Home › Forums › Trading System Mentor Course Community › Progress Journal › Trents Weekly Journal

- This topic is empty.

-

AuthorPosts

-

August 24, 2017 at 4:23 pm #107416

JulianCohen

ParticipantScott McNab wrote:better…added 1 line where if index went crazy (atr) it would add a multiplier to the adx filterus moc 2014 current same as before…now down to 5 days where selection bias and reduced on each of those days

That’s a clever idea!

August 24, 2017 at 10:29 pm #107418Nick Radge

KeymasterWhat code did you use Scott?

August 24, 2017 at 11:38 pm #107423ScottMcNab

ParticipantSetForeign(“$SPX”,True);

IndexVola = ATR(2)>2*ATR(50);

RestorePriceArrays();Mult = IIf(IndexVola,2,1);

August 25, 2017 at 3:55 am #107417TrentRothall

ParticipantScott does it bother you that you’re only using 1/4 of your capital most of the time? I guess that’s the killer isn’t it trying to capture more trades without missing a lot.

August 25, 2017 at 4:18 am #107429ScottMcNab

ParticipantDoesn’t bother me …in a weird way, as long as I can hit 20% cagr, then the less time I am in the market the happier I am

August 25, 2017 at 5:14 am #107419ScottMcNab

ParticipantJulian Cohen wrote:Scott McNab wrote:better…added 1 line where if index went crazy (atr) it would add a multiplier to the adx filterus moc 2014 current same as before…now down to 5 days where selection bias and reduced on each of those days

That’s a clever idea!

Not sure if Julian taking the piss here but in case anyone is interested other things I tried were:

Index volatility on ROC (not as good as ATR so far)

Index switch filter (briefly mentioned to Nick but he sounded dubious so I have binned it)..idea was when things go crazy then drop back to a smaller (larger cap index)…eg SP500 back to SP100 or from SP1500 to SP500

cond1 = NorgateIndexConstituentTimeSeries(“$SPX”);

cond2 = NorgateIndexConstituentTimeSeries(“$OEX”);

IIf(IndexVola, Cond2,Cond1)use the Mult (see other post) on:

atr filter

adx filter

price filter

volume filter

all of these are trying to make it less likely for a stock to trigger a buy in cases where the all stocks across the board are fallingnext research is to look into market breadth indicators to see if that helps

August 25, 2017 at 5:40 am #107437JulianCohen

ParticipantNo for once I’m not taking the piss

It is a clever idea. I hadn’t thought of using the index filter to change the ADX like that.

August 25, 2017 at 8:23 am #107424JulianCohen

ParticipantScott McNab wrote:SetForeign(“$SPX”,True);

IndexVola = ATR(2)>2*ATR(50);

RestorePriceArrays();Mult = IIf(IndexVola,2,1);

I tried this on my MOC. It didn’t have any effect on the number of days with 40 or more trades. I tried it with IIf(IndexVola,3,1) as well as trying it on one of the more important entry criteria.

I’m thinking that for my system there is very little way to predict what will be a ‘big’ day and this code is just affecting the day after it has happened. My ‘big’ days are non consecutive and I can’t figure out a pattern to them at the moment.

Good excercise for me though.

August 25, 2017 at 9:05 am #107450ScottMcNab

ParticipantI suspect our buy conditions differ significantly…if (for example) the buy condition was when the stock closed (crossed) below its MA(C,5) then I would try:

SetForeign(“$SPX”,true);

IndexTrigger = cross(MA(C,5),C);

restorepricearray();as I would expect that on those days the stocks which are simply tracking the index would all look to trigger on that day…so the Index filter would need to be customized for everyone’s system I am guessing but the principle should work (maybe)

August 25, 2017 at 12:44 pm #107453JulianCohen

ParticipantScott McNab wrote:I suspect our buy conditions differ significantly…if (for example) the buy condition was when the stock closed (crossed) below its MA(C,5) then I would try:SetForeign(“$SPX”,true);

IndexTrigger = cross(MA(C,5),C);

restorepricearray();as I would expect that on those days the stocks which are simply tracking the index would all look to trigger on that day…so the Index filter would need to be customized for everyone’s system I am guessing but the principle should work (maybe)

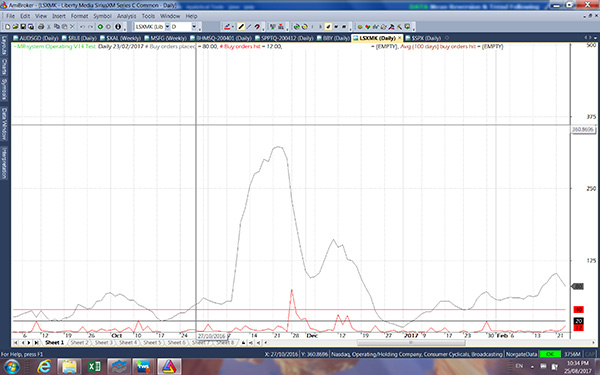

I agree Scott I just can’t seem to see what causes my ‘big’ days. Here’s an example

Here’s a number of days where the signals generated were around 300…number of trades stays under the red line which is 40, except for 28th Nov ’11 where 75 got executed. The SPX chart for that time looks like this.

28th Nov is where the blue line is. A down day but nothing special. No great volume….just another day. Then it goes back to executing less than 40 trades again for a long time. Until now actually. So I reckon that I have to take these ‘big’ days as part of my system. I don’t think I can exclude them. I don’t have an Index Filter as part of my system so that could be a good reason why adding one doesn’t help in this circumstance.

Probably as you say just a factor of how my system is constructed.

August 25, 2017 at 9:53 pm #107455ScottMcNab

ParticipantFrom the first graph it doesn’t look like it happens that often…once or twice a year impossible to avoid probably.

Looking at the second graph (case study of 1 admittedly) it could be a bit of profit taking ?…could try a filter that if (eg) SPX >ref(HHV,(SPX,50),-1) then tighten entry requirements slightly…. could add a small adjustment to which ever filter in system (adx/atr/size of stretch for buylimit/etc) works best…such as multiply adx by 1.2 or buylimit price by 0.995

August 26, 2017 at 5:54 am #107456JulianCohen

ParticipantScott McNab wrote:From the first graph it doesn’t look like it happens that often…once or twice a year impossible to avoid probably.Looking at the second graph (case study of 1 admittedly) it could be a bit of profit taking ?…could try a filter that if (eg) SPX >ref(HHV,(SPX,50),-1) then tighten entry requirements slightly…. could add a small adjustment to which ever filter in system (adx/atr/size of stretch for buylimit/etc) works best…such as multiply adx by 1.2 or buylimit price by 0.995

Good thinking. I’ll look back over the others and see if profit taking is involved.

Gotta love this forum! Speak to you on Monday

August 27, 2017 at 5:50 am #107457JulianCohen

ParticipantJulian Cohen wrote:Scott McNab wrote:Good thinking. I’ll look back over the others and see if profit taking is involved.So I had a good look back and I’m not going to try to code these ‘big’ days out. Firstly I have seen big days down followed by a big profit day that doesn’t have excess signals. Coding out one could negate the other.

Secondly trying to code them out seems like curve fitting and I think it just has to be accepted as part of the system.

August 27, 2017 at 7:53 am #107460ScottMcNab

ParticipantThe curve fitting aspect bothers me too…I am changing the code to reduce buysignals at the cost of worse statistics…CAGR drops about 20%…but it probably is a more realistic outcome…but may still be a form of curve fitting…

August 30, 2017 at 7:40 am #107463TrentRothall

ParticipantSeriously considering screening for earning releases, i’ve been getting wacked the last couple of earning seasons.

Its something that an be avoided relatively easily too. i know we test with gaps etc, but it is costly sometmes

-

AuthorPosts

- You must be logged in to reply to this topic.