Home › Forums › Trading System Mentor Course Community › Progress Journal › Tim’s Journal

- This topic is empty.

-

AuthorPosts

-

December 1, 2018 at 3:29 am #109359

TimothyStrickland

MemberNovember Results

-Live-

US Original 0% (Cash)

US Aggressive: 0% (Cash)

401k strategy: Getting back in DecemberPortfolio Drawdown: – 23.8%

– Simulated – (Tim’s systems)

SPX Momo: Staying in cash for December

NDX Momo: -Will be getting back in December

NDX Aggressive: Will be getting back in DecemberJanuary 1, 2019 at 8:28 pm #109442TimothyStrickland

MemberDecember 2018

-Live-

US Original: 0%

US Aggressive: 0%

401k Strategy: -9.17%– Simulated –

SPX Momo: 0%

NDX Momo: -16.6%

NDX Aggressive: -33.2%2018 Yearly

– Live –

US Original: -19.72%

US Aggressive: -7.1%– Simulated –

Same as monthly resultsJanuary 1, 2019 at 8:34 pm #109497TimothyStrickland

MemberAll systems Live and Simulated go back to cash for the new year.

January 10, 2019 at 12:36 pm #109498TimothyStrickland

MemberI was hoping to get a couple shorter term systems designed last year but I ran out of time, work schedule picked up to 80 hours per week plus the time consumed from my Real Estate business. I was just doing enough to manage my current systems.

2019 New year, new goals. Have a plan to develop at least 1 shorter term system. I am thinking mean reversion to fill out the gaps in my trend following systems.

I have been doing some research on my own and have a few ideas, anyone have any good resources on where to start they would like to share on this topic.

I will likely need lots of help in the system design from Nick and Craig again.

Thoughts currently:

Most of my portfolio will be in Trend following since how I understand it, is where most of my profits are going to come from. I am thinking of using, maybe 25% of my capital to devote to a mean reversion system. Currently I am following along with the US Original strategy but would like to design my own.

Would be nice if I could create a system for short and long so it would be active during trend system downtime but that isn’t a must if it cuts into my profits to much.

January 10, 2019 at 8:44 pm #109519Nick Radge

KeymasterSounds like a solid plan Tim.

A few suggestions on where to start:

– decide if you wish to hold for a few days or exit MOC. Pro’s and con’s for either…

– research suggests long only tends to be more effective than long & short (although I’d like to be proven wrong here)

– Google RSI(2) / Larry Connors for some starting ideas

– Personally I have found Bollinger Bands work well in various ways

– Look at other oversold indicators and combinations

– hit me up when you get stuck or need further ideas

January 13, 2019 at 2:20 am #109520TimothyStrickland

MemberThanks Nick,

Getting some results somewhere around where I want. 15-20% CAGR using no leverage. I tried to apply leverage but the code went crazy so I sent it to Craig. I am using a combination of Bollinger Bands and RSI, seems to be profitable in and out of sample with some different results of course. In sample data was around 25% CAGR while out of sample on several time frames came in around 15-20%. Drawdown seems to be about the same as the CAGR except for in sample data. I haven’t optimized anything yet, this is just my foundation.

January 31, 2019 at 12:44 pm #109522TimothyStrickland

MemberWith LOTS of help from Nick and Craig, I’m getting to a testable Mean reversion system. My first system I thought I was doing a good job, had to reach out to Craig almost daily for coding issues then I sent to Nick and he basically said, throw it out and start over lol!

I am glad I did exactly that as I was able to deconstruct what I did and put it back together again, understanding all the moving parts and with that much better returns with a lot less drawdown. I will post the numbers once I feel it is ready.

February 1, 2019 at 12:55 am #109582TimothyStrickland

Member– Simulated Systems –

SPX Momo: CASH

NDX Momo: CASH

NDX Aggressive: CASH

SPX Mean Reversion: +3.4%– Live systems –

US Aggressive: CASH

US Original: CASH

401k strategy: +.31%February 4, 2019 at 10:29 pm #108329TimothyStrickland

MemberNick, Craig, I honestly can’t thank you guys enough for helping me on my journey to be a profitable trader. I have never before been so confident in my system as I am now.

I am nearly done with my Mean Reversion system. It seems to be extremely robust. I would like to get more profit out of it but I feel as though it would be over optimizing. The worst year was 2018 oddly enough and the system does not have a single losing year. This is because of the amount of trades it makes, about 600-800 per year. It exploits its edge often.

Oddly enough the Out of Sample data most of the time performed better than the In Sample data. I used multiple years at several time periods and could not break the system. I did multiple variance tests on the system and also could not break it that way either. 2018 was the only anomaly but even the losses were not that bad.

February 4, 2019 at 10:38 pm #109614TimothyStrickland

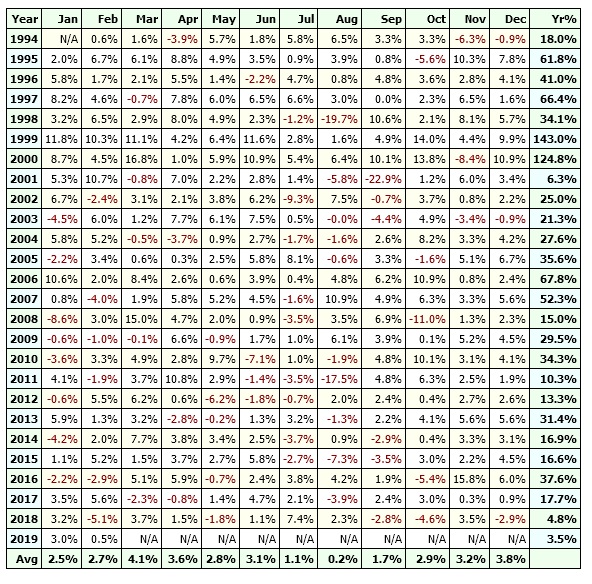

MemberStats

February 4, 2019 at 10:39 pm #109616

February 4, 2019 at 10:39 pm #109616TimothyStrickland

MemberI only built the system over a 5 year period and then opened it to see what it could do over the long term.

CAGR: 35%

MAX DD: 31% (during tech bubble) 21% otherwise.February 5, 2019 at 8:21 am #109615ScottMcNab

ParticipantTim Strickland wrote:I am nearly done with my Mean Reversion system. It seems to be extremely robust. I would like to get more profit out of it .Is this the SPX system you have been paper trading in the previous post Tim ? If so, the RUI may give you that boost..no worries with SB any more thanks to JC…ok…etc

February 5, 2019 at 12:58 pm #109620TimothyStrickland

MemberYes, I started to sim it but the one I posted was a modified version so I will re-introduce it again. Unfamiliar with acronmyms you used here, RUI?

If I eliminate the tech bubble the system gives mid to high 20s for RAR and high teens for DD.

I did more testing last night and ran it over the Russell, Nasdaq, S&P 1500 Composite and I got similiar results, it performed better on the composite.

February 6, 2019 at 8:22 pm #109621TimothyStrickland

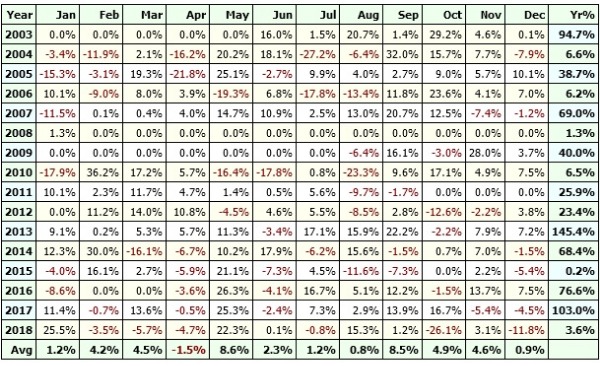

MemberStats for NDX Aggressive strategy:

February 6, 2019 at 8:37 pm #109628

February 6, 2019 at 8:37 pm #109628TimothyStrickland

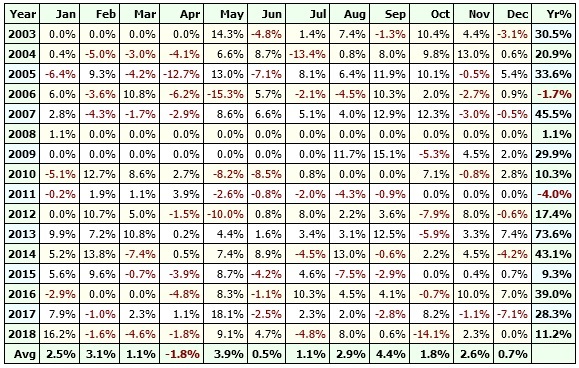

MemberNDX Momo stats (conservative)

-

AuthorPosts

- You must be logged in to reply to this topic.