so many tests easily, would have taken me forever in Amibroker with all the changes.

-

AuthorPosts