Home › Forums › Trading System Mentor Course Community › Trading System Brainstorming › Trading system broken?

- This topic is empty.

-

AuthorPosts

-

January 29, 2020 at 2:07 am #110848

MichaelRodwell

MemberQuote:Well, I’m not quite sure when this theory of a down year means the system is broken?This is the point I was getting at Nick. Your system had a similar performance drop to Daniels but you continued to trade because you understood that:

Quote:2016 and 2017 were extremely low volatility years. As pointed out, my system is volatility based, so low vola doesn’t help.The system was out of sync with the market for a couple of years and then made a come back.

Could this be the case for Daniel?

February 1, 2020 at 2:47 pm #110849TimothyStrickland

MemberI am a little late to the conversation but my MRV had a big drop in performance as soon as I took it live. However, this was not unusual compared to other’s MRV performance. 2019 was a losing year but mostly because of May where I lost 15.1% which I could explain, the rest of the year wasn’t that bad. If I removed May out of the equation it would have been a positive year. I had read other’s MRV wasn’t doing well like Caesar, and a few people mentioned too many people were trading it so the edge was gone, I wasn’t buying it. How do you know how many people are trading MRV’s or not trading them? So I wrote this off as just a guess and kept plugging on, plus:

I spent months testing this system with Nick. I ran the system 100s of times on almost every index, not only that but I threw out at least a dozen systems before I even got to my system because they failed to perform on other indexes, only the one I was testing in which in my mind is a (huge red flag). This one performed well on all indexes I tested it on even the Nasdaq which I was a little surprised because the system generates its profits through a high volume of trades, there are a lot fewer triggers in the Nasdaq because the amount of stocks is less. It had much lower returns but it still had a positive equity curve on the Nasdaq on the time.

I have had Nick check my system numerous times last year because it had surpassed its max drawdown that was tested. However, both of us could not find anything inherently wrong with the system so I stuck it out, even though it was at 30% Drawdown.

Fast forward to now, the system has recovered over half of its drawdown and is performing well, from what I can tell my system just was out of sync with the market in a good portion of 2019 but started a fast recovery close to the end. Looking at the backtest this is actually not that unusual and has happened multiple times in the past.

What Scott said is one of my requirements. I will not use a system that does not perform well on other indexes, Nick told me this before I started building it. If the system does not perform well on other indexes and you can’t explain why its a red flag. I also made sure I didn’t optimize but one parameter. The other parameters were standard and the one I decided to optimize, I tried to pick a flat spot near the middle of the optimization point. Because of all the testing, I put my system through it helped me hang on to it longer, even when it was in a very bad drawdown and now it is in a nice recovery.

I am a Test Engineer at Boeing and my job is to break, invalidate, software or systems that are in my charge. I would much rather break something in testing than after it is delivered to the customer, I took the same philosophy here. My goal is not to make the system work but to break it if at all possible and if I can’t, that is a very good sign. Another thing I did to all my systems was to run random tests on each index meaning I added a random change on the parameters in the system by a certain percentage and then re-tested everything on all indexes and got very similar results, this might be overkill but I was trying to break the system and I was unable too. Hope that was helpful

February 1, 2020 at 2:58 pm #110873TimothyStrickland

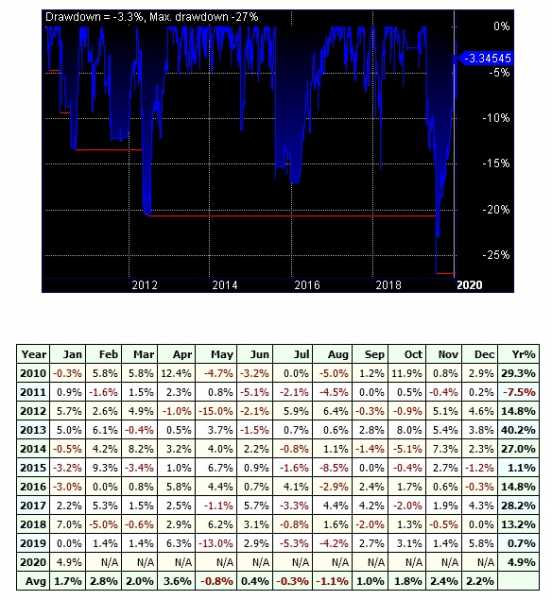

MemberFor instance, this is my system backtested on the Nasdaq. The system was built for the S&P but the performance is very similar overall. Big drawdown in May, even on the Russell it shows a big drawdown in May 2019 and a recovery after.

February 2, 2020 at 7:03 am #110874

February 2, 2020 at 7:03 am #110874Nick Radge

KeymasterI didn’t know you worked for Boeing Tim. Trish and I visited Boeing Field in Seattle late last year. Was fascinating. My father flew Boeings his whole career, from the F-86 Sabre right through to the 747-B

February 2, 2020 at 2:06 pm #110895TimothyStrickland

MemberOh, I didn’t know you went there last year. very cool about your dad, he worked for Boeing as a pilot? I don’t mention I work for them lately because of the whole 737 Max incident which I do not work on, but people I talk to seem to think that everyone works on the same thing haha, I guess it is just human nature.

I work at a facility in Northern VA, so if you ever visit New York, DC, Hampton Roads or Richmond let me know and we can meet up! Maybe we can do a crossfit workout together, although with all those videos you been posting on facebook I am not sure I can keep up haha.

February 2, 2020 at 9:37 pm #110899Nick Radge

KeymasterDad was a pilot, initially for the Australian Airforce, then for Qantas for 35 years.

February 2, 2020 at 9:46 pm #110900MichaelRodwell

MemberQuote:I am a Test Engineer at Boeing and my job is to break, invalidate, software or systems that are in my charge.Tim: do you work with Pivotal Cloud Foundry for Cloud Native Development?

Before the 737 Max debacle we had some decent deals on the table with you guys (I work for Dell – Owners of Pivotal & VMware).

Quote:My father flew Boeings his whole career, from the F-86 Sabre right through to the 747-BWhat was it like growing up with a pilot dad Nick? Did you ever get to ride up the front?

February 3, 2020 at 1:08 am #110901TimothyStrickland

MemberMike, not yet! I have spent the last 19 years testing software and trying to find bugs, I am in the process of trying to learn how to write it because its fun and I can make more money. We do a lot of VM testing on Dell servers which I know quite a bit about though.

-

AuthorPosts

- You must be logged in to reply to this topic.