Home › Forums › Trading System Mentor Course Community › Progress Journal › Trents Weekly Journal

- This topic is empty.

-

AuthorPosts

-

October 22, 2016 at 11:05 am #105618

Anonymous

InactiveTrent Rothall wrote:Darryl, your total commission payment would be rising pretty quickly wouldn’t it??yes i can see commissions are a slow killer… at this point its close to ~$30 in and out for each trade.

so far im keeping ahead:

October 22, 2016 at 8:57 pm #105610JulianCohen

ParticipantNick Radge wrote:mmmm….seems to be some very aggressive results there guys? -17% and -13% in a month seem very extreme…Mine so far:

ASX MR: -5.2%

US HFT: -2.4%

US Rotation: -3.2%I’ve been running the momentum system for nearly 3 months. First month it lost 13% and has stayed at that level since then. It’s on the ASX and looks like I caught the end of a good run up. It fits the backtests exactly so I’m not concerned.

October 23, 2016 at 12:21 am #105620TrentRothall

ParticipantDarryl Vink wrote:Trent Rothall wrote:Darryl, your total commission payment would be rising pretty quickly wouldn’t it??yes i can see commissions are a slow killer… at this point its close to ~$30 in and out for each trade.

so far im keeping ahead:As long as the comms are correctly accounted for in backtests, all should be fine i think. Even though it may hurt seeing the cost rising steadily, just a cost of doing business.

October 23, 2016 at 1:14 pm #105619SaidBitar

MemberTrent Rothall wrote:Said Bitar wrote:for this month alone it is -9.26%

i think the reason of the huge swings that my system takes is due to the fact that i hold maximum of 10 positions.

the reason I put 10 is that the number of fills is not huge, the maximum fills in the backtest was 12 or 13So is your position size 20% of account on each? I use 20 positions and i don’t miss many trades due to selection bias. In 2016 so far i think there has only been ~10 that i have missed due to having a full portfolio.

I might relax my parameters a bit and do some testing to see what i come up with actually..

Darryl, your total commission payment would be rising pretty quickly wouldn’t it??

i checked in the beginning for 20 positions but 80% of the time the system is holding less than 10 this is why i decided to use 10

actually here is the distribution:

<= 10 80.7%

<= 15 87%

<= 20 91.5%

<= 25 95.2%

<=40 98.8%

max positions is 56 and it is 1.2%

maybe it is good idea to change to 20 or even 25 but the annoying thing that 80.7% of the time the money will be just sitting in the account instead of being allocated to the existing tradesOctober 28, 2016 at 5:53 am #105625TrentRothall

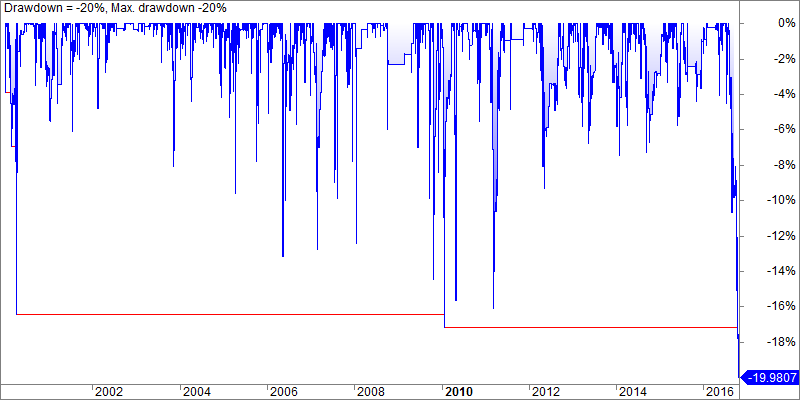

ParticipantMy current DD is a bit different to others in my testing that have hit the >10% mark. They have been from a quick drop in the market and have occurred over a week or so where the current one has just been a slow burn down since August. Might end up being one of the longest in duration by the time i hit new equity highs…

Time will tell

October 28, 2016 at 12:01 pm #105648SaidBitar

Member

new DD level,

Honestly i do not know to be happy that real trading and backtest are aligned or i should be sad that both are bad :sick:October 28, 2016 at 9:43 pm #105656Nick Radge

KeymasterSaid,

So the question here is why?Is the market condition different?

Has there been a specific explanation that you can see?

How much curve fitting/optimisation has been done on the system?October 29, 2016 at 6:34 am #105658JulianCohen

ParticipantNick Radge wrote:Said,

So the question here is why?Is the market condition different?

Has there been a specific explanation that you can see?

How much curve fitting/optimisation has been done on the system?Sorry Nick am I missing something? Shouldn’t the real trading be aligned with the backtesting? Or is that what you are saying?

October 29, 2016 at 9:49 am #105659SaidBitar

MemberNick Radge wrote:Said,

So the question here is why?Is the market condition different?

Has there been a specific explanation that you can see?

How much curve fitting/optimisation has been done on the system?Regarding curve fitting i do not imagine i have any curve fitting or optimisation done for the system.

Maybe the reason behind the big swings in the system is that i hold maximum of 10 positions this is one thing that i have to check more in details over the weekend.the system performed bad i believe due to the market conditions and also i had few more losers than winners

so instead of having 65% winning rate the winning rate

was 37%anyhow i will check this stuff also in details and review the trades

October 30, 2016 at 12:54 am #105660TrentRothall

ParticipantJulian Cohen wrote:Nick Radge wrote:Said,

So the question here is why?Is the market condition different?

Has there been a specific explanation that you can see?

How much curve fitting/optimisation has been done on the system?Sorry Nick am I missing something? Shouldn’t the real trading be aligned with the backtesting? Or is that what you are saying?

I think Nicks saying why has this DD been worse than other previous DD in backtesting.

October 30, 2016 at 5:27 am #105662TrentRothall

ParticipantOctober results

52 trades

42% win rate

0.83 W/L-6.0% return

Bit of a rough month, the first time in testing/trading that there’s been 3 losing months in a row. Been doing a lot more trades in the last 2 months than the first few it seems; that makes sense with the choppy conditions i think.

Total Return

221 trades

53% win rate

1.02 W/L ratio10.2% return

Sitting on about a 11% DD giving back some profits the last few months after starting off with a bang. Still a small sample in the grand scheme of things, hopefully a good run up to Christmas =]

Equity curve isn’t looking so pretty either…

October 30, 2016 at 9:29 am #105663ScottMcNab

ParticipantCurve fitting is my greatest concern (for this month anyway) ….suspect we are all doing this but I test for curve fitting by taking my system and testing it on at least 2 other markets…eg if I design it on the ASX then I take it to the SPX/NDX/HKSE …if the system doesn’t give me similar expectancy I don’t trade it. I will see if I can find the system I came up with a few weeks ago for comic relief…I added 3 lines of code to the ASX/SPX MOC system I am trading live ….I got a SR approaching 3 on XAO (that should have been my first warning) but when I took it over to SPX it was a dog !! ….curve fitted

How does it go on other markets Said ?

October 30, 2016 at 11:03 pm #105664SaidBitar

MemberSo over the weekend i checked the ASX MRV system to see if there is selection bias and/or curve fitting.

regarding selection bias the system captured 91.27% of all the trades from first of Jan 2000 till today, so i don’t thing there is any selection bias in it.

Regarding the curve fitting the system has 2 simple rules no parameter optimisation is done for them the only thing that i optimised is the stretch so i ran walk forward optimisation from 2000 till today on 6 months steps to see if the best value for the stretch is far from the one that i am using and the results were not far.@Scott the system is similar to the ones that i am using in the US market results are not so far. I think that the system is OK the only problem is the starting time was not the best

November 8, 2016 at 6:36 am #105665TrentRothall

ParticipantCalm before the storm?

No buy orders for today and only 1 open position after tomorrows open. We will see what’s in store…

November 8, 2016 at 8:04 am #105713JulianCohen

ParticipantTrent Rothall wrote:Calm before the storm?No buy orders for today and only 1 open position after tomorrows open. We will see what’s in store…

Pretty much the same. No open MR positions and very few MOC entries for today. Looks like our systems are protecting us

-

AuthorPosts

- You must be logged in to reply to this topic.