Forum Replies Created

-

AuthorPosts

-

LeeDanello

ParticipantWere you thinking this?

Code:LE = Ref(BuySetUp,-1) AND L <= Ref(BuyLim,-1) AND NOT OnLastTwoBarsOfDelistedSecurity; ConsecutiveDownDays = LLV(L < Ref(L, -1),3); ConsecutiveDownDaysSinceBuy = LE AND ref(ConsecutiveDownDays,-1); if( LBIT[j] > 1 AND ConsecutiveDownDaysSinceBuy[j] OR OnSecondLastBarOfDelistedSecurity[j])3 lower lows since buy signal occurs

LeeDanello

ParticipantSaid Bitar wrote:Brent Hause wrote:Quote:I liked the Idea and wanted to try it, so i modified the codes to check the number of signals per day and to adjust the number of positions accordingly. then i ran 4000 MCs to compare with my previous MCs.

i was expecting to find the STDEV tighter but the result was almost the same at leas the stdev for CAR and DD.Said – curious how you coded this…what function did you use to count the number of setups on a given day?

i added all the signals to a new ticker and run a scan after than i used the values of that ticker in position sizing

hint:

Code:AddToComposite(BuySignal, “~~~SystemSignals”, “X”);Code:AddToComposite(Buy,”~Buys”,”X”);

AddToComposite(Sell,”~Sells”,”X”);

Buys = Foreign(“~Buys”,”C”);

Sells = Foreign(“~Sells”,”C”);

Plot(Buys,”Buys”,5,1);

Plot(Sells,”Sells”,4,1);LeeDanello

ParticipantThat is shocking!

They need to keep their systems well and truly secret.

LeeDanello

ParticipantGo to the analysis tab and click the spanner and point to the saved custom backtester afl.

LeeDanello

ParticipantA good one to add is expectancy. Custom metrics

Code:SetCustomBacktestProc(“”);

if( Status(“action”) == actionPortfolio )

{

bo = GetBacktesterObject();

bo.Backtest(); // run default backtest procedure

st = bo.GetPerformanceStats(0); // get stats for all trades// parameters to output

car = NumToStr(st.GetValue(“CAR”),1.2);

maxDD = NumToStr(st.GetValue(“MaxSystemDrawdownPercent”),1.2);

carMDD = NumToStr(st.GetValue(“CAR/MDD”),1.2);

numTrades = NumToStr(st.GetValue(“AllQty”),1.0);

winningTrades = NumToStr(st.GetValue(“WinnersPercent”),1.2);

losingTrades = NumToStr(st.GetValue(“LosersPercent”),1.2);

expectancy = st.GetValue(“WinnersAvgProfit”)*st.GetValue(“WinnersPercent”)/100 + st.GetValue(“LosersAvgLoss”)*st.GetValue(“LosersPercent”)/100;// setup some colours and html formatting to output

carOutput = WriteIf(st.GetValue(“CAR”) > 10,StrFormat(“” + car + “%%“),WriteIf(st.GetValue(“CAR”) > 0,StrFormat(“” + car + “%%“),StrFormat(““+car+”%%“)));

maxDDOutput = WriteIf(st.GetValue(“MaxSystemDrawdown”) > 30,StrFormat(““+maxDD+”%%“),WriteIf(st.GetValue(“MaxSystemDrawdown”) >= 10,StrFormat(““+maxDD+”%%“),StrFormat(““+maxDD+”%%“)));

carMDDOutput = WriteIf(st.GetValue(“CAR/MDD”) > 2,StrFormat(““+carMDD+”“),WriteIf(st.GetValue(“CAR/MDD”) >= 1,StrFormat(““+carMDD+”“),StrFormat(““+carMDD+”“)));

numTradesOutput = WriteIf(st.GetValue(“WinnersPercent”) > 1,StrFormat(““+numTrades+”“),StrFormat(““+numTrades+”“));

winningTradesOutput = WriteIf(st.GetValue(“WinnersPercent”) >= 50,StrFormat(““+winningTrades+”%%“),StrFormat(““+winningTrades+”%%“));

losingTradesOutput = WriteIf(st.GetValue(“LosersPercent”) <= 50,StrFormat("“+losingTrades+”%%“),StrFormat(““+losingTrades+”%%“));

expectancy = WriteIf(expectancy < 0,StrFormat("” +”$“+”“+NumToStr(expectancy,1.2)),StrFormat(“” +”$“+”“+NumToStr(expectancy,1.2))); // print to report

bo.AddCustomMetric(“CAGR”, carOutput);

bo.AddCustomMetric(“Max. system drawdown”, maxDDOutput);

bo.AddCustomMetric(“CAR/MDD”, carMDDOutput);

bo.AddCustomMetric(“Total Trades”, numTradesOutput);

bo.AddCustomMetric(“Winning Trades”, winningTradesOutput);

bo.AddCustomMetric(“Losing Trades”, losingTradesOutput);

bo.AddCustomMetric( “Expectancy”, expectancy );

}November 15, 2016 at 11:59 am in reply to: Selection bias – how much is too much and general MOC discussion #105796LeeDanello

ParticipantScott McNab wrote:I would recommend a walk forward test to see what the worst 3 or 4 daily drawdowns are (remember to change to fixed position size) over several yearsWhy change to fixed position size?

November 15, 2016 at 9:34 am in reply to: Selection bias – how much is too much and general MOC discussion #105795LeeDanello

ParticipantNick Radge wrote:A metric that I find very useful and rarely used is Profit Factor. Profit Factor measures the difficulty to trade the strategy. Anything under 1.5 in my view is probably a very difficult ask for most traders.So 1.5 is a minimum, maybe 2.0 is ambitious

November 15, 2016 at 9:16 am in reply to: Selection bias – how much is too much and general MOC discussion #105792LeeDanello

ParticipantBrent, Just to let you know that if I test my system on the Russell 1K my profit factor drops to about 1.7. The metrics on my system are better on the ASX. Win percentage is just shy of 70%

November 15, 2016 at 7:24 am in reply to: Selection bias – how much is too much and general MOC discussion #105789LeeDanello

ParticipantBrent, The system I designed isn’t a MOC system. Not sure I could handle one. I designed it for the ASX All Ords and has a holding time of 5 days for winning positions and 8 days for losing positions. Based on MC, trade wins are 72.12% ave, 69.83% mean and 73.97% max. My profit factor has a min of 2 but my minimum payoff ratio goes down to 0.8 and a max of 1.0. I need the higher profit factor to make it worthwhile.

November 15, 2016 at 5:55 am in reply to: Selection bias – how much is too much and general MOC discussion #105787LeeDanello

ParticipantBrent, Looking at your stats, these are my personal observations:

1.Why aren’t you using 4:1 leverage? I thought that was the point of MOC sysytems.

2.Your Max Equity Drawdown is great. I aim for the low teens.

3. Your Profit Factor is low. There doesn’t seem to be much leeway between profits and losses. I aim for 2.0 and above

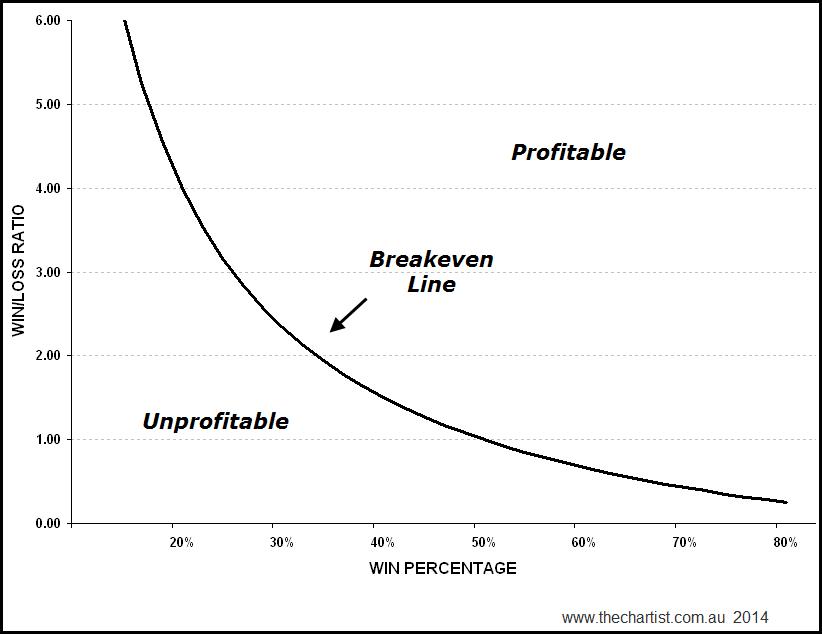

4. Your trade win is low, 70% is my cut off. Look at where you are on the curve – Ave Win/Loss v % Win and see where you are on the curve. I wouldn’t think you’d be that far right of the curve.

5 Your pay off ratio is good.

6. The variance between your CAR is a bit great for me. When you say iterations are these 3 runs only?

If so what about Monte Carlo?Seems like it wouldn’t take that much to turn those winners into losers.

November 12, 2016 at 5:03 am in reply to: How to identify signal that triggered entry/exit if multiple signals are used #105767LeeDanello

ParticipantYes, You can weed out your superfluous exits. and figure out what signals contribute to the profits.

LeeDanello

ParticipantThat’s why I’m paper trading. I’m trying to build some confidence in my system. I’ll get there soon.

LeeDanello

ParticipantWhat a crazy bloody world. Darryl, don’t think do!

LeeDanello

Participantrun for the hills. ha ha

LeeDanello

ParticipantTrent, Once you’ve committed don’t deviate from your plan. I’m still in the testing phase at the moment because I want a decent out of sample size to compare with Amibroker. I suppose it’s a confidence thing.

-

AuthorPosts