Forum Replies Created

-

AuthorPosts

-

AlexanderLuong

MemberI totally get you on the short paranoia lol. I started shorting last year and it was really painful for a while. It felt like I would get lucky and make money for a few days then just take a hit on some moon stock and instantly lose it all. I was thinking of switching back to long-only, but the uncorrelation effect of MR MOC Long + Short is just too smooth to pass up. It led to me just exaggerating everything in my short system for 2021. I doubled the stretch, increased all the indicator thresholds, and got the maxDD down to half of what I thought I could tolerate on longs lol. Made sure that maxDD is in the low-mid single digits for shorts…

It’s been doing much better ever since and I’m having a great year on shorts so far. Jan 27 was a good winning day for me. FOSL passed my conditions, but seems to have fell out of my top 40 ranking criteria. In fact, it didn’t even show up in the csv at all. So my ranking helped me dodge at least that bullet that day. FIZZ on the other hand…

Try introducing distance above BBandTop to your ranking somehow. I do that because I try to be conservative and short things that are way overextended. FOSL just barely closed above it on Jan 26, whereas everything I shorted was already far above it.

But the thing that hit me the most YTD was the day I shorted SAVA on the open around $30 and it closed above $60 lol. That one stung a bit, but I sucked it up and ended up recovering the loss in just 2 days.

AlexanderLuong

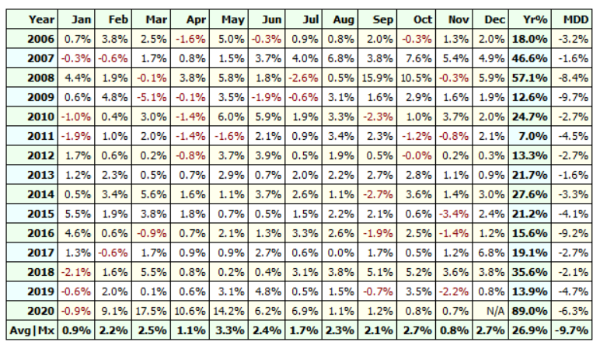

MemberI usually test from 2006 cause Nick picked that year when he was talking to me on the phone once. This is my MR MOC Short I am running:

Looks ok, right?

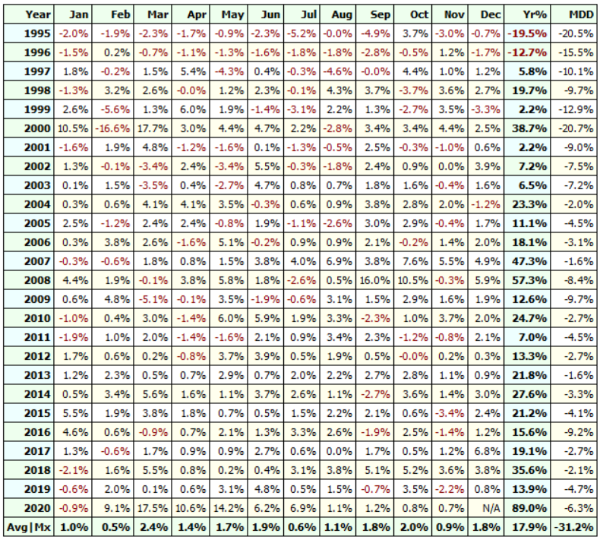

Then I was bored one day and tested back to 1995:

Yikes! Scared me a little LOL…

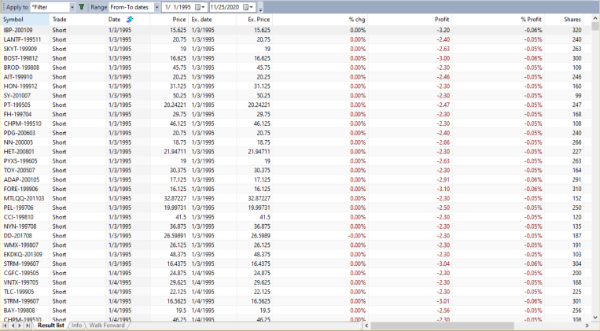

Not sure what’s up with this 1995 data all 0:

But I’m trading it cause I feel like it’s probably a good idea to do both long + short and I don’t have anything else on the short side! I watched it make a ton of money and then lose it all in a day 3 times already! Lots of fun for a newbie trader!

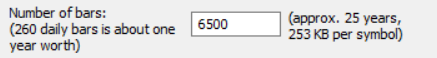

So I’m just gonna ignore 1995-1996 because at the moment, I think the most important thing for me is just trading and following the process. Which I’ve been doing!

Edit: Oh woops, that’s set to 25 years to 1995 alright. So that’s why the 0 data. Seems like I’m ok then!

AlexanderLuong

MemberCongrats Seth! I have to ask, why employers? Cause I’m trying to make the opposite switch, hahaha. If you’ve been a successful business owner and trader, a free man, do you think you can deal with all the BS and politics, daily standups, Agile, Scrum, useless PMs, and all? Cause I can’t stand it anymore and I need to get out of soul-sucking corporate slavery ASAP LOL. Working out all the time sounds amazing! Grass is always greener, I guess.

API sounds great. Before I met Nick, I was playing around with forex, crypto, and futures (and losing money), so I ended up writing my own API that I currently live trade with on a platform called QuantConnect. It can hook into multiple brokers for stocks/options/crypto/forex/futures so it’s nice for messing around with all sorts of stuff. It can backtest too, but Amibroker + Norgate is better. But now that I’m probably just gonna focus on stocks and IBKR to actually make money, I plan on just writing my own IBKR API as well.

Btw @Seth and @Julian, and others with multiple MOC systems, how do you squeeze that all under a single account balance? I was already running into many insufficient margin issues with my LMT fills getting canceled with just 1 long + 1 short strategy at 40 x 10% each even with the low fill rate. But I guess that’s like trying to use 8x leverage when I only have 4x, so Nick helped me sort that out with smaller size or LIT orders.

Might be fun to team up at some point. I’m a tech lead and proficient with all the main programming languages (Python/JavaScript/Java/C++/C#/Go), frontend UI (I like React) and backend servers, databases, DevOps, AWS/GCP cloud, etc. My plate is kinda full right now, but I plan on quitting my software engineering job next year because I have few itches I want to scratch before I turn 30 and my life is over, like just trading for a year and seeing if I starve or not + growing my dating app lol! Cheers!

AlexanderLuong

MemberFor ranking, I tend to like:

1. Momentum

– ROC

– (Annualized) Exponential (not Linear) Regression Slope

– RSI

– CCI1b. Coefficient of Determination = Correlation Coefficient^2

– Momentum * Correlation(Cum(1),C,5)^22. Math to combine Momentum & Volatility and make it bigger

– Momentum + Volatility

– Momentum * Volatility3. Volatility

– ATR

– Bollinger Band Width

– StDev

– Historical Volatility = StDev(log(C/Ref(C,-1)),P1) * sqrt(250)3b. Inverse Coefficient of Variation = abs(C-MA(C,5))/StDev(C,5) or abs(C-MA(C,5))/ATR(5)

– Volatility + Inverse Coefficient of Variation

– Volatility * Inverse Coefficient of Variation -

AuthorPosts