Home › Forums › Trading System Mentor Course Community › Performance Metrics & Brag Mat › Trying to make sense of MR and MOC performance

- This topic is empty.

-

AuthorPosts

-

June 9, 2019 at 12:31 am #101919

Nick Radge

KeymasterBeen thinking about performance of MR and MOC systems of late.

Here’s a few charts for discussion:

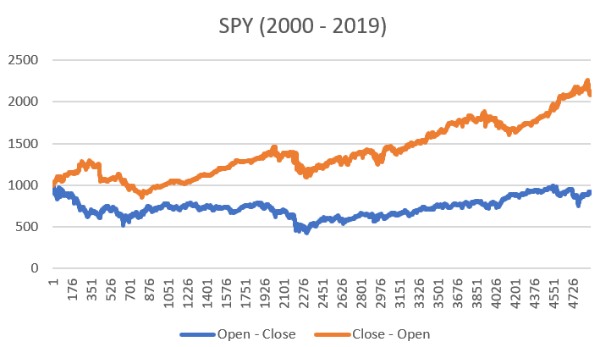

This is the $SPY from 2000 through today. It’s measuring the move from Open to Close and the Close to next days Open.

Pretty clear picture that almost all gains in the SPY have come from the overnight move. Perhaps buying on close is a worthy point of investigation?

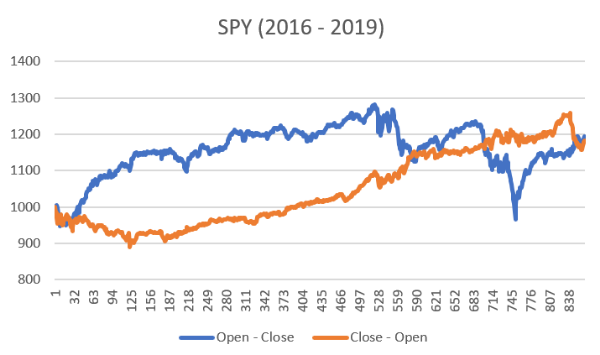

Here is the same data for the last few years. Appears to be some deterioration, although general trend remains…

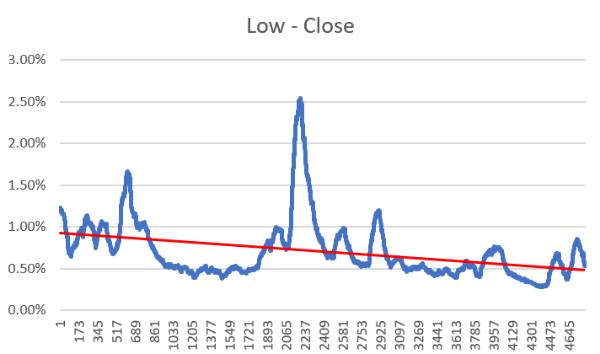

In this one I wanted to measure the distance from the sessions low to the close. The theory being most of our MR systems are buying further weakness and not really the open.

A clear trend over the last 20-years showing closes tend to be closer to the days low

Interested in thoughts…

June 9, 2019 at 3:44 am #110089JulianCohen

ParticipantFor anyone wanting to test this, Cesar has some reverse engineering code that you can try to use on his website.

June 9, 2019 at 6:31 am #110090ScottMcNab

ParticipantVery interesting…2 initial thoughts..

1. tempting to try and use

PercentRank((close-low),100) or something similar in a positionsizing formula (increase bet size when favorable) ?

2. wonder if similar patterns for Aussie ?June 11, 2019 at 5:40 pm #110091JulianCohen

ParticipantNot just you thinking about this Nick,

June 12, 2019 at 5:17 am #110096JulianCohen

ParticipantI’ve been thinking about this for a couple of days now

1. By running limit buy and sell same day systems, what we call MOC, we have access to 4 times leverage which we wouldn’t have with a buy on close system as we have to hold overnight.

2. Our existing MR systems are taking advantage of the markets potentially going up more during the night than during the day already, as irrespective of when during the day they buy, they are still holding over the potentially more profitable period.

3. So that leaves a system to be tested which would buy on the close after a designated signal has been triggered and sell on the open to see if that has any merit.

I’m now thinking about that.

June 12, 2019 at 5:50 am #110097Anonymous

InactiveWhats the liquidity/volumes like in the after hours sessions? E.g. if doing a 20K position on a $20 symbol then 1,000 units will be needed. Is this a large or small portion of the overnight volume?

June 12, 2019 at 6:04 am #110099JulianCohen

ParticipantAre you planning on trading in the out of hour sessions?

Without investigating I would suggest that the volume is sparse unless there is a reason for it not to be, ie earnings announcement outside of hours like Apple does, global news affecting the stock etc…

The problem with thinking of trading outside of hours would be that there would not be a consistency of volume.

June 12, 2019 at 6:23 pm #110100TimothyStrickland

MemberSome great ideas. I have been pondering some ideas as well after my MRV took such a big hit last month not really changing my MRV but just creating more systems to spread out my risk and profit to more consistent results. I am working on my MOC system currently and I am learning how to apply the buy on open sell on close, so this is a fairly new concept to me. So this is an extremely relevant topic for my current trading journey right now.

Julian, you brought up a good point about being unable to capitalize on the 4x leverage during the overnight session since after the market closes we would be back to the standard 2x leverage. I am still going to see if I could figure something out, I will test both ways during my design phase and see what would make the biggest difference.

I guess the biggest questions to test are does the 4x leverage still outperform the fact that the market performs better after the close. I am also setting myself up to overnight risk (not a huge deal but something to consider).

June 13, 2019 at 8:02 am #110098SaidBitar

MemberJulian Cohen wrote:I’ve been thinking about this for a couple of days now1. By running limit buy and sell same day systems, what we call MOC, we have access to 4 times leverage which we wouldn’t have with a buy on close system as we have to hold overnight.

2. Our existing MR systems are taking advantage of the markets potentially going up more during the night than during the day already, as irrespective of when during the day they buy, they are still holding over the potentially more profitable period.

3. So that leaves a system to be tested which would buy on the close after a designated signal has been triggered and sell on the open to see if that has any merit.

I’m now thinking about that.

When I tested this idea I kept the trade signal in my system as it is currently but i tested with Limit on close and the exit is the open of the second day, also i tested the entry with limit order intraday and the exit is the open of the following day but as you mentioned due to the 2x leverage the results were poor i will double check again today

June 18, 2019 at 10:06 pm #110112Anonymous

InactiveSimilar to Said, I have tested all of my MOC systems also as close on the following open at market. In my case the returns are not nearly as strong as for the MOC systems and the drawdowns are also always worse. I rationalized this as not only do you get 2x more leverage for MOC, but also you get a compounding effect – i.e. more leverage isn’t linear.

While the MDD was better for my MOC systems, I don’t think This alone captures the added risk that one is taking on with the 4x leverage of MOC systems. In the back of my mind I worry what an 1987 black Monday would do to my MOC systems…

So for me MOC has been preferred vs holding overnight and selling market on open but I think there is more tail risk

-

AuthorPosts

- You must be logged in to reply to this topic.