Home › Forums › Trading System Mentor Course Community › Progress Journal › Trents Weekly Journal

- This topic is empty.

-

AuthorPosts

-

August 23, 2017 at 11:28 am #107391

RobGiles

MemberThanks for posting these…Dumb question for the month…How do you generate those MaxDD graphs and the monthly tables as its not out of STT?

cheers

RobAugust 23, 2017 at 3:35 pm #107392SaidBitar

MemberI believe they are from Amibroker

August 23, 2017 at 9:18 pm #107393SaidBitar

Memberhere are for one the others are more or less the same

here are the results from live trading

somehow there is differenceAugust 24, 2017 at 1:46 am #107394TrentRothall

ParticipantThanks guys, nice results.

Julian when you said 95% selection bias; are you aiming for higher than that? Boom year

Rob the MDD figures are there because of some custom backtester code i believe. The code is in the forum somewhere i think Maurice posted it a while ago.

I really think i need to get a US system up and running instead of my two Aus systems. A bit more diversification, athough if they hadn’t been flat for 7 months i wouldn’t be saying that..

I’m trying to not drop a system beecause everything you hear about “results come from long term application, etc etc” but i think i might be too heavy in the asx.

August 24, 2017 at 1:46 am #107395ScottMcNab

ParticipantSelection bias or not getting fills do you think Said ? Does (eg) 1-June result in live equate to May return for Ami ?

August 24, 2017 at 3:52 am #107398JulianCohen

ParticipantTrent Rothall wrote:Thanks guys, nice results.Julian when you said 95% selection bias; are you aiming for higher than that? Boom year

No I’m happy with 95% but I was just mentioning it because a 100% return normally indicates 70% selection bias in my experience so I’m saying that this system holds up very well when it has a big return…..so far

August 24, 2017 at 3:52 am #107402

August 24, 2017 at 3:52 am #107402JulianCohen

ParticipantSaid what is the selection bias on your system?

August 24, 2017 at 4:03 am #107403TrentRothall

ParticipantThat’s nice, has your real time results been following backtest?

August 24, 2017 at 4:59 am #107405JulianCohen

ParticipantTrent Rothall wrote:That’s nice, has your real time results been following backtest?I changed up my system two months ago. A complete overhaul once I discovered and understood selection bias. Until then I was running a system with 75% bias, which was actually working really well, but I know now that was luck more than judgement.

So I rewrote the system from scratch two months ago and probably accidentally hit on one that was very simple and worked almost immediately in terms of selection bias and backtesting.

Since then it hasn’t made any money ha ha! In line with the backtests though!

August 24, 2017 at 7:21 am #107404SaidBitar

MemberJulian Cohen wrote:Said what is the selection bias on your system?This was the problem Selection bias was in the range of 70% and this is real proof of the divergence between backtest and live trading due to it.

then I changed the Universe from the original R1000 to SP500 and increased the stretch a bit so i am now in the range of 92%

I have to admit since i changed the trade frequency dropped and the backtest and live trading started to align but i will give it some more time and verify again

August 24, 2017 at 9:46 am #102723ScottMcNab

ParticipantI’m still a bit fazed by selection bias…the asx system is pretty good …of the 800 or so trading days in the 2014-current sample there were only 5 that it didn’t capture all the signals and even on those days it went pretty close

The SP500 seems ok on the number of days it captures all the signals (missed 9 of the 800) but on the days it misses it can REALLY miss a lot….wondering if it is worth trying to add some sort of index filter (as these days of huge buysignals occur when the entire index is dropping) ?

August 24, 2017 at 9:49 am #107411ScottMcNab

ParticipantAlong the lines of trying to increase the stretch for the buylimit when volatility of index goes berserk perhaps

August 24, 2017 at 10:08 am #107412JulianCohen

ParticipantScott McNab wrote:Along the lines of trying to increase the stretch for the buylimit when volatility of index goes berserk perhapsOne problem with that will be the lag. If it missed 9 of 800 days are they days just out of the blue? If so then you can’t predict when they will occur and can’t code for them as the indicators you use reference the day before.

August 24, 2017 at 10:29 am #107415ScottMcNab

ParticipantJulian Cohen wrote:Scott McNab wrote:Along the lines of trying to increase the stretch for the buylimit when volatility of index goes berserk perhapsOne problem with that will be the lag. If it missed 9 of 800 days are they days just out of the blue? If so then you can’t predict when they will occur and can’t code for them as the indicators you use reference the day before.

Seems to be when entire index takes large nosedive for a few days in a row…suspect your right and will just have to live with it

August 24, 2017 at 11:59 am #102724ScottMcNab

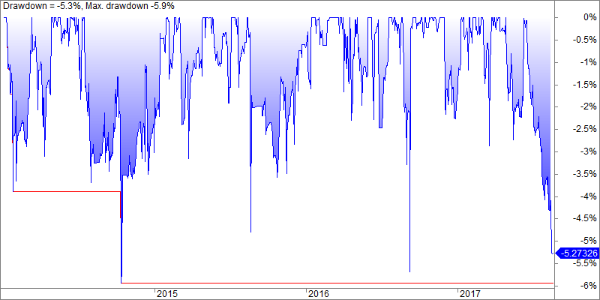

Participantbetter…added 1 line where if index went crazy (atr) it would add a multiplier to the adx filter

us moc 2014 current same as before…now down to 5 days where selection bias and reduced on each of those days

-

AuthorPosts

- You must be logged in to reply to this topic.