Forum Replies Created

-

AuthorPosts

-

LeeDanello

ParticipantClenow rebalances his portfolio at the end of the month using relative momentum. So the weaker stocks go out. Not sure about Antonacci as I haven’t read his book. Is that a form of rotation?

Haven’t had much free time doing this course – yet!

LeeDanello

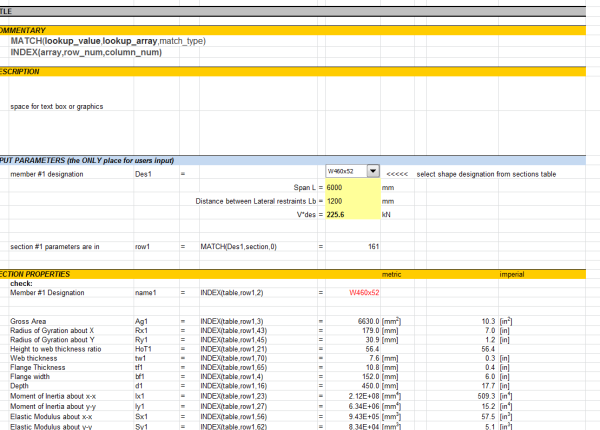

ParticipantSomewhere in there, there is a spreadsheet where you can show correlations between different systems in a tabular format.

LeeDanello

ParticipantLonger term sounds good. My thoughts are given that the 2 hottest books out there are written by Gary Antonacci and Andreas Clenow, why don’t we start with these two and start testing them on a couple of markets. While my coding is not fantastic I’m willing to do some checking and do some of the stress testing. I have both of them and am willing to let others borrow them in the name of education.

LeeDanello

ParticipantLeeDanello

ParticipantWould be a good idea if we could come up with a group strategy that we could all share in addition to the ones we are creating.

LeeDanello

ParticipantStephane, In my opinion your drawdown looks OK and in line with mine and others I’ve seen. I think you’d probably want your CAGR to exceed your drawdown i.e. so your MAR is over 1.0.

LeeDanello

ParticipantI do the same as Said, Imgur is free and easy to use or https://imgsafe.org/. You don’t lose resolution with large images. For small images Nicks method is faster.

eg

Just my 2c

LeeDanello

Participantignore

LeeDanello

ParticipantDamn I was hoping we could have all shared in the profits. Could have been a a group collaboration.

LeeDanello

ParticipantI’m interested in giving it a crack although it won’t be until the weekend. When I can confirm your results I will test it on the ASX

LeeDanello

ParticipantAre these results unleveraged.

LeeDanello

ParticipantThanks I’ll check out the difference

LeeDanello

ParticipantThanks for that Said. Now and again I get a macro error when I import the rolling windows data

All the sheets then become hidden and then I have to re-import the data again which seems to work.LeeDanello

ParticipantI found this zig zag indicator on the Amibroker website which was written for the S&C website called the The 1-2-3 Wave Count. It plots lines connecting highs to lows and vice versa but does not use the zig function to do this.

Code:ZZPercent = Param(“ZZPercent”, 5 );

ATRPeriod = Param(“ATRPeriod”, 5 );

ATRFactor = Param(“ATRFactor”, 1.5, 0, 5 );HLPivot = ZZPercent * 0.01 + ATRFactor * ATR( ATRPeriod )/Close;

Ll = Low[ 0 ];

Hh = High[ 0 ];

Llb = Lhb = 0;if( High[ 1 ] >= Hh )

{

Hh = High[ 1 ];

Lhb = trend = 1;

}

else

{

Ll = Low[ 1 ];

Llb = 1;

trend = -1;

}Line = Null;

for( i = 2; i < BarCount; i++ ) { if( trend > 0 )

{

if( High[ i ] >= Hh )

{

Hh = High[ i ];

Lhb = i;

Curline = LineArray( Llb, Ll, Lhb, Hh );

Line = IIf( IsNull( CurLine ), Line, CurLine );

}

else

if( Low[ i ] < Hh - Hh * HLPivot[ i ] ) { Ll = Low[ i ]; Llb = i; trend = -1; CurLine = LineArray( Lhb, Hh, Llb, Ll ); Line = IIf( IsNull( CurLine ), Line, CurLine ); } } else { if( Low[ i ] <= Ll ) { Ll = Low[ i ]; Llb = i; CurLine = LineArray( Lhb, Hh, Llb, Ll ); Line = IIf( IsNull( CurLine ), Line, CurLine ); } else if( High[ i ] > Ll + Ll * HLPivot[ i ] )

{

Hh = High[ i ];

lhb = i;

trend = 1;

CurLine = LineArray( Llb, Ll, Lhb, Hh );

Line = IIf( IsNull( CurLine ), Line, CurLine );

}

}

}Plot( Line, “”, colorBlueGrey, styleThick );

Plot( Close, Date()+ ” Close”, colorDefault, styleCandle );I’ve tested this using the bar replay function and the pivot points seem anchored ie the line connecting high to low or vice versa doesn’t plot unless the minimum percentage swing is met. I’m just wondering if any of the hard core coders out there can verify this also. You can see from the chart below that the new upswing line is still to plot. There are lots of people out there saying you can’t use the zig zag function in trading systems and I agree in some cases because sometimes the last pivot moves, but I think using the above formula could be OK.

LeeDanello

ParticipantHi Said, Your spreadsheet works pretty well. I wonder if you could reduce the font and the number of decimal places on some of the charts as they overlap.eg.

Also not sure why I didn’t get anything plotted on the following graphs. I input the data as requested

-

AuthorPosts