Forum Replies Created

-

AuthorPosts

-

LeeDanello

ParticipantSometimes I can’t see the wood from the trees. I might be looking too hard.

LeeDanello

ParticipantFound this site which has depository of trading strategies. It could be a good place to get some ideas

LeeDanello

ParticipantStreet Smarts

LeeDanello

ParticipantFinished the theory side of things. Now the hard part – putting into practice. At the moment it seems like I have information overload. I think I need to take a step back and find out how to assimilate the theory.

LeeDanello

ParticipantBest we save these as snippets

LeeDanello

ParticipantParam(“Probability of Ignoring any Entry Signal %”,0,1,100,1);

Param( ”name”, defaultval, min, max, step, sincr = 0 )

you have a default value of 0 and a minimum of 1. That doesn’t sound logical. The minimum should be 0

LeeDanello

ParticipantOk I might skip straight to Adam Grimes book. I thought Kevin Daley was a bit different given he used Tradestation and the fact that he did pretty well in the Trading World Cup. So he’s in the Larry Williams mould. He pushes his own course pretty hard. Looks like my reading will be multi tasking. Will probably print out Tony Crabel’s book that is in the depository and have a look at the bar patterns in that and try and use that in conjunction with some other stuff as a stepping stone in building am mean reversion system. Seems like everyone has got one of those!

LeeDanello

ParticipantLove the huge upside gap. Thinly traded stock

LeeDanello

ParticipantThanks. Didn’t think it was that easy

LeeDanello

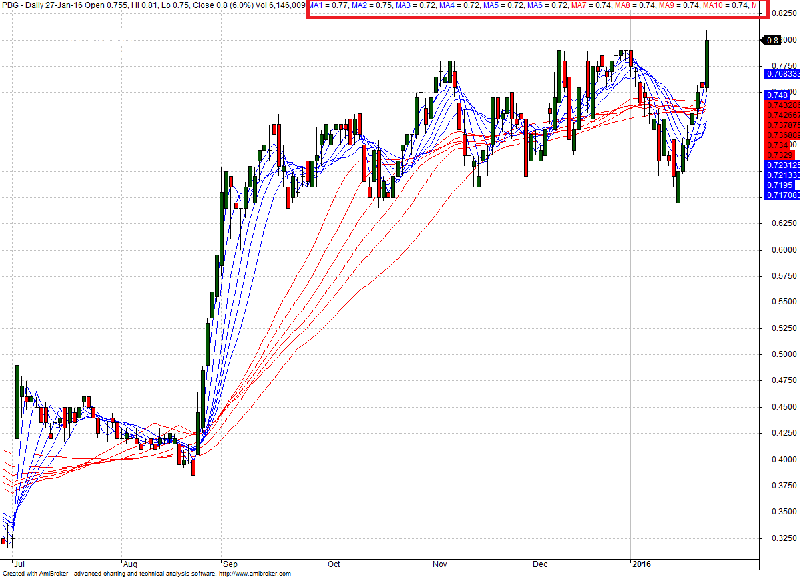

ParticipantDoes anyone what the code is to show the values of the moving averages stacked below each other in the chart pane. That is rather than the default of reading across the top of the chart left to right, how can we code it so the values of the MAs are stacked on top of each other from fasted to slowest

LeeDanello

ParticipantHello, My name is Maurice and I’m 54 years old with an engineering background. I became interested in the markets in the late 90s just before the tech crash. At that stage I just watched from the sidelines and read the Aussie stockmarket forums about normal everyday people making lots of money trading ASX tech stocks like Davnet and wondered how I might join in the fun. Fortunately I took a paasive approach and watched from the sidelines as the Nasdaq and other markets came crashing down not long after. I knew then that the market wasnt a place where you could muck around with 2K and a handful of Darryl Guppy books and that’s when found I Nick Radge and Reef Capital. Ever since then I’ve wanted to know how the professionals did it and have bought plenty of books, been to a few seminars and even did a the old SIA technical analysis course. Even though I sarted out as a discretionary trader, I’ve always believed that my personality suited mechanical trading, as this suits my analytical bent. The problem arose that in order to become a mechanical trader you need to be able to code (to some degree) and also understand how to stress test a system. This is where this course will fill in the blanks. By the end of this, the shroud of secrecy will be unveiled and I’ll have a lot more tricks in my tool bag. I’m sure in years to come I will see this as a turning point!

-

AuthorPosts