Home › Forums › Trading System Mentor Course Community › Progress Journal › Tim’s Journal

- This topic is empty.

-

AuthorPosts

-

December 31, 2020 at 10:28 pm #112627

TimothyStrickland

MemberBy far this is the best year I have ever had in trading. This month was kind of weird for my momentum system, while the Nasdq was trucking higher, the stocks I was in had a massive pullback. Luckily I implemented a hedge by closing 50% of my positions 2 weeks ago before it started and missed most of the damage, the timing couldn’t have been better actually. I do not hedge the MRV system.

December 2020

MRV HFT: +14.4%

NDX Momo Backtest: +1.1%

NDX Momo Actual (Due to Hedge): +6.8%NDX Aggressive Backtest: -4.4%

NDX Aggressive Actual (Due to Hedge): +8.4 %Year 2020 Actuals

MRV HFT: + 69.2%

NDX Momo: +151.2%

NDX Aggressive: +210.9%Thoughts:

My MRV HFT had a nice equity curve.

Nick is a genius! The hedging tool saved my butt in March and this month. The backtest did not match my actual results because I missed a good chunk of drawdown during the pandemic start 1987 style crash (Sold 50% of my positions) and then again 2 weeks ago. This had a massive impact on my actual performance.

December 31, 2020 at 11:55 pm #112741

December 31, 2020 at 11:55 pm #112741Nick Radge

KeymasterGreat work Tim.

January 1, 2021 at 12:30 am #112743GlenPeake

ParticipantSuper numbers for the year Tim….!!!! Well done!!!

January 1, 2021 at 3:00 pm #112746TimothyStrickland

Member2020 Report Card: Following Nick’s lead

Overall, between all the trading systems, I ended up more than doubling our accounts.

My strategic portfolio which consists of a 401k in which Boeing matches all my contributions by 100% grew by nearly 40% this year also. Unfortunately, I can’t manage this as much as I would like and I must contribute or I do not get the Boeing match.

Real Estate properties, I own 4. We took another small loss this year due to COVID, not allowed to evict a renter that refused to pay. The state gives us nothing for it, they expect the landlords to eat the loss, it is frustrating.

My wife and I couldn’t be more pleased with the mentorship here and what Nick and the team has done for us.

My Total account size going in was $220,000 and is now almost $500,000. I would have never dreamed that I’d make 280k in a single year of trading and certainly not this quickly after completing the mentor course. This easily payed for the cost of the course, another failed trading course and we still had a ton of profits left over.

I have been using Nick’s hedge tool this year and will continue to do so. Basically when Nick posts that the market risk is at 4 I sell 50% of my positions in my longer term systems. I then go back in once the risk is down to 2 or lower. I do this because my momentum systems are very aggressive and typically have higher drawdowns than others here, this allows me to mitigate (at least partially) some of those drawdowns. When I have more time, probably not until 2022, I will develop a better system that keeps my drawdowns at 20%.

Goals for 2021:

Finish my BS in Computer Science degree so I can advance in my career and use this knowledge to develop more robust systems with code.

I would love to follow what others are doing in the forum but just haven’t had the luxury of time. My goals right now is to keep things simple and continue trading my systems at their basic levels. I plan on signing up for more of Nick’s strategies temporarily at least, so I can diversify a little bit more for next year; at least until I can develop more systems of my own.

My wife and I will be funneling more money into investments next year. She hasn’t had a job this year because she left to get training as a Software Engineer. We want to get back to saving at least 60% of our take home pay, as she is landing a Software Engineering job soon.

Our plan is to retire (or at least be in a position to retire) in 10 years, 17 years before the normal retirement age.

Diversify into Nick’s US Momo system most likely until I create my own.

I hope everyone has a great new year!

January 1, 2021 at 11:06 pm #112776JulianCohen

ParticipantI chose to use Nick’s systems for my Trend Following plans as I have not had any success devising my own for various reasons. I couldn’t be happier with that decision.

January 2, 2021 at 3:02 pm #112786TimothyStrickland

MemberJulian,

You have a few systems that you post every month, are those all the ones you created or does that also encompass Nick’s systems?

My NDX Momo system is basically one Nick help me design, I haven’t changed it. I only do a small optimization every year for one parameter. I am pretty sure if I toyed with it too much I wouldn’t have made the profits I did this year.

January 4, 2021 at 3:01 am #112798JulianCohen

ParticipantI have messed about with loads of different systems over the last few years but I haven’t had much success with my own Trend Following systems, so I now have Nick’s US Long Term system and his ASX Momentum and Growth Portfolio….so in effect, I let him take care of the Trend Following and I run the MOC short term on the US markets.

I’m hoping that I finally have the MOCs down to a point where I can stop adjusting them for more than a few months. 2020 I added the short side, and started adding more strategies so the results were never really consistent…I mean by that that I can’t do a backtest to compare real time with backtest as I was always chopping and changing things.

I hope that 2021 will be different. I have the MOC portfolio set up the way I would like to run it for the foreseeable future so I’m hoping to stop testing and just get on with the boring job of placing orders, going to bed, logging trades when I wake up, then placing orders again….etc etc etc….Occasionally stopping to count the money

January 4, 2021 at 8:11 am #112813

January 4, 2021 at 8:11 am #112813SaidBitar

MemberJulian

I have one question it really confuses me, since you are trading many MOC systems I imagine the correlation is a bit high between all of them especially if the universe is the same.

So where is the benefit?January 4, 2021 at 9:57 am #112815JulianCohen

ParticipantSo the simple answer is the universe is not the same.

I have pared down to 2 long RUI, 2 long RUT and the same for Short, plus one individual system that runs on the RUI and uses the VIX as an entry filter.

So basically there are only 2 strategies working on each universe competing with each other; however there is diversification in running on the different universes with different strategies. I am not always using the same long RUI strategy as RUT strategy…however in reality it doesn’t make a massive difference if I were to run the same strategies in both universes. The power of RT is being able to test multiple strategies in one portfolio, and seeing the effect on MDD of having strategies drawing down at different times.

This is the correlation matrix for the strategies run over the last ten years, both returns and drawdowns underneath.

As far as I can tell there is very little correlation between even strategies sharing the same universe.

I1L is RUI, strategy1, Long

I2L is RUI, strategy 2, Long

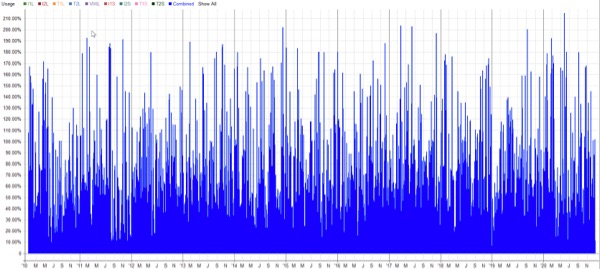

T2L is RUT, strategy 2, Long etc etcThis portfolio returns around 35% ROR with 10% MDD….at maximum it was 210% leveraged, which only happened a few times…see below. On average it was 54% leveraged..in other words there is plenty of room to ratchet it up to work the funds harder if I wanted to….

Each strategy is holding 5 positions and each positions is around 6% of total equity…some are 7.5% and some are 3.5% such as the shorts. Each strategy places 15 orders so there is selection bias built into the portfolio

Sorry I can’t seem to get the screen shots to display well

One other thing. The portfolio is set up so that no strategy can hold the same stock at the same time as another strategy…this really makes a difference to the correlation.

January 9, 2021 at 8:54 pm #112817Anonymous

InactiveQuote:The power of RT is being able to test multiple strategies in one portfolio, and seeing the effect on MDD of having strategies drawing down at different times.Anyone coming head and reading, I want to give this a double highlight. I had no idea how important this was until I was able to see it visualized in RT. Could you do it with AB, yeah, probably, but you’d have to whip out Excel as well, and I prefer to not.

January 9, 2021 at 10:34 pm #112847JulianCohen

ParticipantSeth Lingafeldt wrote:Quote:The power of RT is being able to test multiple strategies in one portfolio, and seeing the effect on MDD of having strategies drawing down at different times.Anyone coming head and reading, I want to give this a double highlight. I had no idea how important this was until I was able to see it visualized in RT. Could you do it with AB, yeah, probably, but you’d have to whip out Excel as well, and I prefer to not.

You can do it in Amibroker. Cesar has a multi strategy tool and that was the first time I had the ability to see how combining the strategies affected the MDD this way.

January 29, 2021 at 10:43 pm #112850TimothyStrickland

MemberJan 2021 Results:

MRV HFT: +6.1%

NDX Momo: +18.3%

NDX Aggressive: +28.8%January 29, 2021 at 10:49 pm #112934Nick Radge

KeymasterHoly shit. You’re on fire mate.

What are you holding in the NDX Aggressive portfolio?

January 29, 2021 at 11:01 pm #112935TimothyStrickland

MemberMRNA, TSLA and KLAC.

MRNA makes up a large portion because of the recent moves, I haven’t rebalanced.

The system bought MRNA in Nov of 2020 right before it exploded and has been holding TSLA since JUN, most of the returns came from these 2

January 30, 2021 at 3:02 am #112936GlenPeake

ParticipantNice work….again Tim!!!

Well done.

-

AuthorPosts

- You must be logged in to reply to this topic.